Stockernumber2

Introduction

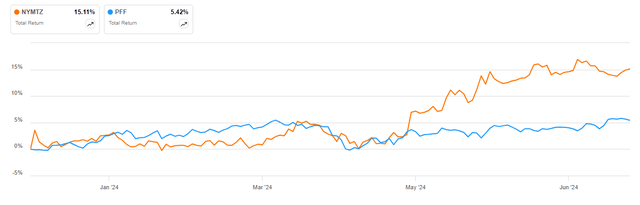

New York Mortgage Belief’s Sequence G 7% fixed-rate most popular shares (NASDAQ:NYMTZ) have considerably outperformed the iShares Most well-liked and Revenue Securities ETF (PFF) to this point in 2024, delivering a 15% whole return in opposition to the mid-single-digit achieve for the benchmark ETF:

New York Mortgage Belief Sequence G most popular shares vs PFF in 2024 (Searching for Alpha)

I count on the outperformance to proceed because the Sequence G shares commerce at a steep low cost to par worth. Whereas the popular dividend protection lately has been subpar, to say the least, I’d argue that the shift in Fed financial coverage would reverse a number of the elements which have contributed to losses in latest quarters. Given the circa 9% present yield and double-digit capital appreciation potential in mild of the appreciable low cost to $25 par worth, I believe the Sequence G shares are value a purchase score.

Firm Overview

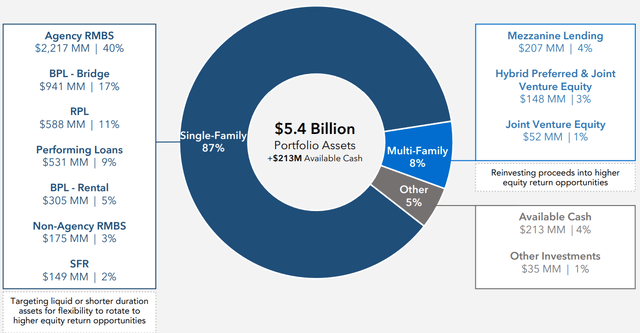

You’ll be able to entry all firm outcomes right here. New York Mortgage Belief (NYMT) is a mREIT targeted totally on single-family mortgage property which account for 87% of the corporate’s securities portfolio, adopted by an 8% publicity to multi-family:

Portfolio Overview (New York Mortgage Belief Q1 2024 Investor Presentation)

From the presentation slide above we observe the majority of the publicity (40% of the portfolio) is to company residential mortgage-backed securities, or RMBS, but in addition consists of extra area of interest areas comparable to enterprise function loans, or BPLs, re-performing loans, or RPLs, non-agency RMBS, and single-family rental properties, or SFR.

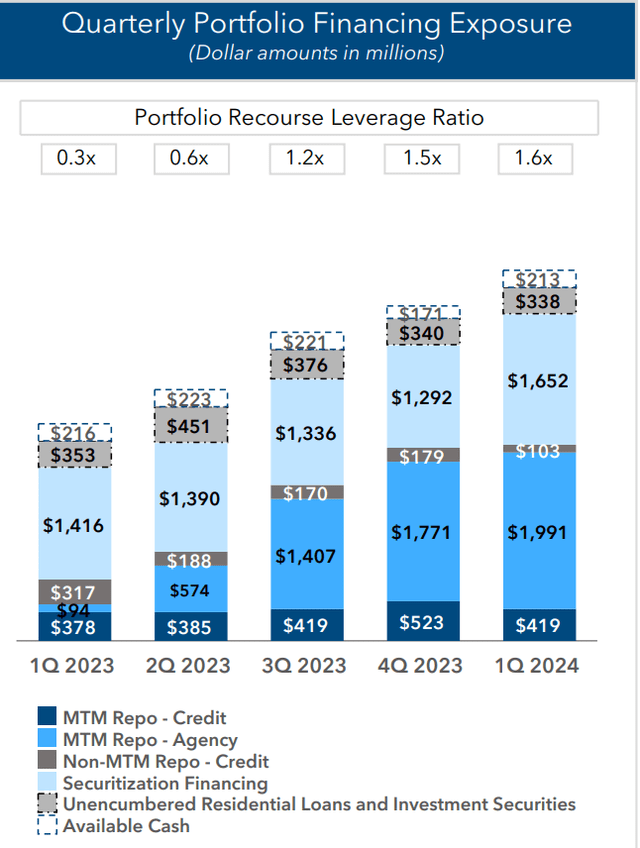

From a GAAP perspective, the $1.5 billion stockholders’ fairness (which incorporates each frequent and most popular shares) is levered 4.96 instances, whereas the recourse leverage ratio stands at 1.6, consisting primarily from mark-to-market, or MTM, services:

Recourse leverage overview (New York Mortgage Belief Q1 2024 Investor Presentation)

We should always notice the corporate holds a $1.15 billion actual property portfolio (on a internet foundation after depreciation), primarily consisting of multifamily and single-family properties. This allocation accounts for 15% of New York Mortgage Belief’s property.

