By Lance Roberts

Grasping companies will not be inflicting inflation. Such is regardless of the claims of a lot of these on the political left that failed to grasp the very fundamentals of financial provide and demand.

Right here is the essential argument by these pushing for a extra socialistic agenda:

“Grasping companies are inflicting inflation by jacking up costs and having fun with document earnings.”

Elizabeth Warren is pushing this specific narrative very laborious.

For almost all of Individuals who now get their “information” from social media, the uneducated lots now have a brand new goal of hatred for his or her monetary woes.

The issue, as with most of the narratives ramping up the ire of Individuals on social media, is it’s patently false.

As Michael Maharrey lately penned:

“One merely has to motive by means of the declare to uncover the absurdity. If companies can willy-nilly elevate costs and luxuriate in “extreme” earnings, why don’t they do it on a regular basis? Did companies abruptly get grasping in 2021? And why did the Federal Reserve spend a decade fretting about inflation being ‘too low’ because it struggled to hit its 2% goal? Was there not sufficient company greed earlier than coronavirus?”

When you concentrate on it this manner, it’s obvious one thing else occurred.

All the time And All over the place A Financial Phenomenon

With regards to inflation, many armchair economists are fast to cite Milton Friedman.

“Inflation is at all times and in all places a financial phenomenon.”

The issue is there’s rather more to Friedman’s assertion on the reason for inflation.

“It’s at all times and in all places a results of an excessive amount of cash, of a extra speedy improve of cash, than of output. Furthermore, within the fashionable period, the necessary subsequent step is to acknowledge that right now the governments management the amount of cash in order that, because of this, inflation in america is made in Washington and nowhere else, After all, no authorities any greater than any of us, likes to accountability for dangerous issues.

All of us are people. If one thing dangerous occurs, it wasn’t our fault. And the federal government is similar approach, so it doesn’t settle for accountability for inflation. When you take heed to folks in Washington speak, they are going to let you know that inflation is produced by grasping businessmen, or it’s produced by greedy unions, or it’s produced by spendthrift customers, or perhaps its these horrible Arab sheiks who’re producing it.”

As he concludes:

“However none of them produce inflation, for the quite simple motive that neither the businessmen, not the commerce union, nor the housewife have a printing press of their basement on which they’ll end up these inexperienced items of paper we name cash. Solely Washington has the printing press, and subsequently, solely Washington can produce inflation.”

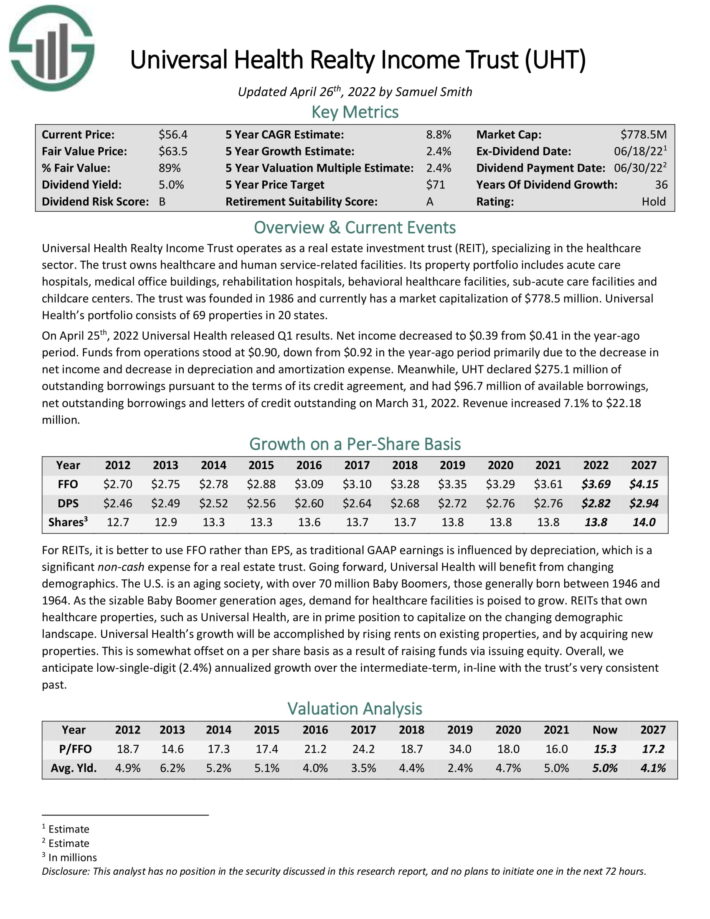

Milton Friedman’s assertion is backed up by the chart under of the M2 cash provide in comparison with inflation (with a 9-month lag).

