Morsa Photos

I’ve been lucky to interview quite a lot of thought leaders within the hashish area on my podcast Lead-Lag Stay. The one factor I all the time got here away from these conversations? Hashish demand is unbelievable, however the challenges of investing within the area negate the trade’s development, given a scarcity of a transparent framework on the federal finish of issues. In some unspecified time in the future, it will change. And when it does, you might wish to contemplate the AdvisorShares Pure US Hashish ETF (NYSEARCA:MSOS). This ETF consists of firms centered on cultivation and distribution, generally known as multi-state operators (MSOs) and ancillary hashish operators. MSOS invests solely in US-based cannabis-related firms, excluding Canadian exposures frequent in rival hashish ETFs.

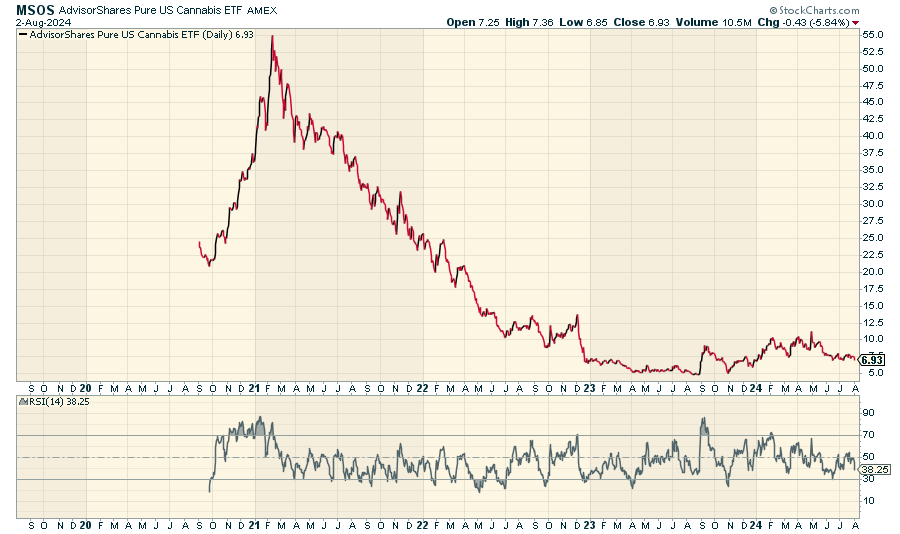

The fund has had a really laborious time because the 2021 peak, and, candidly, has been flat on its again not too long ago. Maybe, although, that’s precisely why you might wish to place right here.

stockcharts.com

A Look At The Holdings

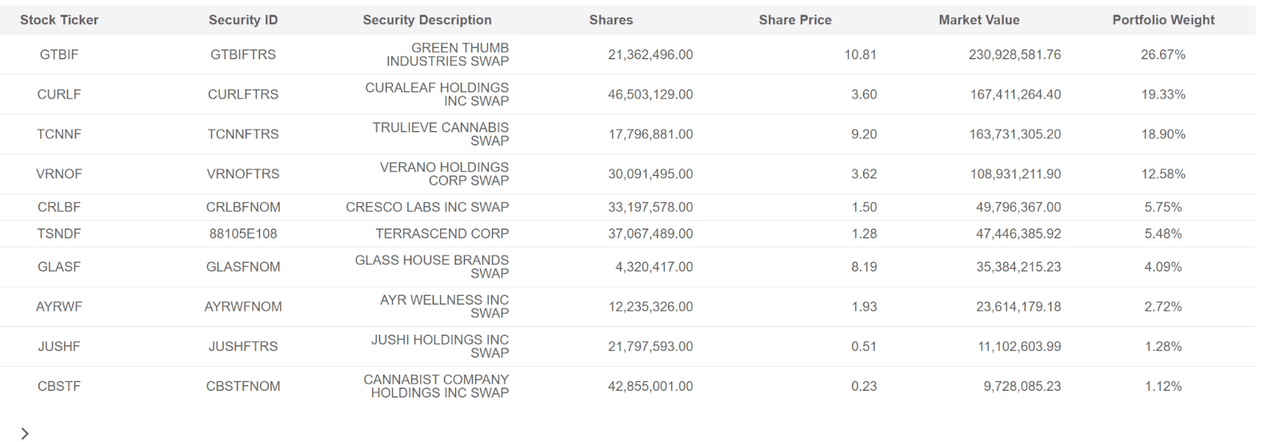

Essentially, MSOS is a basket of top-tier US hashish firms throughout manufacturing, distribution and retail segments. Or maybe extra precisely, a set of swaps round these firms.

