Imagine you had a device that allowed you to peer into the future. You enter a subject matter into this machine, requesting a specific quantitative measure, and at a specific future time. In other words, Price and Date. The machine whirrs and spins, lights flash, bells ring, and out pops a chart showing a range of answers and their probabilities.

You might imagine a machine like that would be worth a lot.

We actually have and use lots of such devices; we take traders’ bets and use them to assess the probabilities of future occurrences. The problem is not how good or bad their track records are (they tend toward mediocre); rather it is our failure to use these tools properly, consistent with an inherently unknowable future always subject to new data and information that changes those probabilities.

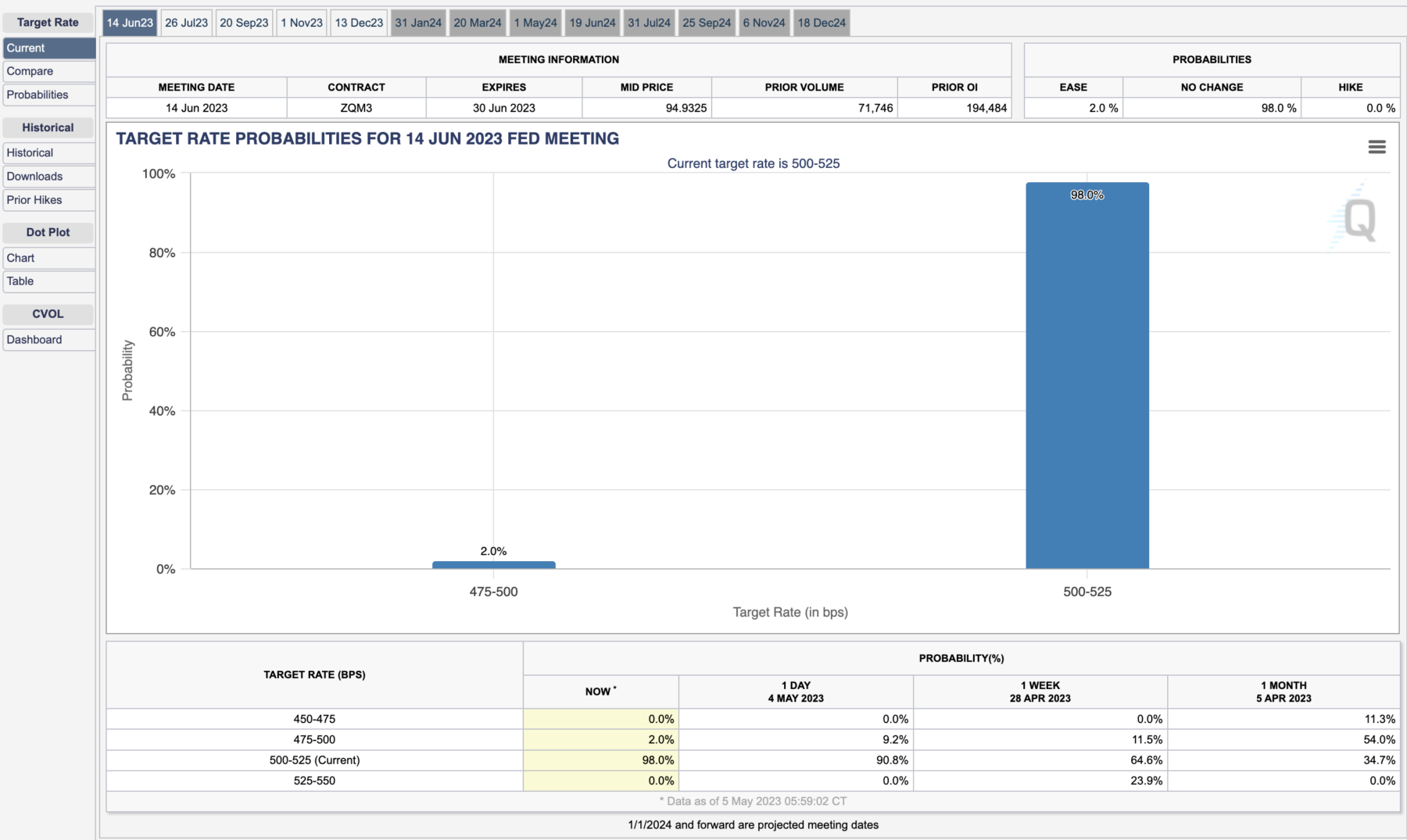

Consider just the past 48 hours of the CME FedWatch tool. Yesterday (May 4) it looked like this the odds of a pause were over 98.9% with the probability of a rate cut at the June meeting in the low single-digits (2.0%):

CME Group FedWatch Tool (May 2023)

