Paul Bradbury/OJO Images via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA) as an investment option at its current market price. This is a multi-state, closed-end fund with an objective “to provide current income exempt from regular federal income tax and the alternative minimum tax applicable to individuals by investing in an actively managed portfolio of tax-exempt municipal securities.”

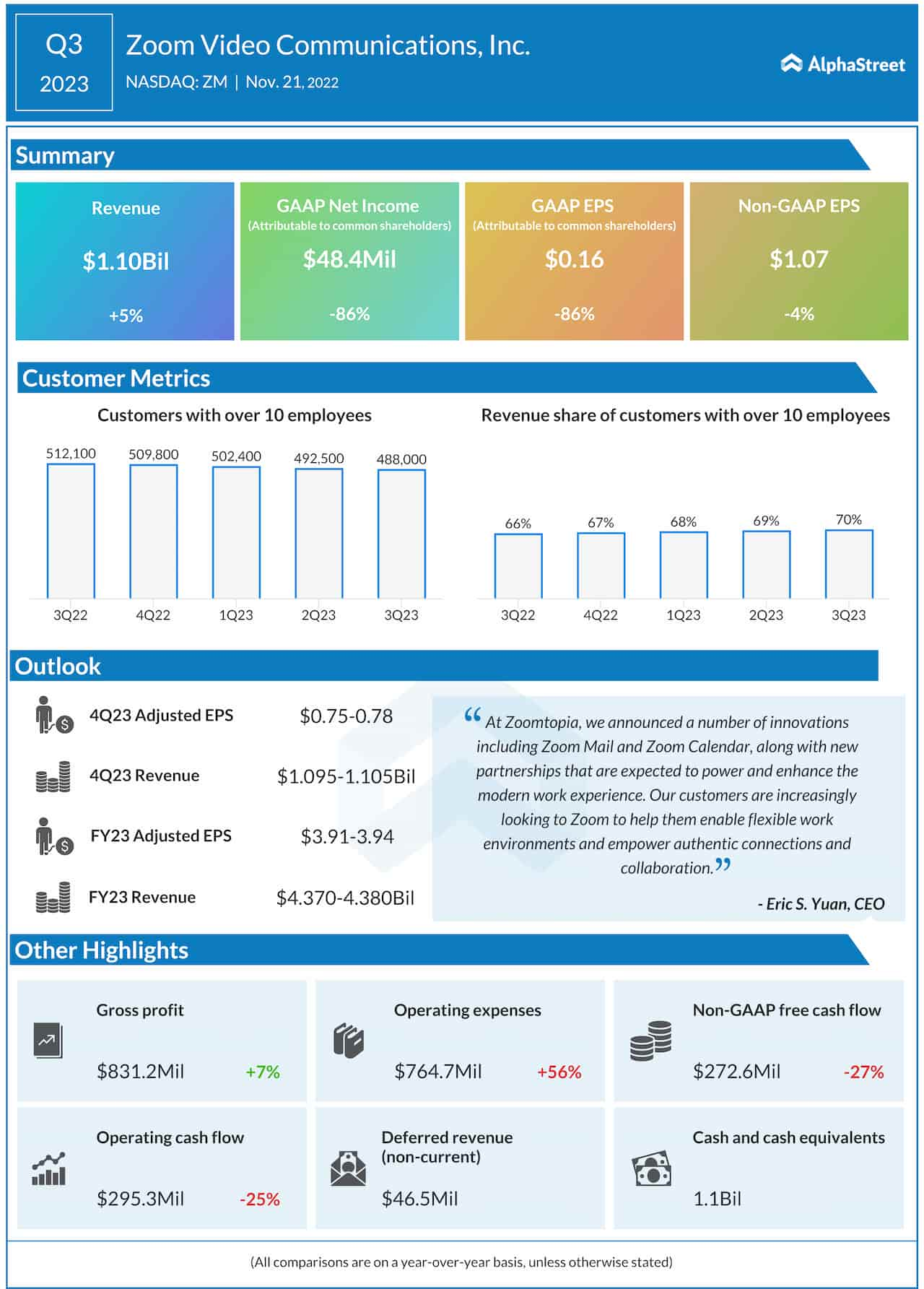

NEA is one of the few CEFs I stuck with over the past year because of its tax-free objective. While I generally shed my leveraged exposure due to an unfavorable macro-backdrop, I still saw value in munis and thought NEA’s holdings that were AMT-free status and its large discount to NAV would bring in buyers. Unfortunately, I was off the market in this regard. The fund has continued to perform poorly and has lost double-digits since my July 2022 article:

Fund Performance (Seeking Alpha)

In this review I will discuss why my bull thesis was off the mark, whether some of the same challenges still exist today, and the rationale for downgrading this fund to a “hold” in the short term. Despite still liking munis as a whole, retail investors who use CEFs as their primary vehicle to play them face a couple of key challenges that won’t go away until confidence returns more broadly.

