HeliRy

Navios Maritime Partners (NYSE:NMM) remains one of the most undervalued shipping companies by a significant margin, and perhaps one of the most undervalued companies in the market in general. The company’s cash flow from operations is hovering around all-time highs, exceeding $200 million for FY 2021 and is poised to surpass the $500 million mark for FY 2022. The news gets even better for the years ahead as a significant component of revenue and, consequently, cash from operations is locked in for several years, thanks to the booming containership market over the past two years, which enabled NMM to lock in its 47 containerships on highly lucrative multi-year contracts.

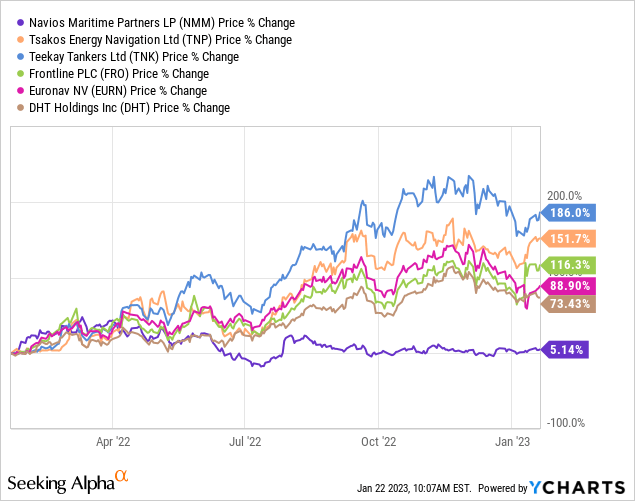

The company has locked in $3.2 billion in contracted revenue, of which approximately $2.3 billion is attributed to containerships. The remaining balance of approximately $663 million in backlog relates to tankers and approximately $226 million relates to the dry bulk fleet. It is important to note that while the containership and dry bulk markets have softened, the tanker market has been on fire, as reflected in the performance of most tanker stocks. For example, tanker peers such as Tsakos Energy Navigation (TNP), Teekay Tankers (TNK), Frontline (FRO), Euronav (EURN) and DHT Holdings (DHT) have all seen gains ranging from 73.43% to 186% over the past year. Meanwhile, NMM has only seen a gain of 5.14%.

The market has not appreciated NMM’s diversification strategy. In 2021, NMM merged with Navios Maritime Acquisition, acquiring a large tanker fleet and becoming the largest U.S. publicly-listed shipping company in terms of vessel count, consisting of 55 dry bulk carriers, 43 containerships, and 45 tankers. Since then, NMM has grown further and now has 87 dry bulk carriers (an increase of 32 vessels following the acquisition of the dry bulk fleet from Navios Maritime Holdings (NM)), 47 containerships (4 vessels increase), and 51 tankers (6 vessels increase).

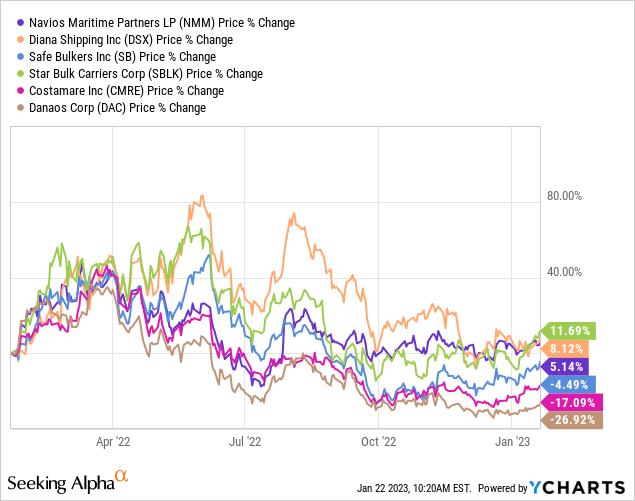

Despite making substantial progress in many areas, including simplifying its corporate structure, expanding its fleet, and securing lucrative long-term charter contracts, NMM’s unit price has not seen the same hype as other tanker companies. Its performance has been mediocre, more comparable to that of dry bulk and containership companies, as illustrated in the graph below.

Even though NMM benefits from the stability of long-term cash flows from its containership vessels and the upside potential from its tanker and dry bulk market fleets, it seems that the market is not fully recognizing its value. The outcome is quite perplexing: NMM is a cash flow machine, generating more than half a billion dollars per year in operating cash flow, but its unit price is trading well below its net asset value (NAV). And we are not talking about a 10-15% discount to NAV, we are talking about a 70% discount!

