CreativeNature_nl

The only oil name Berkshire seems to love

I haven’t delved into oil and gas names seriously for quite some time. I had been tricked in the past investing at the top of the cycle when Warren Buffett and Bill Gates both were buying Exxon (XOM) hand over fist. Oil was supposed to be headed north of $100 a barrel. Didn’t happen as usual and the stock traded sideways until the crash during Covid.

Now Berkshire Hathaway (BRK.B)(BRK.A) seems infatuated with accumulating Occidental Petroleum, (NYSE: OXY). It doesn’t pay anywhere near the dividend rate of its large-cap brethren, at 1.28%, but it does buy back a lot of shares. The most eye-popping stat I could pull when comparing Occidental to Chevron (CVX) and Exxon, was that the company had the lowest CAPEX as a percentage of Depreciation and Amortization, opening the door for more clear-cut “owner earnings” or free cash flow.

If you have read The Warren Buffett Way, By Robert Hagstrom along with the compilations of letters and essays in The Essays Of Warren Buffett, you realize that Buffett has most dear to his heart an obsession for companies that can achieve non-cash expenses above capital expenditures consistently. Occidental Petroleum seems to be right up that same alley.

What they do

From the 10K:

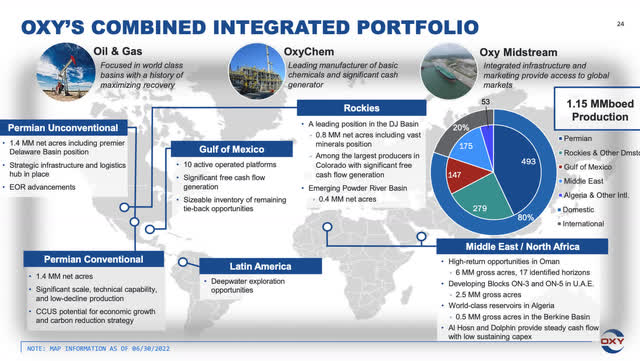

Occidental’s principal businesses consist of three reporting segments: oil and gas, chemical and midstream and marketing. The oil and gas segment explores for, develops and produces oil (which includes condensate), NGL and natural gas.

The chemical segment primarily manufactures and markets basic chemicals and vinyls. The midstream and marketing segment purchases, markets, gathers, processes, transports and stores oil, NGL, natural gas, CO and power. It also optimizes its transportation and storage capacity, and invests in entities that conduct similar activities, such as WES.

The midstream and marketing segment also includes OLCV. OLCV seeks to leverage Occidental’s legacy of carbon management expertise to develop CCUS projects, including the commercialization of DAC technology, and invests in other low-carbon technologies intended to reduce GHG emissions from its operations and strategically partner with other industries to help reduce their emissions.

The story up to here

The company acquired Anadarko Petroleum in 2019 with the Assistance of Berkshire Hathaway which infused the deal with $10 Billion in cash for preferred shares yielding 8%. They were able to beat out Chevron in the bid. The amount of interest is much more expensive than other debt and Berkshire has taken some of the payments in the form of equity. Anadarko provided a great portfolio of US oil and gas assets to the portfolio.

Therefore we can see in addition to the pricing of Occidental, Berkshire Hathaway has other interests at stake including warrants.

OXY Q2 Earnings Presentation

The earnings trajectory

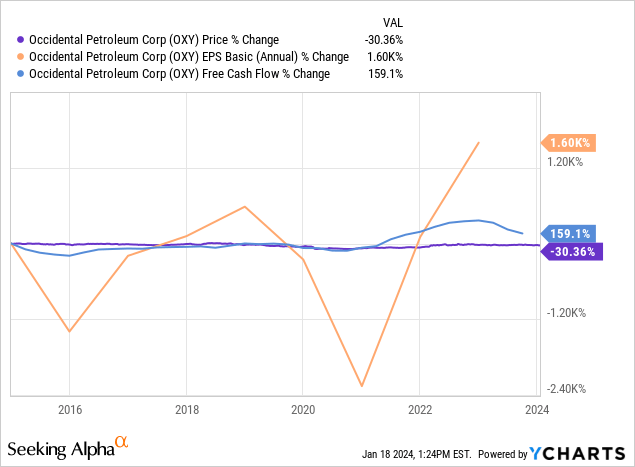

Some nice gaps emerge when comparing Occidental’s 10-year price appreciation versus EPS growth and free cash flow growth. While earnings per share on a GAAP basis have been jagged, free cash flow growth looks stable and has much better growth than the negative -30.36% share price would allude to.

