The March pure gasoline contract has been on a rollercoaster experience over the previous month, pushed by a number of elements, together with polar vortex blasts throughout the Decrease 48, commerce tensions, rising synthetic intelligence-related power demand underneath the “Powering Up America” theme, and surging liquefied pure gasoline (LNG) exports. This heightened volatility displays how merchants are unsure about value course forward of the spring months.

Bloomberg calculations primarily based on 60-day volatility present that the March contract for NatGas has blown out to the widest stage ever over what Bloomberg’s Elizabeth Elkin identified are merchants “making an attempt to determine the course for gasoline as LNG exports, rising demand for gas-fired electrical energy to run knowledge facilities and the specter of tariffs are rising as potential elementary movers in a market usually dominated by climate fluctuations.”

Elkin added, “To cap it off, forecasts have swung broadly over the previous couple of weeks, making it troublesome to foretell how excessive demand will probably be to warmth houses and companies.”

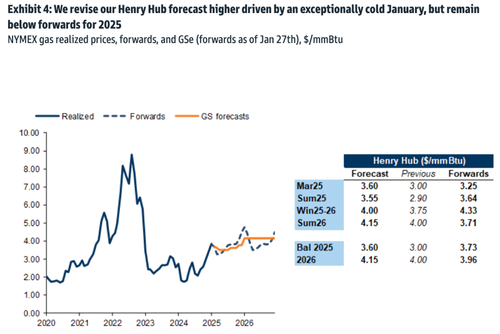

For coloration on attainable course, Goldman’s Samantha Dart instructed shoppers early final week that she shifted her US NatGas value forecast from $3/mmBtu to $3.6 “to mirror tighter balances.”

Dart additionally famous: “We see additional upside to 2026 US gasoline costs.”