One of the core philosophical beliefs I hold dear is that the future is inherently unknown and unknowable. This tends to be true for the vast majority of people almost all of the time. The world is full of endless, random, often-invisible factors that greatly impact outcomes.

Our own psychology works against our understanding this: Our hindsight bias allows us to see these unknowable results with perfect after-the-fact clarity; that fools us into believing our prior expectations turned out to be correct when they were nothing of the sort. We selectively recall our brilliance regarding market calls and stock picks while conveniently forgetting the failures. The occasional accurate forecast – regardless of whether the result of skill or luck – fools us into believing that we too can predict the future.

Which leads us to today’s delightful cover story: Cisco Systems and its brilliant CEO, John Chambers.

23 years ago today, Fortune magazine’s cover story about networking gear maker Cisco was published. The cover asks two questions about Cisco:

1.”Is John Chambers the Best CEO On Earth?” and

2. “Is it too late to buy his stock?”

Rather than cherry-picking the most egregious quote from the article, allow me to share the opening paras:

“Suppose you were stranded on a deserted island and could own just one single stock. What would it be? Think about it for a minute. Would it be a stock that’s been battered this spring and is down 20% from its high? A stock that trades at more than 100 times earnings? A stock that’s already climbed around 100,000% since going public ten years ago, that’s already enjoyed one of the greatest rides in stock market history? The stock of a company that now faces unprecedented challenges in tough new markets dominated by the likes of Lucent and Nortel, plus a posse of red-hot upstarts?

Yup, that would be the stock. No matter how you cut it, you’ve got to own Cisco.” (emphasis added)

I am hard-pressed to find a major magazine cover story that was both more accurate in its assessment of a manager — Chambers was a very good CEO — and less accurate about the prospects for the company’s stock. A few charts from that era reveal just how misguided this cover story was.

