Klaus Vedfelt/DigitalVision by way of Getty Photos

Expensive Nordstern Capital Companions and Pals:

Come collect ‘spherical individuals Wherever you roam

And admit that the waters Round you’ve gotten grown…

…The sluggish one now will later be quick As the current now will later be previous The order is quickly fadin’.

And the primary one now will later be final For the occasions they’re a-changin’.

– Bob Dylan

Change

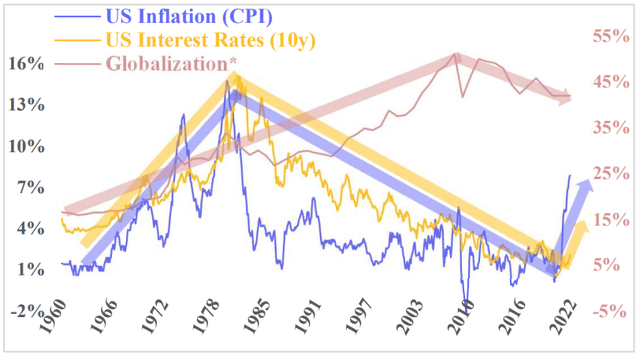

Uncooked information from TheGlobalEconomy.com; *Globalization: Merchandise Commerce as %World-GDP

We noticed 40 years of deflation and declining rates of interest. As well as, the final 15 years noticed an incredible enhance within the cash provide and authorities debt. We loved an addictive cocktail of huge financial stimulus. Inflationary pressures didn’t materialize, partly as a result of rise of China and elevated world commerce. Outsourcing to Asia stored costs low.

All the image is about to alter. China’s progress is slowing, wages are rising, nationalistic tendencies are resurfacing, world commerce is declining. The inflation genie is out of the bottle, rates of interest are going to rise, and the FED introduced to transition from quantitative easing to deleveraging. All of this implies ache for the US economic system.

This huge paradigm shift was effectively underway, then Russia began a warfare. It absolutely doesn’t assist to ease the troubles.

Fixed

Valuation is necessary. If we pay 50 cents for one thing that produces and pays out $1 tomorrow, that could be a cut price. That is true no matter a recession. Throughout the previous few years, monetary markets had been irregular and exuberant, however valuation errors may show expensive when the ‘everything-bubble’ bursts. Nonetheless, Nordstern Capital owns corporations at low costs in comparison with their near-term money circulation technology and, I consider, will emerge as a winner within the new period of excessive inflation (and potential recession).

Inflation

“The remedy for top costs is excessive income”

– Johannes Arnold

It is not uncommon lore that ‘the remedy for top costs is excessive costs’…the thought behind this phrase is that increased costs entice extra competitors. Elevated competitors (on value) will in flip result in decrease costs. The difficulty with this argument is that what attracts extra competitors isn’t increased costs per se, however increased income.

The basis reason behind rising costs is an imbalance of provide and demand. Our downside is that the US doesn’t have sufficient provide for its demand. The scarce provide goes to the best bidder (theoretically, the one who wants it most). The capitalist treatment is that individuals need to reap these income and can make investments (money and time) into manufacturing of extra provide. Denying ‘windfall income’ to the beneficiaries of excessive costs, e.g. by placing extra tax levies on the oil business as it’s proposed by sure legislation makers, exacerbates the issue. Who needs to take a position if they’ll’t reap the spoils?

Costs will climb and shortages will worsen till inflation beneficiaries are rewarded by income excessive sufficient to draw extra funding. So long as we’re a capitalist society, inflation beneficiaries will get their outsized returns, both now or over time.

That’s, until demand collapses. The FED’s ‘cash printing’ elevated demand for years, which may be about to alter. The FED lately u-turned and intends to combat value will increase by way of charge will increase and ‘quantitative tightening’, each measures are basically supposed to suppress demand. Nonetheless, this recipe may lead the US right into a recession.

Investing

The best funding is priced cheaply in relation to the current worth of its future cashflows, and the long run cashflows must be benefitting from inflation and must be antifragile in a recession.