You may watch Milton’s complete speech on “Cash and Inflation”

The Authorities Brought on It

The amount principle of cash states that costs differ in proportion to the cash provide. That relationship is predicated on the next premise:

“The worth of the transactions carried out in an economic system is the same as the amount of cash current in that economic system multiplied by the variety of instances that cash adjustments fingers (aka velocity of cash). That assumes the speed of cash is comparatively fixed and development in cash provide is in keeping with development in financial exercise, Such implies worth stability. Alternatively, if the cash provide grows extra shortly than financial exercise, this generates upward strain on costs, i.e. inflation.”

As proven, financial velocity, the expansion in cash provide, and financial exercise are grossly misaligned.

Not surprisingly, the huge surge in cash provide flooding the system throughout an “financial shut down” created a requirement glut towards a constrained provide.

With customers flush with “free capital” to spend, there was no accessible manufacturing to offer the wanted provide. With an excessive amount of cash chasing too few items, inflation was the inevitable consequence.

As famous in “Financial Stagnation Arrives:”

“Because the stimulus hits customers, they spend it relatively shortly, which results in a ‘sugar rush’ of financial exercise.”

Now, that cycle is starting to reverse as provide will increase and demand weakens. As famous in “Market Backside:”

Stimulus funds to US households are evaporating from $2.8tn in 21 to $660bn, and there’s no buffer from extra financial savings with the speed at 6.9%, which is decrease than 7.7% in 2019). There’s a big stock construct in retail merchandise (ex-auto), whereas the upcoming weak US consumption probably catalyst for consensus cuts in GDP/EPS.”

After all, that reversal of the “Authorities printing press” is problematic economically talking.

Nevertheless, there’s a treatment for inflation.

Inflation Is Cured By Excessive Costs

There’s an outdated axiom that the “treatment for top costs, is excessive costs.”

Whereas the Fed is contemplating climbing charges to quell inflation, in the event that they do nothing inflation will ultimately treatment itself by means of the traditional financial cycle. With the huge deluge of government-provided liquidity now used, disposable incomes are falling which constrains client spending. Not surprisingly, over the course of the subsequent 12-months inflation will return to the long-term pattern of two% annualized.

Nevertheless, this reversion in inflation will occur extra quickly because the Fed hikes charges. The issue for the Fed is that every successive financial coverage cycle requires fewer price hikes earlier than one thing breaks economically.

Notably, producer costs, as proven under, have risen considerably quicker than client costs. Such reveals that these “grasping companies” are absorbing enter prices, which ultimately impairs their profitability. There’s a excessive correlation between company earnings and inflation.

When the inflation unfold rises sufficient to impair profitability, companies take defensive measures to cut back prices (layoffs, price cuts, automation.) In flip, as job losses rise, customers contract spending pushing the economic system in the direction of a recession.

Inflation shortly turns into deflation.

Conclusion

Inflation, notably in 2022, is a operate of the elevated cash provide from Authorities injections on to households. There was an excessive amount of cash chasing too few items, and inflation was the consequence.

As Maharrey concludes:

“The reality is the federal authorities wants inflation. It relies on Federal Reserve cash printing to help its borrow and spend budgeting technique. With out the Fed’s inflationary exercise, the federal government couldn’t finance its out-of-control spending behavior. However politicians don’t need you to know that they’re levying an inflation tax on you, in order that they perpetuate every kind of myths about inflation to attempt to make you’re feeling higher about it.”

The typical individual is especially inclined to the grasping company fable. Since folks have already got a distrust of huge companies, and inundated by false data on social media, and have little understanding of economics, it’s not shocking. Individuals, like Elizabeth Warren, prey on the weak-minded to advertise their very own political agenda.

“When you hear any individual blaming inflation on grasping companies, it signifies they don’t perceive inflation. Or they’re mendacity to you.” – Maharrey

If they’re a politician working for re-election, it’s in all probability the latter.

257 views