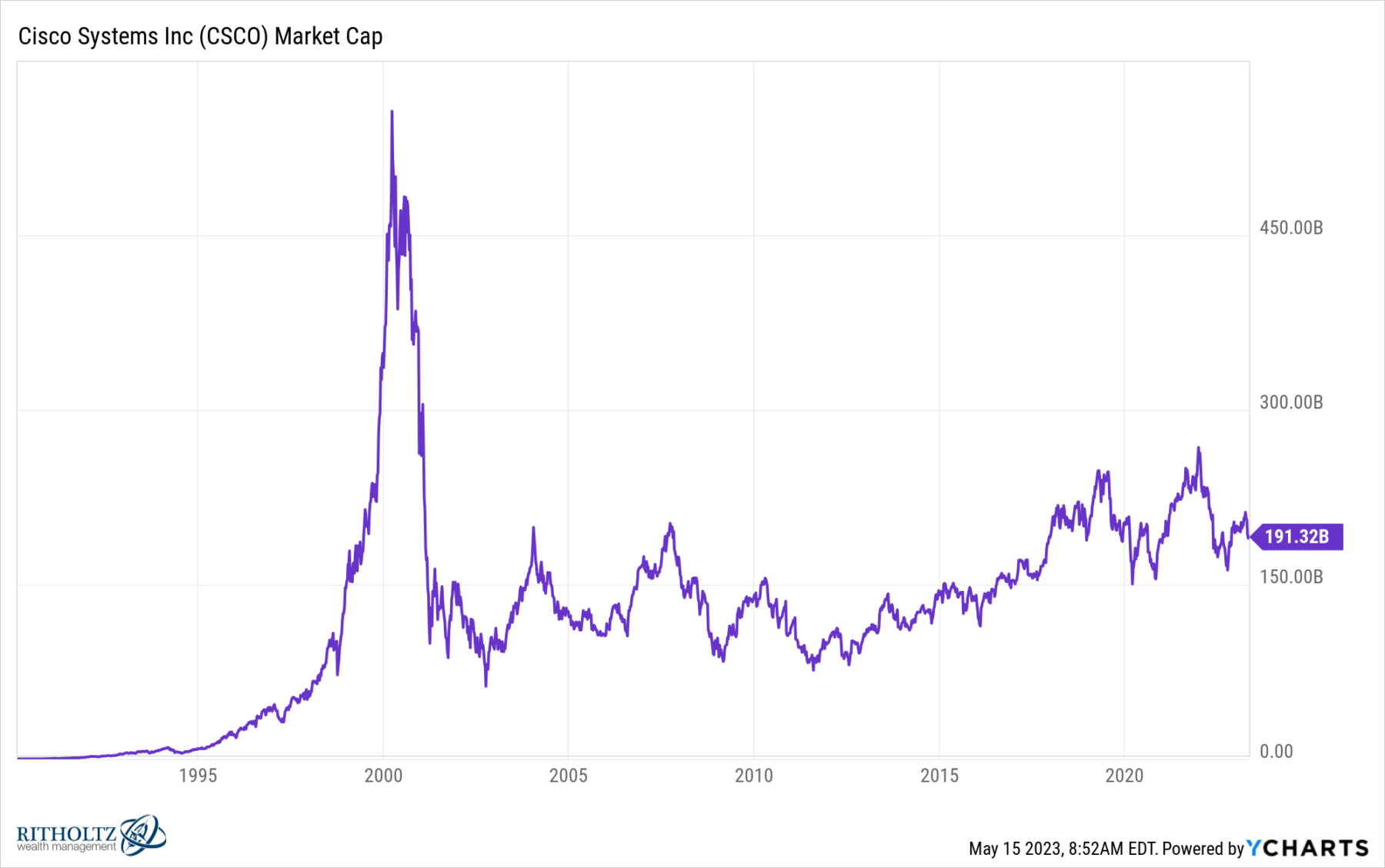

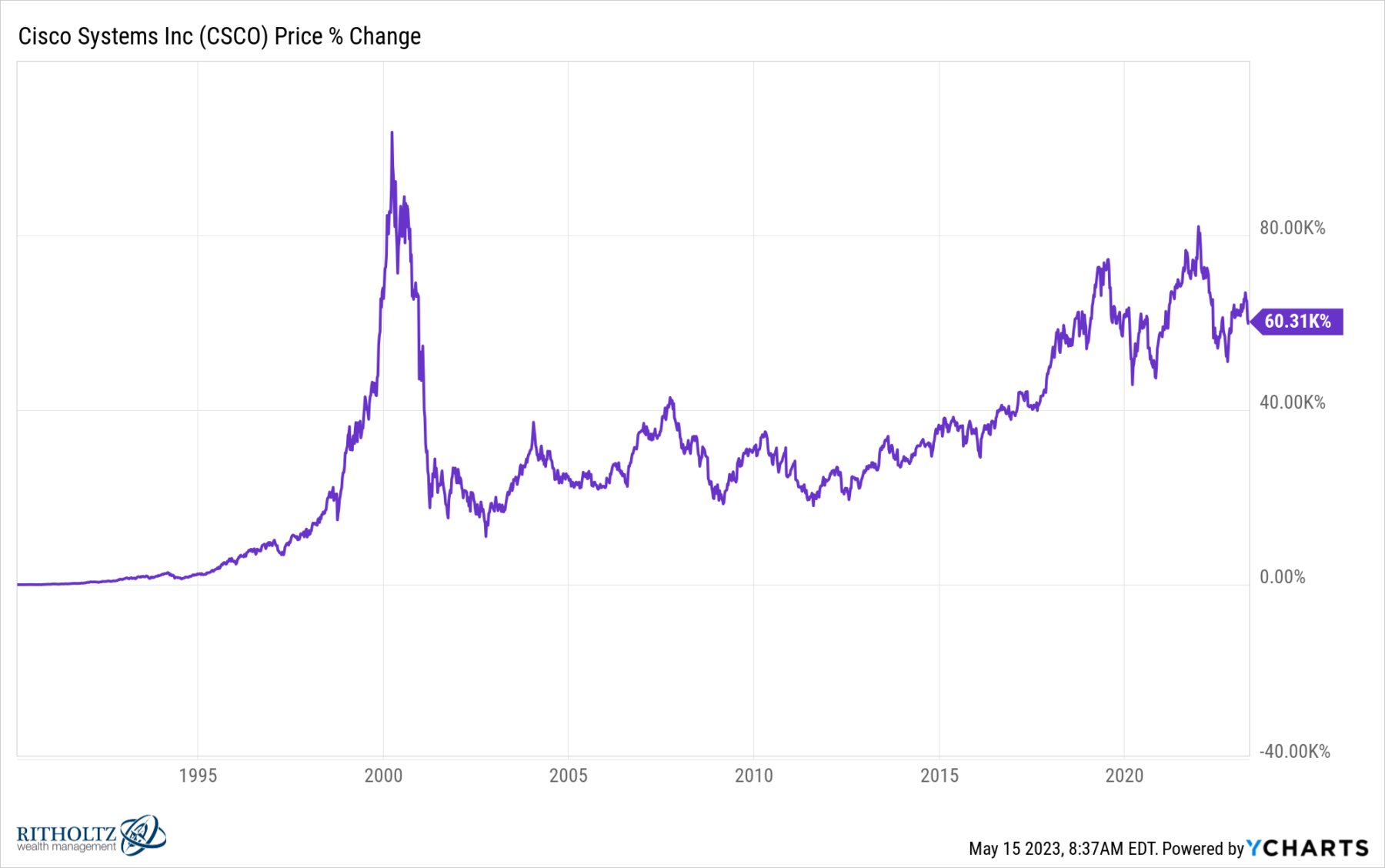

CSCO as a cover story showing how successful companies could be made sense: The 1990s had been good for the networking gear company,whose routers and other hardware had been snapped up by internet providers. By the time this cover story was published on May 15, 2000, the price of $CSCO was making all-time-highs, and it was predicted the company would become the first trillion-dollar market-cap firm in history.

