metamorworks

Shareholders of Oaktree Capital (NASDAQ:OCSL) may be feeling comfortable as the business development company continues outperforming broader market trends and proving its worth as a dividend option for low-risk portfolios. It is worth holding Oaktree due to its 0% non-accrual ratio along with 87% portfolio concentration towards secured debt. Despite that, I am concerned about the company’s dividend growth potential due to its conservative investment strategy, declining investment commitments, and unstable profit growth. Meanwhile, its competitor, Trinity Capital (TRIN), appears better positioned to capitalize on the growing demand for venture debt due to its aggressive investment strategy, product diversification, and potential to generate high cash returns in the years ahead.

BDCs Thriving Despite Bearish Market Trends

The US stock market has already lost trillions of dollars so far in 2022, but it is still difficult to predict how long the bearish trend will last. The higher-than-expected CPI data suggests the Fed may extend its tight monetary policy to tame inflation. For stock markets, higher rates combined with economic contraction will lead to a decline in profits and revenue for corporations. As a result, there may be a need for investors to rethink their portfolio preferences. Historically, buying dividend-paying stocks is the best way to beat bearish market trends.

So far in 2022, companies that specialize in business development have demonstrated their ability to thrive in tough market conditions. They continue to pay substantial dividends, and their shares remain less volatile than the market as a whole. This is because high rates and slow venture capital funding have increased venture debt demand. To raise cash, capital-hungry startups are turning to venture debt rather than selling stakes at a steep discount to venture capital. PitchBook data shows that venture debt volumes in the US reached $17.1 billion in the first half of 2022, up 7.5% from the same period last year.

While BDCs continue to grow in spite of bearish broader market conditions, investors should still be cautious when selecting stocks. This is because different investment approaches and different profitability and growth rates make BDCs differ from one another. Therefore, dividend investors must select the right BDC to beat the bearish market condition and earn sustainable long-term returns.

Is Oaktree Capital The Solid BDC To Own?

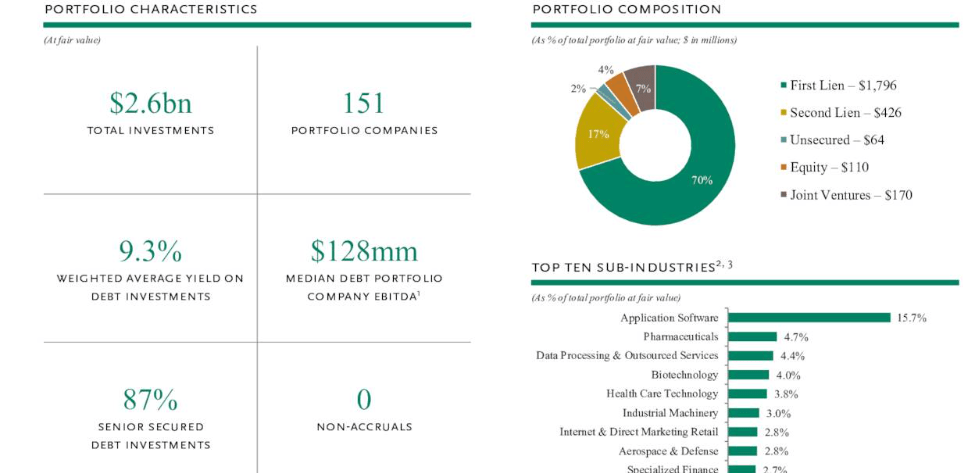

Listed on NASDAQ in 2008, Oaktree Capital is a prominent business development company with a market cap of $1.20 billion. Shareholders have received consistently strong returns from the company over the past decade, and these returns have grown substantially in the last two years. Besides cash returns, many other metrics indicate that it can be a safe investment for dividend investors. As an example, Oaktree’s portfolio is highly concentrated on secured loans, thereby reducing the risk of bad debts. As of June 2022, approximately 70% of its portfolio was invested in first liens, while about 17% was in second liens. A total of 13% of the BDC’s portfolio holdings were unsecured investments in equities and joint ventures. Additionally, the company has $455.0 million in undrawn credit facility and $34.3 million in unrestricted cash and cash equivalents.

Portfolio Composition (Third Quarter Presentation)

Since past performance is no guarantee of future success, I am concerned that Oaktree’s conservative investment approach might hinder its ability to generate healthy growth in dividends. What’s more concerning is that the firm’s Chief Executive Officer and Chief Investment Officer Armen Panossian expressed confidence in Oaktree’s conservative investment strategy in the latest conference call. He stated that they are currently exercising more conservatism than in the past. It is prudent to show discipline in asset allocation in current market conditions, but this strategy has started impacting its investment income and dividend growth.

