Pgiam/iStock via Getty Images

Investment Update

Nextracker (NASDAQ:NXT) posted Q3 fiscal ’24 earnings last week, with upsides versus consensus at the top and bottom lines. This is constructive since our original buy thesis on the company in September. I encourage all readers to scour through that analysis to understand the premise of our investment thesis on the company (see it here).

As a reminder, the central thesis point are:

- Differentiated offering in the utilities market, thereby enjoying consumer advantages with higher-priced offerings and higher-margin revenues.

- Strategically positioned to deliver value downstream from production.

- Regulatory tailwinds in the Inflation Reduction Act (“IRA”).

- Tangible growth in the sector, with forecasts of deployments of c.263GWdc to be online by the end of 2028.

The company’s CEO was also tremendously constructive on NXT’s trajectory in the coming years, with the following to say on the call:

Naysayers point to the intermittency of renewable power as an impediment to its large scale adoption in the grid. We believe this issue will improve. Sharp decreases in battery costs have enable steep ramping of battery storage, power plants in the grid both co-located with renewable power and standalone project.

Battery power increased five-fold in the last two years to 15 gigawatts, operating in the USA today. And batteries are expected to triple again to about 50 gigawatts by 2026

[…] We [NXT] are the skeletal system for the solar power ecosystem.“

Based on findings from the Q3 analysis, we reiterate NXT as a buy, eyeing another 35% return objective. The following insights unpack all the details from Q3 and what this means moving forward for investors. Net-net, reiterate buy.

Figure 1.

Source: TradingView

Insights from Q3 ’24 earnings

(As a reminder, the company reported its fiscal Q3 ’24 earnings, coinciding with Q3 CY 2023. All references will be made as such, unless otherwise stipulated).

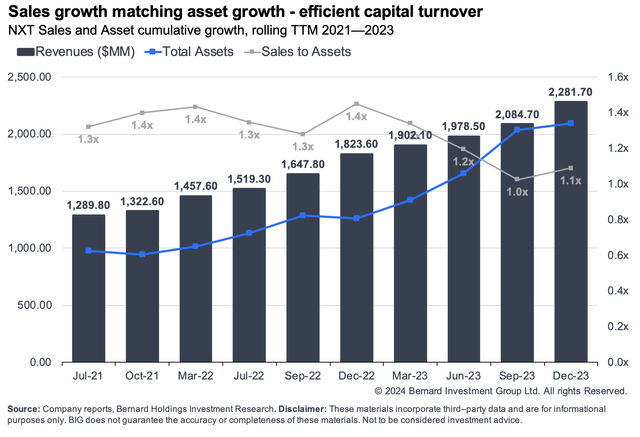

(1). Double-digit top line growth

NXT put up strong Q3 numbers, growing revenues 38% YoY to $710mm. It pulled the top-line to adj. EBITDA of $168mm, up 168% YoY upside, on adj. earnings of $142mm or $0.96 per share.

Top line growth was underlined by a 70% expansion in its U.S. market, partially offset by a 17% decline in international sales. Consequently, the revenue split was tilted towards the U.S. at 78% vs. 22% ex-U.S. Critically, management foresees continued strength in its U.S. exposures, projecting 60%-70% of FY’24 revenues to be produced domestically.

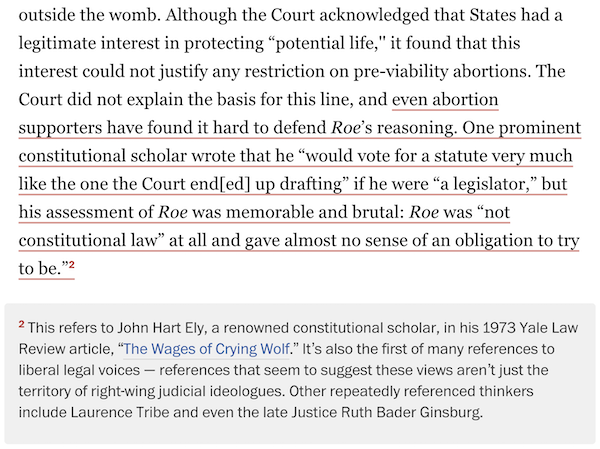

Moreover, the growth trends remain in-line with the company’s longer term trajectory with sales and asset growth (Figure 2). Each $1 of assets is rotating back $1 in sales on a persistent basis, promising for the company’s growth outlook for ’24 and ’25 in terms of sales power and asset factors.

Figure 2.

Equally as compelling is the growth at the operating margin, NXT has exhibited in the last 2 years. As seen in Figure 2 and 2a, as revenues and gross assets compounded, the company has realized higher rate on cost and expanded adj. EBITDA margins from 12% in its Q3 fiscal ’24 to 24% last period – a doubling in percentage points.

Unsurprising to see it produce 29.6% return on total capital employed in the last 12 months on this background, around 4x the sector median of c.7% return on capital.

Here we have a unique value proposition:

- Capital producing $1 of sales for every $1 of assets employed on the balance sheet

- Post-tax margins increasing with each new $1 of sales and each $1 of invested capital.

These are exceptional economics that has seen the company create exceptional value relative to the equity capital employed in the business since listing last year – around $9 for every $1 of capital employed.

Figure 2a.

