Davidovici

Investment Thesis

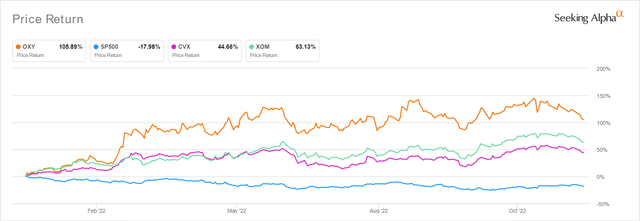

OXY YTD Stock Price

Seeking Alpha

The Buffett premium is still massively apparent for the Occidental Petroleum Corporation (NYSE:OXY) stock, given the impressive YTD rally of 105.89%, against Exxon Mobil Corporation (XOM) at 63.13%, Chevron Corporation (CVX) at 44.66%, and the S&P 500 Index at -17.98%. Despite so, consensus estimates remain bullish about OXY’s prospects, due to their price target of $77.36 and a 20.61% upside from current prices.

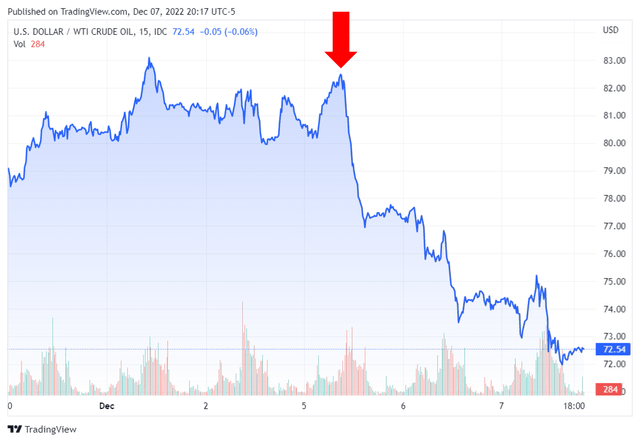

WTI Spot Prices After The Blood Bath on 05 December

Macro Trends

However, we prefer to exercise caution for now, due to the massive uncertainties in the oil/gas industry over the past week. The recent OPEC+ rumors of a 0.5 Mb/d increase in production on 05 December have had the catastrophic impact of crashing WTI crude oil spot prices by -12.07% by the time of writing. Many oil stocks suffered similarly, with the OXY stock declining by -8.7% since 05 December, XOM by -6.43%, and CVX by -4.65% at the same time.

The S&P 500 Index was not spared either, with a -3.38% decline as the November labor report and activity in the services industry proved overly bullish to market analysts as well. Thereby, triggering a sudden sentiment reversal from Powell’s recent dovish commentary, since the November CPI report could potentially come in hotter than expected, attributed to the Thanksgiving and Black Friday festivities. As a result, speculatively pushing the Feds for the fifth consecutive 75 basis points hike by 14 December. We’ll see, since 78.2% of market analysts are still optimistically projecting a 50 basis points hike instead.

OXY Remains Laser-Focused On Aggressive Deleveraging, Instead Of Shareholder Returns

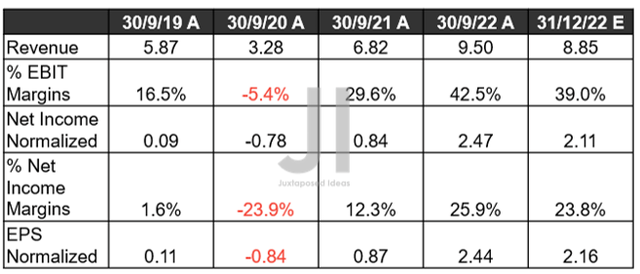

OXY Revenue, Net Income (in billion $) %, EBIT %, and EPS

S&P Capital IQ

Mr. Market remains confident that OXY will continue to deliver excellent results in FQ4’22, due to the projected YoY revenue growth of 10.5% and EPS growth of 46.2%, despite the tougher YoY comparison and moderated crude oil prices. Furthermore, the company is expected to report a further YoY expansion of 3.9 percentage points in its EBIT margins and 5.7 in its net income margins by the next quarter, pointing to the management’s stellar operating efficiencies thus far. By FQ3’22, the company reported sustained QoQ and YoY expenses, despite the rising inflationary pressures.

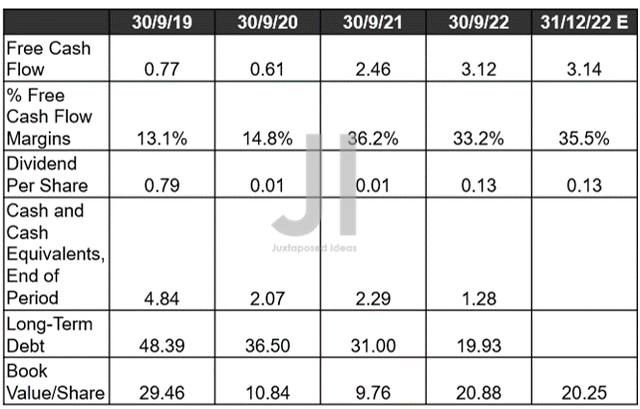

OXY Cash/ Equivalents, FCF (in billion $) %, Debt, and Dividend

S&P Capital IQ

Furthermore, market analysts expect OXY’s Free Cash Flow [FCF] generation to further expand to $3.14B and margins to 35.5% for FQ4’22, despite the sequential growth of its capital expenditure over the last twelve months by 54.36% to $3.89B in FQ3’22. Impressive indeed, since the company has also aggressively reduced its long-term debts by -58.83% and $28.47B since FQ3’19 to $19.93B in the latest quarter. Thereby, naturally strengthening its balance sheet through the worsening macroeconomics and volatile energy markets, due to its stellar cash and equivalents of $1.28B and account receivable of $4.04B.

