lucadp/iStock via Getty Images

A Quick Take On Aristocrat’s Acquisition Of NeoGames

NeoGames S.A. (NASDAQ:NGMS) went public in November 2020, raising $94 million in gross proceeds from an IPO that was priced at $17.00 per share.

The firm provides a suite of lottery management software solutions to national and state-regulated lotteries and iGaming solutions.

Australian company Aristocrat Leisure Limited (ALL) (OTCPK:ARLUF) announced an agreement to acquire NeoGames for an enterprise value of $1.2 billion in an all-cash transaction that values NeoGames at $29.50 per share.

The deal has the support of at least 61% of NeoGames shareholders, so it appears set up to close upon the completion of further contingencies, including a domicile change, regulatory and shareholder approvals.

My outlook for NGMS is a Buy at its current price of $27.17, as the stock has an approximate 8.6% upside to the acquisition price of $29.50.

NeoGames Overview

Luxembourg-based NeoGames was founded to develop iLottery management software and games for state lotteries and other lottery operators as well as iGaming software for private operators.

Management is headed by Chief Executive Officer, Mr. Moti Malul, who has been with the firm since 2014 and was previously at predecessor firm Aspire in various roles for five years.

The company’s primary offerings include:

-

Regulation and compliance

-

Payment processing

-

Risk management

-

Player relationship management

-

Player value optimization

-

Game studio

The firm pursues long-term contracts with national and state lotteries and other lottery operators.

The firm provides four areas of services to customers: Marketing operations, player operations, technology operations, and business operations.

Market and Competition

According to a 2023 market research report, the global online lottery market was an estimated $10.3 billion in 2022 and is expected to reach nearly $15.1 billion by 2028.

This represents a forecast CAGR (Compound Annual Growth Rate) of 6.1% from 2023 to 2028.

The main drivers for this expected growth are increased Internet access, growing use of mobile devices, improved entertainment experiences, and younger demographics playing lottery games more frequently.

Also, within the lottery industry, management says the global iLottery segment “has emerged as a fast-growing segment…with GGR increasing at a CAGR of 24.0% between 2003 and 2019, according to H2GC.”

Major competitive or other industry participants include:

-

International Game Technology (IGT)

-

Scientific Games (SGMS)

-

Instant Win Gaming

-

Camelot Group

-

LottosOnline

-

MultiLotto

-

Jackpot.com

-

Others

NeoGames’ Recent Financial Trends

-

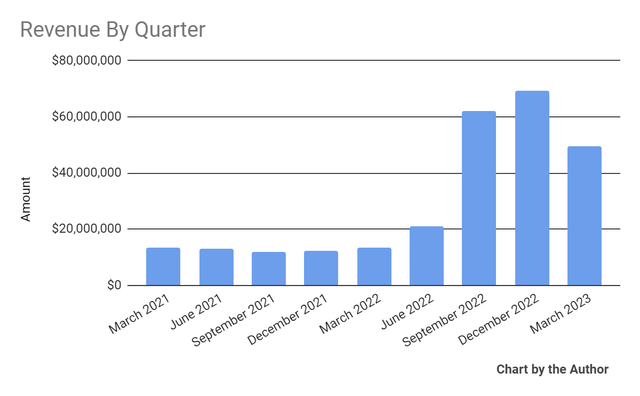

Total revenue by quarter has risen sharply in the wake of NeoGames’ acquisition of Aspire in mid-2022.

NeoGames Total Revenue (Seeking Alpha)

-

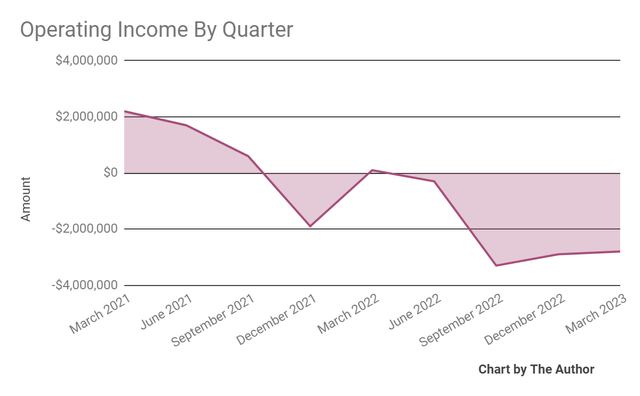

Operating income by quarter dropped into negative territory in five of the last six quarters, especially as the firm integrated Aspire’s operations:

NeoGames Operating Income (Seeking Alpha)

-

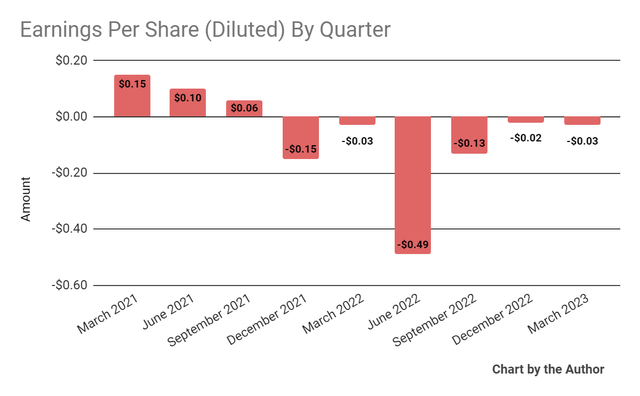

Earnings per share (Diluted) have remained negative but recently approached breakeven:

NeoGames Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

The NeoGames/Aristocrat Deal

Aristocrat will fund the deal from cash on hand and appears to have the resources to close the transaction.

The transaction requires NeoGames to re-domicile from Luxembourg to the Cayman Islands, probably for tax and other merger-related reasons, after which NeoGames will merge with a subsidiary of Aristocrat.

The acquisition values NeoGames at an EV/revenue multiple of approximately 5.4x and a stock price premium of around 104% over the volume-weighted average price of NGMS for the three months ended May 12, 2023.

Completion of the deal is scheduled to occur within twelve months, and it is subject to various regulatory and shareholder approvals.

NeoGames shareholders representing 61% of the outstanding shares “have executed a support agreement with Aristocrat, pursuant to which they have irrevocably agreed to vote in favor of the Transaction.”

For Aristocrat, the transaction adds complementary capabilities by providing the firm with a notable market player in the real money gaming (RMG) iLottery, iGaming and online sportsbook segments, and geographical expansion opportunities.

Aristocrat CEO and Managing Director, Trevor Croker, said, “Bringing together NeoGames and our growing Anaxi business will position Aristocrat with global scale and capability in the growing online RMG industry. Through the acquisition of NeoGames and its industry-leading global online RMG platform, this transaction will deliver on our strategy by providing a portfolio of end-to-end solutions for iGaming, iLottery, and Online Sports Betting operators globally. We see great opportunities in the combination of our complementary businesses, with clear revenue and growth potential that comes with a complete and seamless online RMG solution.” (Source – Aristocrat)

With a greater than 100% stock price premium and a 61% NeoGames shareholder support agreement, Aristocrat appears to have locked up the transaction, assuming it receives the necessary regulatory and other shareholder approvals.

To sweeten the pot for its existing shareholders, Aristocrat has announced a further AUS$500 million share buyback authorization.

The question for investors is whether another suitor will come along to offer a higher price, which the NeoGames Board of Directors would be required to evaluate?

Anything is possible, but Aristocrat paying a 100% premium to NGMS’s current stock price is likely enough of a premium to dissuade others from bidding, certainly private equity and smaller corporations.

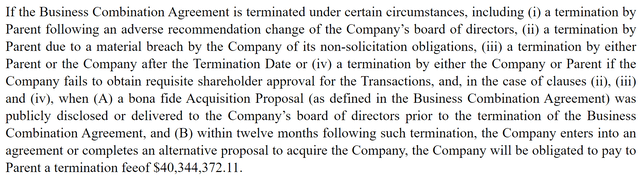

Also, there’s a breakup fee of $40.3 million if NeoGames doesn’t go through with the deal, under the following circumstances:

Form 6-K (SEC)

My outlook for NGMS is a Buy at its current price of $27.17 as the stock has an approximate 8.6% upside to the acquisition price of $29.50.