cagkansayin

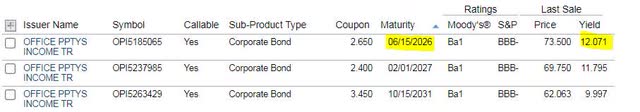

Office Properties Income Trust (NASDAQ:OPI) is an office building REIT that was hit hard by the COVID-19 pandemic, as workers shifted to remote/working from home arrangements. Now that the pandemic has lifted, the company faces the new challenge of keeping tenants in their existing leased space and managing an environment of higher interest rates. The decline in the company’s stock has created a 14% dividend yield, but there has also been a sharp decline in the price of their corporate bonds. The company’s 2026 maturing bond is now yielding 12% and I believe this represents a better investment for fixed income investors.

FINRA FINRA

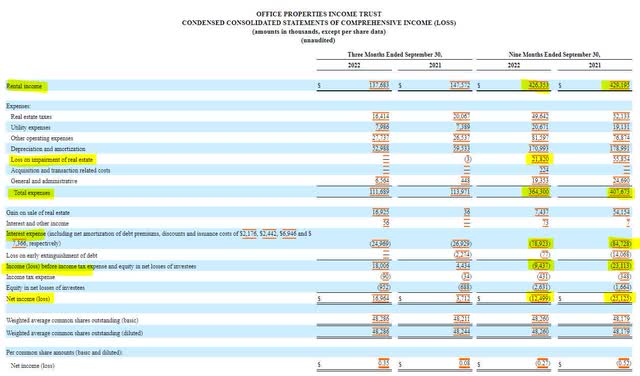

Office Properties’ revenue headwinds post COVID continues as the company’s year to date revenue was flat. They did reduce their operating expenses due to a lower impairment charge, which bled down to a net loss of 3% of revenue, half of what it was a year before, but the continued decline in revenue and net loss makes it less likely to support its dividend in the future.

SEC 10-Q

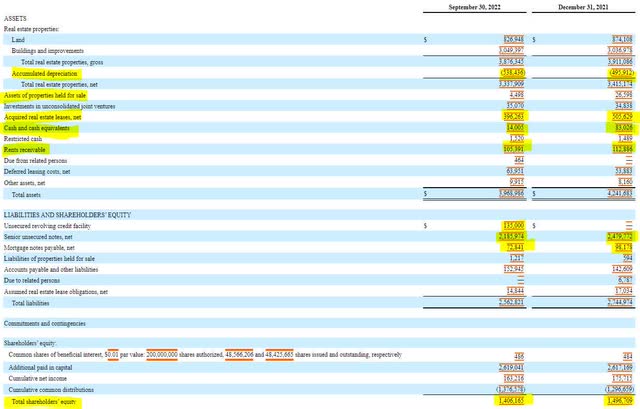

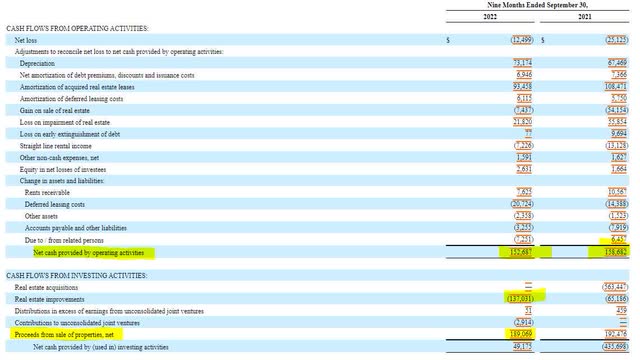

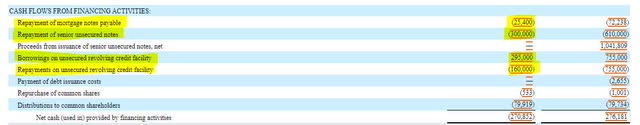

Office Properties has engaged in a modest number of asset sales during the year 2022. The drop in net real estate leases is concerning because it is a measure of future business and the largest contributor to a drop in shareholder equity. The company has managed to pay down some debt this year, but not without drawing on its credit facility.