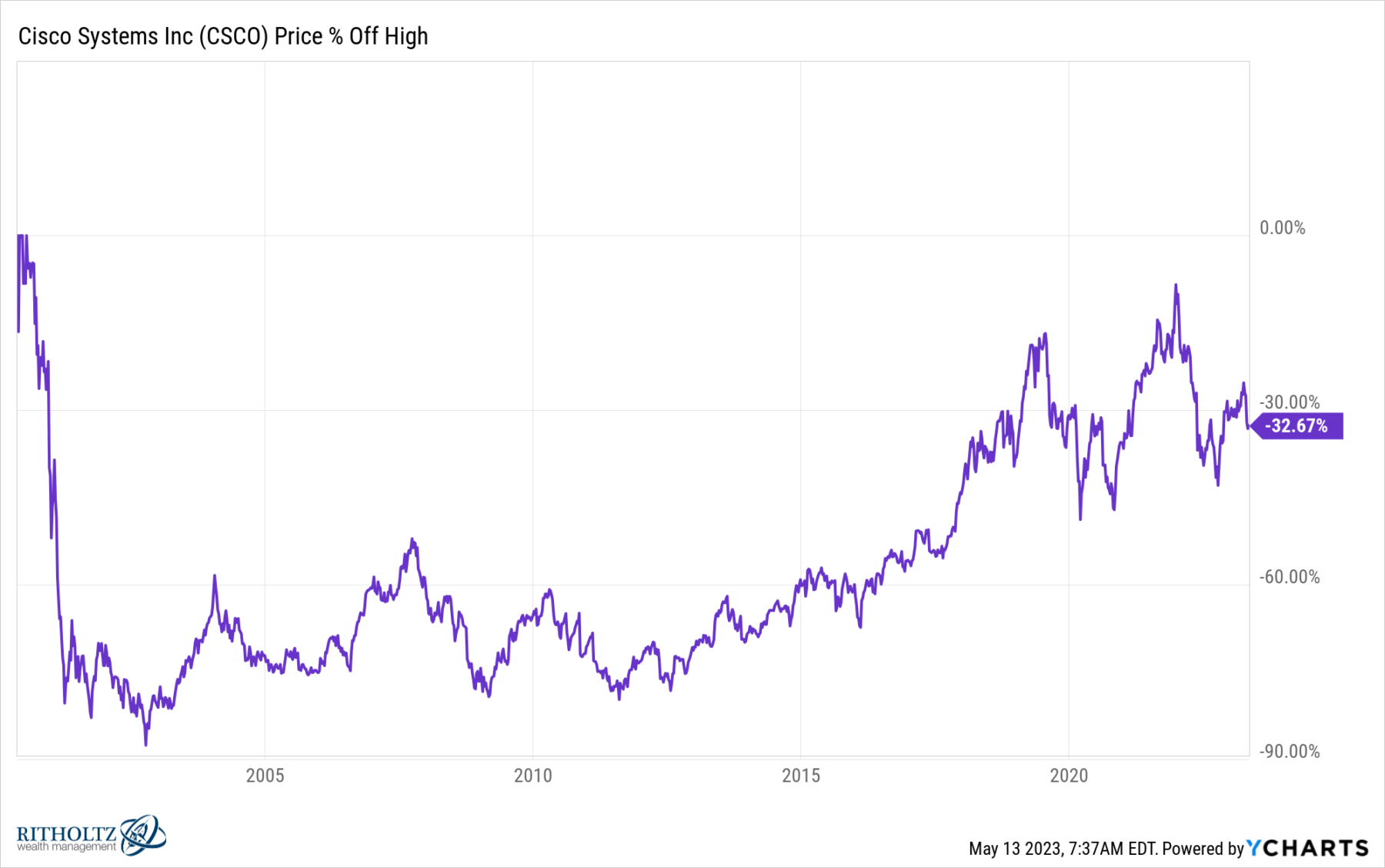

Alas, it was not meant to be. On March 27th, 2000, a mere 2 weeks after this cover story, the stock peaked. It has since been one of the poorest performers on the Nasdaq. By the time the (then tech-focused) index made its low in October 2002, CSCO had plummeted 85.7%

