magicmine

Thesis

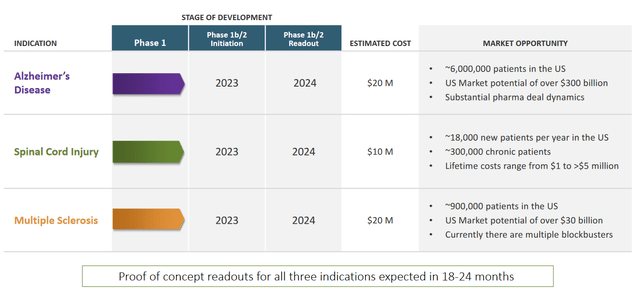

NervGen (OTCQX:NGENF)(TSXV:NGEN:CA) is a Canadian clinical stage biotech company with one lead drug candidate, NVG-291, to treat several neurodegenerative diseases. The company is in the last stages of its Phase 1 trial to assess safety, tolerability and metabolism reactions in postmenopausal women. Once this trial is done, the goal is to kick off three Phase 1b/2a trials in spinal cord injury, multiple sclerosis and Alzheimer’s disease.

The drug has shown what I believe to be unprecedented results in preclinical spinal cord injury models, and impressive results in preclinical multiple sclerosis models. Further preclinical work in other indications shows the consistency of the drug’s promise.

The company builds on the scientific developments showing the negative involvement of astrogliosis and microgliosis, basically overreactive immune cells or glial cells, in sites of injury and in neurodegenerative diseases. The technicity of NVG-291 will be explained in some more detail below. NervGen’s success also aligns with other successes, smaller or larger, of other companies in different indications with a similar underlying scientific rationale. I list some of those below.

The markets targeted by NervGen are huge, and I believe that in spinal cord injury and multiple sclerosis, chances of having a disease-modifying drug are huge. Given the lack of preclinical work in Alzheimer’s, I’m not giving that part of NervGen’s pipeline any value at this point.

There are some potential catalysts ahead for NervGen, such as the potential uplisting on Nasdaq, the topline data of its Phase 1 trial, and the start of its Phase 1b/2 trials.

The company will require further funding at a given timepoint, and still awaits the lift of a partial clinical hold by the FDA.

Company Profile

Pipeline

NervGen is a clinical stage biotech company dedicated to developing innovative treatments that enable the nervous system to repair itself following damage, whether due to injury or disease. This is its pipeline.

NervGen current pipeline (Corporate Presentation)

As one sees, 2024 is expected to be a catalyst-rich for NervGen, with readouts in three major indications. NervGen will need total funding of $50 million for these trials. It has recently picked up $15.2 million through a private placement, adding to its cash position, but will need a bit more to finalize these trials.

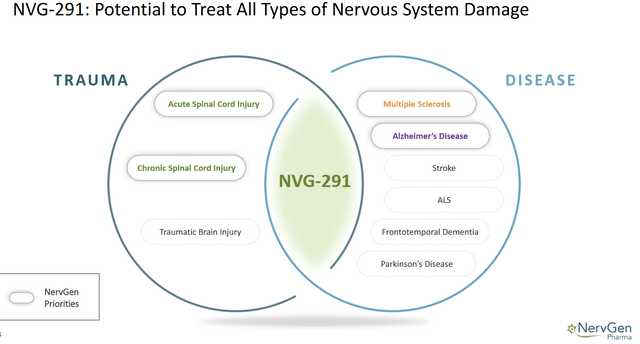

NervGen intends to pursue these goals with its drug candidate NVG-291, which it likes to refer to as a ‘pipeline-in-a-drug’, with the potential to treat all types of nervous system damage.

NVG-2291 potential pipeline (Corporate presentation)

I will explain that below, with a short introduction on the immune cells of the body or glial cells, among which astrocytes, microglia and oligodendrocytes are the most important.

