Wirestock/iStock via Getty Images

Introduction

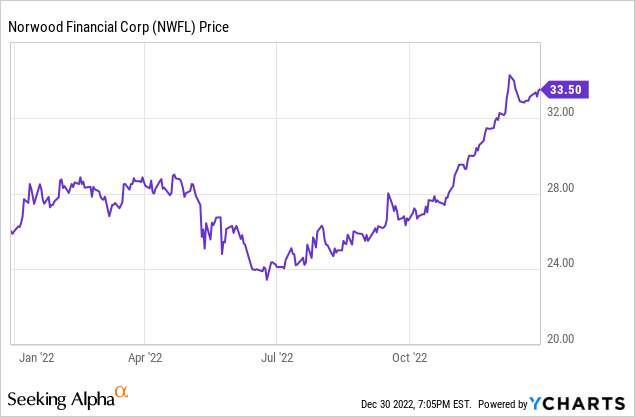

Back in July, when I last reviewed Norwood Financial (NASDAQ:NWFL), the holding company for the Pennsylvania and New York focused Wayne Bank, I wasn’t quite sure if the bank would be able to protect its tangible book value per share. While I expected the full-year EPS would come in above $3/share, the exposure to the securities available for sale would likely have a negative impact on the book value. During the first nine months of the year, Norwood’s TBV per share fell by just over 25%, but I expect increasing earnings to start compensating for the decrease in value of the securities available for sale.

Earlier this year, I expected the TBV to fall

The theory behind that thesis was rather simple. Unlike securities classified as ‘held to maturity’, securities classified as ‘available for sale’ have to be marked to market. And increasing interest rates mean the value of those securities is going down, resulting in a book value loss.

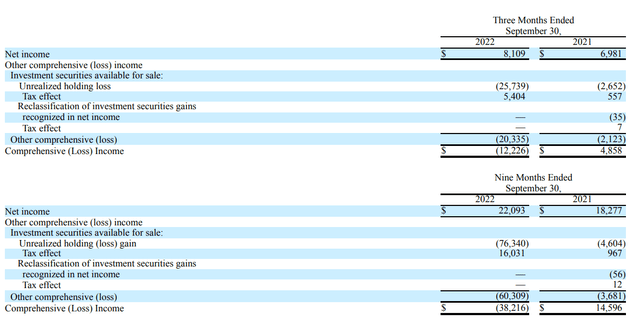

These decreases in valuations are not noticeable in the income statement, but are included in the comprehensive income. And as you can see below, the bank recorded a $25.7M value decrease during the third quarter and a total drop in value of in excess of $76M during the first nine months of the year.

Norwood Financial Investor Relations

And that is the main reason why, despite recording about $15M in retained earnings in the first nine months of the year, Norwood’s book value actually decreased.

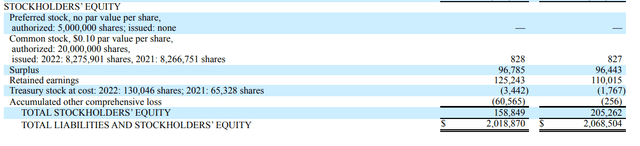

Norwood Financial Investor Relations

I can’t say I’m shocked nor surprised, as this is exactly what I expected to happen. As of the end of September, Norwood’s book value per share was $158.8M / 8.13M shares outstanding = $19.53. Unfortunately, the balance sheet also contained about $29.6M in goodwill and other intangibles, resulting in a tangible equity value of $15.89 per share. The bank’s press release mentions a TBV of$16.29 per share, but this only seems to include the goodwill.