It didn’t quite get to a trillion either, peaking a little more than halfway there, at $556.74B.

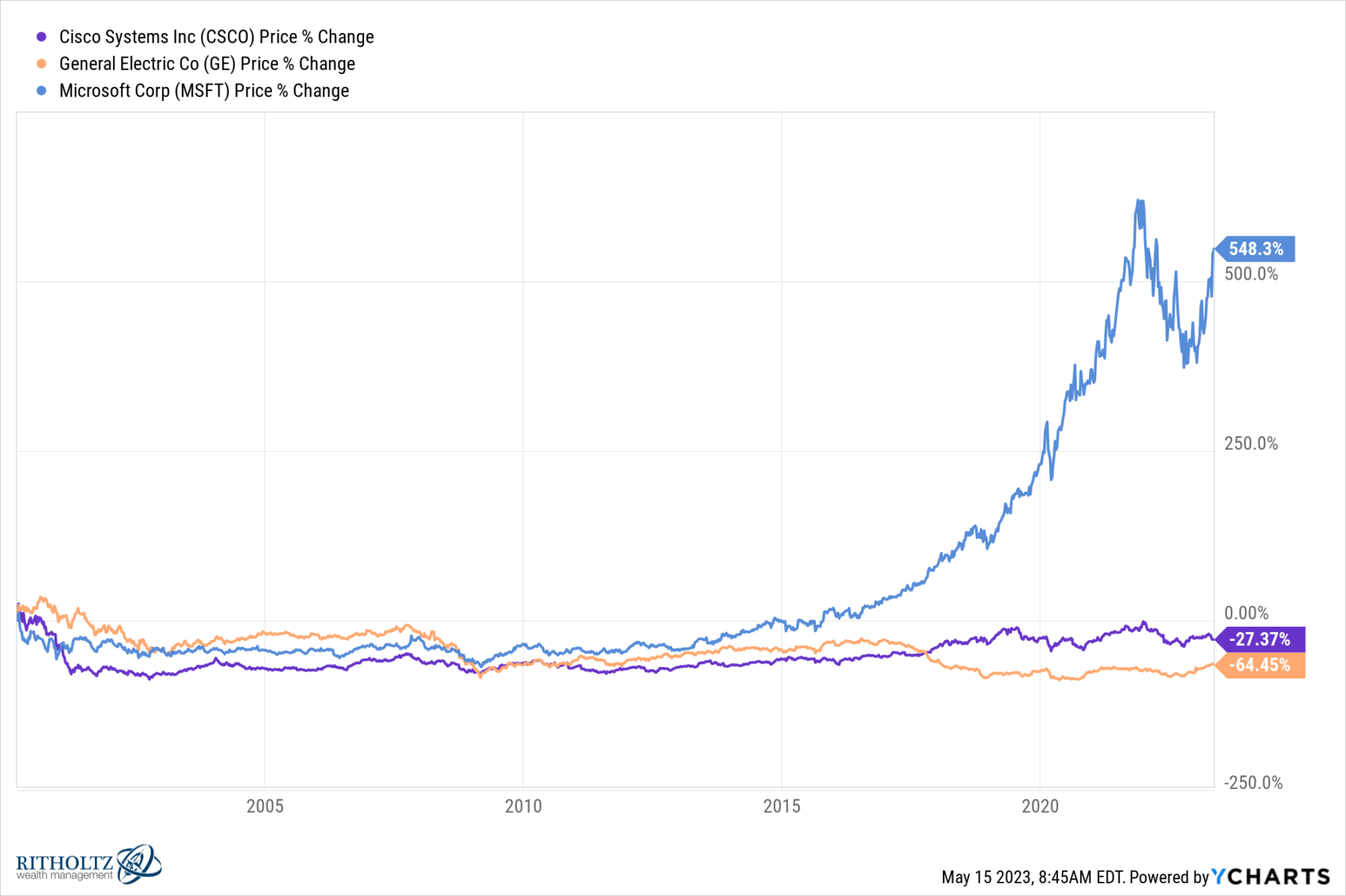

The article picks CSCO over MSFT and GE. At this point, the column appears as just a dart-throwing exercise dressed up as stock analysis. Microsoft has demolished CSCO since then, while GE did somewhat worse over the ensuing 23 years.

