cagkansayin/iStock via Getty Images

Thesis

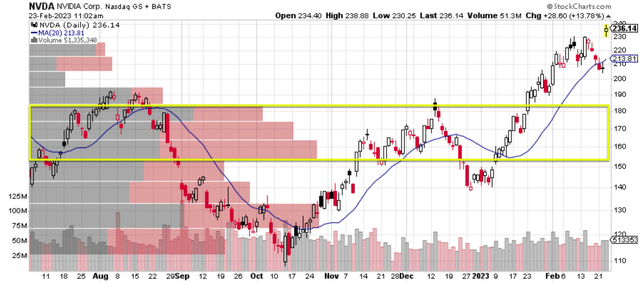

NVIDIA Corporation (NASDAQ:NVDA) just released its FY Q4 earnings report (“ER”). And by this time, I am sure that you have been informed of all the good news already. As a brief recap, its Q4 results exceeded expectations, with gaming recovery as the most important driver. As its CEO Jensen Huang commented during the ER, “Gaming is recovering from the post-pandemic downturn” and Huang further went on to comment on the promise of AI as the “inflection point.” Its stock price soared by almost 13% after the ER, as you can see from the following chart, and hovers around $236 as of this writing, the highest level since July 2022.

If you are thinking about joining the buyers now, the thesis of this article is to remind you to check out insider activities first. After all, the insiders are usually more informed about the true value of their own business. And in NVDA’s case, its recent insider activities have been 100% selling activities. And next, I will explain why I agree with these insiders’ selling decisions given the risks ahead.

Source: Author based on data from stockcharts.com

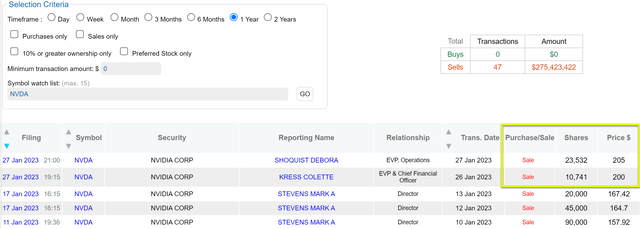

NVDA’s insider activities

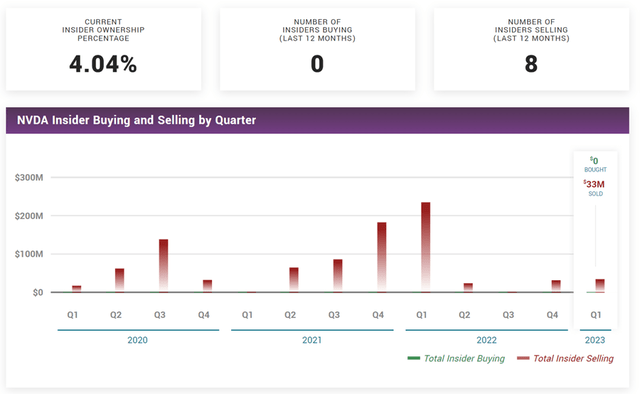

The chart below shows NVDA’s insider activities in the past 12 months. As seen, over the past year, there have been a total of 47 insider transactions, and 100% of them were selling activities. The cumulative amount from these 47 selling transactions was about $275 million.

More notably, the latest selling activities in Jan 2023, from two of its EVPs (as highlighted in the yellow box), were in the $200+ price range. I think these latest transactions are especially relevant and should serve as a caution for potential investors who are thinking about buying into the hype now. As you can see from the 1st chart above, NVDA’s trading activities in the past 6 months or so were largely in the price range from $155 to $185 (as highlighted in the yellow rectangle in the chart). And trading volume above this range (like in the $200+ range those two EVPs have sold their shares) is very minimal, and thus very opportunistic in my view.

Source: DataRoma.com

Finally, before I move on, a few more words about the above insider activities. First, the above insider activities from DataRoma are confirmed by the information provided by MarketBeat data, too (see the next chart below). As seen, MarketBeat data show zero insider buying in the past 12 months, too, and a total of $33 million insider selling in Q1 2023 alone. And secondly, as detailed in my earlier article,

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. The reason is that selling activities can be triggered by a range of factors irrelevant to business fundamentals (such as divorce or buying a new house). In contrast, insider buying activities usually have only one explanation – the insiders think the stock is undervalued.

Despite my usual skepticism towards insider selling activities, I take notice when the selling is so overwhelming, as in NVDA’s case here. And next, I will examine the business prospects further and explain why I think these insiders are selling rationally (rather than to raise money to buy a new yacht).

Source: MarketBeat data

Valuation risk too high

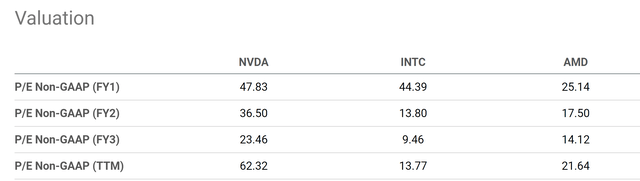

To begin with, the valuation risk is too high. And the significant price advancement after ER made it even higher. NVDA is just trading at an unjustifiable premium the way I see things. Its TTM price-to-earnings (P/E) ratio is currently at 62.3x, which is higher than its peers such as Advanced Micro Devices (AMD) (at 21x) and Intel Corporation (INTC) (at 13x) by almost a factor of 3x and 5x, respectively. And next, I will examine the headwinds that NVDA is/will be facing in the next section. And you will see why I view NVDA’s current premium valuation as unsustainable.

