Hero Images Inc

If you are a value investor like I am, you likely believe that the market can often be, or at least sometimes can be, inefficient. In other cases, it can be efficient. And where our returns come from is recognizing which instances are which. Earlier this year, the banking sector experienced a wave of fright, caused by the fear that high amounts of uninsured deposits would cause various institutions to collapse. Some did, while many others survived and saw eventual recoveries in their share prices. There have been a few, however, that did survive but have seen very little upside since. And it’s with many of these companies that some opportunities might exist for value-oriented investors.

One prospect that does seem to fit in this category is Northwest Bancshares (NASDAQ:NWBI). From its closing price on February 28th of this year until shares bottomed, the stock experienced downside of 28.4%. And even though the contagion is a now distant memory, shares are still down 24.5%. Digging into the business, we see that it’s not the greatest prospect that can be had. In some ways, it is surprisingly mediocre. But given how shares are priced and how deposits continue to grow, I do believe that it makes for a soft ‘buy’ candidate at this time.

A bank that’s worth a bit of optimism

With a market capitalization of $1.32 billion, Northwest Bancshares is far from being a large bank. But it’s not a small one either. Through the 142 bank offices that the institution has in operation, it provides customers with a wide array of traditional banking services. These customers include those located in multiple states, including Pennsylvania, parts of Ohio and New York, and in Indiana.

Examples of these services include traditional deposit services, as well as the origination of residential mortgages, home equity loans and lines of credit, and a wide array of other consumer loans such as those used for the purchase of automobiles, the payment of credit cards, and more. The company also lends capital for the purpose of buying and/or fixing up commercial real estate. Examples of these properties can include student housing facilities, senior living facilities, medical buildings, and more. The company is also engaged in certain investment activities. This includes the purchase of debentures and mortgage-backed securities, with the latter typically being invested in with the goal of achieving positive interest rate spreads at very little expense in order to lower the company’s credit risk.

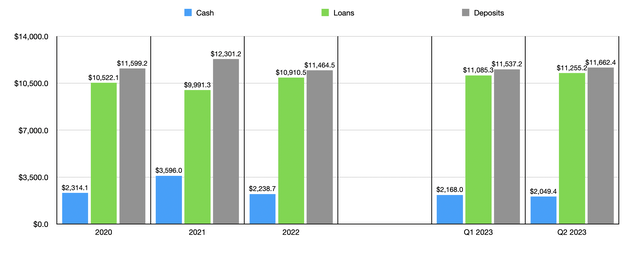

Author – SEC EDGAR Data

Over the past few years, management has done well to grow the value of the company’s loan portfolio. From 2020 through 2022, this metric increased from $10.52 billion to $10.91 billion. In the first half of this year, the value of loans grew further to $11.26 billion. It does appear as though some of this increase might have come as a change to the company’s overall operational strategy. I say this because, while the value of loans increased, the value of cash has been on the decline since 2021 when it peaked at just under $3.60 billion. As of the end of the second quarter of this year, it had fallen to $2.05 billion. This came about even as the value of debt on the company’s books spiked from 2021 to 2022 from $391.8 million to $924.3 million. But since then, debt has declined to $875.7 million.

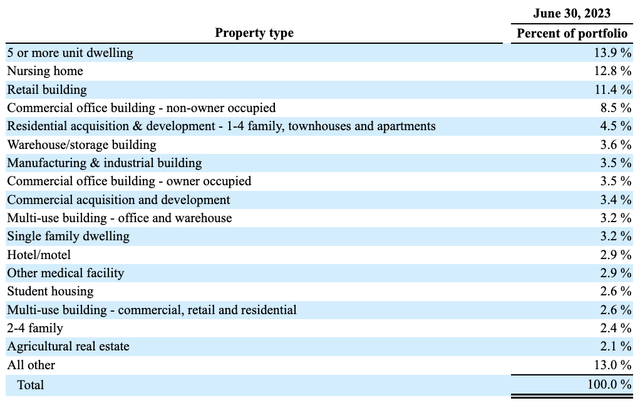

Northwest Bancshares

Before we move on to other things, one thing that does deserve some attention is the composition of the company’s loan portfolio. At this moment, the market is, justifiably, concerned about exposure to office assets. As of the end of the most recent quarter, 8.5% of the company’s commercial real estate loan portfolio is in the form of non-owner occupied office properties. This is the highest risk of office assets in my opinion. It does have some other exposure though. Owner occupied commercial office buildings comprise another 3.5% of loans, while multi use buildings that include both office space and warehouses make up another 3.2%. I’m not concerned about this third category and I’m only minimally concerned about the owner occupied ones. As a whole, this picture is not great, but it’s far from bad.