The chart

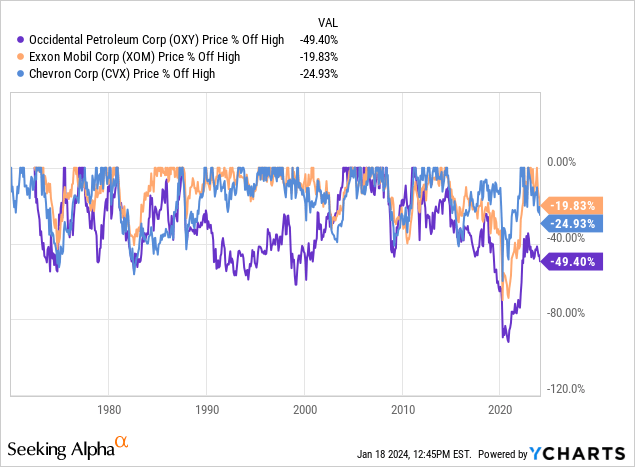

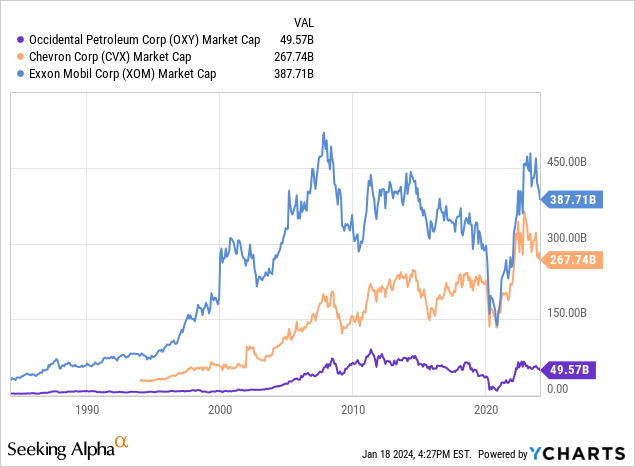

Out of the 3 comps we are looking at today, Occidental also is trading at the furthest off its’ all-time highs. Just from that perspective alone, I have started to become intrigued.

The EV story seems set for a pullback

One other reason I have been re-attracted to oil and gas has been the slowdown in all things related to electric vehicles. While Tesla (TSLA) is the clear front runner in vehicle sales, their materials suppliers are starting to tell a different story about the headwinds the industry in general will be facing.

Panasonic (OTCPK:PCRFY)(OTCPK:PCRFF) has canceled the possible build of an additional Oklahoma battery plant. Lithium giant Albemarle (ALB) is cutting capital spending amidst a glut of lithium supply at suppressed prices.

I never believed EVs were a threat to oil consumption in general, but it changes market perception when you see those headlines.

Valuations with comps

Firstly, just looking at a valuation comp set based on the aforementioned “owner earnings” discount, we can see that Occidental Petroleum is trading the most cheaply out of the group at 44% of intrinsic value.

As a note, the Owner Earnings discount typically uses the risk-free rate rather than adjustments for CAPM if the cash flows are stable. Warren Buffett would add a couple of points if he believed the risk-free rate was too low. With rates expected to decline, multiples could expand.

All numbers TTM courtesy of Seeking Alpha in Millions

| STOCK | NET INCOME | Plus D&A | Minus CAPEX | OWNER EARNINGS | Per share value discounted at RFR 5.5% | current price | percent of fair value |

| OXY | 5425 | 6961 | 6246 | 6140 | 127.29 | 57 | 44% |

| XOM | 41130 | 9793 | 21474 | 29449 | 135.14 | 99 | 73% |

CVX | 25463 | 14959 | 15303 | 25119 | 242.02 | 145 | 59% |

CAPEX as a percentage of Deprecation and Amortization

Looking at depreciation and amortization as a percentage of CAPEX, Occidental is at the lowest end of the spectrum while Exxon the highest.

| STOCK | CAPEX | D&A | CAPEX as a percentage of D&A |

| XOM | 21474 | 9793 | 219% |

| CVX | 15303 | 14959 | 97.70% |

| OXY | 6246 | 6961 | 89.70% |

Graham Number Comps

| stock | BV | TTM EPS | GRAHAM NUMBER | Precent of fair value |

| OXY | 23.95 | 4.97 | 51.751413 | 108% |

| XOM | 50.39 | 10.07 | 106.850897 | 89.80% |

| CVX | 87.55 | 13.51 | 163.134948 | 86.50% |

However, if we pit these companies against each other using the Graham Number, or the square root of 22.5 X TTM EPS X Book value we get a bit of a different story. Since Occidental is trading at the highest relative book value of the lot, they get dinged a bit on this metric and look 8% overvalued.