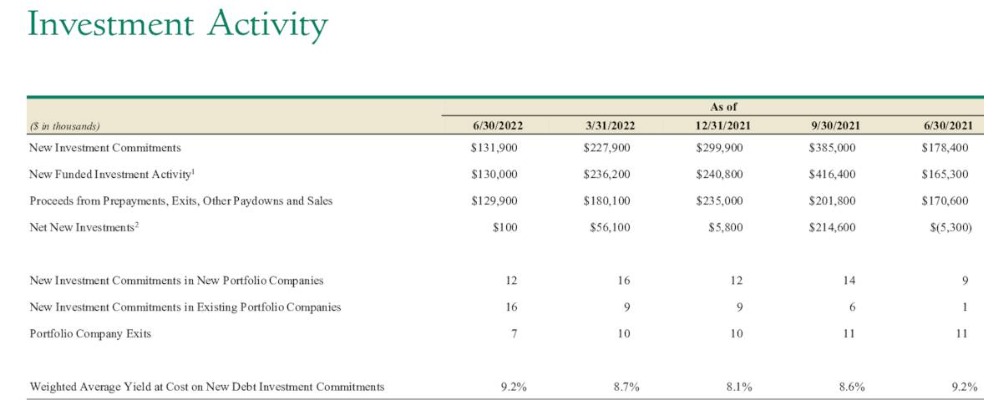

Investment Activity (Third Quarter Presentation)

In the June quarter, the company’s investment commitments fell to $131 million from $227 million in the previous quarter and $178 million a year earlier. The company’s investment commitments have also fallen significantly from around $385 million in the September quarter of last year. Lower investment commitments mean lower net investment income for the company. In the June quarter, its adjusted net investment income came in at $0.17 per share, down from $0.18 per share in the previous quarter and $0.19 per share a year ago. Based on quant data from Seeking Alpha, the company’s revision factor received an F grade, indicating Wall Street analysts are lowering their expectations. If Oaktree’s investment income stagnates, it might struggle to continue raising dividends on a quarterly basis. A payout ratio of 100% based on net investment income in the latest quarter also hints at lower room for dividend increases in the following quarters.

But Trinity Capital’s Aggressive Strategy Paves Path For Lofty Returns

A strategy of aggressively investing in growth opportunities and capitalizing on the increasing demand for venture debt puts Trinity Capital in a solid position to offer sustainable dividend growth. The company has doubled its employees in the last two years and started working closely with startups to help them achieve their objectives. Furthermore, the company doubled its investment commitments to a record $460 million in the first half of 2022 compared to the same period last year. Its portfolio assets also jumped above the $1 billion level for the first time in the June quarter.

Its forward dividend yield jumped to over 12% after it raised its September quarter dividend by 7% to $0.45 per share. It has increased dividends every quarter since its debut on NASDAQ in early 2021. Moreover, the company’s confidence in its fundamentals can also be seen in hefty supplementary dividends of $0.15 per share in the past three consecutive quarters. With a forecast for over $2 in earnings per share for 2022, Trinity’s dividends growth looks completely safe. If you are interested in learning more about Trinity Capital, read my article “Trinity Capital: A Perfect Time To Buy For Hefty Gains.”

Quant Grading Favors Trinity Over Oaktree

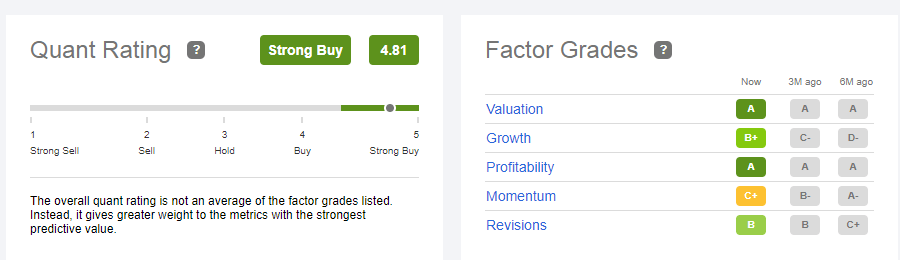

Quant Grades (Seeking Alpha)

Seeking Alpha’s quant grading system also rates Trinity a strong buy with a quant score of 4.81 while Oaktree received a quant score of 3.08 with a hold rating. Besides momentum, Trinity received solid grades on the rest of the quant factors. A grade for profitability and B plus for growth vindicates my stance about its aggressive investment strategy and higher earnings growth potential. B grade for revisions also reflects that Wall Street analysts are optimistic about its future earnings growth potential. Oaktree, however, is far behind Trinity in many areas, including growth, profitability, and revisions. The company received a negative C grade on growth, a B+ on profitability, and an F on revisions.

Final Thoughts

There is no doubt that business development companies are proving to be recession-resistant. In spite of that, choosing the right stock is crucial to achieving sustainable returns over time. Oaktree is a solid BDC with a high dividend yield and an excellent dividend track record. However, its conservative investment strategy and declining earnings growth potential poses risk to its dividend growth in the quarters ahead. On the other hand, Trinity’s aggressive investment strategy in high-yielding assets is expected to boost earnings growth. I, therefore, consider Trinity Capital to be an attractive addition to a portfolio compared to Oaktree.