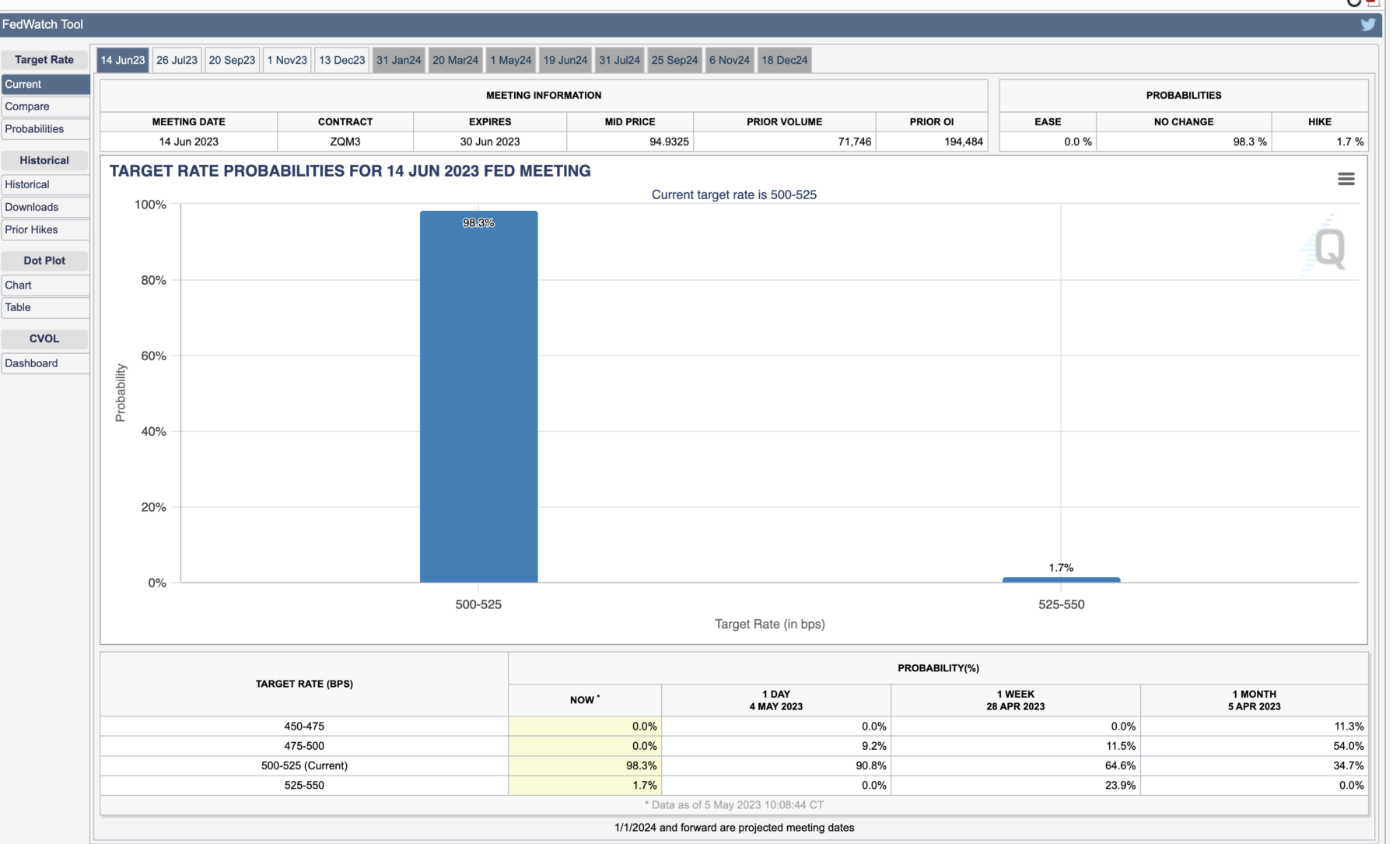

The next day (today, May 5) a medium NFP of 253,000 on May 5th exceeded consensus; this upended those probabilities slightly by shifting the odds of a rate cut to zero and making the odds of a rate hike at the June FOMC meeting a low single-digits probability (1.7%):

The tool is operating as it’s supposed to, incorporating new data as it comes in. The odds still favor a pause, but the lean has shifted in a way that I would suggest is a mostly meaningless rounding error.

That unfortunately is not how it gets discussed.

The problem lies not in the data but in ourselves. These data series always bounce around, confounding forecasters much of the time. Rather than accept the volatility of month-to-month economic datapoints — NFP, Consumer Spending, Manufacturing, Inflation, etc. — people tend to get sucked into the minutiae, allowing recency bias to affect how they look at the world. From the perspective of an asset management and financial planning firm, the challenge is getting people to ignore the day-to-day noise in favor of thinking about where prices will be a decade hence.

Consider the top chart above; it shows how the odds of future rate hikes or cuts have changed over each month. The odds change constantly as new information gets incorporated. Given that, you would imagine that investors would approach these future expectations of rate changes with a grain of salt. (I have long been a fan of the concept of Strong Opinions, Weakly Held). Instead, there is a tendency to put too much weight onto the numbers themselves, encouraging a variety of changes and modifications to portfolios due to whatever the latest data suggests.

It’s not just that we tend to be wrong, but rather, we seem to not accept the mathematics behind the odds of our own errors. They are exceedingly high, and we ignore that reality at our own peril.

It’s not just that nobody knows anything, but rather so few of us know that we know very little.

Investing is a humbling practice that requires the practitioner to not only acknowledge their limited understanding of the future but to behave in accordance with that small piece of wisdom. The temptation to respond to every economic shift every new data point each new change in probabilities is how people end up chopping themselves up with small costs that are accruing into larger ones.

“Don’t just do something, sit there” continues to be sage advice for investors…

Previously:

Nobody Knows Nuthin’ (May 5, 2016)

Nobody Knows Anything, NFP edition (June 5, 2020)

Nobody Knows Anything, NYC Real Estate Edition (June 10, 2022)

Nobody Knows Anything, Kentucky Derby Edition (May 9, 2022)

Forecasting & Prediction Discussions