But, Occidental is one of those efficient companies with higher free cash flow per share or owner earnings than GAAP earnings at $7.59/share in TTM free cash flow. Using that metric instead of GAAP EPS puts intrinsic value at $63.95 a share. While oil and gas seems to be a very capital-intensive business, there seem to be some efficiency advantages that Occidental is at least currently enjoying that warrant exploration.

Goal orientation

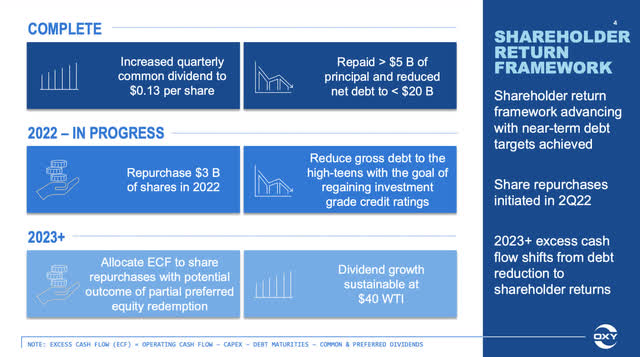

OXY Investor Relations

This graphic lays out quite clearly the beyond 2023 goals of what to do with excess capital, buyback shares and pay-down debt.

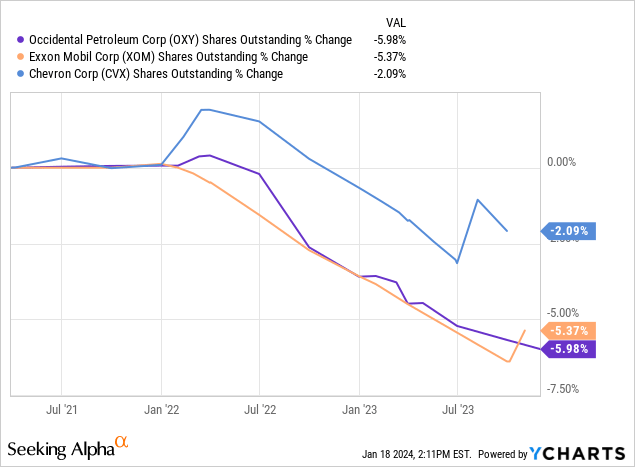

Looking at the last 3-year trajectory of share buybacks, we can see that Occidental is best in this group with almost a 6% reduction. However, due to equity financing in the Anadarko deal, pref supplement payments in equity, and others, shares were at an all-time high in 2021 at 934 million shares. It will be a while before shares get back to the mid-700 million level seen before the acquisition.

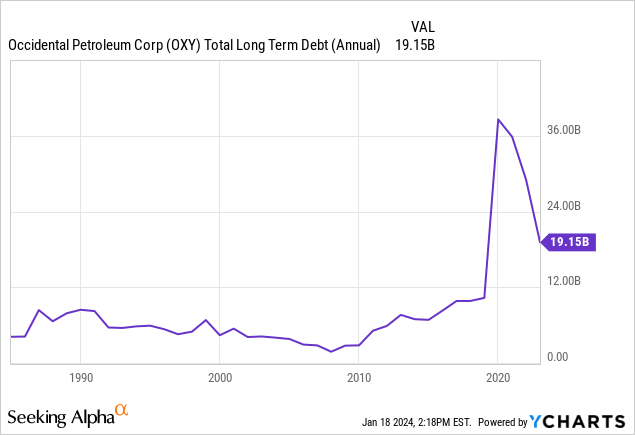

However, Occidental was also able to retire a significant portion of debt in the past few years getting its leverage ratio back to where it needs to be for investment-grade debt.

Again, the company may be more leveraged than the other operators compared here, but this is a massive reduction in long term debt from over $36 Billion to under $20.

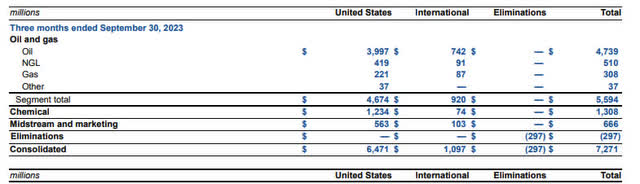

Revenue sources

OXY Q3 10Q

| source | percentage of total |

| oil and gas | 65% |

| chemical | 18% |

| midstream | 9.10% |

Oil and gas break down

- Total Q3 revenue $5,594

- Oil: 84%

- NGL: 9.1%

- Gas: 5.5%

- Other .06%

Occidental Petroleum is overweight oil and gas revenue exposure with 84% of the overall oil and gas mix coming from oil revenue. The lion’s share comes from United States production with a large chunk via Anadarko. Occidental is one of the leaders in Permian basin oil production at #7. This in itself is a minor moat as barriers to entry for new U.S. oil production are near impossible. This is also a large feat for the company being that the market cap is only around $50 Billion while Exxon and Chevron are closer to $300 Billion.