advisorshares.com

A swap is a by-product contract between two events (often one in every of which is a monetary establishment) who change money for the return of the asset the swap is for. Due to a scarcity of federal legalization, MSOS will get entry to the return patterns of hashish firms via these swap agreements. Complicated? Certain. However primarily the one method the fund can get entry to extra firms within the absence of a federal framework that’s pleasant in direction of investing.

Now, with that mentioned, there’s a excessive diploma of focus right here, with the largest allocation making up practically 27% of the fund. Excessive focus. What do these firms the swaps cowl do? Inexperienced Thumb Industries is a number one nationwide hashish client packaged items firm and retail operator that manufactures and distributes a portfolio of branded hashish merchandise together with Beboe, Dogwalkers, Dr. Solomon’s, and the GTI Home of Manufacturers. Curaleaf Holdings Inc is a multi-state hashish operator with a vertically built-in community throughout america. Trulieve Hashish Corp is a vertically-integrated “seed-to-sale” multi-state operator with dominance in Florida and a fast enlargement throughout the US. Verano Holdings Corp. is a vertically built-in multi-state operator working cultivation, processing, and retail shops throughout a number of states. And Cresco Labs Inc is a vertically built-in multi-state hashish operator, cultivating the highest-quality branded hashish merchandise for a variety of buyer choices in servicing each client and business-to-business clients.

Peer Comparability

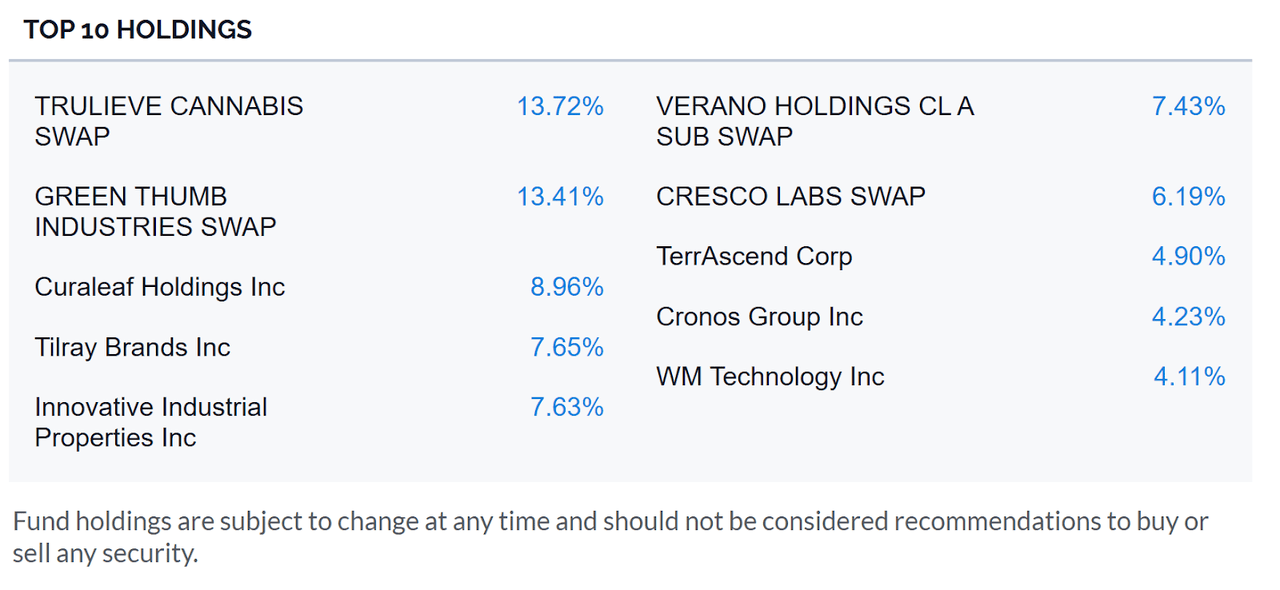

MSOS isn’t the one hashish ETF you should purchase. One fund value evaluating this towards is the Amplify Seymour Hashish ETF (CNBS). This ETF is actively managed, which focuses on the authorized hashish trade within the US and Canada. The fund equally makes use of swaps for a few of its positions, and likewise has a excessive focus within the prime 10.

