Pierre Longnus/The Image Bank via Getty Images

The Q4 and FY2023 Earnings Season is nearing the halfway mark for the Gold Miners Index (GDX), and one of the most recent companies to report its Q4 results was Newmont Corporation (NYSE:NEM). Unfortunately, the sector’s largest producer had a tough Q4 and full year, with production coming in below plans and costs above plan after an extended strike at Penasquito, a setback at Ahafo that has reduced through temporarily, and wildfire impacts that affected Eleonore. The result was that attributable production came in at just ~5.55 million ounces of gold at $1,444/oz all-in sustaining costs, up from ~5.96 million ounces of gold at $1,211/oz all-in sustaining costs last year.

In this update, we’ll dig into the Q4 FY2023 report, why the recent strategy change is a positive, and whether NEM stock is worthy of investment.

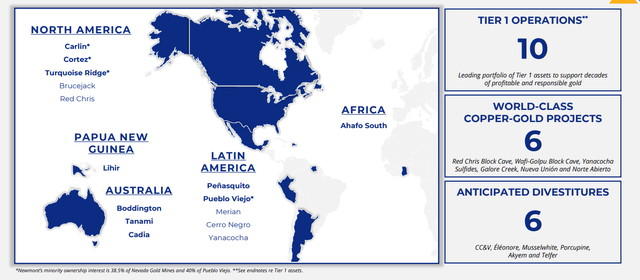

Newmont Operations – Company Website

Q4 & FY2023 Results

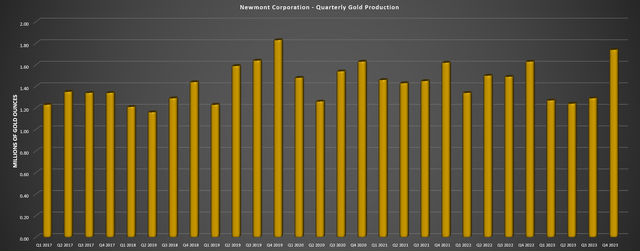

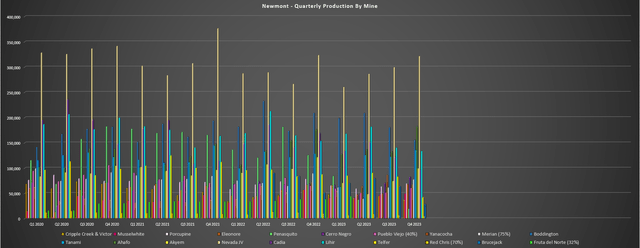

Newmont released its Q4 and FY2023 results today, reporting quarterly production of ~1.74 million attributable ounces of gold production, a 7% increase from the year-ago period with a partial quarter from its new assets acquired in the Newcrest deal. This was below my estimates with Brucejack and Telfer offline for part of December after a tragic fatality at Brucejack, a weaker quarter at Penasquito which took time to ramp back up to full capacity after the strike was ended, and a weaker quarter at Ahafo South due to lower throughput. Unfortunately, the delays at Pueblo Viejo didn’t help (equity-managed joint-venture), and the mediocre finish to 2023 led to production declining year-over-year to ~5.55 million ounces of gold. Worse, gold-equivalent production also suffered, but this was largely out of Newmont’s control, with the surprise Penasquito strike putting a significant dent in its operating performance.

Newmont Quarterly Gold Production – Company Filings, Author’s Chart Newmont Quarterly Production by Mine – Company Filings, Author’s Chart

