Cindy Ord

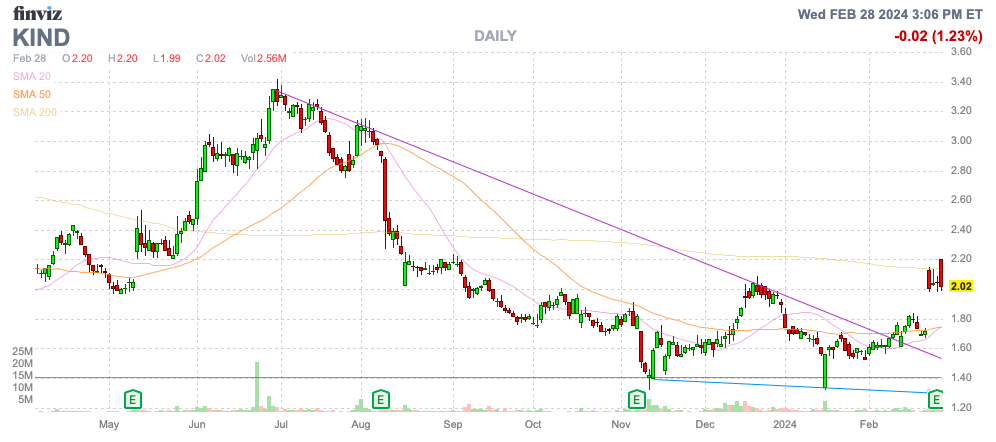

Nextdoor Holdings, Inc. (NYSE:KIND) remains an interesting social media player with a tie into local advertising. The company has struggled to reinvigorate growth in the last couple of years similar to the sector, but new proprietary ad technology and higher user engagement provide encouraging signs of the next growth opportunity. My investment thesis remains ultra Bullish on the stock due to the cheap valuation and the promises of local advertising.

Source: Finviz

Reinvigorated Growth

The problem facing Nextdoor has been the lack of growth since the massive pull forward during COVID-19 shutdowns. The local social company only has a revenue base of $200 million and daily active users (“DAUs”) a fraction of the reported weekly active users (“WAUs”), suggesting a rather easy path to vastly higher numbers, so the failure to grow has been a concern weighing on the stock.

Nextdoor finally reported some signs of life in Q4, leading to a big revenue beat. Also, the stock is likely up on the announcement of the co-founder returning to the CEO position after Sarah Friar has been in the position for several lackluster years.

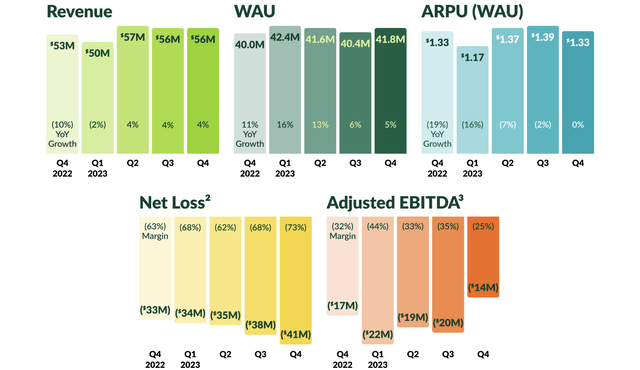

Source: Nextdoor Q4’23 shareholder letter

The WAUs peaked at 42.4 million in Q1 ’23, and users have generally been down the rest of the year. Nextdoor reported only 41.8 million WAUs for Q4, though up 5% YoY.

The company has added new ad technology, hopefully leading to more sustainable growth going forward with the ability for the use of more personalized data to serve ads. The company can use first-hand data from the site to provide more localized data for advertisers leading to the holy grail of local advertising, which still isn’t showing up in the average revenues per user, or ARPUs.

The most encouraging metric is the growing engagement of existing users. Per the leaving CEO Sarah Friar on the Q4’23 earnings call:

Users remain active and engagement is high on our platform. Impression growth was strong. Session depth, which reflects the number of ad impression opportunities during each user session, increased by 36% year-over-year and accelerated versus Q3, ending the year at a record level.

