metamorworks

MARKET OUTLOOK POSITIONING

The fixed income investing landscape remained challenged in the third quarter. We maintain our recommendation for focus on individual credit selection over broad-based asset class or rate calls. Credit selection remains paramount, given the heightened uncertainty surrounding how this rate hike cycle will eventually impact the economy. While many areas offer uninviting index-level valuations, the turbulence created by this cycle has led to noticeable disparities at the subsector and individual security levels. This continues to underpin our advocacy for a discerning approach to high-quality leverage loans, non-agency securitized products, and unique narratives within the high-yield and investment-grade sectors. Within these sectors, our focus remains on securities that not only demonstrate promising total returns but also possess robust credit profiles that should prove resilient to potential adverse outcomes from the Fed’s policies. If we continue to move higher in yields as we finish the year without a meaningful repricing of credit default risk, our strategy will become further anchored by adding high-quality duration, including extending our positioning with U.S. Treasurys, agency-backed securitized and investment grade corporate bond asset classes.

We have stabilized our exposure to corporate credit overall, following deliberate reductions in exposure during the calendar year’s first half, and we have shifted toward securitized and premium duration assets. If we were to get a significant repricing of credit risk in the lower quality sectors of corporates, we would likely shift our stance from protective to proactive, broadening our consideration of individual corporate credits in the lower quality portions of the credit market.

Today, in the realm of junk bonds, our guidance remains consistent: meticulous due diligence is essential. We emphasize investing in entities that are independent of short-term capital market reliance and are well buffered with enough liquidity to weather a potential recession.

Performance

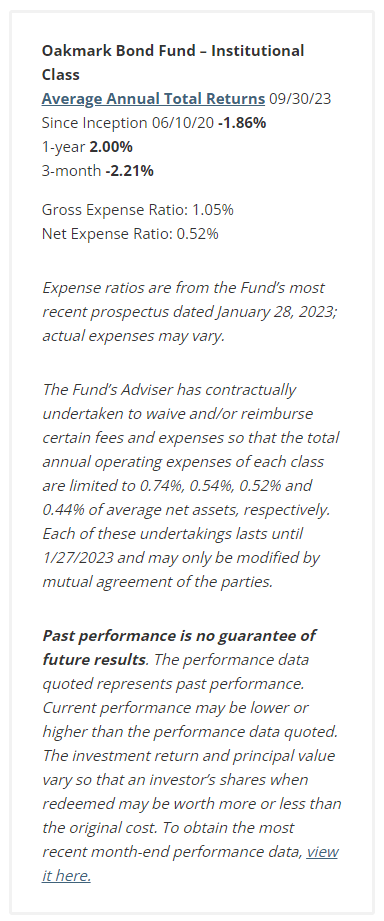

The Oakmark Bond Fund (MUTF:OANCX, “the Fund”) lost 2.21% in the third quarter ending September 30, 2023, outperforming its benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned -3.23%. For the fiscal year ended September 30, 2023, the Oakmark Bond Fund returned 2.00%, beating the benchmark return of 0.64%.

During the quarter, the Fund’s outperformance was driven by security selection, asset allocation decisions and its shorter duration profile than its benchmark. Approximately 40bps of the Fund’s outperformance during the quarter was a result of security selection, which was primarily driven by credit opportunities within asset-backed securities and strong performance from select corporate credits. The securities contributing most significantly to this quarter’s security selection were CPS Auto Trust ABS, FHLMC Multifamily Structured Pass Through, and BANK 2022-A4 Commercial Mortgage Pass Through. On the other hand, Tenet Healthcare Corporation (THC) 6.75% Sr. Secured Note, Parsley Energy LLC (PE) 4.125% Sr. Unsecured Notes, and Wells Fargo & Co. (WFC) 3.9% Jr. Sub Perpetual were the largest detractors from the Fund’s security selection performance.