The glial scar

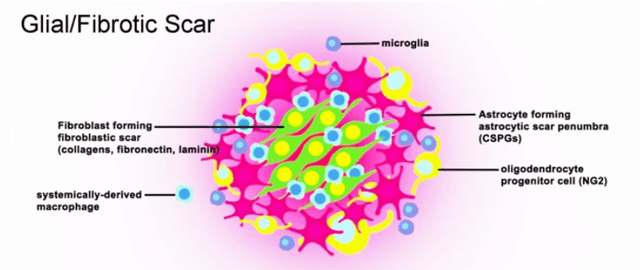

Glia are immune cells of the central nervous system (CNS). Microglia are the most known, with multiple functions, such as immune surveillance, shaping neural circuitry, and monitoring the integrity of synaptic function. Astrocytes’ functions are to preserve homeostasis, defend against oxidative stress, tissue repair and synapse modulation. Oligodendrocytes are most known for myelination of axons.

When trauma to the CNS occurs, a glial scar is formed, as a mechanism to protect and begin the healing process. This newly formed complex structure permanently remodels cellular architecture. Similar cellular formations occur following stroke, infection, and neurodegenerative diseases. The glial scar mechanism is based on gliosis, a reactive defense mechanism whereby glial cells change phenotype in an effort to minimize and repair the initial damage after CNS injuries.

Glial scar drawing (PubMed publication: New Insights into Glial Scar Formation After Spinal Cord Injury)

The glial scar is both a hallmark of spinal cord injury and multiple sclerosis.

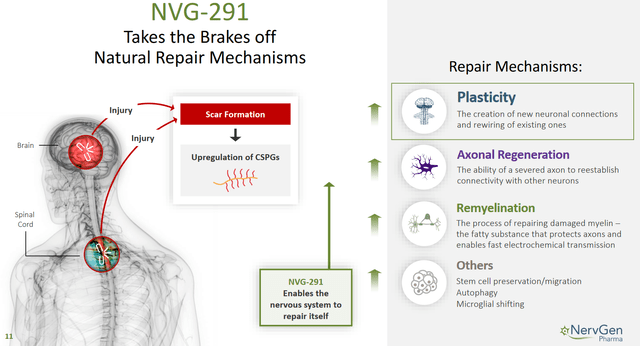

Glial scars contain inhibitory molecules inhibiting repair of damaged tissue. Those inhibitory molecules include chondroitin sulfate proteoglycans or CSPGs. CSPGs contribute to proinflammatory signaling, leading to enhanced TNFα secretion by microglia/macrophages. It was shown that PTPσ may serve as a switch to execute axon outgrowth or synaptogenesis. On the basis of that understanding, it was hypothesized that by inhibiting PTPσ signaling using an intracellular sigma peptide or ISP, neurogenesis, improvement of inhibited synapse formation and remyelination could reoccur.

NVG-291

NVG-291 is an inhibitor of PTPσ. NervGen believes that inhibiting the activity of PTPσ has the potential to promote nerve repair mechanisms such as nerve regeneration, remyelination and plasticity; promote autophagy, a cellular self-cleaning mechanism; and to promote a non-inflammatory phenotype in microglia cells, the innate immune cells of the brain. Preclinical work has that NVG-291 markedly enhances microglial phagocytic/digestive capacity, alters the pro-inflammatory environment, allows for myelin regeneration, and allows glial cells to return to their normal not reactive/inflammatory phenotype, conferring neuroprotection.

NVG-291 mechanism of action slide (Corporate presentation)

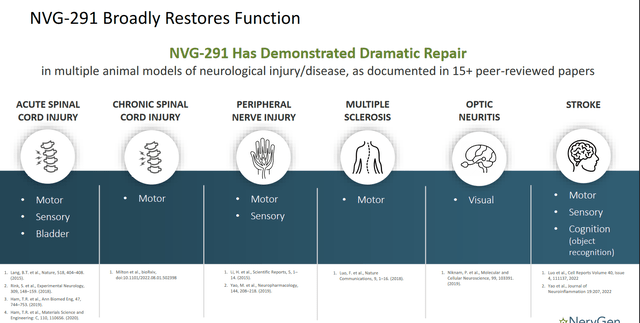

The preclinical work is abundant here, with peer-reviewed publications in six indications in over 15 scientific publications.

