We’re in the “Information Age” — where digital knowledge is power.

Artificial intelligence is the main driver behind this rally, as demand for the software expands to what seems like every sector of the market.

And it’s helped push us into a new bull market … for tech stocks!

The Nasdaq and the S&P 500 are on a tear, with technology performance markets boosting higher than ever before.

The S&P 500 in particular gained 20% off its October 2022 lows, and it’s now in its fifth technical bull market in about 30 years…

And it’s all thanks to big-cap tech.

We break down more on the “why” on today’s video, along with what to expect for the rest of 2023…

(Or read the transcript here.)

Hot Topics in Today’s Video:

- Tech News: How we started the year versus where we are now with ChatGPT and AI demand. [2:00]

- Market News: In light of the upcoming Federal Reserve rate hike decision, will the U.S. economy reach a “soft landing” on inflation? [6:00]

- Crypto Corner: The SEC is suing Binance! What to do if you’re a customer, and why Coinbase will reign supreme as the ultimate crypto trading platform. (And how this will benefit crypto traders!) [12:35]

- Mega Trend: America’s electric vehicle battery industry is dawning! Here’s our top recommended exchange-traded fund in this emerging market. [19:00]

- New Report: Coming soon to Extreme Fortunes subscribers. [26:00] If you’re already a member, keep an eye out for it! If not, learn more about becoming a member.

See you soon,

Ian KingEditor, Strategic Fortunes

Well, it was nice while it lasted!

Americans have long had a compulsive spending problem. It seems to be programmed into our collective national DNA.

But there was a brief moment in which we Americans finally got our spending under control — in 2020 and the first half of 2021.

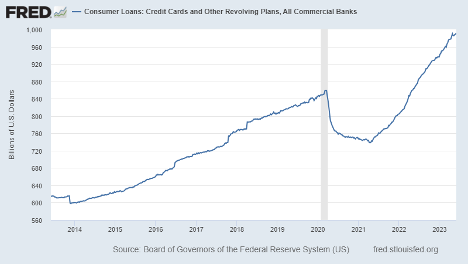

Checks from the government were abundant, but there wasn’t much to spend them on due to the pandemic. Credit card balances declined from just shy of $860 billion to about $738 billion (a decline of about 14%).

It didn’t last.

Starting in 2021, credit card debt blasted off to new highs and is now closing in on a trillion dollars. Credit card debt is up about 34% from its 2021 lows and about 12% in just the past 12 months.

As we’ve noted in The Banyan Edge, virtually every major retailer has mentioned in their recent earnings calls that consumers look tapped out. They are prioritizing basic necessities over discretionary purchases.

Even Wendy’s noted that they’ve been seeing higher-income Americans in their restaurants, opting for a cheap cheeseburger over pricier options.

Of course, we know how this ends. Consumers will continue to build higher balances until they can’t. At some point, the minimum payment becomes too high to maintain, the balance gets maxed out or they simply look at the hole they’ve dug themselves into, and opt to stop paying.

Then the defaults start … and credit ratings get ruined. Shoppers are forced to scale back for lack of available credit. And we have a proper recession.

What does that timeline look like?

Frankly, no one knows. The leading economic indicators have been flashing recession warning signs for months, and continue to flash those signals today.

My best guess is that we see a recession within the next three to six months. Given the backward-looking nature of the data, we may already be in one and it simply hasn’t been called yet.

Regardless, while recession is a risk in the immediate future, it’s time to prepare for the next bull market. Today, Ian and Amber highlight the official dawning of the 2023 tech market boom.

What exactly is spearheading this, and more importantly…

How can we take advantage of this as investors? Find out by watching today’s video!

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge