J Studios/DigitalVision via Getty Images

We previously covered NIO Inc (NYSE:NIO) here in December 2022. Its massive tailwinds for growth and adoption in the EU were discussed in depth, due to the company’s aggressive plan to expand the number of power swap stations in the region. Notably, the company reported improving monthly EV deliveries and a robust balance sheet, implying growing consumer demand and improved liquidity over the next few quarters.

For this article, we will focus on NIO’s strategic choice in investing in the consumer experience and moving forward with the battery swap idea, one previously abandoned by Elon Musk. Combined with the expansion of its line-ups, the company had reported elevated operating expenses, triggering headwinds to its profitability. However, with the normalization of supply chains and management’s ambitious guidance, we might see the company deliver stellar numbers in 2023.

NIO’s Aggressive Operating And R&D Efforts Remain Speculative

NIO House & Spaces Globally

NIO

NIO had aimed to promote a premium automotive lifestyle, attributed to its 399 houses/ spaces (akin to clubhouses/ showrooms) in 149 cities and 280 service centers/ delivery centers in 163 cities. The company also boasted overseas locations in Germany, Norway, and Sweden by the end of 2022, with plans to expand to the Netherlands and Denmark, amongst others.

On top of that, NIO installed a total of 1.21K power swap stations and 2.05K of charging stations thus far, with a partner charging network of over 380K chargers in the EU. Notably, the company aimed to operate over 120 power swap stations in the EU by the end of 2023, with up to 1K planned by 2025.

As NIO expanded its sales/service network and advocated its battery swap idea (one that was abandoned by Elon Musk since 2015), it was no wonder that the company had recorded an elevated SG&A expenses of 9.39B Yuan or the equivalent of $1.32B (+35.4% YoY) over the LTM.

In comparison, Tesla (NASDAQ:TSLA) had opted for an asset light strategy, with a limited number of stores and service centers. This might have explained its reduced SG&A expenses of $3.95B (-12.6% YoY) in FY2022.

Compared to TSLA’s existing four retail models, NIO’s eight models also offered a staggering variety of choices. While this might have served consumers well, it appeared that the strategy had not worked in its favor, considering that the company only delivered 122.48K of vehicles in 2022 (+34% YoY), despite the 150K design capacity on a single shift.

These numbers were naturally lacking compared to TSLA’s delivery of 439.77K in 2022 for the Chinese market alone, expanding by 37.1% YoY. Notably, the company’s Shanghai Gigafactory was working on double shifts, churning out over 710K vehicles in 2022 on a factory design capacity of 1M. According to these numbers, consumer demand was more than healthy indeed.

This comparison matters, since NIO reported 8.66B Yuan or the equivalent of $1.22B in R&D expenses over the last twelve months [LTM], comprising up to 20% of its revenues. Meanwhile, XPeng (NYSE:XPEV) only spent 5.43B Yuan/ $764M/ 17.9% and Li Auto (NASDAQ:LI) at 5.84B Yuan/ $821M/ 15.2%, respectively.

On the other hand, TSLA recorded a much improved ratio at 3.9%/ $3.07B of its automotive revenues at $77.55B in FY2022, with BYD (OTCPK:BYDDF) (OTCPK:BYDDY) similarly achieving excellent operating and production scale at 3.8%/ 13.63B Yuan/ $1.92B of R&D expenses while reporting 338.64B Yuan/ $47.6B of revenues in the LTM.

With unsatisfactory results to show till now, NIO might have been overly aggressive with the marketing and R&D efforts, since it has yet to report positive operating margins.

A Price War May Be Coming In The Chinese EV Market

Most importantly, TSLA’s aggressive price cuts have sparked massive retail demand, growing by 36% YoY to 25.68K vehicles in January 2023. Its Model 3 and Model Y now retailed at 229.9K Yuan and 259.9K Yuan, discounted by -13.5% and -10% from 2022 prices, respectively.

