Moussa81

Introduction

On January 10, 2023, Canada-based New Gold Inc. (NYSE:NGD) released its fourth quarter 2022 operational results ending December 31, 2022.

Note: This article is an update of my article published on November 4, 2022. I have been following New Gold on Seeking Alpha since 2019.

1 – Fourth quarter production release commentary

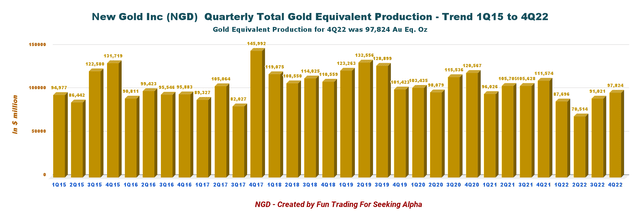

Gold equivalent production recovered from the catastrophic second quarter of 2022 and had an excellent 2022 finish in the fourth quarter, with 97,824 GEOs showing that the 2Q22 challenges have been resolved. However, production is down sequentially.

CEO Patrick Godin said in the press release:

New Gold was faced with several challenges in 2022, but our teams remained resilient executing on our plans, and as a result, our operations met all updated production guidance targets

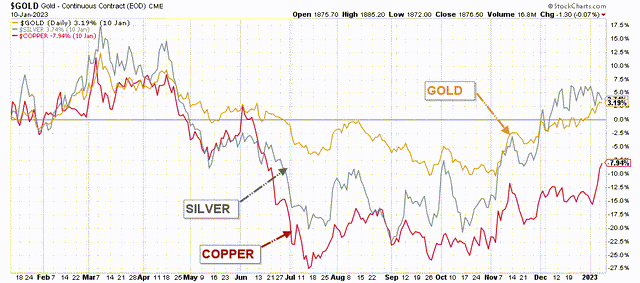

Unfortunately, the precious metal prices were quite depressed in 4Q22 due to inflationary pressures that forced the FED to hike interest rates several times. However, since December’s last rate increase, the market has been bullish on gold expecting the FED to slow down its preventive action against high inflation.

The result is that the gold price for 4Q22 will be only slightly above $1,725 per ounce despite gold trading at nearly $1,880 per ounce now. The same issue has affected both silver and copper prices.

NGD Gold, Silver, and Copper 1-year variation (Fun Trading StockCharts)

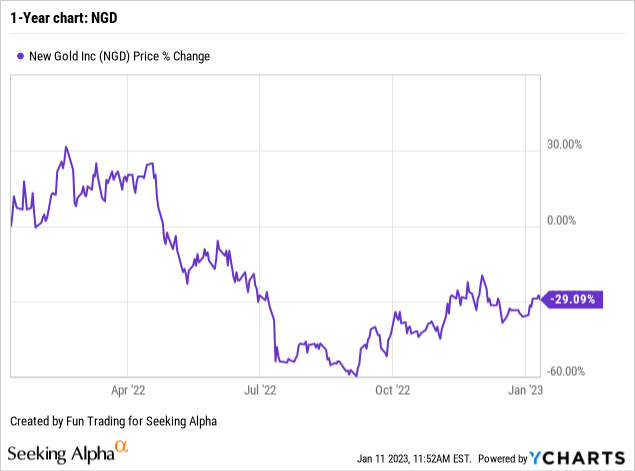

2 – Stock Performance

New Gold Inc. recovered from its collapse in September 2022 by showing that the technical issues experienced in July were now under control. However, NGD is still down 29% on a one-year basis.

4Q22 Gold production analysis

1 – The raw numbers

NGD Quarterly gold equivalent production history (Fun Trading)

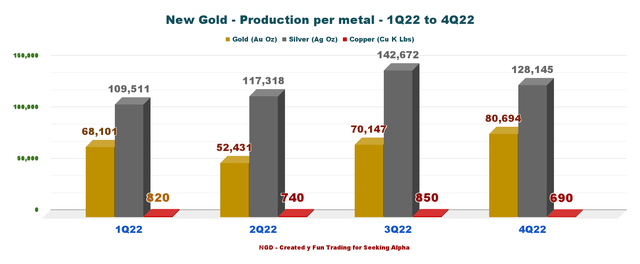

NGD announced on January 10, 2023, that it produced 97,824 GEOs during the fourth quarter, up 7.5% sequentially. The production of gold equivalent ounces GEO includes gold, silver, and copper. Below are the details:

- Gold production was 80,694 Au oz

- Silver production was 128,145 Ag oz

- Copper production was 6.9 M Pounds.

Note: The company did not indicate the amount sold in 4Q22, which is potentially a good sign.