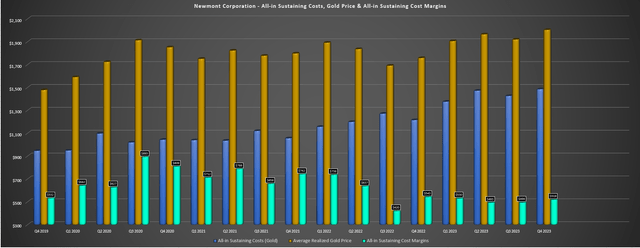

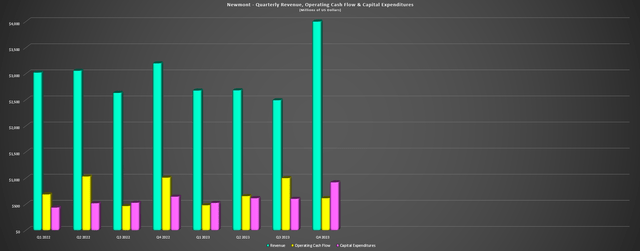

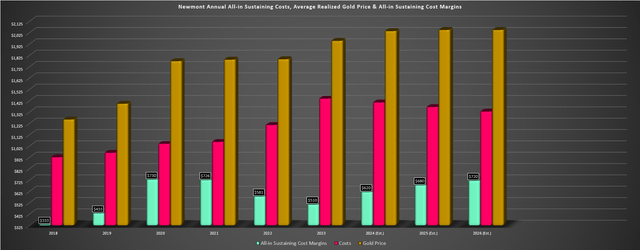

Moving over to costs, the results weren’t much better unfortunately, with all-in sustaining costs [AISC] spiking to $1,485/oz, resulting in AISC margins of just $519/oz (Q4 2022: $543/oz) despite the benefit of a much higher average realized gold price ($2,004/oz). Meanwhile, operating cash flow sunk to $616 million and free cash flow fell to [-] $304 million, though this was related to a $297 million in unfavorable working capital changes. On a full-year basis, the results were also behind my expectations due to the weaker December from Telfer and Brucejack, with FY2023 production of ~5.55 million attributable gold ounces at $1,444/oz AISC (FY2022: $1,211/oz), and FY2023 AISC margins of $510/oz vs. $581/oz in the year-ago period. And while revenue did come in higher at ~$3.96 billion due to increased gold sales and a higher gold price, operating cash flow slipped to ~$2.75 billion vs. ~$3.20 billion in the year-ago period.

Adding insult to injury, Tanami 2 Expansion costs were revised up from $1.2 billion to $1.3 billion to $1.7 billion to $1.8 billion, with commercial production pushed to H2 2027 vs. estimates of H2 2026 previously with completion targeted for late 2025 previously. Newmont noted that the higher costs to complete and delays were related to “required overbreak and underbreak remediation” at Tanami, with ~$750 million spent to date since approval. Fortunately, Ahafo North remains on track for H2 2025 (300,000 ounces at $900/oz AISC in its first five years), and the budget was held at $950 million to $1.05 billion, with this set to be a very solid asset with all-in sustaining costs over 30% below the estimated industry average (~$1,450/oz) in its first five years.

Newmont Quarterly AISC, Gold Price & AISC Margins – Company Filings, Author’s Chart Newmont Quarterly Revenue, Operating Cash Flow & Capex – Company Filings, Author’s Chart