NVG-291 preclinical publications (Corporate presentation)

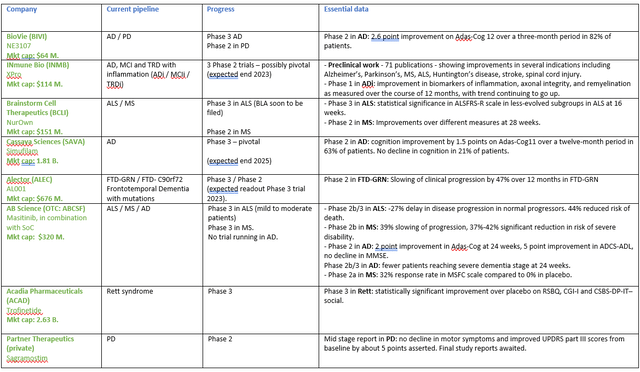

The consistent successes of modulating glial activity

At a given point, it becomes undeniable that several potentially disease-modifying successes in different neurodegenerative indications have a very similar overarching hallmark. That hallmark, for me, is successfully modulating glial activity and reducing neuroinflammation. NervGen has proven that this goes as far as spinal cord injury, an indication which most people would consider never to be fully treatable. I have drafted a non-exhaustive overview of other companies that I believe have shown successes in their respective fields in taking a similar approach. Knowing that in all of these indications, successes are extremely exceptional, I believe a very clear pattern is emerging here.

Other companies modulating glial activity (Own work)

Tickers mentioned: BIVI, INMB, BCLI, SAVA, ALEC, ABCSF, ACAD. Of the companies listed above, insofar as I am aware, only INmune Bio’s (INMB) XPro has also been shown to improve motor function and reduce AD onset post spinal cord injury. With BioVie (BIVI) in a Phase 3 trial to be read out in mid 2023 and INmune Bio having stated that it plans to go for accelerated approval after its randomized Phase 2 trials which makes sense in light of recent FDA guidance, I believe both INmune Bio and BioVie may be considered closest to the approval stage. Cassava Sciences (SAVA) is included in the above category as its drug candidate has been shown to reduce biomarkers of neuroinflammation and to modulate glial activity as evidenced by a change in the sTREM2 biomarker. Although this company was the first to report good cognition data, I do not believe it is best placed for approval, lacking peer-reviewed publications and given the skepticism surrounding the science related to filamin A.

NVG-291 for spinal cord injury

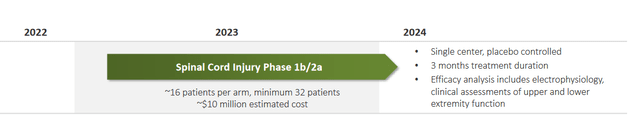

Spinal cord injury is a serious condition in which, often due to an accident, the spinal cord is damaged and in rare cases severed. Symptoms may include paralysis, loss of sensation, and loss of bowel, bladder and sexual function. Rehabilitation may provide some recovery over a longer timeframe, but often, that recovery is limited. There are no approve treatments available in the US. NervGen has received Orphan Designation in Europe for this indication, but not in the US. This is the design of the upcoming Phase 1b/2a study.

Spinal Cord Injury Phase 1b/2a trial design (Corporate presentation)

If there would be any reason why investors should get excited about NervGen, then I believe it is the preclinical work done here. Repeatedly, NVG-2291-R, which is the drug version for rodents, has achieved dramatic functionality recovery after spinal cord injury. The company has several video’s which cannot be shown here, but I would invite investors to go and take a look at NervGen’s latest presentation from September 20, 2022 here.

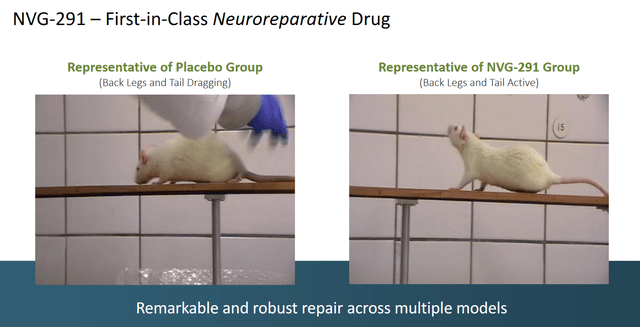

NVG-291 in SCI preclinical trial slide (Corporate presentation)