Most well-liked dividend protection

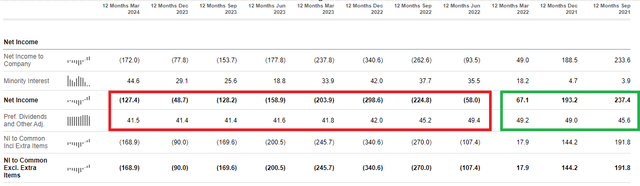

In Q1 2024 the corporate paid $10.4 million in cumulative most popular dividends which weren’t coated by quarterly internet revenue as New York Mortgage Belief recorded a $57.9 million loss. Since quarterly earnings for mREITs are extraordinarily unstable as a consequence of mark-to-market positive factors/losses on securities, it makes extra sense to watch most popular dividend protection on a trailing twelve-month (TTM) foundation (which higher captures the dynamic change within the valuation of the corporate’s portfolio as rates of interest and mortgage spreads change). From this attitude, we discover that ever for the reason that Fed began elevating rates of interest in 2022, the corporate has been unable to cowl most popular dividends from internet revenue:

Quarterly internet revenue and most popular dividends (Searching for Alpha)

If now we have to discover a silver lining, it could be that the corporate generates optimistic internet curiosity revenue, the true property operation is worthwhile if we account for depreciation/accounting modifications, so absent mark-to-market losses and impairment costs (which at $36.2 million in Q1 2024 have been fairly important), New York Mortgage Belief ought to be capable to cowl most popular dividends going ahead.

Outlook for Fed charges

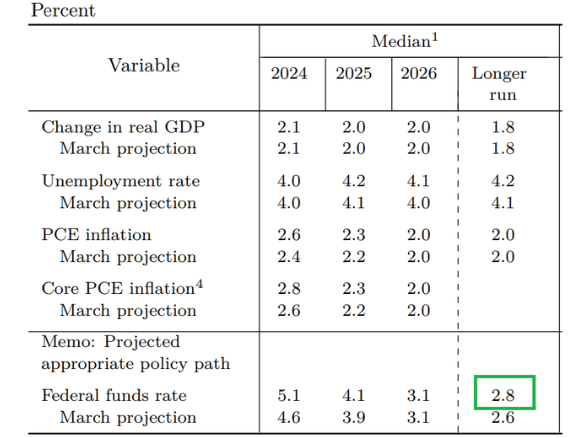

New York Mortgage Belief will profit considerably from the much-anticipated pivot in Fed financial coverage. Not solely are its mortgage property more likely to recognize, however its multifamily actual property portfolio can be anticipated to extend in worth. Present futures pricing signifies the Fed is more likely to carry charges to 3.75-4.00% in July 2025, 1.5% decrease than present ranges. Moreover, in its June 2024 abstract of financial projections, Fed officers signaled they count on additional cuts submit 2025, to a degree of about 2.8% in the long run:

Outlook for macroeconomic indicators (Federal Reserve June 2024 Abstract of Financial Projections)

Explaining actual property impairment costs of $36.2 million highlighted above, the corporate famous that they have been the results of each decrease internet working revenue and better cap charges. Because the Fed cuts charges over the following few years, I’d count on cap charges to maneuver broadly decrease. Because of this, it’s fairly probably that a number of the impairment costs might be reversed.