Prime Nordstern Capital Investments

Embracer Group (OTCPK:THQQF, inventory value: – 18% in 1Q 2022)

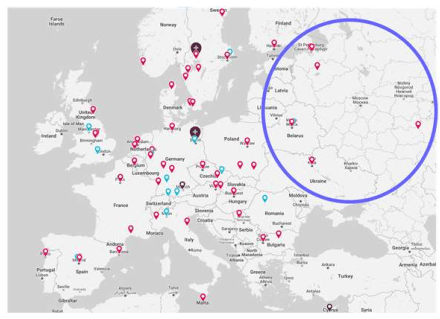

Embracer Group is our largest holding and its inventory value declined 18% final quarter. The video-gaming business remains to be unloved by ‘the market’ post-lockdown. Embracer’s footprint within the European battle area has raised issues: 1,000 workers in Russia, 250 in Ukraine, and 250 in Belarus, collectively about 12% of Embracer’s complete headcount.

The Russian warfare is a tragedy. Embracer Group is spending $5m for humanitarian assist and is aiding with relocation and different types of assist for workers and their households. The group’s revenues are affected by the warfare by roughly 1% solely and all publishing and mental properties are owned and managed exterior the area.1 Most of Embracer’s war-struck workers work on the subsidiary Saber Interactive. Nonetheless, Saber’s launch of the most important title Evil Lifeless: The Sport in three weeks (on Friday, Might 13) isn’t solely on monitor but additionally sports activities promising pre-sales numbers2.

Video video games are a comparably low-cost type of leisure, and the business is historically resilient in financial downturns3. Decrease financial exercise and extra time spent at house may in actual fact enhance demand for video gaming. Inflation, however, is at the moment driving up wages within the sector. Nonetheless, since value tends to be solely a subordinate criterion for many shoppers of a online game, I consider that long-term margins within the online game enterprise will show not solely recession resilient but additionally inflation resistant.

Embracer Group expects to generate $1.3bn in EBIT two years out. This administration forecast implies that Embracer Group will develop income method over 50% per 12 months and that the enterprise would price lower than 6- occasions EBIT on the present share value.

Embracer Group, for my part, is a sturdy high-growth high-quality cash-generator and is at the moment accessible for a similar value {that a} low-quality enterprise in decline may demand. Embracer is an apparent cut price, and the worth drop was exploited by govt Matthew Karch, who oversees the Russian and Ukrainian workers. He purchased Embracer shares price greater than $7m for his personal account in March4.

Imperial Metals (OTCPK:IPMLF, inventory value: + 19% in 1Q 2022)

Gold and copper costs each elevated throughout the quarter as inflation ravages. Gold is regaining curiosity as the shop of worth in unsure occasions.

Mount Polley operations resuming (www.mountpolley.com)

The Mount Polley mine is reopening as I’m scripting this letter. A latest initiation report on Imperial Metals5 estimates about CAD$115m free money circulation from this mine in 2023 (assuming $4 per pound copper and $1,850 per ounce gold6). Primarily based on this estimate Imperial Metals is at the moment priced at lower than 5-times 2023 free money circulation of the Mount Polley mine alone.

I anticipated some replace on early mining of the high-grade pods at Crimson Chris throughout Newcrest’s earnings launch in March. Sadly, nothing of this type was printed. Imperial Metallic’s CEO Brian Kynoch believes nonetheless, that early mining of the high-grade pods stays extremely probably with an unchanged timeline (beginning in 2023). These pods at present commodity costs ought to carry in additional than $1bn income (greater than twice the corporate’s market cap) for Imperial Metals earlier than 2024.

I consider that Imperial Metals over the following couple years will turn out to be a high-growth high-margin cash- machine and is obtainable at this time for a small fraction of its future money flows.

Evolution (OTCPK:EVVTY, inventory value: – 25% in 1Q 2022)

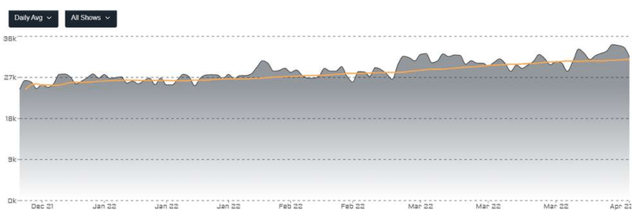

Participant numbers, profitable new recreation releases, and new operator contracts in current in addition to in new geographies point out that Evolution AB had one other robust quarter in 1Q2022, but the share value declined.