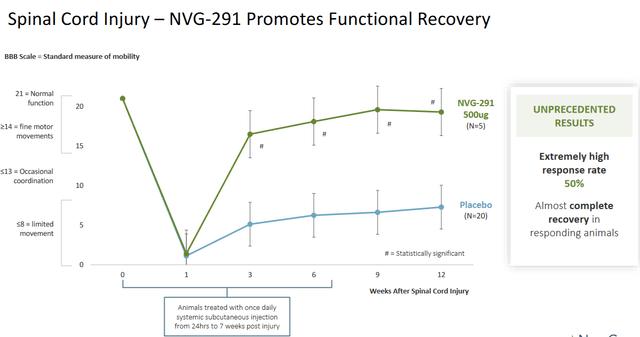

Animals treated either with placebo or with NVG-291-R had been partially injured with a spinal cord injury. The placebo animal has no coordination, its tail is down, and the legs aren’t moving underneath the hips. The animal treated with NVG-291-R post injury recovers fast from that injury, with moving legs, its tail up and coordination (link: min. 9.48). The response rate is as high as 50%, seeing an almost full recovery in responding animals and 100% improvement in bladder function. Previous reporting had mentioned 50-70% (slide 12 – link to publication). A 100% response has been seen in bladder function. There is another trial where rats treated with NVG-291-R are able to climb a ladder again, with seemingly regained control of their hind legs.

Functional recovery in SCI slide (Corporate presentation)

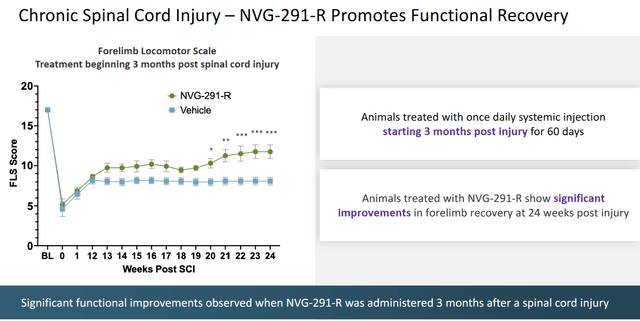

A recent publication of preclinical work also shows that the trend of improvement persists in chronic spinal cord injury, i.e. long after the glial scar has been formed. I believe this is very good news for a potentially disease-modifying drug, and I believe it coincides with the strong remyelination reported as will be shown below.

Long-term spinal cord recovery slide (Corporate presentation)

As to the above-mentioned 50%-70% response rate in motor function, and 100% response rate in bladder control, the question is how this will translate to humans. This includes indications such as multiple sclerosis and Alzheimer’s disease, which are known to be multifactorial diseases. In those indications, other companies have reported partial response rates, such as BioVie and Cassava Sciences, and some companies are targeting population subgroups which are likely to respond. Some base subgroup identification on gene expression, INmune Bio does so on the basis of the presence of neuroinflammation). I am interested in seeing how NervGen sees its trial moving forward specifically in those multifactorial indications.

Whereas I can’t form an opinion for spinal cord injury at this stage, I do find it problematic that NervGen uses a one-size-fits-all trial design for multiple sclerosis and Alzheimer’s disease, knowing these are multifactorial diseases. That means randomized trials may have non-responders, which means statistical significance and chances of success may be affected at some point.

With three trials soon running, even partial success in any indication here could give a considerable boost to the share price.

The annual incidence of spinal cord injury is about 17,900 cases per year in the US. Approximately 296,000 persons are living with a spinal cord injury in the US. Average yearly expenses in the year following injury are in between $300,000 and $1 million, with lifetime costs in between $1.7 million and $5 million.

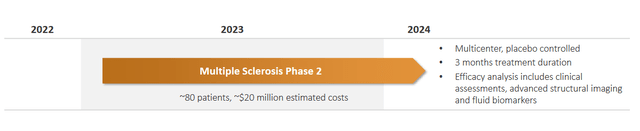

NVG-291 for multiple sclerosis

In multiple sclerosis (MS), the myelin sheath of the axons in the CNS is destroyed. This is the design of NervGen’s upcoming Phase 1a/2b study:

MS Phase 1b/2a trial design (Corporate presentation)