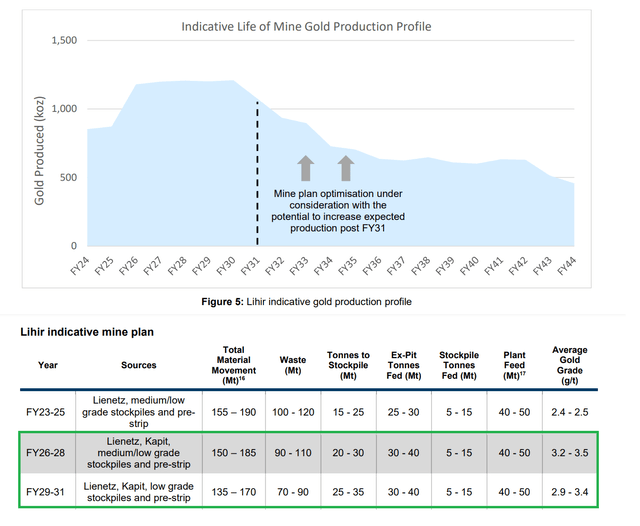

Overall, these results were undoubtedly disappointing, but this was a kitchen sink year for the company with issues at several assets and many out of its control (extended strike, wildfires). And while this is undoubtedly disappointing, Penasquito is now back on track after the strike ended in mid-October, Newmont has added a significant cash flow generator in Cadia with negative all-in sustaining costs on a by-product basis and a nice bump to its copper production, and it’s also added a top-10 gold mine by scale in Lihir that will be a cash flow machine later this decade as it ramps up closer to 1.0 million ounces per annum with higher grades from the Kapit ore body as part of Phase 14A.

Newcrest Assets

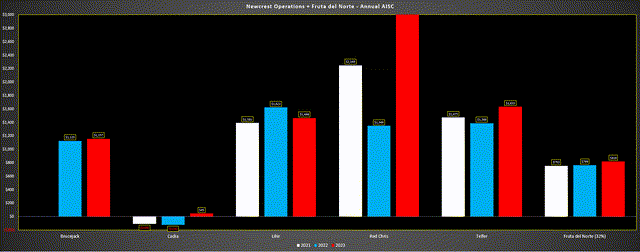

With the Newcrest deal, Newmont added two monster assets in Cadia (sub $200/oz all-in sustaining costs after by-product credits), Lihir which has had a tough couple of years but was acquired just at the right time as its grade profile improves, and Brucejack, a solid ~300,000 ounce per annum producer with some of the highest gold grades globally. Meanwhile, although Red Chris may not look great on the below chart with AISC well above the industry average, this is an incredibly well-endowed asset with major new discoveries including East Ridge, with Newcrest’s exploration target for East Ridge coming in at 500 million tonnes at 0.39 grams per tonne of gold and 0.47% copper at the high end or 6.1 million ounces of gold and 2.3 million tonnes of copper. Notably, this is not included in the Red Chris Block Cave study that envisioned a mine capable of producing ~320,000 ounces of gold and ~80,000 tonnes of copper per year in its first five years at negative all-in sustaining costs from a by-product credit standpoint.

Newcrest Assets Annual All-in Sustaining Costs (FY2021 – FY2023) – Company Filings, Author’s Chart