OXY’s shareholder returns remain decent as well, with $2.45B of shares repurchased and $0.54 of dividends paid out over the past twelve months. Nonetheless, investors should also note the massive difference against its peers, such as XOM at $10.63B/ $3.52 and CVX at $1.75B/ $5.60, respectively, at the same time. Oh, wells.

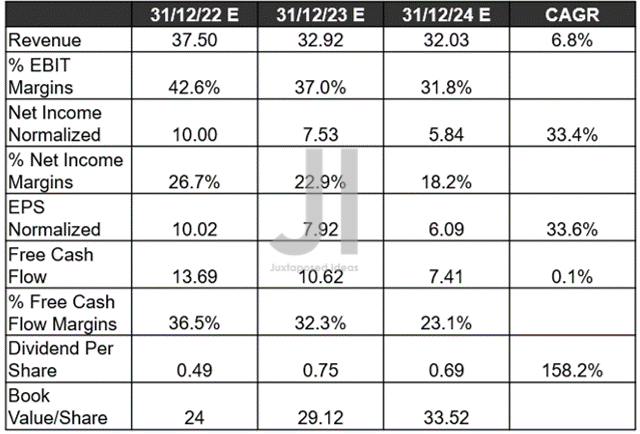

OXY Projected Revenue, Net Income (in billion $) %, EBIT %, EPS, FCF (in billion $) %, and Dividends

S&P Capital IQ

Meanwhile, it is evident that there is no demand destruction at all, since market analysts have also upgraded OXY’s top and bottom line growth by 12.30% and 30.64% through FY2024. Furthermore, the company is expected to sustain its excellent profit margins moving forward, at EBIT/ net income/ FCF margins of 31.8%/ 18.2%/ 23.1% by FY2024, against 19.8%/5.6%/4% in FY2019 and 57.1%/9.3%/28.1% in FY2021. Notably, these forward margins look impressive against its peers too, such as XOM at 21.8%/10.7%/11% and CVX at 19%/13%/15.2% by FY2024. Combined with the projected EPS of $6.09 by FY2024, we can naturally understand OXY’s current baked-in premium against the FY2019 EPS of $1.45.

In addition, market analysts expect the OXY management to stay on its deleveraging course over the next few years, with its net debts further declining to $6.1B by FY2024, against $38.43B in FY2019 and $28.37B in FY2021. Thereby, also explaining the minimal growth in its dividends paid out at $0.69 by FY2024, against F2019 levels of $3.14. The recent windfall combined with the high-interest rate environment have made this an exceptionally strategic decision indeed.

In the meantime, we encourage you to read our previous article on OXY, which would help you better understand its position and market opportunities.

- Occidental Petroleum: Maybe We Were Wrong And Buffett Right

- Occidental Petroleum: No Longer Cheap – Buy Buffett’s Pick At The Next Dip

So, Is OXY Stock A Buy, Sell, or Hold?

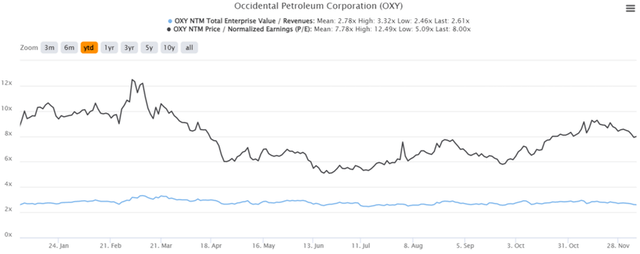

OXY YTD EV/Revenue and P/E Valuations

S&P Capital IQ

OXY is currently trading at an EV/NTM Revenue of 2.61x and NTM P/E of 8.00x, lower than its 5Y mean of 3.27x and 10.03x, respectively. Otherwise, relatively in line with its YTD mean of 2.78x and 7.78x, respectively. Thereby, pointing to the stock’s supposed fair valuation.

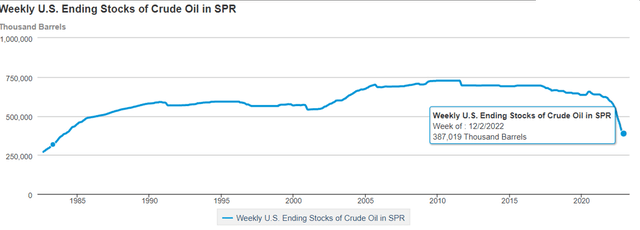

The US Ending Stocks of Crude Oil in SPR

US EIA

However, the oil/gas industry will continue to be remarkably volatile over the next few months, as the G7 recently imposed a price cap on Russian oil, with the refined petroleum products ban kicking in by February 2023. There is no doubt that supply remains extremely tight, with market analysts forecasting another 1.4M barrel drop this week as the SPR stockpile plunges to 1983-lows. Combined with Russia potentially cutting production by a drastic -1.7 Mb/d from December 2022 onwards and the OPEC+’s 2 Mb/d reductions through the end of 2023, it will not take a genius to figure out that crude oil prices will remain elevated in the short term.

It is evident, however, that governments are trying to curb this phenomenon by introducing windfall taxes in the EU and potentially in the US. However, these top-down approaches are also predicted to slow forward oil/gas investment and production while accelerating investors’ returns. In short, supply remains tight while government policies continue to suppress prices, pointing to more uncertainty in the short term.

Therefore, due to the mixed signals ahead, we prefer to continue rating the OXY stock as a Hold for now. Additionally, some investors might want to lock in some gains first, since its minimal dividends would not be sufficient to cushion any future volatility.