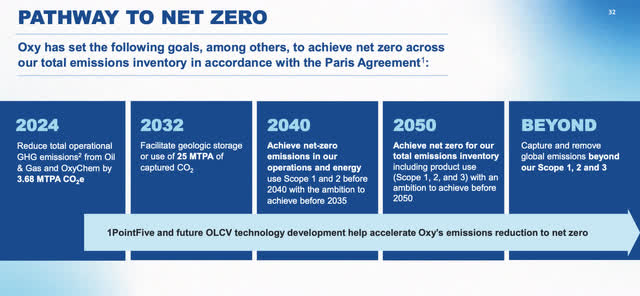

Occidental is taking net zero seriously

Occidental Petroleum Investor Relations

Whether we agree with the hits to profitability that the Paris Agreement and other climate initiatives are impugning upon traditional oil and gas operations, all operators should have a plan in place. Access to financing will one day be dependent upon ESG initiatives. CO2 hub storages across the US are set to come online by 2025. The company has several green initiative partnerships set up, including lithium production similar to Exxon.

The dividend

The yield is substantially smaller than other industry majors, but when compared to free cash flow, there is ample room for growth. At .72 cents a share FWD but producing $7.59 / share in free cash flow on a TTM basis, you can see all the potential for massive dividend growth once the balance sheet gets in order. The company is prioritizing buybacks and debt pay down after the mentioned acquisition and investors just need to be patient. Once the float and debt initiatives are met, outsized return of capital increases via cash dividends seems like a good bet.

Growth trajectories

From the Q3 earnings transcript:

Our accomplishments to date have positioned us as a DAC technology and market leader. The next phase of our DAC strategy is focused on growth through accelerating cost reduction and expanding partnerships. With full ownership of Carbon Engineering’s technology now in-house, we expect to supplement and support the highly talented Carbon Engineering team to accelerate the innovations that ultimately reduce the cost to capture years earlier than initially anticipated. By pairing the strengths of Carbon Engineering, Oxy Major Projects and OxyChem, we will continue to reduce costs for the life of the plant.

Growth in the chemical segment, OxyChem, seems to be a growth focus for both the company and analysts. At 18% of the revenue mix, this is a second-place pecking order cash generator below oil production. The refineries are amongst the biggest complaints when it comes to carbon and other chemical air pollution. Having an in-house carbon capture solution, reducing operating costs of the plants and overall CAPEX is in line with what I be;lBerkshire Hathaway likes to see. The company also estimates it may have excess carbon credits because of how far along in the process they are:

Future regulatory and compliance frameworks that cap emissions growth are driving companies in certain sectors to purchase measurable and durable CDR credits like DAC CDRs. As we reduce the cost of DAC, we expect companies will increase the share of DAC CDRs in their portfolio of solutions. We have included 3 market demand scenarios in our earnings presentation to illustrate how the DAC CDR market may grow rapidly through the end of this decade as the cost to capture is reduced.

Carbon capture is an overstated goal by Occidental to increase profitability. Having purchased Canadian startup Carbon Engineering Ltd. for $1.1 billion, both Occidental and Berkshire must have supreme confidence in their capabilities to have these statements so prescient throughout their presentations and earnings calls.

Risks

Oil and gas are always under the pressure of the commodity that it sells. The company has stated that continued dividend growth is sustainable at $40 WTI. With WTI in the mid-70s, there is quite a bit of room to spare. We can assume that $40 WTI is a price point that the entire sector would take a hit and possibly need to accumulate more debt. With some leading indicators of global economic weakness on the horizon, $40 or lower should not be ruled out as a possibility.

Summary

Looking at the company from a CAPEX to non-cash expense ratio, Occidental looks like one of the cheapest of the bunch. I believe this is a Buffett preference when it comes to the acquisition of a company in large quantities. How stable are their cash flows and do non-cash expenses consistently out-strip capital expenditures? While a lack of a strong dividend has assuredly kept this one down when compared to the peer group, the cash flow is there to hike the dividend once the balance sheet cuffs are removed.

This looks like a similar turnaround story similar to Kraft Heinz (KHC), and Berkshire is heavily entrenched to add support should the share price come under further pressure in my view. This appears to be the cheapest fully integrated oil major right now with up, mid, and down stream aspects as well as a comprehensive carbon capture plan. Some of the Berkshire accumulation is not Berkshire bullishness, but rather equity instead of dividends paid on the preferreds. Regardless, I believe we can assume that Buffett likes the stock. Buy.