The third quarter was pretty strong, and the TBV should stabilize in 2023

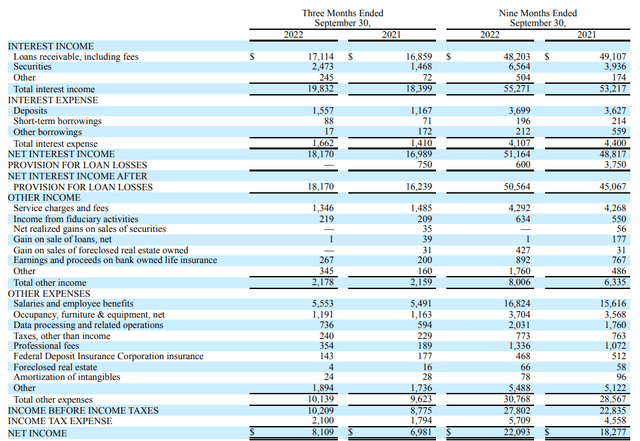

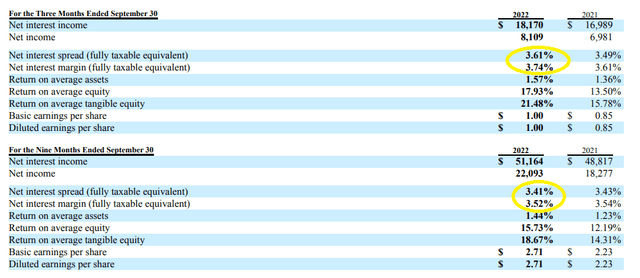

Although Norwood’s balance sheet shrank during the first nine months of the year with an acceleration in the third quarter wherein the balance sheet lost almost $50M (2.5%) of its size, the net interest income increased. Whereas the bank reported a net interest income of $16.9M in the second quarter of this year, the total NII increased by approximately 13% to $19.1M in the third quarter of this year.

Norwood Financial Investor Relations

While the total interest income increased by approximately $1.75M, the interest expenses increased from $1.2M to $1.7M. While that is a very sharp relative increase, the interest income increase was four times higher than the reported interest expenses, resulting in the expanded net interest income of $18.2M.

The bank did not have to record any loan loss provisions during the quarter and after deducting the approximately $8M in net non-interest expenses, Norwood’s pre-tax income jumped to $10.2M (an increase of 16% compared to the third quarter of last year and a 19% QoQ increase) resulting in a net income of $8.1M for an EPS of $1.00.

This pushed the 9M 2022 EPS higher to $2.71 and there’s now very little doubt the bank will effectively meet my $3 EPS expectations. Even if the bank would have to record additional loan loss provisions during the fourth quarter, it’s pretty much guaranteed to exceed the $3 EPS mark. This also means that for next year, we can likely aim for at least $4 per share in earnings. While I do think the bank will have to increase its loan loss provisions, the net interest income should and very likely will increase at a faster pace than additional provisions will be required.

Norwood Financial Investor Relations

Shareholders are directly benefiting from the strong financial performance of Norwood Financial, as the bank increased its dividend by almost 4% to $0.29 per quarter. This means the payout ratio is less than 30% based on the recent financial results and as I expect the earnings to increase, the payout ratio may continue to decrease. At the current share price of just over $33.4, the dividend yield is approximately 3.5%. That’s not very high, but this also means Norwood is retaining about $0.70 per share per quarter and $2.80 per share per year in earnings, and that will be the basis to rebuild the book value and tangible book value going forward.

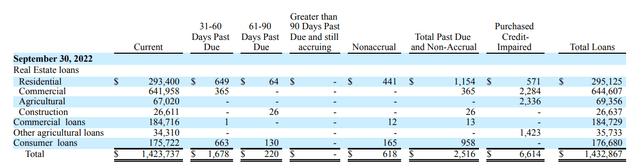

And please note, there is no certainty Norwood will have to increase its loan loss provisions. As of the end of September, just over $2.5M of the loans were past due and no longer accruing, and only $0.6M of the loans was put on a non-accrual status.

Norwood Financial Investor Relations

As the total allowance for loan losses has increased to almost $17M (from $16.4M at the end of last year), there definitely is no urgency in recording additional provisions.

Investment thesis

I admit, I am scratching my head. Norwood Financial does exactly what I expected it to do: the bank is reporting relatively strong earnings and will likely report an EPS closer to $4/share, but despite these very strong earnings, the book value per share continued to erode.

I do expect the bottom to be reached soon as the retained earnings will start to compensate for the erosion of the book value. And as the higher interest rates had a negative impact on the value of the portfolio of securities available for sale, there also is an advantage: Norwood’s net interest margins and net interest income will likely continue to increase.

While I understand the bank still looks cheap at about 9-10 times earnings for this year, the tangible book value per share has now dropped below $16. And I’m not too keen on paying more than twice the tangible book value for a bank stock. Even though I do expect the earnings to improve, pretty much any bank will benefit from increasing net interest margins, and then I simply prefer to buy a bank with a lower premium to the tangible book value.

This means Norwood Financial is still a ‘hold’ for me. Based on the EPS, it could be a ‘buy’, but the triple digit premium to the tangible book value is too rich for my blood.