Tramino

Nikola Company (NASDAQ:NKLA) has wiped tens of millions of {dollars}’ price of investor cash since its market debut in June 2020. The corporate has misplaced greater than 95% of its market worth because the IPO (adjusted for the reverse break up), and much more regarding, stays uninvestable as we speak even at beaten-down inventory costs.

Final September, when Nikola inventory was buying and selling for a split-adjusted worth of round $43, I claimed traders can be burned. I’m not shocked about how issues have turned out since then, with Nikola persevering with to display its incapacity to inch nearer to profitability. Beneath are a number of the fundamental causes I highlighted in my bear report on Nikola final yr.

- The continued self-inflicted reputational injury arising from Nikola’s failure to satisfy automobile supply milestones.

- The excessive cash-burn ratio of the corporate, which was pointing to extra possession dilution.

- The low power effectivity of gas cell electrical autos (“FCEVs”) in comparison with battery-powered electrical autos (“EVs” and “BEVs”).

- Lack of infrastructure to assist elevated adoption of FCEVs.

Quick-forward to as we speak, Nikola appears to have made some progress in its commercialization plans with the corporate delivering 72 Class 8 hydrogen gas vans in Q2, beating the steering for gross sales of 60 vans. After years of manufacturing delays and missed steering, this will come off as music to the ears of Nikola bulls, however a deeper dive into the corporate’s fundamentals reveals Nikola will probably proceed to harm traders over the long term.

There Could Not Be Mild At The Finish Of The Tunnel

All of us love turnaround firms. The truth is, figuring out troubled firms that will ultimately see higher days sooner or later is a profitable funding technique. Nikola, sadly, is just not one.

Nikola restructured the enterprise since 2023 by decreasing its workforce, liquidating its curiosity in troubled battery pack maker Romeo Energy, and divesting its curiosity in Nikola Iveco Europe GmbH, a European three way partnership, to deal with the home market. The corporate has additionally give you a technique centered on increasing its scale to show worthwhile.

Exhibit 1: Nikola’s profitability flywheel

Q1 presentation

Nikola’s challenges stem from the excessive manufacturing prices of gas cell vans. The corporate is making losses from each truck it sells, which isn’t the place you need to be, on condition that the demand for FCEVs could by no means attain the highs related to BEVs. Based on Hydrogen Perception, in This fall 2023, the common manufacturing value of a Nikola truck was $679,000 whereas they had been bought for a median worth of simply $351,000.

Beneath regular circumstances, I might not be alarmed by a younger firm promoting a product at a loss to achieve market share. Nevertheless, relating to Nikola, it is a greater drawback than it appears.

Nikola’s goal market is just not as large as we initially thought. This can be a direct results of the associated fee disadvantages related to FCEVs. Based on IDTechEx, solely 4% of zero-emission autos will likely be powered by hydrogen by 2044. The outlook for gas cell vans is a lot better, as anticipated, on condition that BEVs are perceived to have a drawback on this section because of the weight of lithium batteries required to allow long-distance journeys for vans. IDTechEx expects gas cell vans to account for about 20% of all zero-emission vans by 2044.

Though this section gives a possibility for Nikola, the unit economics image stays disappointing. Nikola CFO Thomas Okray, who joined the corporate in March, acknowledged this drawback through the Q1 earnings name and mentioned:

As famous beforehand, absent significant quantity, profitability will likely be beneath our expectations.