Source: NXT Q3 Investor Presentation

(2). Momentum skewed to H2 with raised FY’24 guidance:

Management revisited FY’24 guidance, now pointing to revenues between $2.425Bn-$2.475Bn, a up from an earlier estimated $2.3Bn-$2.4Bn. This calls for 29% YoY growth at the midpoint. It is eying earnings of $374mm-$429mm on this (16.4%-17.3% margin),

I’d prelude this by noting the earnings figure is inclusive of an est. $50mm-$80mm benefit from IRA 45X tax credit vendor rebates.

The CEO had this to say on the call with respect to these rebates:

We have developed great relationships and arrangements with top vendors in the industry. We have strong conviction that our torque tubes and the bulk of our fasteners will qualify under 45X which will be meaningful to our financials in fiscal year 2025.

[B]ased on current arrangements with vendors and the 45X Treasury rules, we expect to realize a reduction in GAAP, cost of sales in the range of $50mm to $80mm in our fourth quarter fiscal ’24”.

Consequently, I’d advise investors to pay close attention to language on the IRA 45X tax credit vendor rebates over the coming quarters. This may prove to be a meaningful short-term catalyst to see NXT trade up off from 15x forward EBIT.

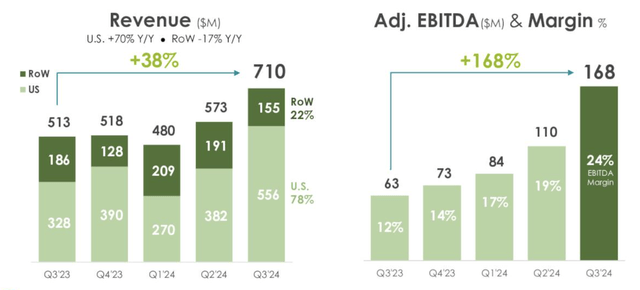

The size of the Q3 earnings beat must be noted, because it was significant magnitude- in the realms of the 50% of Wall Street’s estimates. In addition, the company has also beaten The Street’s estimates in three out of the last four quarters by substantial degrees. The earnings momentum is therefore abundantly clear, and this certainly warrants a bullish view over the coming 12 months.

If consensus is correct, then the company would expect a 270% YoY growth in earnings in the next quarter, followed by a 41% YoY growth in its Q1 fiscal ’25 (Figure 3).

The market has swiftly priced in these outsized growth numbers and change in expectations from Q3 by capitalizing this into higher market valuation to the company. On the day of the announcement, the company stock price climbed from $45 to $54 and has continued to march higher, closing at $58 in the post-market after Friday’s trade.

In my opinion, this illustrates conviction in the company’s growth outlook and is compelling for the bullish view on NXT.

Figure 3.

Source: Seeking Alpha

(3). Additional takeouts

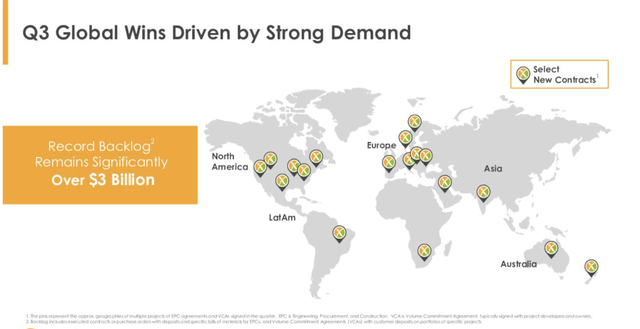

The company’s backlog exceeded $3Bn at the end of Q3, as it secured up projects with a cumulative capacity of 10 gigawatts in deals with India, Middle East, and Africa.

As noted in Figure 4, however, the U.S. and Europe remains the company’s largest markets, with the majority of assets utilized in these regions.

This is critical for balance sheet strength moving forward, in my view. It left Q3 with available liquidity of c.$800mm, underpinned by operating cash flow of $317mm and FCF f $314mm less CapEx made this YTD.

Figure 4.

Source: NXT Q3 Investor Presentation

Valuation and conclusion

The company sells at 15x forward EBIT – around 7-8% discount to the sector – but is priced at 9x the book value of its equity, 250% premium to peers.

This tells me there is opportunity to pay a discounted price for the earnings of a company whose assets are priced at a substantial premium by the market. This dislocation presents as an opportunity in my opinion, especially over the coming 12 months, when starting valuations matter most for investment returns. There appears to be adequate margin of safety if NXT fails to beat its next goals, which invariably will be set high by the market now with its recent momentum.

NXT is also priced at 19.95x trailing EBIT, and can be bought at a market value of $7.25Bn. It grew pre-tax earnings 141% YoY to in the 12 months to its fiscal Q3 ’24. If the company hits its FY’24 growth targets of around $490mm pre-tax, less depreciation, at the same 19.95x multiple, NXT is then worth $9.77Bn (19.95x $490 = $9,775), or 35% upside potential from the time of writing. This is an adequate margin of safety in my estimation, and provides a statistical advantage should the company continue pushing its growth numbers higher.

In that vein, we recommend NXT as a continued buy, in line with the original thesis from September last year. We are eyeing an initial return objective of 35% on money for the next 8-12 months before review. Net-net, reiterate buy.