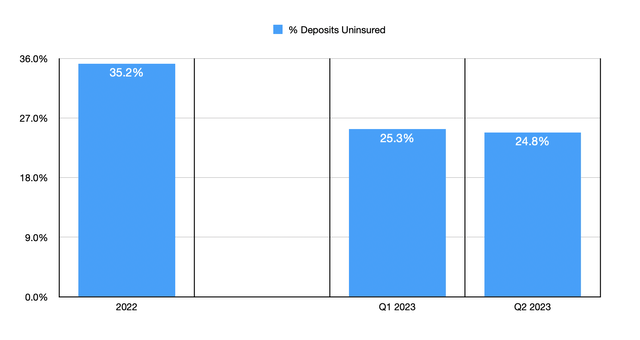

For the most part, the company’s history from a deposit perspective has been positive. After shooting up from $11.60 billion in 2020 to $12.30 billion in 2021, deposits at the bank plunged to $11.46 billion in 2022. This is not surprising in and of itself because, with high interest rates, depositors are looking for more attractive places to put their funds. But since the end of 2022, deposits have resumed their growth. They hit $11.54 billion in the first quarter of this year before climbing further to $11.66 billion by the end of the second quarter. 24.8% of the deposits on the company’s books are currently classified as uninsured. That’s down from the 35.2% seen at the end of 2022. It’s really impressive that the company was able to achieve such a decline in exposure while also increasing deposits in a tough environment.

Author – SEC EDGAR Data

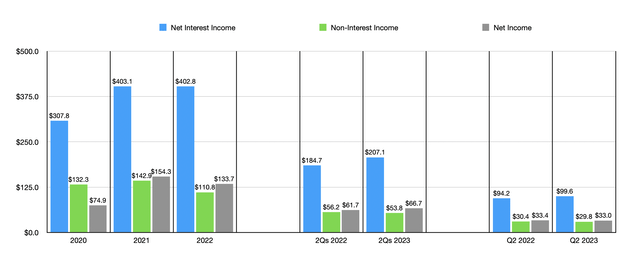

The bank has dealt with, it has managed to keep revenue and profits up for the most part. While net interest income has been a bit lumpy, the $207.1 million that it hit in the first half of the 2023 fiscal year was higher than the $184.7 million generated one year earlier. Non-interest income at the bank has been far lumpier and has, in recent quarters, fallen compared to the same time one year earlier. But net income, for the most part, has generally trended higher. The one exception is the $154.3 million in profits achieved in 2021. But after falling from that point to $133.7 million in 2022, it began a modest climb higher in 2023.

Author – SEC EDGAR Data

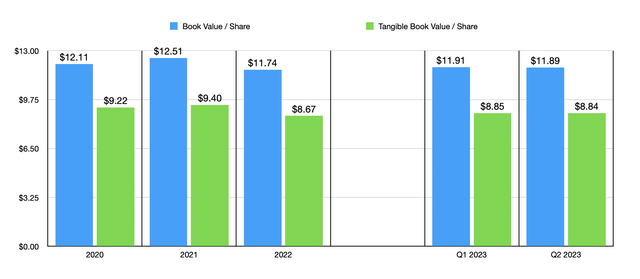

In terms of valuing the company, there are a couple of different approaches that we can take. One of these is to compare the company to its book value. As you can see in the chart below, the book value and tangible book value, both on a per share basis, has declined from where they were back in 2021. However, Northwest Bancshares is trading at a roughly 12.3% discount to its book value and at a modest premium of only 18% to its tangible book value. These numbers are not particularly high, nor are they particularly low, for the current environment. I would say that they are perfectly acceptable. Meanwhile, we can use the other approach, which would be the price to earnings approach. On this basis, the company is trading at a multiple of 9.9. This is more expensive than many other players that I have seen, but it’s still below the industry average of roughly 10.4.

Author – SEC EDGAR Data

Takeaway

Based on the data provided, I will say that I’m not the most enthusiastic when it comes to many of the banks that I have seen. But this one seems intriguing to me. Some of its fundamentals have been lumpy over time and that certainly knocks some points off of the picture. I have seen some banks that are trading cheaper than this. But the stock is not unreasonably priced at all. Uninsured deposit exposure has improved drastically and looks to be in check. And overall deposits continue to expand. Given these combination of factors, I do believe that a soft ‘buy’ rating is appropriate at this time.