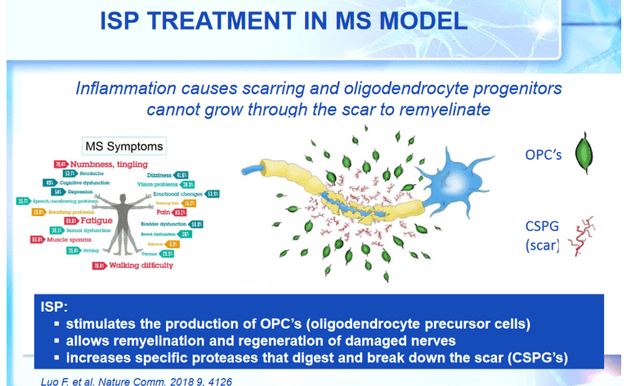

As set out above, this myelin sheath is created by oligodendrocytes. It was established that, also in MS, glial scars exist as caused by inflammation, disallowing remyelination and restricting repair.

ISP treatment in MS model (Sec Filings)

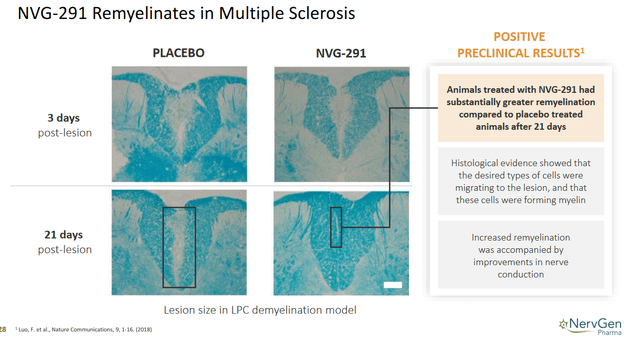

NervGen has shown in preclinical models how, in an animal model of MS, the placebo animals’ hind legs remain paralyzed, whereas in treated animals, a signal of efficacy is seen after 10 days. Treated animals keep their legs underneath their hips, their tail is up, and start walking normally again (link: min. 37.46). That result is confirmed when looking at the myelin sheath of the respective animals, where almost full recovery is seen in treated animals.

Remyelination slide in MS (Corporate presentation)

The market for MS drugs was worth $19.8 billion in 2018, and would grow to $32.9 million by 2028. There is one FDA-approved drug, ocrezilumab, which does not allow for repair of myelin sheath. Evidence of remyelination, is therefore of great value, and not just in MS but also in Alzheimer’s disease.

NVG-291 for Alzheimer’s disease

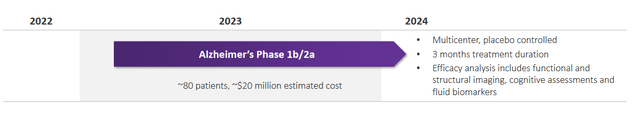

This is the design for the upcoming Phase 1b/2a study of NVG-291 in Alzheimer’s disease.

AD Phase 1b/2a trial design (Corporate presentation)

NervGen has a particularly impressive scientific advisory board for this indication. Though NervGen’s page on Alzheimer’s disease gives me the feel that there is, insofar as I am aware, there is no preclinical work with NVG-291 in this indication yet, which makes it hard to assess chances of success here.

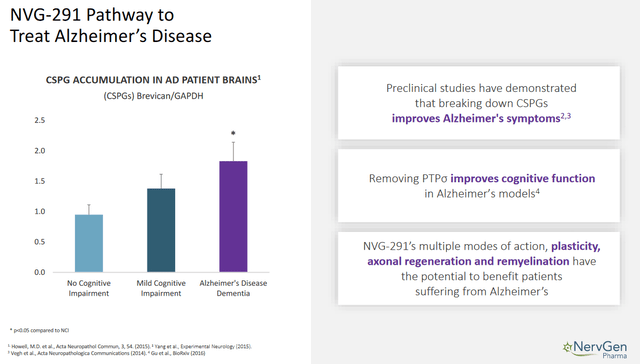

The pursuit of success in this indication builds on the established accumulation of CSPG’s in Alzheimer’s disease as well, and preclinical work has shown that breaking down CSPGs improves Alzheimer’s symptoms (reversal of memory deficits in a mouse model).

CSPG’s in Alzheimer’s (Corporate presentation)

At this point in time, I am not giving this part of NervGen’s pipeline much value, as the preclinical work is rather scarce, and as symptoms of Alzheimer’s disease have been cured many times in mice models, without this being able to translate to humans. Part of that finding could be due to the mouse models used for Alzheimer’s not representing actual Alzheimer’s in humans.