Fears persist that Evolution’s enterprise may undergo from a grievance concerning the firm’s grey market operations {that a} legislation agency has filed with The Division of Gaming Enforcement in New Jersey final 12 months. The state’s regulatory company has not but responded on this matter. Nonetheless, CEO Martin Carlesund declared the allegation report ‘falsified’ within the firm’s

Evotracker.stay signifies vital enhance in participant numbers

February earnings name7. As well as and undeterred by the above allegations, the main US on-line on line casino and sports activities betting operator FanDuel signed a contract to make Evolution the only supplier of stay supplier desk video games not just for New Jersey however for the complete United States8.

Evolution is the dominant B2B service supplier, basically ‘the one recreation on the town’ for on-line stay on line casino operators and enjoys an excessive amount of pricing energy. Therefore, inflation shouldn’t be a priority. As well as, on-line playing can be traditionally resilient in financial downturns9. Nordstern Capital expects continued hyper-growth at hyper-margins for an prolonged interval of years. Together with a free money circulation payout ratio of greater than 50% this warrants an earnings-multiple considerably increased than the 25-times implied by the present share value. The corporate continued to purchase again its undervalued shares all through the quarter.

StoneCo Ltd (STNE, inventory value: – 31% in 1Q 2022)

StoneCo Ltd (Stone) shares suffered a steep value decline within the quarter, extending final 12 months’s fall. Nonetheless, whereas 2021 was a catastrophe for Stone, the March earnings name indicated a robust restoration for the enterprise.

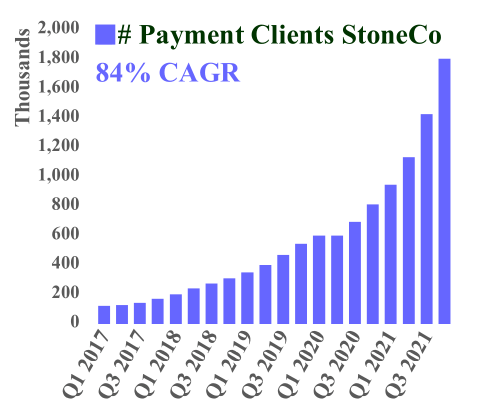

Administration expects Stone to enhance margins and on the identical time to proceed hypergrowth all through 202210. The enterprise is worthwhile and at the moment trades at round 4-times EBITDA. Such a low a number of implies that ‘the market’ expects the enterprise to considerably decline. Both administration or the market have to be flawed.

Stone has grown purchasers for its fee providers each quarter over the previous 5 years from 83,000 to 1.8 million. All through the previous 12 months Stone made a number of acquisitions, donated cash to causes associated to the pandemic, repurchased shares, massively elevated headcount, and acquired shares in different listed corporations. This doesn’t sound like a enterprise that’s headed for chapter. Stone goes to be a winner.

Arch Sources (ARCH, inventory value: + 51% in 1Q 2022)

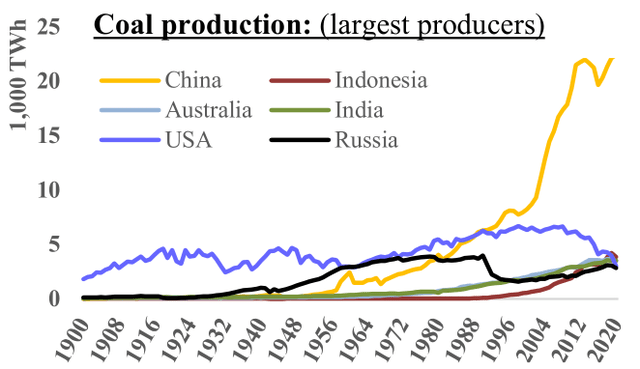

Arch Sources is a low-cost high-quality metallurgical ((met)) coal producer for the worldwide metal business. Coal may be among the many most hated merchandise on this planet, because of its status for being a grimy local weather killer. Nonetheless, steelmaking requires coal, photo voltaic panels and wind generators require metal. Our fashionable society depends on metal and modernizing international locations resembling China, India, Indonesia subsequently depend on coal.