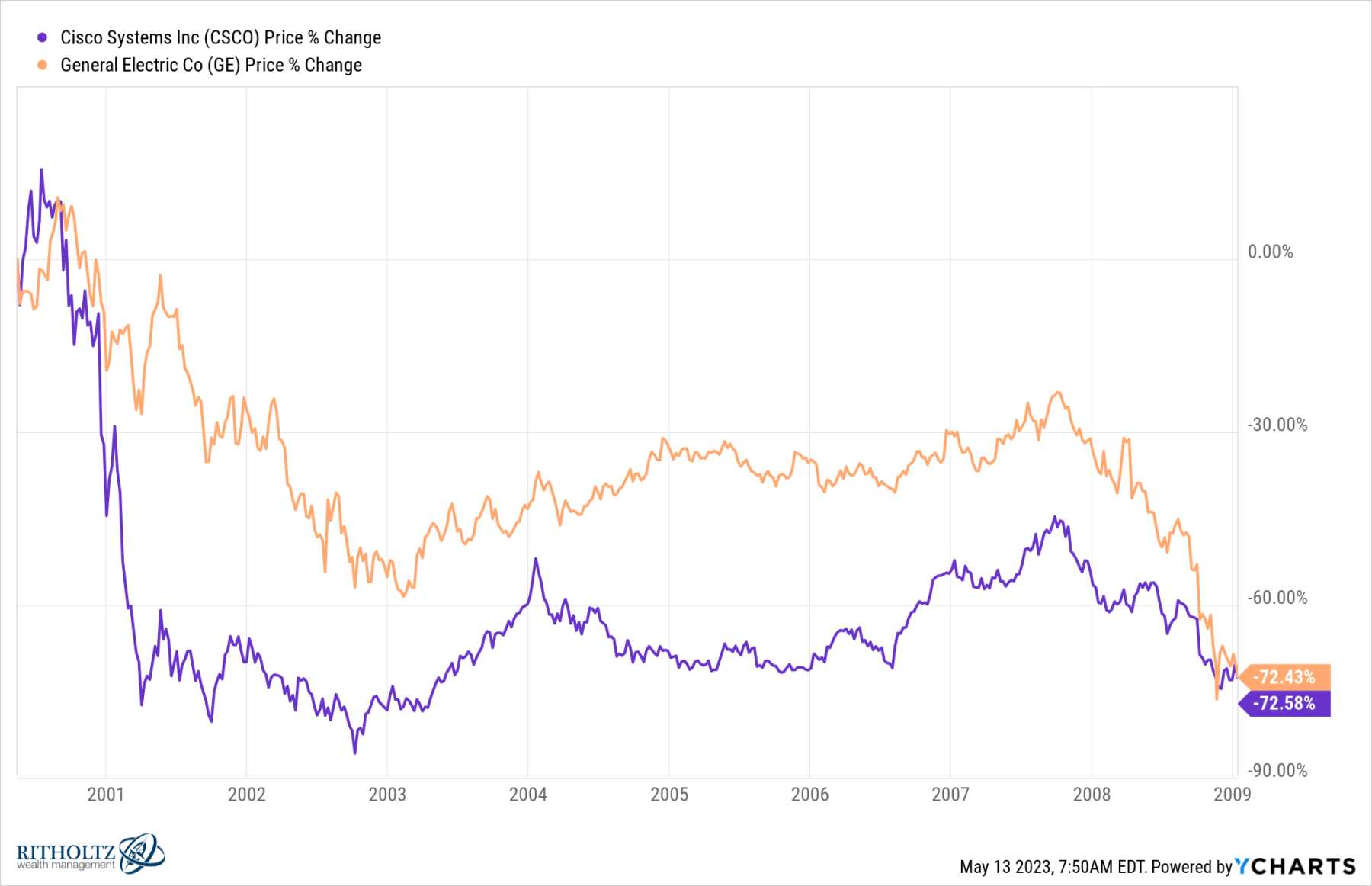

But even GE beat CSCO for the next decade, through January 2009, so choosing CSCO over GE was also a bad pick:

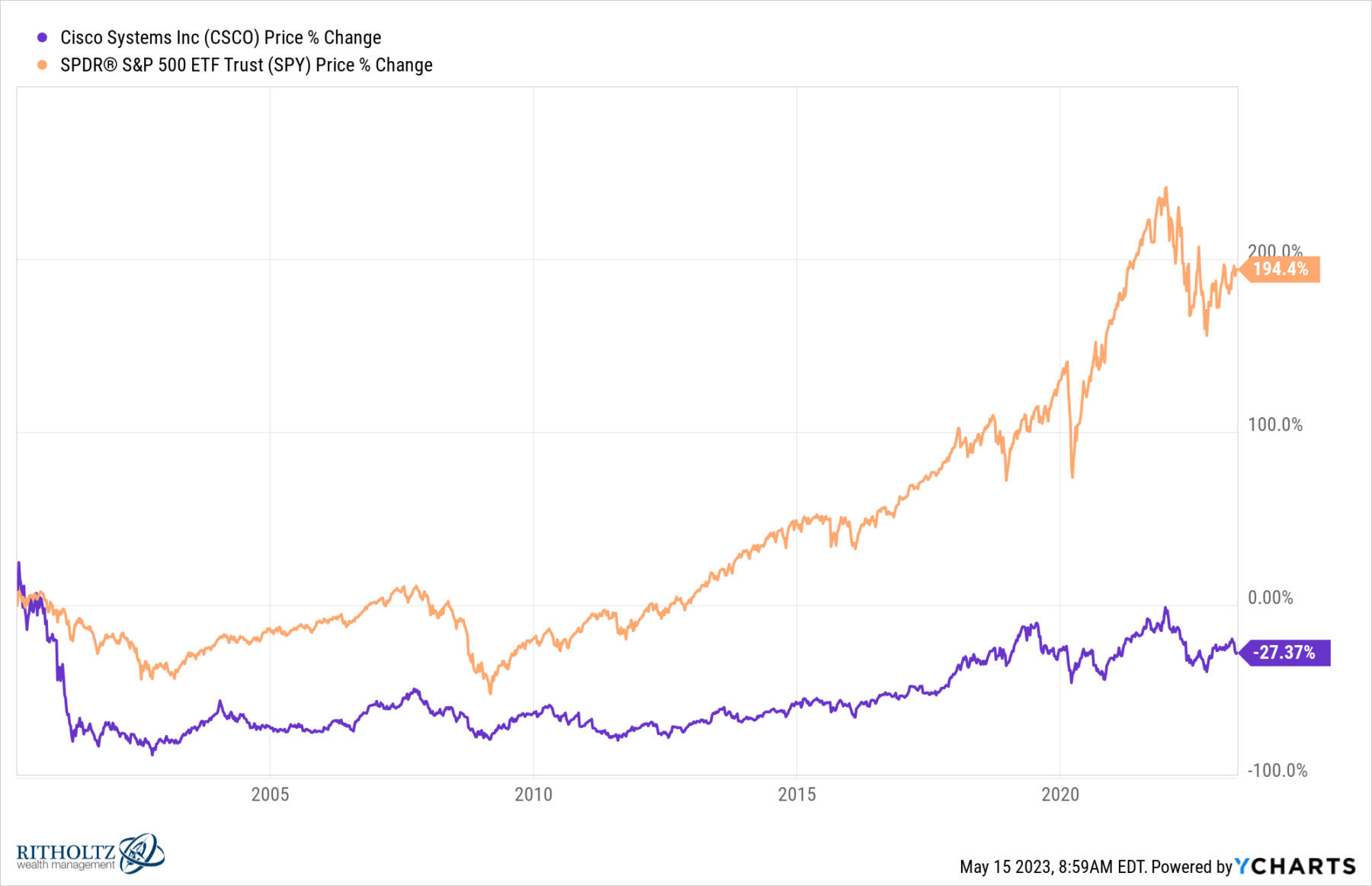

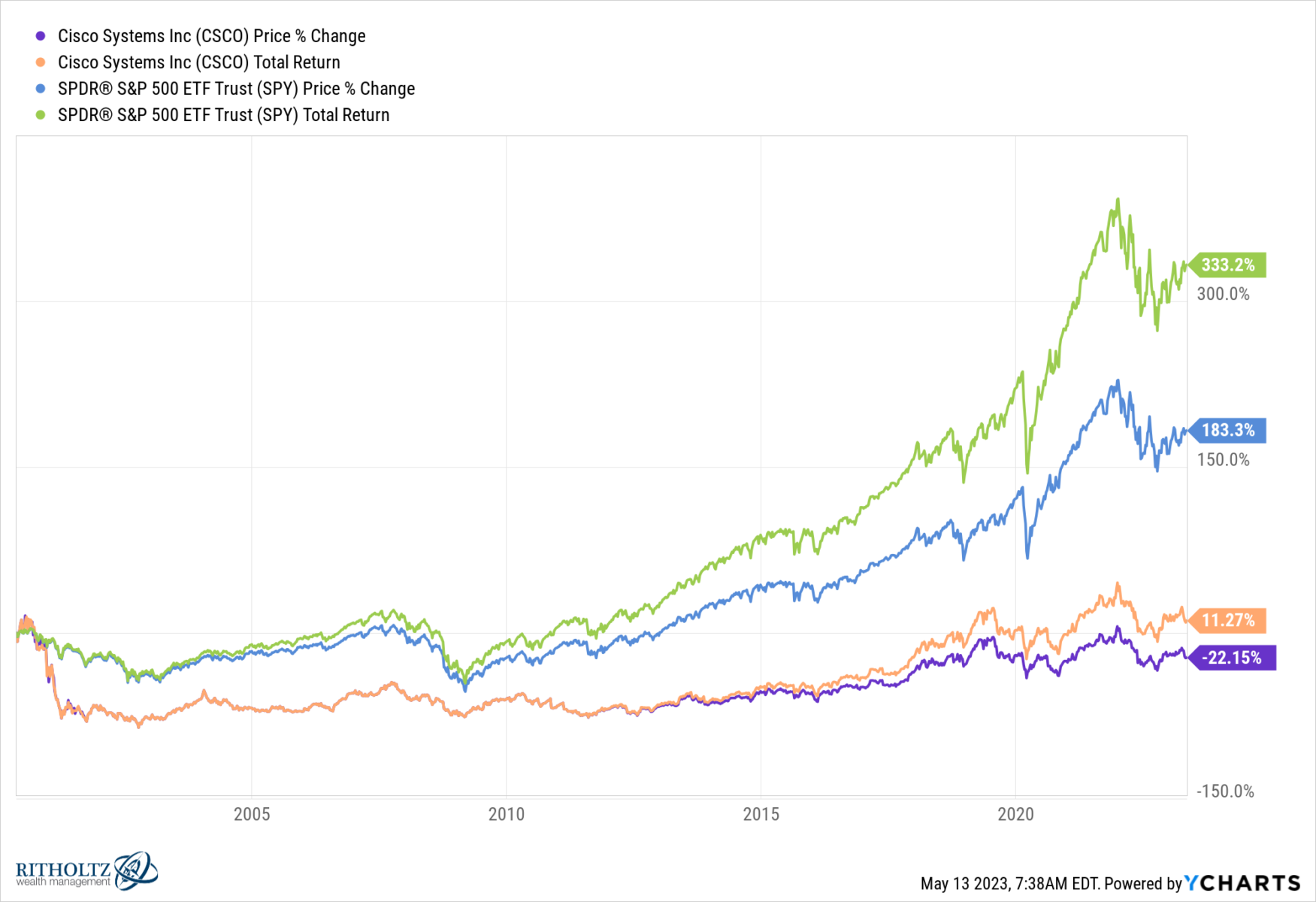

How did the stock pick do against a benchmark?1 Pick your poison: The S&P500 is up 194.4% since that cover story, while CSCO remains 27.4% lower.2