Nonetheless, the market is huge. There are about 6 million patients with Alzheimer’s in the US alone, and NervGen itself sees a market potential of over $300 billion here. That also means that any result here may significantly impact the stock’s course, for the better or for the worse. For reference, Eisai’s lecanemab topline data on lecanemab, an anti-amyloid drug, showed a slowing of decline. When these results came out, Eisai’s (ESALI) share price went up 17% (at the time of writing) and in anticipation of results for Eli Lilly’s (LLY) anti-amyloid drug donanemab, Eli Lilly’s price went up 6.7% post market, respectively representing ~$1.84 billion and ~$20 billion in added value. As is shown in the chart above, other companies have more promising drugs in their pipeline that have the ambition to stabilize or improve cognition in Alzheimer’s patients.

The status of the ongoing Phase 1 trial

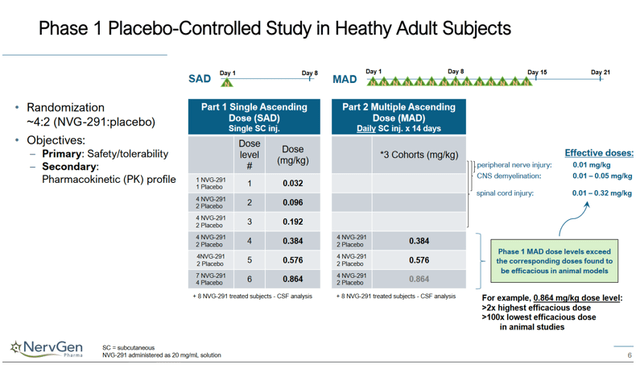

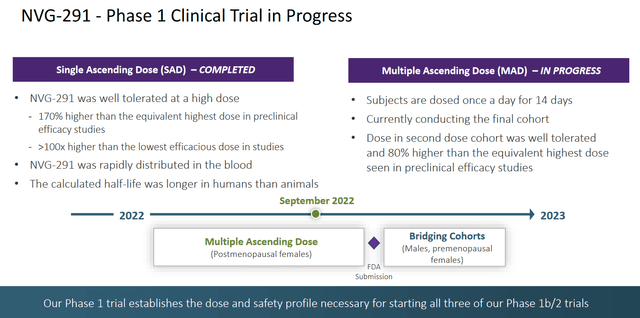

On May 6, 2021, NervGen announced it had dosed its first patient in the ongoing Phase 1 trial. The trial consists of two ascending dose phases, a single- ascending dose phase which has been finalized, and a blinded multiple ascending dose phase which is in progress.

Phase 1 trial design (NervGen May 2022 presentation on Phase 1 trial)

Results of the single ascending dose study have been published, an abstract has been presented at AAIC 2022, and are shown in the slide below. NervGen reported that NVG-291 is safe and without serious adverse events, which the company considers important as dosage is at levels much higher than the efficacious dosing seen in animal studies. In the study’s multiple ascending portion, pharmacokinetics from patients having completed 14 days of blinded treatment with either NVG-291 or placebo were similar to those for the same dose level in the study’s single ascending dose portion. The dose administered in the first cohort is already above the highest corresponding dose found to be efficacious in animal models, and is substantially higher than the lower effective doses where functional improvements were observed.

Phase 1 trial status (Corporate presentation)

On May 12, 2022, the company has received the approval to dose the third and final cohort with no serious adverse events. Reporting should follow afterwards.

NervGen has completed the simple ascending dose portion of the trial in women, and the multiple ascending dose has been cleared for post-menopausal females. There is no full clearance from the FDA to conduct the trial in patients, and the company is in discussions with the FDA regarding this, having provided it with an extensive set of nonclinical data. The reason is that some atrophy in rats’ sex organs had been shown in pre-clinical studies, with male rats being affected more than female rats. A similar effect had not been seen in dogs. The company seems confident that the partial clinical hold will be lifted at a given point, after which it will do a 14-day bridging study in men and premenopausal women.