Source: Seeking Alpha

Other Risks

First, NVDA has been suffering from contraction in several of its key segments in recent quarters, including gaming (second-largest market) and professional visualization businesses. The recovery in gaming in the past quarter might be only temporary, and the headwinds on its other segment could persist. In particular, as detailed in my earlier article, the collapse of cryptocurrency prices (more than halved during 2022) will keep pressuring its high-end units as my analyses showed that the company’s revenues are correlated with crypto mining.

Second, the trade tension between China and U.S., especially in the chip space, remains a wildcard and could escalate. NVDA’s data center demand fell significantly in China in the past quarter, and management attributed the decline due to China’s macroeconomic slowdown and also the U.S. government’s export restriction on its products. Even though the export restrictions have been eased with revised policies, the trade tension has largely remained the same and as such so do the risks. In the case the trade tensions escalate, it could severely disrupt not only a key end-market for NVDA, it could also disjoint its supply chain and manufacturing operations in China. Nvidia relies on Chinese manufacturers for the production of some of its products, so any disruption in the supply chain could impact its ability to meet demand and lead to delays in product launches.

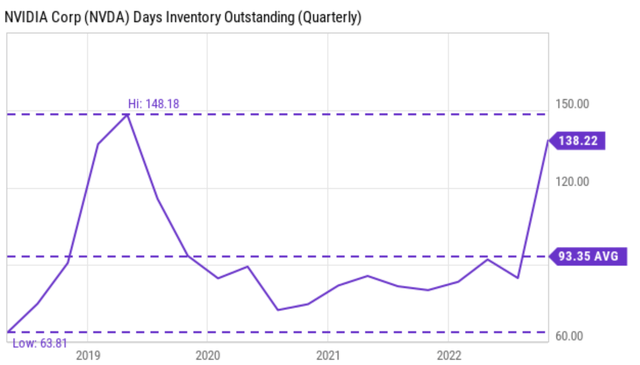

Finally, NVDA is still sitting on a large inventory, which could cause large balance sheet and also profit risks. As argued in our earlier article, NVDA is facing a situation similar to hoarding toilet paper during the COVID. It has a substantial amount of excess inventory as seen in the chart below. To wit, the company now sits on 138 days of outstanding inventory, almost 50% above its long-term average of 93 days and near the peak level since 2018.

Such a large inventory will take time to clear, and likely at reduced prices. Furthermore, it also carries significant balance sheet risks as time passes and market conditions change. For example, the company had to take a $1.2 billion write-off for inventory and related reserves last quarter.

Source: Seeking Alpha

Upside risks and final thoughts

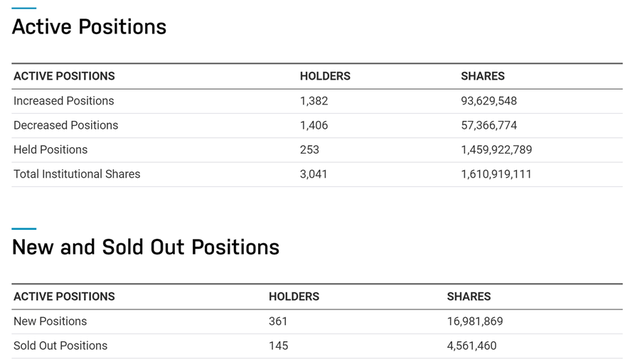

NVDA certainly delivered a great quarter. And the good news appears even better given all the bad news it has been reporting in recent quarters. As a result, it’s understandable that its stock price soared right after the ER. So there are certainly upside risks to the thesis also, and many of these have been detailed by other Seeking Alpha authors in the past few days. Here, I will just focus on an upside risk that is more specific to my thesis here: institutional activities.

Besides insider activities, another major market force that can impact stock prices is institutional activities. And the most recent institutional activities on NVDA are shown below. As seen, the picture is a bit more mixed. Overall, 1,382 institutional holders increased their NVDA positions in the past reporting period, and 1,406 decreased their positions. So, there has been an almost an equal number of institutional sellers and buyers. Although in terms of trading volume, the buyers bought more than the sellers sold (93.6 million shares of buying vs. 57,366,774 shares of selling).

Source: NASDAQ data

To conclude, I won’t join the Nvidia Corporation buyers now and do not recommend you do that either. To the contrary, I view the insider selling activities to be more rational. Especially, I view the latest selling activities that happened in January at the $200+ price as even more telling. Given the trading volume and business fundamentals, I view selling in the $200+ range as very opportunistic.

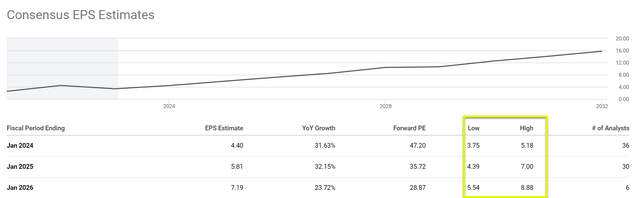

Before closing, one final chart captures much of the business risks and valuation risks mentioned so far. As seen, consensus estimates show such a wide variance for its EPS even for the next two years. Its FY 2024 EPS projection is between $3.75 and $5.18. This wide range of variance reflects the high level of uncertainties and further exacerbates the valuation risks in my mind. Should the EPS turn out to be toward the lower end, its FY1 P/E would be about 62x – approaching a bubbling regime the way I see it.

Source: Seeking Alpha