Below is shown the production for the four quarters in 2022 and per metal:

NGD Production per metal and per quarter in 2022 (Fun Trading)

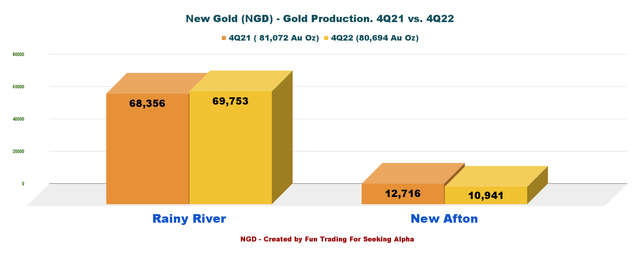

Gold production for the Rainy River mine was 69,753 Au ounces and 10.941 Au ounces for the New Afton mine.

CEO Patrick Godin said in the press release:

In the fourth quarter, Rainy River delivered the strongest quarter of the year, driven by a 25% increase in quarter-over-quarter grades as higher grade underground ore was introduced to the mill, which was partially offset by lower throughput.

At New Afton, the team achieved revised guidance for both copper and gold, and successfully ramped up B3 production to the targeted rate of 8,000 tonnes per day, ahead of plan. New Gold and its operations exit 2022 on a strong note, well positioned for the new year

At Rainy River, underground mining helped deliver solid production.

At New Afton, New Gold Inc. had solid production with the successful ramp-up of B3 with 8,000 TPD.

NGD gold production per quarter and per mine history (Fun Trading)

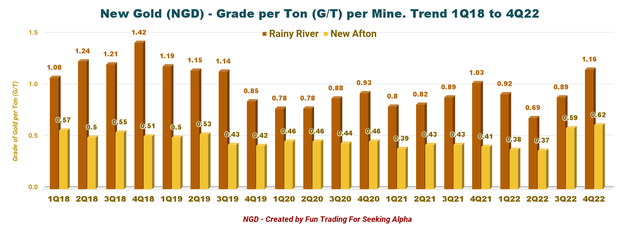

The grade per tonne G/T recovered from the disastrous second quarter with another record high at New Afton and a solid grade at Rainy River due to the underground. Another good sign for 2023.

NGD Quarterly gold grade per mine history (Fun Trading)

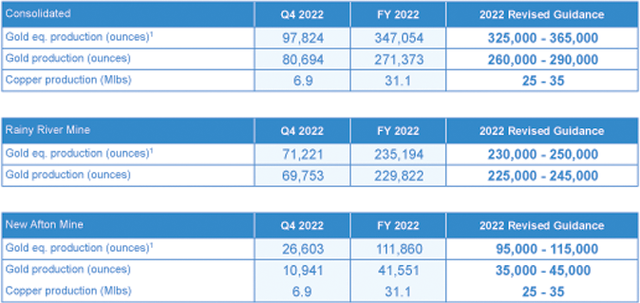

2 – NGD achieved its updated 2022 guidance

New Gold Inc. production for 2022 was 347,054 GEOs, well within guidance. Production of gold, silver, and copper performed well, all above guidance.

NGD 2022 Production within guidance (NGD Press release)

Technical analysis and commentary

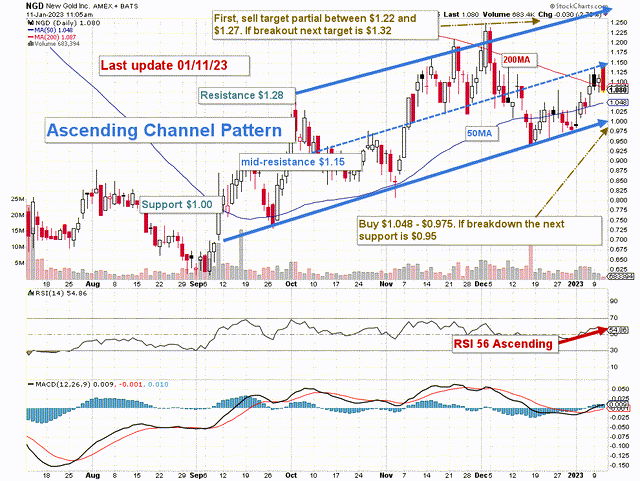

NGD TA Chart short-term (Fun Trading StocksCharts)

NGD forms an ascending channel pattern with resistance at $1.28, mid-resistance at $1.15, and support at $1.00.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices.

The strategy is to trade LIFO about 60% of your position and keep a small core long-term for a better payday.

I recommend accumulating between $1.048 (50MA) and $0.975, with potential lower support at around $0.95. NGD has recovered nicely since September and seems to be moving with the gold price, which is strong and could trend even higher in H2 2023, depending on the FED’s action.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote of support. Thanks.