advisorshars.com

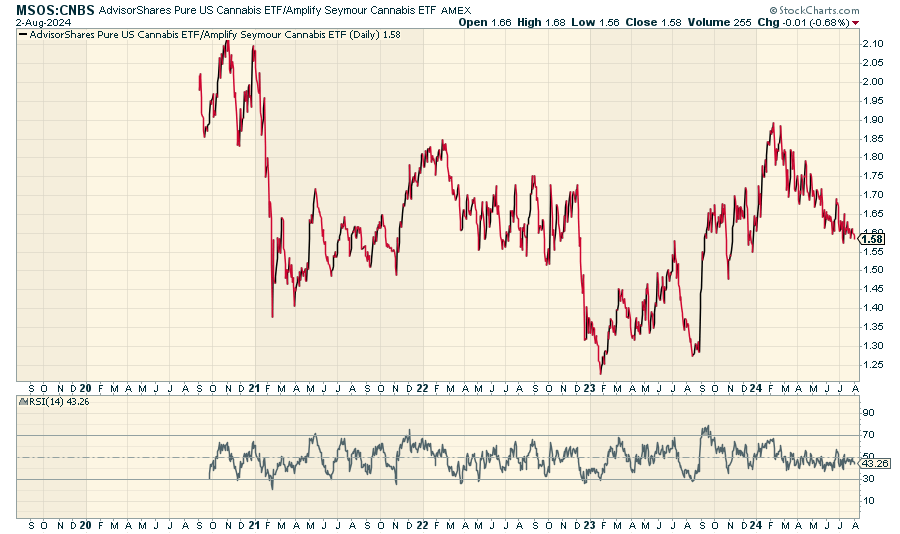

After we have a look at the value ratio of MSOS to CNBS, we discover that the relative efficiency has been erratic. Whereas MSOS is underperforming now, I don’t suppose there’s a transparent message when wanting on the chart from a long-term perspective.

stockcharts.com

Professionals and Cons

On the plus aspect? ETFs like this are the one sensible method for establishments to get publicity to the US hashish trade, which stays an illiquid, unregulated sector. By proudly owning the fund, institutional buyers have a simple approach to get absolutely invested within the hashish sector with out having to do thorough due-diligence on dozens of hashish shares. Furthermore, the fund’s energetic administration permits it to be nimble in reacting to the evolving regulatory and trade atmosphere, capitalizing on alternatives as they seem.

The dangers are massive, although. Hashish-related securities characterize an rising and risky sector. The trade could also be topic to authorized laws relating to medical marijuana and leisure hashish that will differ from state to state and from nation to nation. Any antagonistic ruling or change in legislation affecting cannabis-related securities would seemingly materially and adversely have an effect on the Fund and its shareholders. As well as, as cannabis-related actions stay unlawful below US federal legislation. The securities of issuers engaged in such actions could possibly be adversely affected by modifications in, or the failure to adjust to, federal legal guidelines or laws.

Moreover, the hashish trade remains to be in its very early days, and plenty of firms within the trade aren’t as worthwhile as they need to be, not as simply scalable as they need to be, or not as disruptive as they need to be. Certainly, given its early stage, the hashish trade and, consequently, the MSOS ETF, is doubtlessly extra more likely to be risky than different industries.

Conclusion

With the launch of the AdvisorShares Pure US Hashish ETF, US buyers have an progressive technique of accessing the fast-growing, hashish economic system. MSOS offers buyers with distinctive, diversified, liquid, and actively managed publicity to the dynamic US hashish area. And though the potential returns will be big, uncertainty stays problematic. Ought to we see the federal aspect catch up (lastly) to varied states which have legalized hashish, that might be the time to place right here. Both method – a lot of potential, and frustration, forward.