Nextdoor has recently seen the depth of engagement grow with signs early Q1 engagement has exceeded the 36% growth rate in Q4. The larger amount of ad impressions, with higher quality targeted ads, should lead to similar sales growth rates.

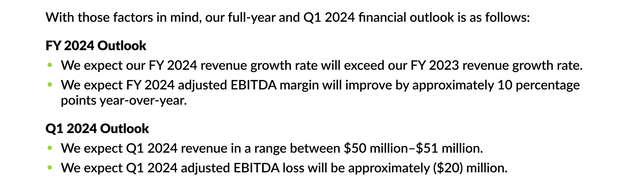

The social media company provided very sparse 2024 guidance metrics as follows:

Source: Nextdoor Q4’23 shareholder letter

Nextdoor grew at a 3% clip in 2023, with the target of exceeding that growth rate in 2024 suggesting at least 4% sales growth. With a $218 million revenue base combined with user growth and much higher engagement, investors would expect far higher growth.

The returning co-founder doesn’t officially take over until Q2, so Nextdoor is probably providing some conservative metrics to start the year. The goal of only improving adjusted EBITDA margins by 10 percentage points appears ultra-conservative as well.

Nextdoor cut the adjusted EBITDA loss margin to a still very high (25)% in Q4, but the margin was already nearly 10 percentage points above the (34)% margin for all of 2023. The company will need to cut the 2024 adjusted EBITDA margin to somewhere far below (24)% to impress the market.

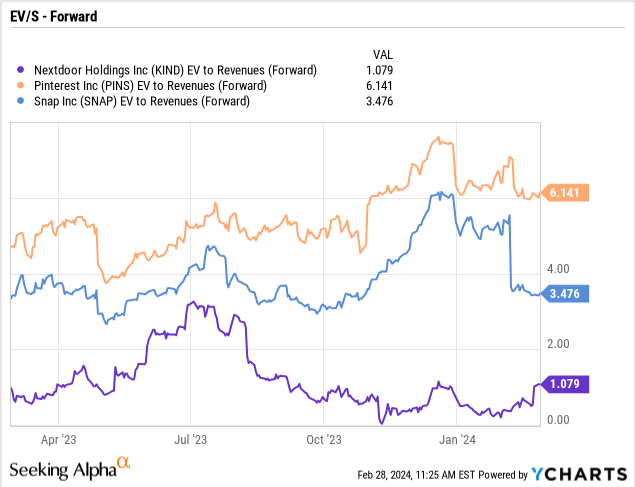

Valuation Multiple Expansions

Nextdoor has been beaten down to $2 for good reason with the large ongoing losses and limited growth. The opportunity is for substantial upside when the company gets the growth story reinvigorated and eliminates most of the ongoing losses.

Currently, other social media companies trade at vastly higher multiples of EV/S. Pinterest, Inc. (PINS) trades a 6x forward EV/S targets, and even Snap Inc. (SNAP) still trades at over 3x these targets following a disappointing quarter, while Nextdoor trades at a minimal multiple of only 1x EV/S targets.

Source: Chart

The stock has a clear path to multiple expansions, but Nextdoor has to turn the higher engagement and new ad products into far faster growth. Analysts currently target 5% revenue growth for 2024 followed by higher growth in 2024. The company should be able to generate far faster growth considering the opportunity in local advertising.

While investors wait for the improvements to materialize into the financials, the company announced plans for a new $150 million share buyback. Nextdoor can repurchase 75 million shares with the stock currently trading at only $2.

Takeaway

The key investor takeaway is that investors can gamble on Nextdoor finally reinvigorating growth and the initial engagement metrics are very positive. The stock will trade materially higher with the company returning to 10% growth, though this path isn’t guaranteed. The large cash balance continues to protect the downside risk, but the returning co-founder needs to eliminate the large losses to ensure the worst-case scenarios are ultimately taken off the table.

Investors should use Nextdoor Holdings, Inc. stock trading at $2 to build a position.