Specifically, the gross fleet value exceeds $5.0 billion, based on average publicly available valuations derived from VesselsValue and Clarksons’ Research. This figure includes vessel values of approximately $545 million for three Kamsarmaxes and four VLCCs under bareboat-in agreements that have been classified as Operating lease liabilities in the balance sheet.

On the other hand, total debt including bareboat liabilities is approximately $2.3 billion. This figure includes approximately $385.7 million of implied loans for seven vessels under bareboat-in agreements that have been classified as Operating lease liabilities in the balance sheet, as well as approximately $185 million of assumed loans for five charter-in vessels that have been classified as finance lease liabilities in the company’s balance sheet. The latter figure, that of assumed loans, is included in the calculation to be conservative and therefore assume a worst-case scenario.

As such, after making some minor adjustments to also take into account the other assets and liabilities, the NAV equates to approximately $2.7 billion. However, the market capitalization remains extremely well below $1 billion, closer to $800 million at the time of writing. In other words, NMM trades at an approximate 70% discount to NAV or around 30 cents on the dollar. This is extreme and outrageous, especially since the company is a cash flow machine, as discussed above, and should be buying back its units right and left.

The good news is that during Q2 earnings on July 28, 2022, NMM announced a $100 million unit repurchase program to close the gap. At the time of the announcement, the CEO Angeliki Frangou commented:

Our board authorized a unit repurchase program for up to $100.0 million. At current prices, this program would cover approximately 17% of the public float. The timing of the repurchases and the exact number of units to be repurchased shall be determined by the Company based on market conditions and financial and other considerations, including working capital and planned or anticipated growth opportunities. Total return to investors, we believe, is the way to measure our success, and will use this tool as a means of achieving this result for our unitholders.

The disappointing news is that during Q3 2022 results, on November 10, 2022, there was no significant progress in this regard. Actions speak louder than words. NMM has historically been slow to take advantage of its undervalued unit price. This has occurred multiple times in the past, but previously there was some justification, primarily due to the complex structure of the Navios Group. It is important to note that NMM is the product of several mergers, beginning with Navios Containers, followed by Navios Acquisitions, and then the acquisition of the entire dry bulk fleet from Navios Holdings. Currently, both Navios Holdings and Navios Partners have distinct strategies, with Navios Holdings focusing on South American logistics and NMM focusing on shipping. Both entities have also de-risked their balance sheets and there is no longer a need for inter-company transactions, which has eliminated any conflicts of interest. Despite this, NMM persists in its ultra-conservative approach, paying a very low distribution, maintaining an extremely low distribution payout ratio as well as its MLP (Master Limited Partnership) status, and believing that over time the market will appreciate its diversification, low leverage, and retention of most internally generated cash flow to increase its asset base and therefore NAV.

In my opinion, given that NMM is trading at such a significant discount to its NAV, and considering the company’s prudent leverage metrics and substantial operating cash flow, the biggest risk lies in its own actions. The persistent undervaluation of its unit price hinders the company’s ability to raise accretive capital (not necessary at present, considering the substantial cash flow generation) or use its share price as a means for aggressive M&A. As a result, it must consistently rely on internally generated cash flow, which, while sufficient at present, is limiting in the long term. In my view, NMM should be more assertive in repurchasing its own units (instead of acquiring vessels at NAV), and then devise a method to compensate its unitholders, such as restoring a progressive distribution that will never decrease again (gradually but surely, since we are starting from an extremely low base) and also consider converting its structure from an MLP to a regular C-Corp. To be candid, the MLP structure does not offer much benefit to unitholders but it does serve as a means for the CEO to retain control through the GP (general partner).

In closing, Navios Partners is being overlooked and undervalued by the market, despite its robust balance sheet and significant cash flow generation. The company’s diversification strategy is being ignored, and its units are being sold at a staggering discount to their NAV. This is a rare opportunity for investors to take advantage of and acquire a piece of a cash flow machine at dirt cheap prices, as well as for the company to do the same via unit repurchases and send a strong signal to the market. It is well known that the shipping industry is prone to volatility, however, the current depressed unit price of NMM offers an unusually large margin of safety. The company is trading at a mere 30 cents on the dollar, while simultaneously generating a significant amount of free cash flow, surpassing the rate of depreciation, which means that the NAV will most likely continue to expand, all else constant. In my opinion, the greatest risk facing the company is the management’s lack of action to bridge the gap between the unit price and net asset value, rather than the volatility of the shipping market itself.