Therefore, it was unsurprising that TSLA’s Shanghai Gigafactory had targeted a production output of 20K vehicles weekly in February and March 2023, compared to December 2022’s compressed levels of 13.94K.

While NIO worked to debunk the supposed price cuts, it had previously offered generous discounts of up to 100K Yuan by early February 2023. The 2022 ES6 and ES8 show/stock cars costed 313.7K Yuan and 428K Yuan, respectively. The company clearly had difficulties clearing older inventories worth $937M by the latest quarter (+86.9% QoQ and +255.1% YoY). Notably, these SUV models remained more expensive than TSLA’s Model Y, even after the drastic discounts equivalent to $14.9K.

As a result of its lack of meaningful profit margin, NIO might face more execution challenges in the Chinese market indeed, in the event of an all-out price war. XPEV had similarly announced unsustainable price cuts between -10% and -13%, in order to retain market share:

We hope to make intelligent vehicles more accessible to more people with more competitive prices. (Reuters)

NIO will likely have to tread very carefully moving forward, despite the stellar total cash/ investments of 44.8B Yuan or the equivalent of $6.29B by the latest quarter. Assuming that the management chose not to engage in the upcoming battle, it might have a better chance of improving its margins and achieving profitability from FY2025 onwards.

In contrast, NIO’s orders and deliveries might be negatively affected by the intense competition, similarly impacting market sentiments and its stock price moving forward. This is what we call being caught between a rock and a hard place.

So, Is NIO Stock A Buy, Sell, Or Hold?

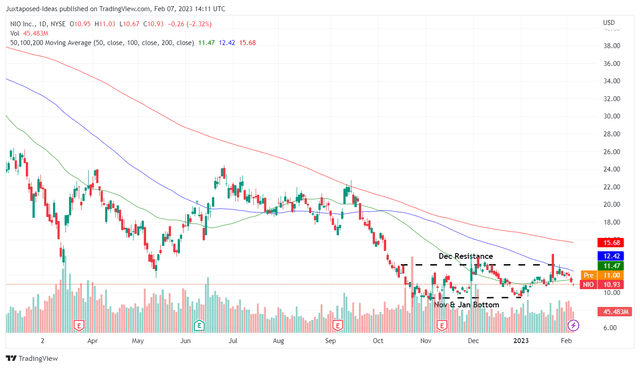

NIO 1Y Stock Price

Trading View

The NIO stock appeared to be on a downtrend after hitting its December and January resistance levels of $12, suggesting a potential retest of the recent bottom at $9. Combined with the pessimistic market sentiments about the January deliveries of 8.5K vehicles (-46.2% MoM & -12% YoY) due to the Chinese New Year festivities, investors might be able to see another attractive entry point ahead.

Therefore, we continue to rate the NIO stock as a speculative buy, with the caveat that the exercise has to consequently reduce investors’ dollar cost average.

As a result of improving supply chains, NIO has guided for an excellent quarterly production output of 43K units moving forward, suggesting a meaningful improvement of 40.4% sequentially. In addition, it aimed to achieve a 19K monthly run rate from December 2022 onwards, implying an ambitious ramp up by 86% YoY to ~228K by the end of 2023. Assuming so, the aggressive marketing and R&D efforts might end up being well worth it, potentially triggering a future recovery of the stock price in our view.

On the other hand, investors must be cognizant of the persistent geopolitical risks associated with Chinese stocks, since it remains to be seen when Mr. Market’s confidence may return moving forward, significantly destabilized by the recent ‘spy balloon’ incident since February 3, 2023. Interestingly, the NIO stock has lost ground by -8.7% since then.

Nonetheless, we remain confident that these headwinds will not last forever, since the rhetoric from Beijing has become increasingly reconciliatory and pro-recovery. This is attributed to the government’s desire to reopen globally after three years of Zero Covid Policy, to achieve the aggressive GDP growth of up to 5.5% in 2023.

We think this correction is a golden opportunity for investors with higher risk tolerances, since the NIO stock price has been drastically compressed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.