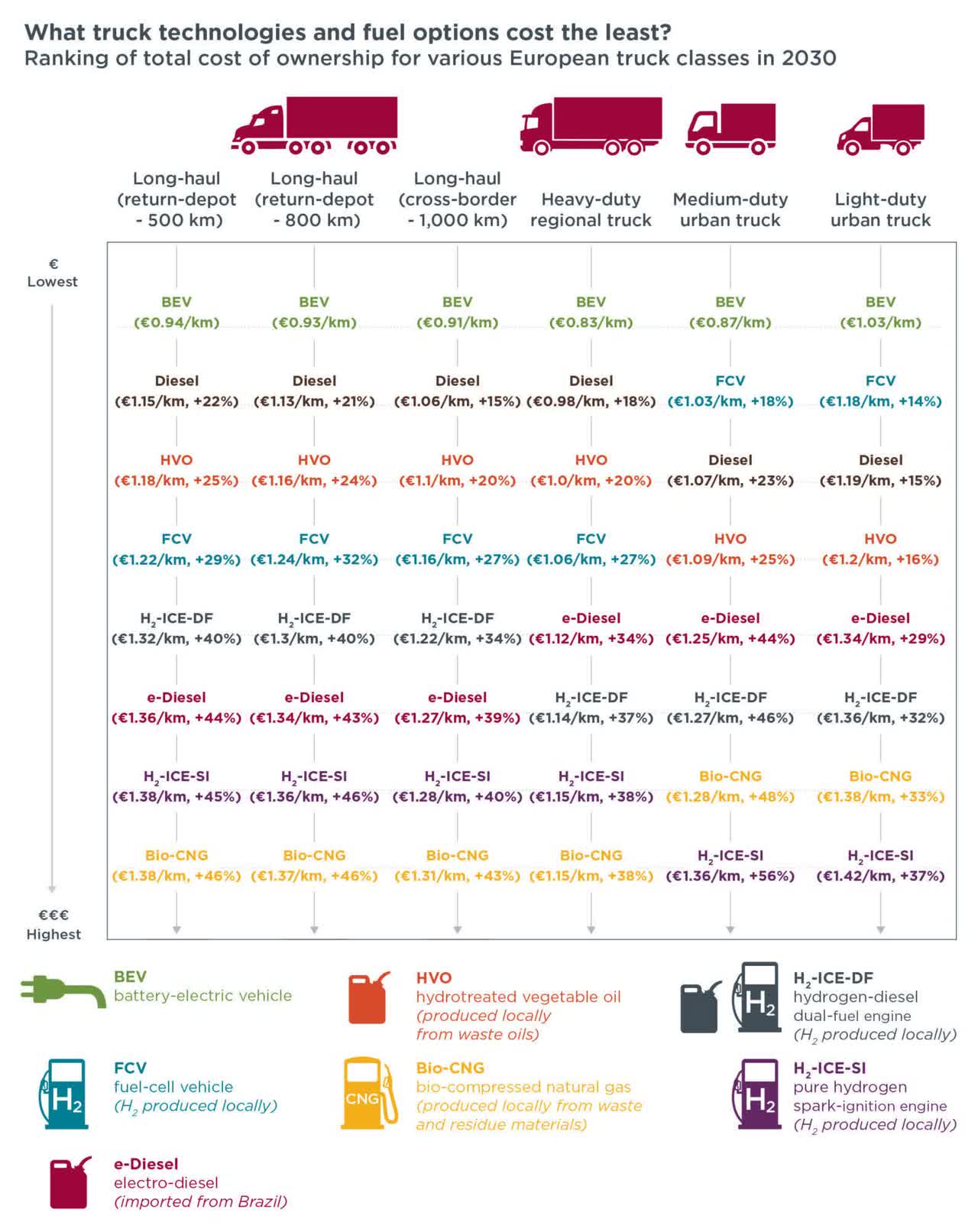

The corporate additionally revealed that common promoting costs elevated to $381,000 in Q1, a $30K enhance from the earlier quarter. This will likely enhance the profitability profile within the brief time period, however I imagine rising costs for FCEVs will dampen the demand ultimately when developments in BEV expertise and infrastructure put FCEVs at a drawback. Based on the Worldwide Council on Clear Transportation, gas cell vans powered by hydrogen is not going to be cost-competitive with diesel vans till 2035. The beneath illustration reveals that battery electrical vans value the least to function amongst all various power sorts.

Exhibit 2: Comparability of gas choices for several types of vans in Europe

The Worldwide Council on Clear Transportation

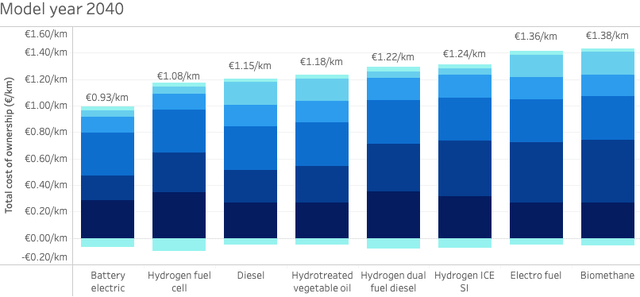

With gas cell expertise advancing, the overall value of possession of a gas cell truck is anticipated to say no sharply within the subsequent decade. This can be a good signal. Nevertheless, even by 2040, hydrogen gas cell-powered vans are projected to value extra to function in contrast with battery electrical vans.

Exhibit 3: Complete value of possession comparability for mannequin yr 2040 long-haul vans

The Worldwide Council on Clear Transportation

Then comes the infrastructure challenges. Charging infrastructure for BEVs has seen main enhancements within the final decade, with main automakers together with Tesla, Inc. (TSLA) investing billions of {dollars} to develop charging networks. Gasoline cell charging infrastructure, alternatively, remains to be at an toddler stage. Nikola’s makes an attempt to method nationwide trucking carriers with massive automobile fleets is not going to achieve success so long as infrastructure is missing. Nikola has already understood this problem, which is why the corporate is aggressively investing in its Hyla refueling community. CFO Thomas Okray mentioned:

Going to those large nationwide accounts, you have to have the gas in place, or else that dialogue would not go as easily as you’ll need to.

Regardless of aggressive investments, it is going to take a few years for hydrogen refueling networks to be as expansive as EV charging networks, which leaves ample room for technological developments within the BEV area to drive the demand away from FCEVs. The rising power density of lithium-ion batteries utilized in BEVs, sooner charging occasions in contrast to a couple years in the past, and the continued discount in battery pack prices paint a promising image for BEVs.

Nikola’s BEV division, which is already struggling to fulfill clients, may also face stiff competitors sooner or later with main automakers drawing plans to aggressively spend money on long-haul autos. For example, Mercedes is investing within the eActros LongHaul truck, which was launched final October, whereas MAN is growing the MAN eTruck which is scheduled for launch this yr. EV chief Tesla has already captured the curiosity of business clients with its Semi truck.

Takeaway

Nikola’s enterprise is in higher form in contrast to a couple years in the past, with the corporate specializing in its strengths within the U.S. market. Nevertheless, the going will get tough sooner or later. Its BEV division is anticipated to face stiff competitors, whereas the inherent disadvantages of gas cell expertise will proceed to be a barrier to mass adoption of gas cell vans. That is wanted for the corporate to achieve a breakeven level. Promoting 400-500 vans, which is what the corporate is hoping for this yr, is not going to make any significant enchancment to Nikola’s monetary efficiency. Based mostly on the difficult outlook for mass adoption of FCEV vans, I imagine traders ought to avoid Nikola Company inventory.