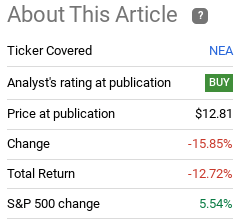

The Leverage Thorn – Still Sticking

The first item of business is to discuss the primary reason for NEA’s weakness. This is consistent across the CEF universe (with few exceptions) since the Fed began hiking short-term rates. The issue is leverage – which is how CEFs tend to make their living during the good times (cheap rates and growing economies). Unfortunately, those “good times” have been challenged over the past 12 – 18 months as the cost of that leverage has soared along with rising borrowing costs for short-term capital:

NEA’s Use of Leverage (Nuveen)

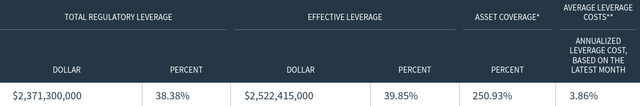

I think this should make it quite clear why NEA is struggling in this environment. As short-term borrowing costs have risen, so too has the cost of having this much leverage. While cost of leverage is always an issue, fund managers (and their clients) will often still benefit from it because of the yield pick-up at the longer end of the curve. The logic being, we borrow at lower rates in the short-term than what we can earn investing in long-term securities. Unfortunately, this “logic” has been turned on its head for the past few years as the inverted yield curve has resulted in higher short-term rates in many cases:

Yield Curve (Inverted) (Charles Schwab)

Ultimately, NEA is paying an annualized cost of almost 4% to find securities on the open market that, if they are lucky, will yield close to that. That means that the yield pick-up is negligible.

But, still, you ask, why would that be a net negative? Isn’t it a wash?

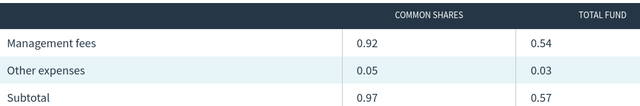

To fund managers, perhaps it is. But retail investors who buy funds like NEA have to contend with management fees as well. So if leverage borrowing is not amplifying the yield, investors are actually losing out on income because the borrowing is not offsetting what is getting siphoned off in fees:

Fund Fees (Excluding Leverage) (Nuveen)

The takeaway from all this is that NEA is in a difficult spot. The fund is costly to operate – which presents a challenge for shareholders. While fund managers get paid either way via expenses, retail investors rely on those expenses to be a net benefit if income is growing at a faster clip. That clearly hasn’t been the case, and this is not something that is likely to change until we get a Fed pause and/or reverse in rates.

So What About Leverage? Income Is The “So What”

The next step is understanding how the prior discussion impacts investors in real terms. Simply put, it isn’t pretty. In normal times (a normal yield curve), leverage is a boon for investors. Fund managers borrow at a lower rate, reinvest those proceeds at higher rates, and pass on the positive differential to shareholders. This results in higher income streams than would otherwise occur from buying individual securities on your own. Not a bad deal, right?

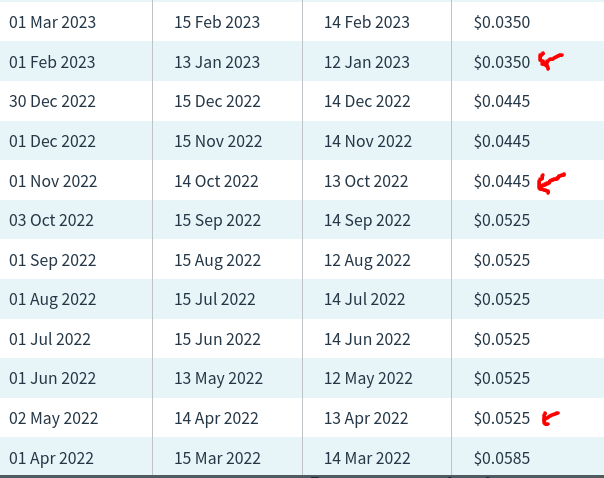

It is a great deal actually. The problem is that an inverted curve can have the opposite effect and in the case of NEA that has clearly been true. Rather than amplifying the income stream, it has helped chip away at it. As the fund takes money off the top for leverage expenses and management fees, less is left to pay to shareholders. The impact has been clear, with NEA’s distribution being cut a number of times in recent memory:

NEA’s Distribution History (Nuveen)

That is three cuts in just over a year. Not too good by any stretch of imagination.

While that is in the past, the challenge is the yield curve remains inverted so this challenge has not gone away. While I think the “worst” is over, the forward outlook remains cloudy as this is a very real risk investors need to weigh carefully before buying this fund – and others like it.

