KristianSeptimiusKrogh/E+ via Getty Images

Nordea Bank (OTCPK:NRDBY) is a Scandinavian bank with about 200 years of history; it is headquartered in Helsinki, Finland.

The main reason I am writing an article on this bank is because of the very interesting remuneration it offers to its shareholders. In fact, in addition to a significant buyback, this bank offers a dividend yield of about 8 percent.

At first glance it would seem like a bargain, however, I think there are a number of aspects to evaluate. Not all that glitters is gold.

Financial results

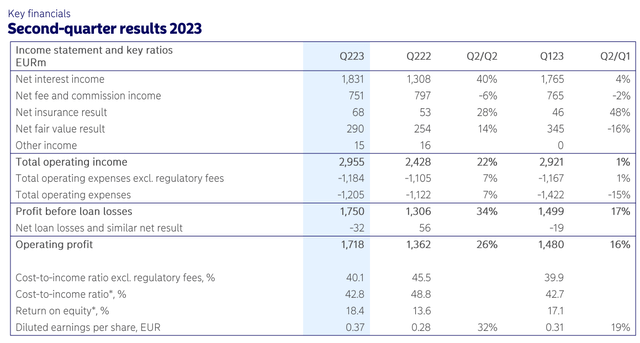

The first aspect I want to discuss is Nordea Bank’s recent financial performance.

Nordea Bank Q2 2023

The latest quarterly report showed results that were a marked improvement over Q2 2022, in fact, net interest income increased by 40%; operating income increased by 26%; diluted EPS improved by 32%. Overall, we talk about excellent results, especially considering the current macroeconomic conditions have tightened a lot compared to last year.

The ECB, in line with major Western central banks, has raised interest rates significantly to combat inflation, and this has led to an economic slowdown.

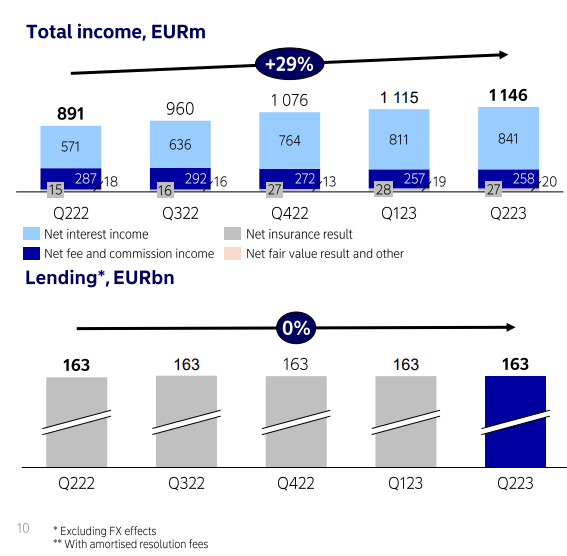

Nordea Bank Q2 2023

Total income continues to grow quarter by quarter but loans are struggling to increase. This is an issue that is affecting all banks as businesses and households prefer not to borrow at current market rates. Finally, the current net interest margin is 1.69 percent, quite low but up 55 bps from last year.

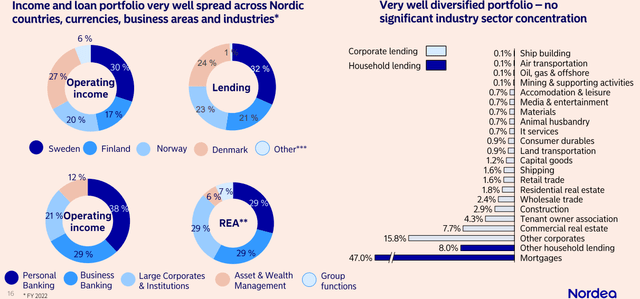

Nordea Bank Q2 2023

The loan portfolio has good diversification among Scandinavian countries; however, exposure to other countries remains very low: only 1 percent. In other words, the health of this bank is almost totally dependent on the Scandinavian economy. Also worth mentioning is the variety of currencies to which this bank is exposed. In fact, Finland is the only Scandinavian country that has the euro; all the others have their own currencies.