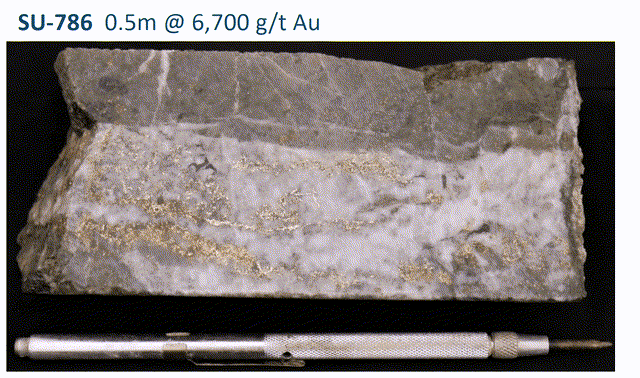

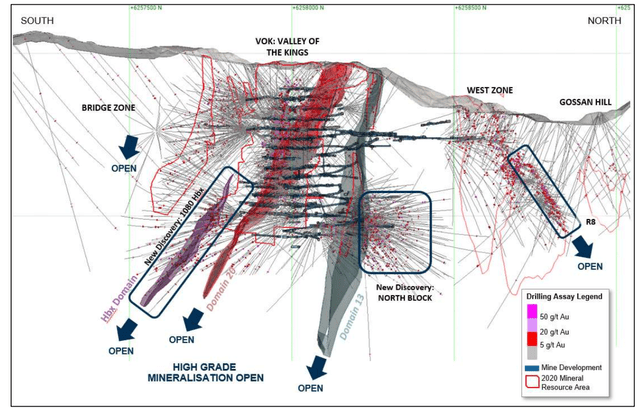

Meanwhile, Brucejack may seem like an average asset as well, but this asset is also quite exciting once optimized, with the potential to increase throughput, optimize the grade profile given the abundance of new high-grade discoveries like Golden Marmot, North Block and 1080 HBx, besides impressive results from Eastern Promises and Gossan Hill. Hence, this is an asset that once optimized could be a 350,000+ ounce producer at sub $1,150/oz AISC, and also one of the better mines in Canada despite it already having mined through some of the best grades at Valley of the Kings. Highlight intercepts outside of the current mine plan at Golden Marmot and Gossan Hill North include 0.50 meters at 6,700 grams per tonne of gold and 3,990 grams per tonne of silver, as well as 5.8 meters at 46.1 grams per tonne of gold, and 18 meters at 48 grams per tonne of gold, well above the current reserve grade at Brucejack of ~8.4 grams per tonne of gold.

Golden Marmot Discovery – Pretium Website Brucejack Drilling Update – Newcrest Website

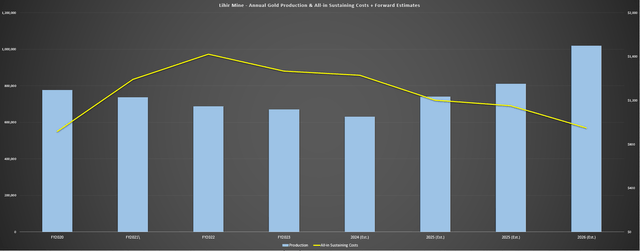

Finally, while Lihir has had two tough years with average annual production of ~680,000 ounces at all-in sustaining costs of ~$1,540/oz, the recently released P14A Study has an impressive IRR of 70%+ at spot prices, and Newmont is following on Newcrest’s work to see if it can improve the production profile further. However, under the non-optimized scenario and simply delivering on the base case of Phase 14A (~$300 million capex), we would see a lift in production over the next few years, with production set to climb from ~670,000 ounces at $1,466/oz AISC last year to ~800,000 ounces in 2026 at ~$1,150/oz AISC estimates, and closer to 1.0 million ounces in 2027 at sub $1,000/oz AISC. This would give make Lihir one of the largest mines globally and a cash cow for the company, and we’d certainly see a far better cash flow profile than average annual cash flow of ~$530 million from FY2020 to FY2023 under Newcrest.

Lihir Mine – Annual Production & AISC & Forward Estimates – Company Filings, Author’s Chart & Estimates

So, why is all of this important?

Newmont targeted $365 million in synergies and additional gains from portfolio optimization when it acquired Goldcorp, and Goldcorp had a weaker portfolio on balance even if it was acquired at a lower P/NAV multiple. Despite this, it generated over $1.1 billion in synergies by applying learnings from its massive Boddington gold-copper open pit mine at Penasquito. In the Newcrest deal, Newmont is targeting $500 million in pre-tax synergies here (20% G&A, 40% supply chain, 40% full potential improvements), and with a much stronger portfolio this figure could come in closer to $1.0 billion.

Hence, while I don’t expect a great year operationally in 2024 for Newmont as it will take time to integrate and optimize these new assets, I would expect a significantly stronger production and cost profile starting in 2026 with portfolio optimization, synergies, additional optimization work from its Full Potential program, and the high-margin Ahafo North asset coming online (H2-2025).

The New Newmont

After several months with the Newcrest assets, Newmont has been able to decide what its ideal portfolio looks like going forward, and how it plans to attack its goal of $2.0 billion in asset sales in the first two years post-deal closing. The confirmed plan includes divesting many smaller and higher-cost assets which will significantly improve their all-in sustaining costs over time. Assets to be divested include Eleonore, Musselwhite, Porcupine, CC&V, Akyem, Telfer, Coffee, and Havieron, with the latter ones likely to see meaningful interest with Havieron benefiting from Telfer infrastructure and being one of the best gold-copper discoveries in the past decade and Coffee being quite an attractive development project in the Yukon (~190,000 ounces at industry-leading all-in sustaining costs).