CSCO versus S&P500

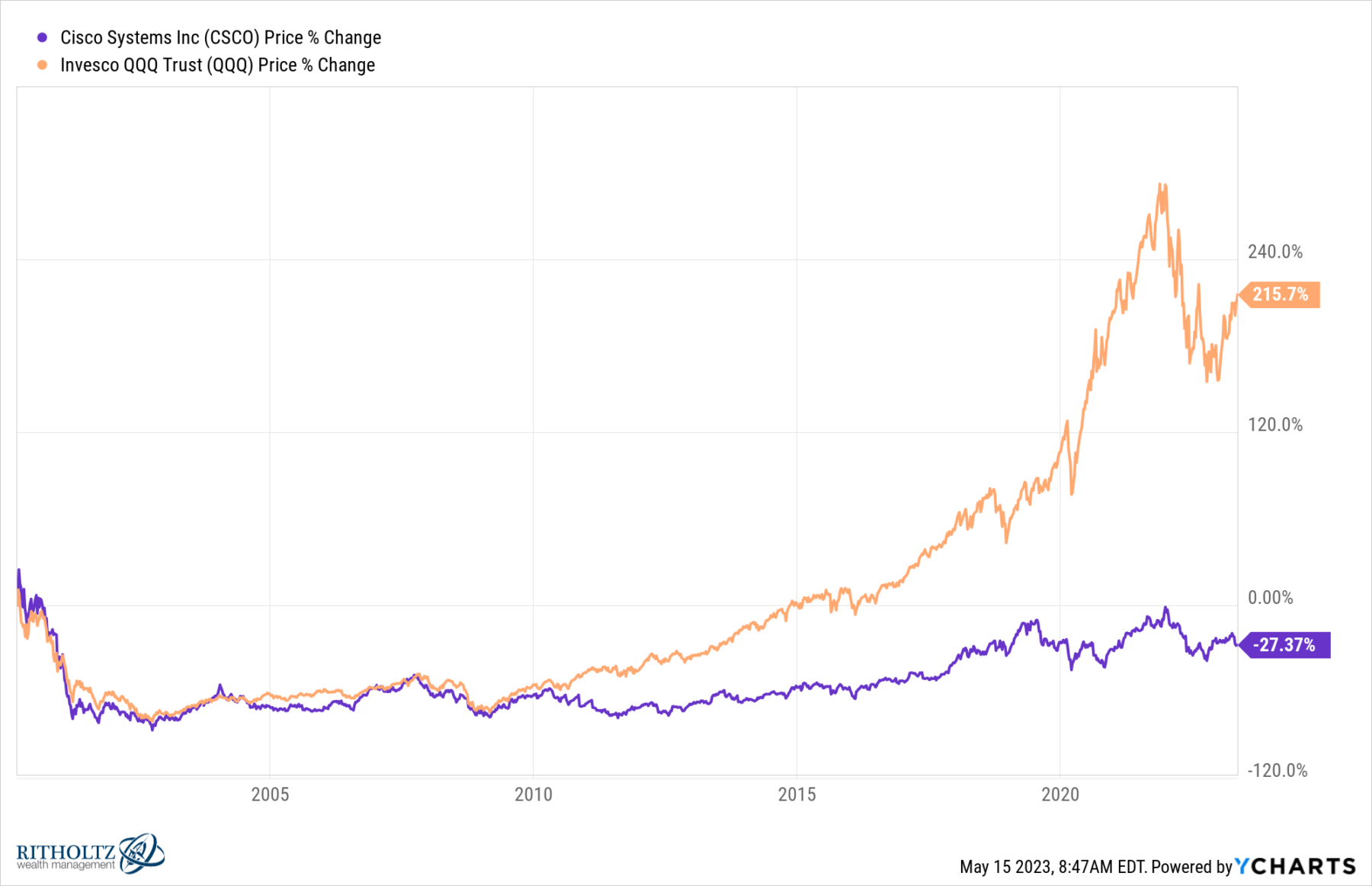

The Nasdaq 100 (QQQ) is up even more than the SPY’s 194.4%, its gained 215.7%, which is even more remarkable when you consider the drag of its once biggest stock — Cisco — has had on the index.

And today? CSCO remains 32.7% below its highs (March 27) when this cover came out 23 years ago…

A stark reminder: When it comes to stock picking and predicting the future, nobody knows anything.

Source:

There’s Something About Cisco

By Andy Serwer, Irene Gashurov, Angela Key

FORTUNE Magazine, May 15, 2000

Mirror (password: CSCO)

Previously:

Can Anyone Catch Nokia? (October 26, 2022)

Gradually, Then Suddenly (October 1, 2021).

Why the Apple Store Will Fail (May 20, 2021)

Nobody Knows Nuthin’ (May 5, 2016)

How News Looks When Its Old (October 29, 2021)

Predictions and Forecasts

__________

1. Passive indexing existed in 2000, but it was nowhere near as widely adopted then as it is today.

2. Its even more amusing showing total returns

CSCO since IPO (%)

CSCO since IPO ($)