SEC 10-Q

On a cash flow basis, which is important for both dividends and debt reduction, Office Properties has a slightly positive free cash flow, but the $15 million is nowhere near what is needed to fund the $80 million in dividends over the past nine months. Office Properties barely has any free cash flow remaining after the reduction of capital expenditures.

While I believe long term capital expenditures will be closer to depreciation (around $60 to $80 million per year), if rent turnover continues, the company will need to continue to invest above depreciation to attract new tenants. This leaves little room for much, if any, dividends. The only way Office Properties was able to pay its dividend and reduce debt this year was due to the sale of assets, which it cannot do in perpetuity to support the dividend.

SEC 10-Q SEC 10-Q

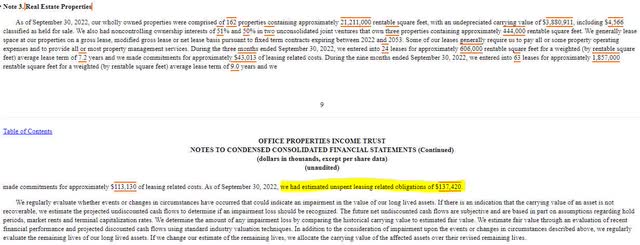

It is also important to note that Office Properties has $137 million in lease obligations, according to its third quarter earnings. This is $137 million of capital expenditures that the company has contractually agreed to execute over the life of the leases with its tenants. Executing on these obligations will be a further drain on free cash flow and ability to pay its dividend.

SEC 10-Q

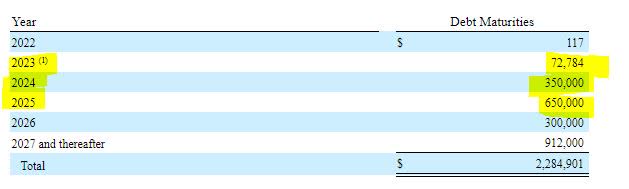

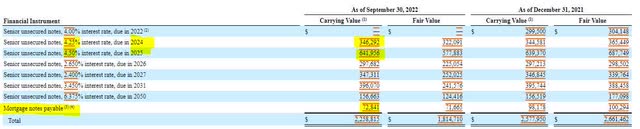

Office Properties will need to refinance approximately $1 billion in debt due in the next couple of years. Fortunately, most of this debt wall is slated to come due in 2025, which gives the company some time to stabilize its cash flow situation. While the debt coming due is at a slightly higher interest rate than its 2026 through 2031 maturities, Office Properties is undoubtedly looking at a higher interest rate for refinancing, even if it is able to hold out long enough for the Federal Reserve to cut rates.

SEC 10-Q SEC 10-Q

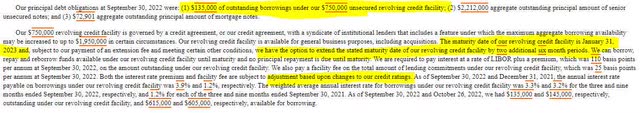

Should Office Properties find itself locked out or restricted in how much the company can refinance, it does have approximately $615 million in liquidity (excluding cash) based on the untapped amount of its revolver. While the revolver matures in January, the company has the option to extend its maturity to January 2024, by opting in to a six-month extension (twice). Investors can expect these borrowing costs to increase should a full refinance occur. Additionally, there are covenants regarding the payment of dividends that aren’t disclosed, but I would expect these to become a huge part of the company’s forward dividend policy.

SEC 10-Q

Office Properties can stabilize and generate recurring free cash flow, but I do not believe it can do so at a pace that would support the current dividend. I do believe that the company has the capital structure necessary to navigate out of the current challenges and that’s why I recommend the safer bonds which will still provide investors with a return over 10%.

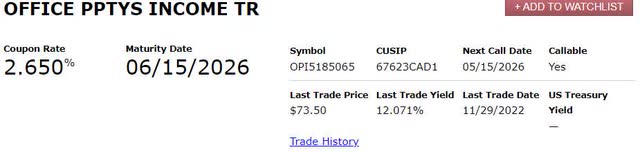

CUSIP: 67623CAD1

Price: $73.50

Coupon: 2.65%

Yield to Maturity: 12.071%

Maturity Date: 6/15/2026

Credit Rating (Moody’s/S&P): Ba1/BBB-