taikrixel

NextEra Energy (NYSE:NEE) investors have underperformed the S&P 500 (SPX) (SPY) over the past year, notwithstanding its solid execution amid a challenging macroeconomic backdrop. I last updated NEE investors in December 2023, assessing the possibility of a further recovery as interest rates declined from their October 2023 highs. However, NEE Bulls lost momentum as the market reassessed its optimism about the Fed’s rate cut cadence. Given the resilience of the US economy, investors must temper their initial expectations of six cuts, suggesting the Fed will not likely shift to a lower gear in its upcoming March meeting.

NextEra Energy posted a solid performance at NEE’s fourth-quarter earnings release in late January 2024. It has continued progressing in its core Florida Power & Light or FPL utilities business. Accordingly, FPL posted an “increase in adjusted EPS by 22 cents.” Furthermore, its ROCE has remained stable at 12.5% while it added more solar projects to its rate base, benefiting its push toward renewable energy. In addition, NextEra also posted “a record year of new renewables and storage origination” in NextEra Energy Resources or NER. The NER business is NextEra’s pure-play clean energy portfolio, focusing on wind, solar, and battery storage opportunities. Notwithstanding the challenging year for utilities and renewable energy companies, NER added about 9K megawatts to its backlog, bolstering its long-term strategy.

NextEra Energy registered an adjusted EPS of $3.17 for FY23, up 9.3%. It marked a significant deceleration from FY22’s 13.7% growth. NextEra management’s forward guidance suggests growth is expected to slow further this year but remains in line with its long-term outlook. Accordingly, NextEra anticipates its adjusted EPS to increase to a midpoint metric of $3.33 in FY24. However, the company clarified that it anticipates delivering “at or near the top of NEE’s adjusted earnings per share expectations ranges in each year through 2026.”

As a result, NextEra Energy thinks there’s sufficient earnings visibility over the medium term. It’s pivotal toward maintaining the confidence of its dividend investors, as it telegraphed a 10% YoY increase in dividends per share. While its forward dividend yield of 3.7% is relatively attractive compared to its 10Y average of 2.7%, it’s much less appealing when compared to the 2Y (US2Y), as it last printed 4.54%. Hence, I assessed that NEE’s near-term thesis would likely depend on the market’s confidence in a faster-than-anticipated rate cut, improving the relative appeal of its proposition.

Despite that, NextEra Energy remains a long-term secular play into sustainable renewable energy generation, supported by its core FPL business. It is well-primed to benefit from the surge in energy demand from generative AI attributed to the insatiable data centers. Therefore, I assessed that NEE’s scale and expertise should position it well in riding the long-term recovery. With NEE valued at an adjusted forward EBITDA multiple of 12.7x, it’s still markedly lower than its 10Y average of 13.8x, bolstering its relative appeal.

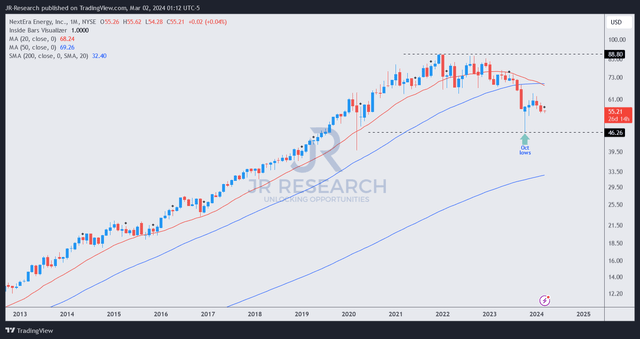

NEE price chart (long-term, monthly, adjusted for dividends) (TradingView)

As seen above, NEE’s price action suggests that its October 2023 lows have been well-defended by dip-buyers at the $46 level. However, the early recovery toward December 2023 has lost momentum as the 10Y (US10Y) bottomed out. Therefore, it appears that NEE’s buying sentiments are still influenced by the level and extent of the Fed’s rate cuts. With the Fed expected to provide its outlook this month, I assessed near-term sentiments on NEE are expected to remain uncertain and volatile.

However, I’m confident that NEE’s relatively attractive valuation and constructive price action predicated on its October long-term bottom should attract robust buying support at the current levels.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!