Finally, 55 percent of the loan portfolio involves loans to households, of which 47 percent are mortgages.

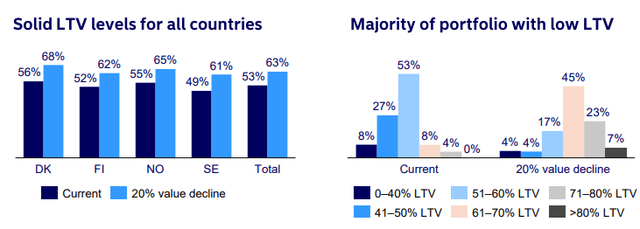

Nordea Bank Q2 2023

Most of these loans have fairly low LTV, making them low risk. In fact, average LTV among Scandinavian countries is only 53%; 88% of exposures have LTVs below 60%.

By the way, Nordea Bank also wanted to publish a stress test that included a market value collapse of 20%. In this scenario, 70% of the portfolio would still have an LTV below 70%. Basically, Nordea Bank’s average client is a Scandinavian family asking for a mortgage equal to half the value of the property. The risk of such a loan is quite low, which is why this bank’s net interest margin is also low.

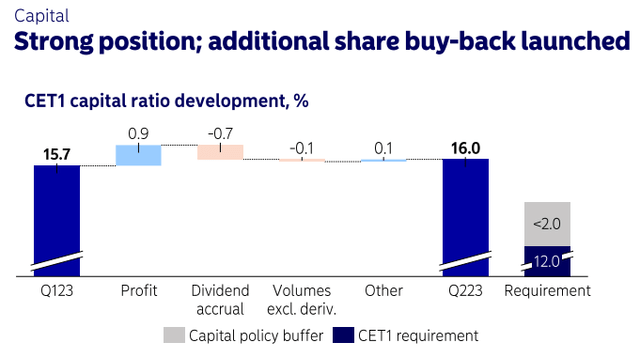

Nordea Bank Q2 2023

Finally, CET1 of 16 percent is another sign of risk aversion by this bank. This value is 4 percentage points above the regulatory requirement.

Overall, we are talking about a solid bank that is fundamental to the Scandinavian economy, yet it has one important negative factor: it fails to grow over the long term.

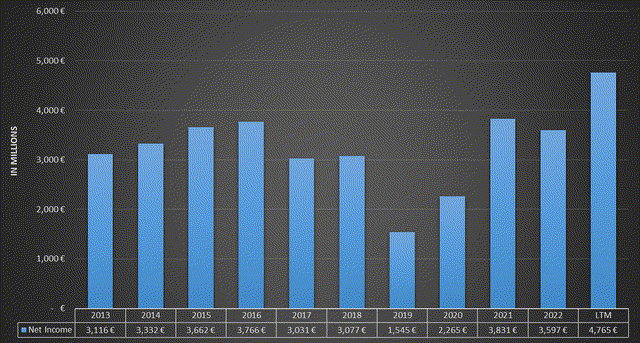

Chart based on Seeking Alpha data

Nordea Bank has posted record profits in the past 12 months, but throughout its recent history, it has failed to grow profits consistently. As I will show in the next section, this is critically important as it relates to the sustainability of the dividend.

Dividend analysis

The current dividend yield is 8 percent, which is much higher than the peers’ average of 3.82 percent. Typically, when a company issues such a high dividend the first question I ask is whether the dividend is sustainable over the long term, otherwise, it would make little sense to invest in it.

In the case of Nordea Bank, the dividend is sustainable in my opinion, but not in the long term. Let me explain further.