Overall, I see this move as positive and, while many will focus on the dividend cut and there’s no question that this is frustrating, I think favoring the buyback over dividend here makes sense with the stock quite becoming more reasonably valued relative to historical metrics. This is especially true given how much better its Tier-1 focused and lower-cost portfolio will be post-2025 with significant free cash flow generation and lower capex once Ahafo North construction is complete and Tanami 2 Expansion spending is winding down. Just as importantly, the buyback will help to improve its per share metrics and claw back shares after the Newcrest acquisition, similar to what Kinross (KGC) did following its Great Bear acquisition, which was to divest non-core assets, focus on its best and largest assets, and buy back shares, which ultimately led to significant sector outperformance over the past 18 months.

The New Newmont Portfolio – Company Website

Digging into the assets to be divested a little closer, we can get a better idea of what the new portfolio will look like, with ten Tier-1 scale operations which include:

- Carlin Complex (38.5%)

- Cortez Complex (38.5%)

- Turquoise Ridge (38.5%)

- Lihir

- Boddington

- Tanami

- Cadia

- Penasquito

- Pueblo Viejo (40%)

- Ahafo South.

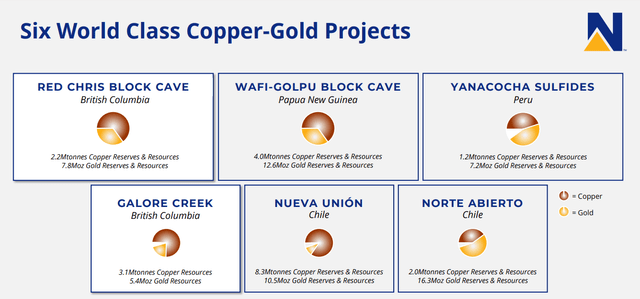

In addition to these assets primarily focused in Tier-1 jurisdictions, Newmont will have a 32% equity interest in one of the highest-margin assets sector-wide (Fruta del Norte) through Lundin Gold (OTCQX:LUGDF), multiple other operations that include Yanacocha, Merian (75%), Cerro Negro, Brucejack, and Red Chris (70%), and a strong development pipeline that includes Red Chris Block Cave (negative AISC with by-product credits), Wafi-Golpu (*), as well as other major copper assets like Yanacocha Sulfides, Nueva Union, Norte Abierto, and Galore Creek. These provide long-term optionality to copper, giving the company significant exposure to the very favorable supply/demand picture for copper.

(*) Wafi-Golpu is one of the better undeveloped copper-gold assets globally in Papua New Guinea with it expected to have negative AISC with by-product credits and it’s a project with incredible historic drill results like 883 meters at 2.15% copper and 2.23 grams per tonne of gold and a reserve base of ~11 million ounces of gold and 4.9 billion pounds of copper per Newcrest’s most recent study. (*)

Newmont Copper-Gold Development Assets – Company Presentation

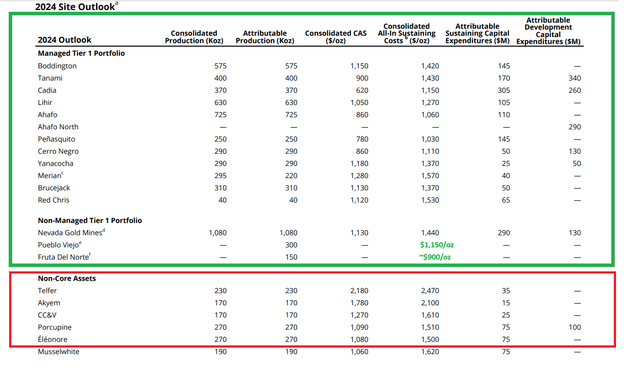

Looking at the below table, we can see that FY2024 all-in sustaining costs for these assets are significantly higher than its core portfolio, which will reduce AISC, with core portfolio AISC expected to be $1,300/oz in 2024 vs. $1,400/oz for the full portfolio.