Most well-liked inventory comparability

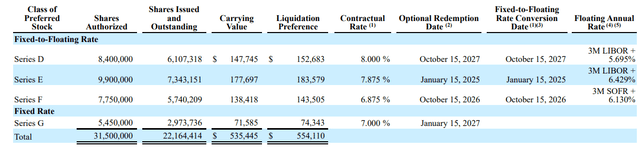

Along with the Sequence G most popular shares (NYMTZ) which carry a set 7% rate of interest on the $25 par worth, the corporate has three different most popular inventory collection, all of which convert to a floating charge within the subsequent three years. These are the Sequence D (NYMTN), Sequence E (NYMTM), and Sequence F (NYMTL) most popular shares, particulars for that are proven under:

Most well-liked inventory particulars (New York Mortgage Belief Kind 10-Q for Q1 2024)

As we are able to inform from the 10-Q snippet above, the Sequence E is most uncovered to Fed coverage given its January 2025 fixed-to-floating conversion date, adopted by the Sequence F in October 2026, and eventually the Sequence D in October 2027. I summarize present yields and capital achieve potential to the $25 par worth within the desk under:

| Most well-liked inventory collection | Present yield | Capital achieve potential |

| Sequence D (NYMTN) | 9.37% | 17.1% |

| Sequence E (NYMTM) | 8.24% | 4.64% |

| Sequence F (NYMTL) | 8.40% | 22.13% |

| Sequence G (NYMTZ) | 9.09% | 29.87% |

Supply: Writer calculations primarily based on present pricing (July 2024)

As is seen from the desk above, the Sequence G shares presently commerce on the largest low cost to par (therefore offering the most important capital upside). Moreover, they provide the second-best present yield after the Sequence D shares. General given the Fed outlook and the yet-to-stabilize operational efficiency, I would like the popular inventory collection with a bigger low cost to par worth. I count on the corporate’s profitability to enhance within the subsequent few years, making 8-9% most popular inventory financing fairly costly, with most popular inventory buybacks fairly probably if costs do not enhance.

In any case, the Sequence E most popular shares look fairly costly because the yield might be round 9.6% on the Fed’s long-term 2.8% impartial charge – on this state of affairs, you quit 25% upside potential for a 0.5% greater yield (in comparison with the Sequence G).

One last item to notice is that each one floating most popular collection will endure within the inevitable recession down the street, with the Fed probably reducing charges under its 2.8% impartial charge. On this state of affairs, the Sequence G most popular shares will really outperform because the 7% coupon might be unaffected by Fed coverage.

Most well-liked protection by market capitalization

As of the top of Q1 2024, New York Mortgage Belief has $554 million in nominal most popular par worth excellent throughout its 4 most popular inventory collection. With a market capitalization of $625 million, at par worth, the popular shares are coated 1.13 instances, which is respectable however not stellar given the lackluster internet revenue efficiency of latest years. The protection improves whenever you bear in mind that each one most popular shares commerce at a low cost to par worth. Based mostly on present pricing, cumulative most popular shares are value $481 million, which improves the market capitalization protection to 1.30 instances.

Lastly, New York Mortgage Belief trades at a reduction to its $931 million fairness worth (adjusted for most popular shares at par) which supplies a further layer of security to most popular shareholders.

Dangers

The principle danger to spotlight is the very poor internet revenue most popular dividend protection ever for the reason that Fed began elevating charges. Whereas I see a path to the protection bettering sooner or later, a higher-for-longer state of affairs will put stress each on the corporate’s mortgage securities portfolio and its multifamily actual property publicity. When you imagine in fewer charge cuts than presently forecast by the market, you might need to go for the Sequence E most popular shares which can reset to a floating charge early subsequent 12 months.

The opposite concern some buyers could have is that the corporate has substantial actual property publicity along with its foremost mortgage portfolio, which creates an unsure dynamic given totally different accounting therapies (amortized value for actual property versus truthful worth for mortgages). As such, if you’re in search of a pure-play mREIT, New York Mortgage Belief might not be the corporate for you.

Conclusion

New York Mortgage Belief didn’t navigate nicely the Fed charge climbing cycle of 2022-2023, incurring important losses over the interval. I imagine a number of the elements that led to the poor efficiency will reverse because the Fed begins easing coverage. This in flip will enable the corporate to finance itself at extra favorable phrases, doubtlessly selecting to purchase again a few of its most popular points, which presently commerce at yields of round 9%. Whereas the present revenue on all 4 most popular collection is sort of engaging, the Sequence G most popular shares stand out for my part since:

- they supply the second-highest present yield.

- they provide the very best low cost to par (excessive security).

- they provide the most important capital appreciation potential (if operational efficiency improves).

- they provide recession resilience if the Fed cuts charges under its 2.8% impartial charge due to the 7% mounted coupon.

Because of this, I rank the Sequence G most popular shares as a purchase.

Thanks for studying.