SHansche

The size cluster that MPC Container Ships (OTCPK:MPZZF) is concentrated in is one that benefits from superior S/D dynamics compared to other size segments. Utilisation is up even if charter rates are slightly down sequentially. Things look shockingly stable in this otherwise cyclical industry. The summer season is a little on the weak side, but it’s not alarming. Forward yield is around 29% and the stock is trading at miniscule multiples. However, the stock and dividend are sensitive to charter rate changes which are volatile. Also, the company does not appear to trade below liquidation value still, based on evolutions since our last article. Nonetheless, purely on the dividend, if we are in fact not in a down-cycle, or we do not enter a down-cycle as soon as the markets are pricing, there is massive upside on holding here and letting the dividend cover your investment. But we definitely don’t think this is a free lunch as the economic risks are real. Still, the current line of stability as well as the very low leverage giving the company staying power has us liking this aggressive play. A speculative buy.

Q2 Breakdown

There is a lot to like about MPC, which is an owner and operator of containerships in the small to mid-size categories.

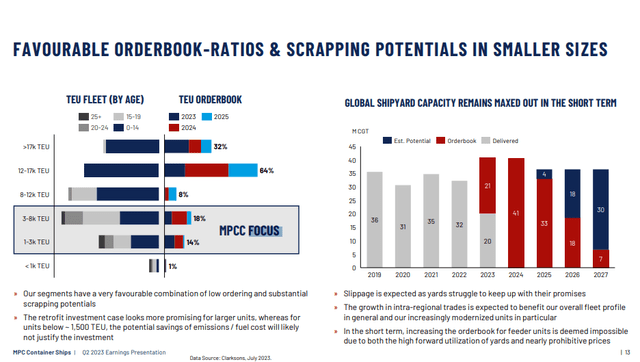

Favourable Supply (Q2 2023 Pres)

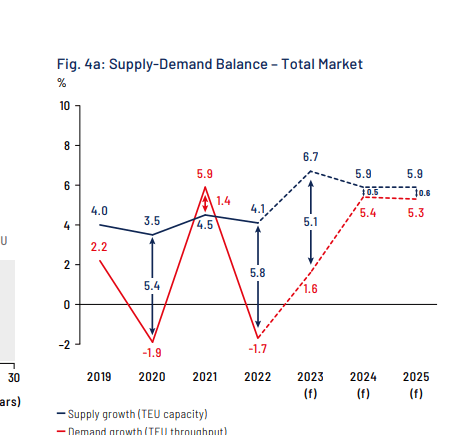

Demand is looking incrementally decent, although there is some pressure over the summer which is usually a stronger month, and gross profit is only up about 1-2% including some bonus revenues associated with a redelivery that is a one-off.

Important is the supply discussion. The exact area where MPC is focused in terms of ship size is also the segment where there are highest forecast demolitions and the smallest order book. Shipyards are also at max capacity, and supply chain considerations do keep building rates slow, including labour. Supply will decline. Also, utilisation rates are rising for these smaller ships benefit from nearshoring and regionalisation trends, which are in force as supply chains reorganise and trade flows shift. Despite some sequential pressure on revenues, utilisation increases are offsetting earnings per TEU.

Supply-Demand (Q2 2023 Report)

Bottom Line

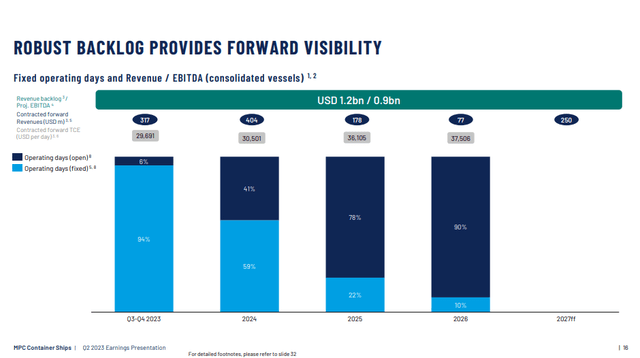

The performance has been good so far, slightly down excluding the revenues from the redelivery. However, the trepidation around the stock comes from the fact that as time passes, the backlog is becoming less robust and the fees and unit economics for the capacity they own are averaging down.

Backlog (MPC Q2 2023)

While the soft landing narrative and revisions in global GDP forecasts by the IMF are nice, there are still major risks to the economy from higher rates to corporate earnings, less so to household income. These start kicking in a big way in 2024.

However, in being priced down according to the risks, MPC is at a miniscule multiple at less than 2x P/E on annualised 2023 earnings. Moreover, with the next dividend establishing a forward rate of almost 30% about to hit the ex-date in a couple of days, the real capital return on MPC is very high. Most importantly, the leverage is very limited, and assets cover net debt by ~30x. This gives them staying power, and even if the dividend is variable, it could come back online reasonably soon after a pause as economic conditions rebound from a possible hit. At a 30% forward rate, even a year of crisis being staved off allows investors to see a strong cash yield on their initial investment, even if it is resumed after an interim pause. If economic hardships end up not materialising, which requires employment to stay at high levels despite large hits to corporate earnings from finance expenses, MPC will turn into an unbelievable asset with a 3-year payback period just from dividends, and an avoided downcycle resets the clock on economic hardships for a few years to be able to realise that return.

However, we think the likelihood of a recession involving higher unemployment remains likely despite fervent soft-landing hopes, and MPC is therefore risky and probably reasonably priced. Nonetheless, being cheap in the event that economic hardship doesn’t strike, this somewhat binary and volatile play probably works as a speculative buy, just not one we’d make.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.