However, there are several important points to make here.

For starters, Lihir should be able to bring costs down below $1,050/oz later this decade if it can grow into a 900,000+ ounce production profile per Phase 14A with much higher grades over the next few years from the Kapit ore body, with further cost benefits from Newmont’s Full Potential program. Second, Boddington’s costs should improve post-2025 with access to better grades (currently working on laybacks), and Tanami’s costs may be elevated currently, but will look much different in 2027 with the Tanami Expansion 2 completed (~600,000 ounces per annum at $1,050/oz AISC). Moving to Africa, Ahafo North is not included in the profile currently, but is expected to have the lowest costs in the portfolio from 2026-2030 with a ~300,000 ounce production profile at $900/oz AISC. Finally, while Brucejack’s costs are elevated currently, I would expect a meaningful improvement in costs by 2026 as the company works to optimize this asset, with the potential for a throughput expansion that Newcrest was considering already and higher grades.

Newmont Site Outlook (Core Assets vs. Non-Core Assets) – Company Filings Lihir Phase 14A – Newcrest Website

Finally, while not managed by Newmont, Pueblo Viejo will be a much stronger contributor once the behind schedule Pueblo Viejo Expansion is complete (14 million tonnes per annum) and Nevada Gold Mines’ costs should drop meaningfully as well, with Barrick (GOLD) starting to turn this asset around after several years of investment. Given these improvements, I would expect a material increase in Newmont’s all-in sustaining cost margins going forward under its new core portfolio, with AISC margins set to improve over 40% this year to $720/oz, assuming a $2,040/oz gold price ($1,320/oz AISC assumptions), and set to increase further to $790/oz in FY2025, $8400/oz in FY2026, and $860/oz in FY2027. This is all based on what I believe to be a conservative $2,050/oz gold price assumption for the 2025-2027 period.

Newmont – AISC, Gold Price & AISC Margins + Forward Estimates for Core Portfolio – Company Filings, Author’s Chart & Estimates

Hence, while margins may look ugly today, this portfolio revamp combined with optimizations will help Newmont to take back the throne as one of the best vehicles for gold exposure. Plus, we have now seen trough margins for the company with the decision to sell off assets that don’t fit its portfolio, with Newmont having very easy comparisons, especially if the gold price continues to cooperate and continues to hang out above the $2,000/oz level.

As for the near-term outlook, 2024 guidance is ~6.93 million ounces at $1,400/oz all-in sustaining costs for the full portfolio, which was in line with my expectations mostly. However, I expect a significant decline in costs post-2025 as new assets come online, and higher cost assets are divested. And as noted related to its core portfolio and what it plans to keep, production is ~5.63 million ounces at $1,300/oz, but that is without Ahafo North, without higher production from Lihir, without improvements at Nevada Gold Mines (primarily Cortez) and before the full realization of synergies and its full potential program applied to Newcrest assets. And as of current long-term guidance, this core portfolio will grow to ~6.9 million ounces by 2028 at $1,150/oz AISC, which if achieved could result in $900/oz AISC margins at a $2,050/oz gold price, ahead of my above estimates of $860/oz.

