Submitted by Newsquawk

- ECB policy announcement due Thursday 26th October; rate decision at 13:15BST/08:15EDT, press conference from 13:45BST/08:45EDT

- Markets are signalling a unanimous expectation that the ECB will keep all three of its key rates unchanged

- Expected decision to pause will be based on inflationary developments, geopol risks and increase in bond yields

OVERVIEW: Markets are signalling a unanimous expectation that the European Central Bank (ECB) will keep all three of its key rates unchanged, following the September policy statement which noted that current rate levels are seen as sufficient for inflation to return to target. Economic indicators since the last meeting show a slight cooling in Y/Y CPI and another contraction in the Composite Eurozone PMI, further cementing this expectation. Rising bond yields and geopolitical risks that further warrant caution, however, the ECB is expected to maintain optionality for future rate hikes. Discussions about ending the Pandemic Emergency Purchase Programme (PEPP) reinvestments early could also be on the table, but unlikely to receive backing at this stage.

PRIOR MEETING: Defying the consensus (which was deemed as somewhat stale given hawkish source reporting by Reuters earlier in the week), the ECB opted to pull the trigger on a 25bps hike to all three of its key rates, taking the deposit rate to 4.0%. The accompanying statement noted that the GC now judges that rates “have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target”. Furthermore, “rates will be set at sufficiently restrictive levels for as long as necessary”. Elsewhere, no tweaks were made to the parameters of its APP or PEPP, with reinvestments in the latter set to continue “until at least the end of 2024”. For the accompanying macro projections, 2023 inflation was upgraded to 5.6% from 5.4%, 2024 (in-fitting with source reporting by Reuters) raised to 3.2% from 3.0% and 2025 lowered to 2.1% from 2.2%, but still ultimately seen just above target. Growth projections for 2023-25 were lowered across the board. At the follow-up press conference, Lagarde cautioned that the economy is likely to remain subdued in the coming months and price pressures remain strong. During the Q&A, the President stated that, whilst some members favored a pause in rates, today’s decision was backed by a “solid majority”. In a follow-up question, Lagarde noted that the GC has not discussed PEPP reinvestments. When questioned on the path of rates beyond September, Lagarde, in an attempt to embed some optionality for the Bank, stated that she is not saying that the ECB is at peak rates.

RECENT ECONOMIC DEVELOPMENTS: Since the prior meeting, headline Y/Y CPI cooled to 4.3% in September from 5.2%, whilst the super-core metric fell to 4.5% from 5.3%; ING attributed the declines to the fact that “base effects from government support last year ended”. The 5y5y inflation forward sits around 2.53% vs. circa 2.61% at the time of the previous meeting. Elsewhere, the ECB’s Consumer inflation expectations survey for August saw an increase in the 12- month ahead projection to 3.5% from 3.4%, whilst the 3yr advanced to 2.5% from 2.4%. On the growth front, Q3 GDP will not be released until October 31st. However, more timely survey data saw the Composite Eurozone PMI for September rise to 47.2 from 46.7, but remaining deep in contractionary territory with the accompanying report noting “output volumes across both the manufacturing and service sectors were constrained by deteriorating demand conditions”. In the labour market, the unemployment rate remains at the historic low of 6.4%.

RECENT COMMUNICATIONS: President Lagarde has continued to reiterate that rates are sufficiently restrictive, whilst also noting there is more policy lag in the pipeline from past hikes. Chief Economist Lane has suggested that the ECB has reached the interest rate level that will help tame inflation, adding that the key is to maintain this rate level for as long as needed and seeing wage data coming in lower is very important. The influential Schnabel of Germany has observed that dynamics in wage growth remain strong, adding that there is not yet the all-clear for the inflation problem and if risks materialise, further hikes could be needed. At the dovish end of the spectrum, Greece’s Stournaras says the Middle East crisis casts a shadow over the ECB meeting and the Israel-Hamas war supports the case for keeping rates on hold. Even the hawks on the Governing Council such as Netherlands’ Knot have stated that they are “comfortable” with the current level of interest rates. On the balance sheet, Latvia’s Kazaks has suggested that an early end to reinvestments in PEPP should be discussed; the likes of Greece’s Stournaras has disagreed with this viewpoint.

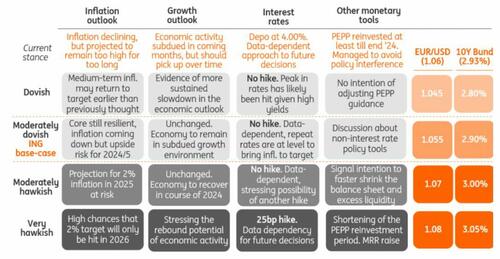

RATES/BALANCE SHEET: Consensus is unanimous in expecting the ECB to stand pat on all three of its key rates with markets virtually signalling a 100% chance of such an outcome. The expectation for unchanged rates has stemmed from the September policy statement, which noted that the GC now judges that rates “have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target”. As noted above, inflation has continued to slow, whilst it is also worth noting that recent increases in Eurozone bond yields will act to tighten financial conditions and geopolitical risks in the Middle East have also given reason for caution. That being said, as has been the case for other major central banks that have engineered a “pause”, policymakers will likely wish to keep optionality over further rate hikes beyond October, particularly given the recent increase in oil prices; it is likely that this will be a key line of questioning by journalists in the press conference. In terms of pricing beyond October, the first 25bps cut is priced for July 2024. With regards to other policy measures, a couple of policymakers have suggested that an early end to PEPP reinvestments (currently set to run until the end of 2024) should be discussed at the upcoming meeting. However, ING is of the view “the surge in bond yields, combined with new debt sustainability concerns in the eurozone” makes it difficult for the ECB to agree an early conclusion to reinvestments at this stage.

Finally, here is the iconic ING Economics ECB cheat sheet. Read all about it here.