I understand that the partial clinical hold could be concerning to some investors. However, even if the hold would not be lifted, I do not necessarily believe the NVG-291 could not be approved. The question would rather be at which stage. Other drugs have been approved by the FDA with a reproductive toxicity profile. There is a clear unmet need, some patients may be past their reproductive phase, and some patients may accept the risks inherent to NVG-291 in light of the chances of substantially improved quality of life. This also holds true for patients suffering from neurodegenerative diseases with a disease onset typically later in life.

Upcoming potential catalysts

NervGen has four upcoming potential catalysts which it lists on slide 31 of its corporate presentation:

— Phase 1 study topline data of the multiple ascending dose portion of the Phase 1 trial

– US department of defense sponsored grants

– potential uplisting to Nasdaq

– preclinical studies in spinal cord injury and Alzheimer’s disease models.

As to the potential uplisting on Nasdaq, the latest update I found is that the company now plans this for 2023, once a new CEO is in place. The Nasdaq listing requirements are that shareholders equity is at least $2,000,000, there are at least 100,000 shares of public float, there is a minimum of 300+ shareholders, total assets of $4,000,000, at least two market makers, a $3 minimum bid price of the company stock, and public float market value of $1,000,000. As the current share price is trading well at CA$1.63 and thus below a $3 minimum bid price, the company may need to apply some changes to its shareholder structure to be uplisted on Nasdaq.

Financials and other information

NervGen recently picked up $15 million through a private placement in July. As of June 30, 2022, it had $11.6 million in the bank. That totals $25.6 million. The last quarter’s cash burn was The net cash burn for the last reported quarter was approximately $3.7 million. R&D expenses were $4.7 million, and general and administrative expenses were $1.6 million. Net loss was $6.3 million. I did not find an estimate on how long that cash will last NervGen, but I will assume it will do so until mid 2023 in light of the expected $50 million cash burn to run the announced 3 Phase 1b/2a trials.

The float is 43.7 million, of which 25.34% is held by insiders and only 0.06% by institutions. The stock has an average of 38.000 shares.

On September 23, 2022, NervGen announced that the CEO Paul Brennan will step down, and that he will be replaced by Bill Radvak as interim CEO and Dr. Adam Rogers as interim president. Reasons for Mr. Brennan’s departure are unknown.

Risks

Aside from the typical risks of biotech investing, including volatility, competition and regulatory uncertainty, I see five possible risks. First, NervGen is currently dependent on the FDA to remove a partial clinical hold, as the current trial does not allow dosing to men and premenopausal women. Second, I am less confident with NervGen’s drug candidate the more the indications it targets increase in addressable market potential. That would mean, for example, that a failure in Alzheimer’s disease may have a disproportionate effect on the entire share price. Third, NervGen will need funding at a given point. With three Phase 1b/2 studies about to start with a total cost of $50 million, current funding will be insufficient. There is also a risk of partial response in at least multiple sclerosis and Alzheimer’s. Finally, successful reporting for this company still lies two years ahead, but once those readouts will come, I believe NervGen may surprise the markets.

Conclusion

NervGen has brought unprecedented results in preclinical models of spinal cord injury and multiple sclerosis, using a same drug which modulates glial activity. These results are sustained over a longer period of time. That trend is important, as it may show we are dealing with a truly disease-modifying drug candidate. I believe the mechanism of action of NVG-291 is successful, and I see it as a returning theme of early-stage successes of biotech companies focusing on other indications. Modulating glial activity is probably the most promising way forward, and NVG-291 seems to prove that marvelously. That makes me very bullish for NervGen’s future in the long run.

NervGen has several potential catalysts ahead which may create value for investors. These are the expected uplisting on Nasdaq, the expected lift of the partial clinical hold, the expected grants from the department of defense, and further publications of preclinical work. In the longer run, 2024 should see readouts of upcoming trials in spinal cord injury, multiple sclerosis and Alzheimer’s disease. I am expecting successful reporting in at least the first two of these indications.

There are some risks attached to this stock, such as negative investor sentiment in case the partial clinical hold would not be lifted. It is unclear at this stage how the FDA’s view on this will be.

As I believe this company is destined for a great future, and investor’s returns over a two-year timeframe could be significant, I am planning on taking a long-term investment in NervGen at a given point in time. For those reasons, I’m rating the company as a Strong Buy.