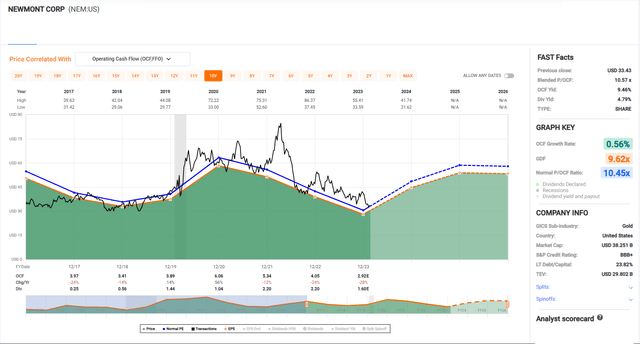

Valuation

Looking at today’s valuation, Newmont is trading at a depressed multiple of just ~7.3x more conservative estimates of $4.40 in FY2024 cash flow per share at a share price of US$31.90. I see this as a very attractive valuation for the world’s largest and most diversified gold producer that just got an upgrade from a jurisdictional standpoint with multiple new Tier-1 jurisdiction assets added to its portfolio (Cadia, Brucejack, Red Chris), a ~1.0 million ounce per annum producer near peak levels (Lihir), and an interest in one of the best assets globally from a scale/margin standpoint in Fruta del Norte. And even if we use more conservative multiples of 10.0x cash flow vs. its historical multiple of 12.2x on FY2025 estimates and a 1.25x P/NAV multiple (1.40x – 1.50x historically) plus a 65/35 weighting on P/NAV vs. P/CF, NEM’s fair value comes in at ~US$49.00 or a 59% upside from current levels (62% when including its fixed $1.00 dividend).

Newmont Historical Cash Flow Multiple – FASTGraphs.com

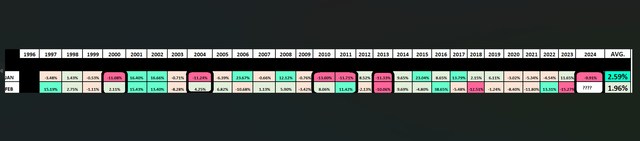

Seasonality

The last point worth noting is that the Gold Bugs Index [HUI] has taken a beating year-to-date in what’s typically one of its strongest periods from a seasonality standpoint, with January and February typically being positive months. However, a bad January (defined as an 8% or worse monthly decline) has typically led to a strong February, with an average gain of ~3.2% in February and February being positive 80% of the time. This is well above the average gain for February of 1.96% for the Gold Bugs Index, and the month being positive on average just 56% of the time. So, with the Gold Bugs Index still negative for the month with just two weeks to go, seasonality would suggest a turnaround and recovery is likely over the next 7 trading days.

Gold Bugs Index Seasonality January & February – Author’s Data & Chart

Obviously, seasonality is not perfect, and a sample size of five is not one to bet the farm on by any means. Still, with the GDX detached from the gold price short-term, several names back on the sale rack, and seasonality in the corner of the miners as well, I’m cautiously optimistic about a recovery in the GDX/HUI to finish the month. Hence, if I were looking to add exposure to precious metals, this is certainly a much improved reward/risk setup from the $26.00 level on GDX, assuming one is putting capital to work in higher-quality miners.

Summary

The headline news for Newmont is understandably disappointing, with many investors not pleased with a dividend cut. However, I think it’s better to rip the band-aid than continue paying out an unsustainable dividend due to the ~$600 million increase in the dividend (calibrated at $1.60) from new shares issued in the Newcrest deal.

Additionally, I like the move to buy back shares given the significant decline we’ve seen in the stock, which will ultimately improve per share metrics during this period of transformation after two major acquisitions in the past five years that have led to growth in the share count. In fact, the major buyback at multi-year lows is similar to the playbook after Newmont closed its Goldcorp deal in 2019, and it helped to bottom out the stock, and we saw a similar setup for Kinross following its Great Bear acquisition which offset a considerable amount of shares issued.

More importantly, though, I like Newmont’s decision to shed higher-cost assets that may not fit its current portfolio and might be better suited for a smaller company as it reduces its capex needs, improves its margin profile considerable and allows it to focus on a more streamlined portfolio of assets that benefit economies of scale. In fact, I wish more companies in the sector would focus on mining the most profitable ounces vs. worrying about mining the most ounces, as this is ultimately what will allow the sector to be more respected with more consistent returns to shareholders and better margins overall.

So, with NEM down over 7% on the day, I see this selloff in NEM shares to the US$31.00 level as overdone. I would consider adding to my position once more if this Newmont Corporation weakness persists.