Allocation decisions positively contributed to the Fund’s performance for the quarter, accounting for approximately 34bps of outperformance versus the benchmark mainly due to the Fund’s overweight to corporate credit and securitized debt.

Furthermore, the Fund’s short duration position relative to the benchmark accounted for 42bps of outperformance for the quarter, given the increase in rates across the curve, particularly at the medium and long end. By the end of the quarter, the Fund held an overall duration of roughly 5.6 years in contrast to the benchmark’s duration of about 6.1 years. Despite a decrease from the previous quarter, the Fund still maintains a higher proportion of corporate debt compared to the Bloomberg U.S. Aggregate Bond Index at 42% versus 26%, respectively.

For the fiscal year, asset allocation decisions and duration positioning accounted for a combined 173bps of outperformance, while security selection accounted for an additional 13bps of outperformance versus the benchmark. The positions that contributed most significantly to positive security selection were CPS Auto Trust ABS, Freddie Mac STACR 2022 Uninsured U.S. Agency Mortgage Pass-through, and the Oceaneering International Inc 6.0% Sr. Unsecured Note. Positions that detracted from security selection during the fiscal year were SVB Financial Group (OTCPK:SIVBQ) 4.25% Perpetual Preferred bond, Signature Bank New York (OTCPK:SBNY) 4.0% Subordinated bond and SVB Financial Group 4.0% Perpetual Preferred bond.

Connect with us

We value our relationship with our investors and welcome any questions or concerns. Please don’t hesitate to reach out to our team. We hold regular investor calls and meetings where you can interact with us and learn more about our strategies and future plans. You can also email us at [email protected] or [email protected].

Adam D. Abbas | M. Colin Hudson, CFA

| The securities mentioned above comprise the following preliminary percentages of the Oakmark Bond Fund’s total net assets as of 09/30/2023: BANK 2022-BNK40 A4 3.507% Due 03-01-64 2.8%, CPS 2022-C E 9.080% Due 04-15-30 0.7%, CAS 2022-R06 1M1 8.065% Due 05-25-42 1.1%, FHMS K1522 A2 2.361% Due 10-01-36 3.5%, Freddie Mac STACR 2022 Uninsured U.S. Agency Mortgage Pass-through 0%, Oceaneering International Inc 6.0% Sr. Unsecured Note 0%, Parsley Energy CC 2/23 144A 4.125% Due 02-15-28 1.3%, Signature Bank New York 4.0% Subordinated bond 0%, SVB Financial Group 4.0% Perpetual Preferred bond 0%, SVB Financial Group 4.25% Perpetual Preferred bond 0%, Tenet Healthcare CC 05/26 144A 6.750% Due 05-15-31 0.9% and Wells Fargo QC 03/26 3.900% Due 01-01-50 0.8%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. Access the full list of holdings for the Oakmark Bond Fund as of the most recent quarter-end. The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements”. These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements. The Bloomberg U.S. Aggregate Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasurys, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). This index is unmanaged and investors cannot invest directly in this index. The Oakmark Bond Fund invests primarily in a diversified portfolio of bonds and other fixed-income securities. These include, but are not limited to, investment grade corporate bonds; U.S. or non-U.S.-government and government-related obligations (such as, U.S. Treasury securities); below investment-grade corporate bonds; agency mortgage backed-securities; commercial mortgage- and asset-backed securities; senior loans (such as, leveraged loans, bank loans, covenant lite loans, and/or floating rate loans); assignments; restricted securities (e.g., Rule 144A securities); and other fixed and floating rate instruments. The Fund may invest up to 20% of its assets in equity securities, such as common stocks and preferred stocks. The Fund may also hold cash or short-term debt securities from time to time and for temporary defensive purposes. Under normal market conditions, the Fund invests at least 25% of its assets in investment-grade fixed-income securities and may invest up to 35% of its assets in below investment-grade fixed-income securities (commonly known as “high-yield” or “junk bonds”). Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. All information provided is as of 09/30/2023 unless otherwise specified. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.