Information Supply: BP Statistical Evaluate of World Vitality

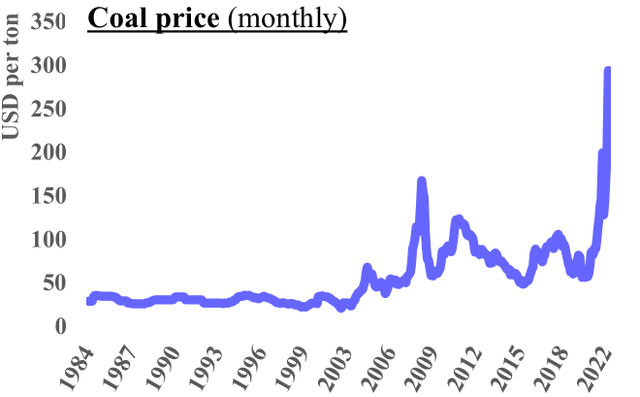

Information Supply: World Financial institution

Coal is a necessary commodity, but the business was ‘left for lifeless’ by Wall Avenue, ESG-driven funding flows, politics, the general public, and everybody else. It will most likely proceed to pose a large moat for potential new entrants. Years of constrained provide and underinvestment now meet with world supply-chain points, elevated demand post-lockdowns, and inflationary pressures. As well as, the sanctions in opposition to Russia are crippling one of many huge six producers, China is shifting away from Australia11and Germany’s governing Inexperienced Get together all of the sudden considers extra coal12. Demand up, provide down → value: moon.

Worth investing veteran Bob Robotti argues in “revenge of the previous economic system” that US producers of bodily items are benefitting from sustained inflation. Inflation pushed power prices in China and Europe enhance a lot sooner than within the US. Therefore, US energy-intensive industries resembling steelmaking are at a relative benefit.13 A wholesome US metal business will bode effectively for US met coal producers resembling Arch Sources.

ARCH isn’t solely an inflation beneficiary, but additionally a progress firm. Its met coal manufacturing is guided to extend greater than 20% this 12 months. Leer South, a big brand-new fashionable coal mine will attain full capability solely later this 12 months. ARCH correctly used its money circulation and the monetary market neglect to cut back primary share depend from 25 million in December 2016 to round 15 million as of December 2021.

ARCH trades at round $2.5bn enterprise worth and is anticipated to ship near $1.5bn EBITDA in 2022 alone (assuming $200 per ton coal, whereas present costs are above $300).14 ARCH’s present tax charge is actually zero.15 Administration guided CAPEX at $150m for this 12 months and introduced to payout 50% of free money as dividends, the remaining 50% may be used for share buybacks16. Thus, at lower than 2-times EBITDA, an funding in ARCH at this time may lead to a 25% money payout and one other 25% discount within the share depend this 12 months (assuming such a big buyback wouldn’t enhance the share value). Good-looking.

The Nordstern Capital partnership can flourish due to our companions’ belief, which empowers us to disregard short-term inventory value volatility and to concentrate on choice making for long-term funding success. I’m satisfied that the devoted concentrate on the long-term money circulation prospects of our investments will lead to higher long-term returns.

Lengthy-term oriented accredited traders who are usually not companions but are inspired to use. Trying ahead to listening to from all of you.

Sincerely,

Johannes Arnold, Nordstern Capital Traders LLC

Footnotes

1Replace on the state of affairs as a result of warfare in Ukraine – Embracer

2At the moment #1 pre-ordered recreation on Epic Retailer in addition to Amazon’s PS5 and Xbox Collection X shops

3https://www.nielsen.com/wp-content/uploads/websites/3/2019/04/valuegamer_final1.pdf

4Sök

5Argentis Capital: Initiating Protection of Imperial Metals, 2022-04-07

6Present market costs are $4.70 per pound copper and $1,950 per ounce gold

7CEO’s feedback in Evolution AB 2021 year-end report, February 9, 2022

8https://www.evolution.com/information/fanduel-group-and-evolution-extend-us-live-casino-partnership

9Gross Gaming Income (GRR) for the iGaming business grew throughout the financial downturn 2007ff., in response to H2GC

10StoneCo 4Q2022 earnings presentation, March 17, 2022

11https://www.power-technology.com/evaluation/coal-supply-chain-china-australia-india-international-trade/

12https://www.bloomberg.com/information/articles/2022-02-28/germany-mulls-extending-coal-phaseout-to-wean-off-russian-gas

13Robert Robotti, Douglas Meehan, Michael van Biema “As Inflation Bites…”, BARRON’S, January 28, 2022

14BRiley Securities Analysis, March 8, 2022

15Arch Sources has $1.3bn web working loss carryforwards as of December 2021

16Arch Sources 4Q2022 earnings report, February 15, 2022

Authentic Publish

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.