Luis Alvarez

Commodities are showing some renewed signs of momentum as inflation picks back up on the backs of a continued strong U.S. economy. I think if you’re investing in equities, the Materials sector globally makes sense. This is a part of the marketplace which has underperformed other major sectors like Technology, and I would argue is due for outperformance.

If you agree with me, then the iShares Global Materials ETF (NYSEARCA:MXI) is worth a strong look. This Exchange-Traded Fund, or ETF, grants investors access to a portfolio of companies engaged in the business of basic materials, encompassing sectors such as metals, chemicals, and forestry.

Launched by BlackRock (BLK), a global titan in asset management, MXI debuted on September 12, 2006. Its mission is to mirror the performance of an index that aggregates worldwide equities within the materials sector. The ETF seeks to track the S&P Global 1200 Materials Sector Index™ as its core benchmark, offering a specialized doorway to equity investments in the materials sector across the globe.

The Core Holdings of MXI

MXI holds a diversified portfolio of 99 individual securities. Top holdings include:

- Linde PLC stands: a premier worldwide entity in the industrial gases and engineering sector.

- BHP Group Ltd: a global frontrunner in the resources domain, with operations in mining and processing of minerals, oil, and gas.

- L’Air Liquide Societe Anonyme Pour: recognized as a French multinational firm, providing industrial gases and services across various sectors.

- Shin Etsu Chemical Ltd: a Japanese chemical enterprise, specializing in the production of polyvinyl chloride (PVC), semiconductor silicon, and rare earth magnets.

- Rio Tinto PLC: a British-Australian multinational corporation, ranking among the globe’s leading giants in the metals and mining industry.

The fund’s assets are well diversified across these companies, thereby mitigating the risk associated with investing in a single company. Linde has the largest allocation currently, with an 8.56% allocation.

Sector Composition of MXI

From an industry allocation perspective, this is primarily allocated to Chemicals followed by Metals & Mining.

- Chemicals – 47.65%

- Metals & Mining – 36.22%

- Construction Materials – 8.79%

- Containers & Packaging – 4.96%

- Paper & Forest Products – 1.80%

- Cash and/or Derivatives – 0.58%.

The fund’s sector composition provides a balanced exposure to different sub-sectors within the broader materials sector.

MXI vs. Similar ETFs

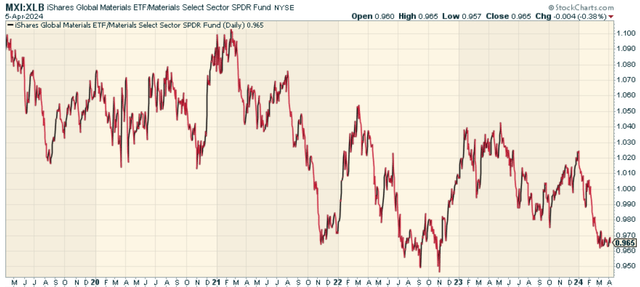

When comparing MXI with similar ETFs, it’s important to consider factors such as the fund’s performance, management fees, and asset size. MXI currently has a management fee of 0.41% and net assets totaling $259 million. I’m glad to see this actually as the relatively small AUM suggests it’s likely an underinvested part of the marketplace. I wasn’t able to find out global Materials sector ETFs to comp against, but relative to the US-centric Materials Select Sector SPDR ETF (XLB), MXI has underperformed. Note the ratio seems to be stabilizing now though, which could bode well for the future.

stockcharts.com

The Pros and Cons of Investing in MXI

Like any investment, investing in MXI comes with its own set of advantages and drawbacks.

Pros:

Diversification: MXI provides exposure to a diversified portfolio of companies involved in the production of raw materials.

Global Exposure: The fund offers targeted access to material stocks from around the world, providing a global sector view.

Potential Growth: MXI has shown consistent growth over the years, making it an attractive investment option for potential growth.

Cons:

Sector-Specific Risk: Since MXI is concentrated in the materials sector, it’s more susceptible to factors affecting this sector.

Geopolitical Risk: The fund’s global exposure also means it’s subject to geopolitical risks, which could potentially affect its performance.

Market Volatility: Like any other ETF, MXI is subject to market volatility, which could lead to potential loss of investment.

The Final Verdict: To Invest or Not to Invest in MXI?

Considering the fund’s performance, its diversified and global exposure to the materials sector, and its potential for growth, MXI could be a good catch-up trade as commodities continue to show strength and investors look outside the U.S. I like the mix here, and think there’s room to run on a relative basis.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).