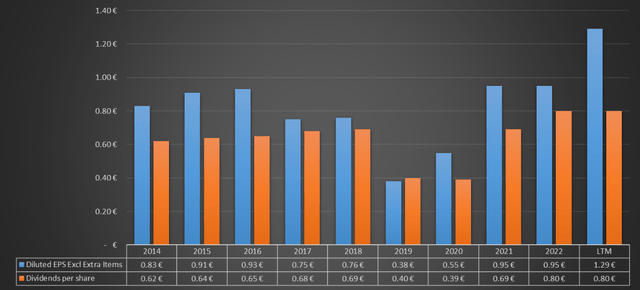

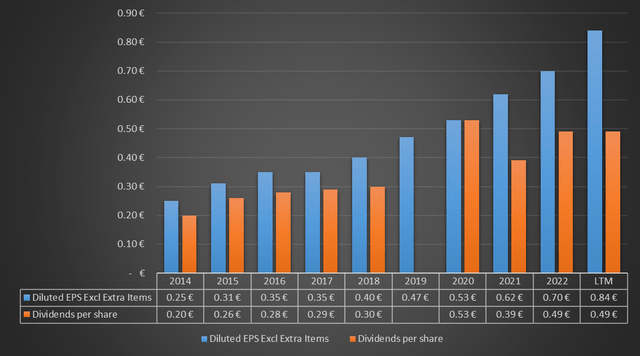

Chart based on Seeking Alpha data

As we can see from this image, diluted EPS has always covered dividend issuance (with the exception of 2019), which technically makes the dividend sustainable. The point is, however, that the dividend per share does not tend to increase steadily, as its issuance depends on how the bank performs in a specific year. In fact, the current dividend per share is the highest in recent history due to improved earnings over the past 12 months.

This means that when Nordea Bank goes through a rough time, a reduction in the dividend is almost certain. For those who believe they are investing in this bank with the view of earning a dividend yield of 8 percent per year over the long term in my opinion are wrong.

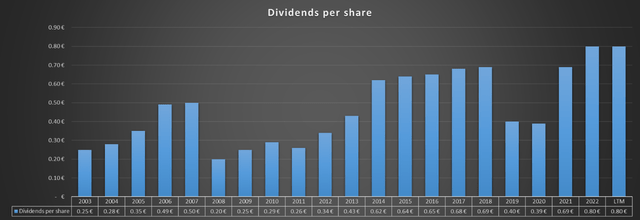

Chart based on Seeking Alpha data

Over the past 20 years, the dividend per share has never been constant but marked by ups and downs. Personally, I prefer to invest in companies that issue increasing dividends year after year, even if the dividend yield is much lower than 8 percent. What matters is that over the long term, the yield on cost has had a significant improvement.

Seeking Alpha

Buying this bank at the peak of the financial crisis would have meant a yield on cost of 13.92 percent but with all the ups and downs along the way. In short, while high, I am not interested in the dividend issued by Nordea Bank because of its inconstancy and fluctuating growth. After all, if EPS does not follow a long-term upward trend, dividends cannot follow a different trend.

Personally, I think there are more interesting banks in Europe, such as FinecoBank (OTCPK:FCBBF).

Chart based on Seeking Alpha data

This Italian bank is growing strongly and its EPS is increasing year after year. Dividends also show long-term growth. Since 2014, the dividend per share has more than doubled. Its dividend yield is 4.10%.

This is not an invitation to invest in FinecoBank, simply a way to put Nordea Bank’s position in context with other European banks that I find more interesting.

Finally, the double taxation for the dividend should not be forgotten: when the dividend beneficiary is not a corporate entity, the withholding tax is 30 percent.

Conclusion

Nordea Bank has had one of its best performances in the past 12 months, however, the long-term trend is not in its favor. EPS is inconsistent, and as a result, the dividend is likely to be cut in difficult times. Although the dividend yield is currently 8 percent, I believe there are better opportunities in Europe, including FinecoBank. For those with a short-to-medium-term view, Nordea Bank might be for them; my approach is long-term.

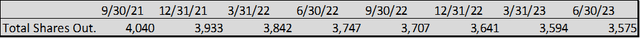

Finally, I would like to mention that this bank does not only remunerate shareholders through dividends but also through buybacks. In less than two years, outstanding shares have been reduced by 11.50% through a series of buybacks.

Chart based on Seeking Alpha data

At the end of April, the fourth €1 billion share buyback program was launched: yet CET1 remains high, at about 16% of risk-weighted assets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.