The Discount Didn’t Make-Up The Difference

The leverage aspect was well known – and has been – for a while now. So what argument could have possibly been made to buy this fund anyway? One was that I like munis, and I still do, because they offer strong income streams on a tax adjusted level compared to other sectors. This doesn’t change materially, it just isn’t reflected in CEFs due to expenses. But if one bought munis on the open market or in a passive (non-leveraged) ETF this story wouldn’t be as painful.

Reason number two was I believed that the discount to NAV that NEA traded at would balance out some of this risk. This was an error in judgment on my part. The broader sell-off in bonds and the reluctance of investors to take on leveraged exposure has led to a widening of this discount. So rather than see a narrower discount make up for some of the pain elsewhere, instead we see added pain as the discount grew. Ouch.

This again was no small development. In July last year, NEA had a discount in excess of 6%. This hardly drew in buyers, as that discount has expanded to over 14% at time of writing (6/13):

NEA: Fast Facts (Nuveen)

In fairness, this is starting to look like a value that will be hard to pass up. NEA does not historically trade in this range or lower. So value-oriented buyers may very well be coming along to scoop up this disproportionately high discount and that could narrow it back down to low single-digits. If so, that offsets some of the leverage/income risk discussed above. That is central to the premise that an outright sell or bearish argument is tough to make right now.

Still, it is unrealistic to think NEA is going to get a 10% pop just on a buying spree from retail investors who suddenly see the value in tax-exempt income for 14% cheaper than the underlying value. While possible, it doesn’t seem plausible to me right now, hence the need to exercise some caution.

Tax Receipts Not As Strong As Prior Year

Looking at the muni sector more broadly there are other reasons for concern. To be clear, I think state and local governments are still backed by strong credit ratings and an ability to make good on their obligations related to municipal issues. This is not meant to be alarmist to any degree, as I still prefer this type of debt over corporate issues, on average.

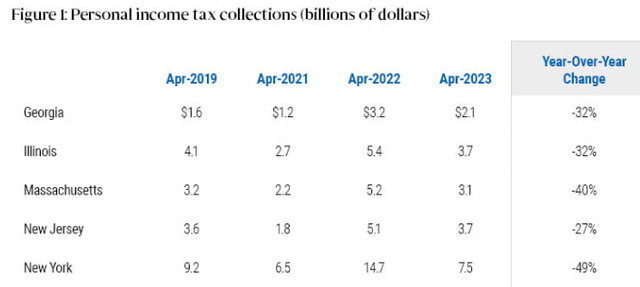

However, it is worth pointing out that 2023 has seen a slowdown in tax receipts, especially related to personal income tax collections. This has been driven mostly by a drop in the stock market. As investors and households earn less in stocks – they subsequently pay less in income taxes. After a boon year in 2021 that saw record receipts in 2022, we have seen a cooling off period:

Personal Income Tax Receipts (PIMCO)

These drops are significant but we do need to remember that the previous April was a record high in most instances. So while these drops in historically important states for muni issuance are a big unnerving, receipts are still at elevated levels. That is the good news.

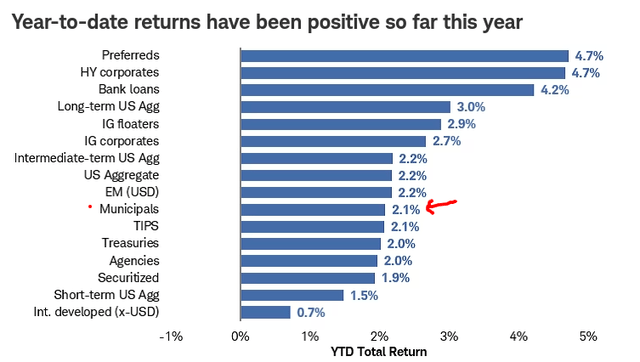

The challenge going forward is how much of a premium are investors going to pay for this debt when the fundamentals aren’t as strong as they were. Again, I see them as quite strong, but a drawdown in collections is not a good signal regardless. This is probably why munis, although up for the year, are lagging behind other fixed-income sectors in 2023:

YTD Performance (By Sector) (Bloomberg)

I see this as a reasonable reason to put a “hold” rating on NEA. The leverage hurdle is a difficult one, the cheap valuation has yet to draw in buyers, and other areas in the credit realm have more momentum. While that can signal a contrarian buy call, I think patience is the right move here.

Bottom-line

NEA has been a straight up disappointment for me over the past year. I was fortunate to take a negative view of most leveraged CEFs and avoid a lot of pain – but not with this option. Looking ahead, this fundamental headwind remains and will pressure total return in the second half of the year. While the above-average discount and strong muni sector fundamentals lend merit to continue to own this fund, I suggest readers approach new positions very selectively going forward.