Pgiam/iStock via Getty Images

The J.P. Morgan Guide to the Markets is exactly what it says on the tin: a comprehensive, in-depth guide to global investment markets. It includes a treasure trove of quantitative information regarding U.S. and international equities, bonds, and other investment securities, as well as broader macroeconomic conditions. The guide includes detailed information concerning equity valuations, including comparisons across industries, regions, segments, etc. I’ve been writing sporadic articles looking at particularly undervalued asset classes / industry segments. This is one such article.

U.S. value stocks look particularly cheap right now, much more so than in prior years. Performance has been mixed for quite a few years, but I remain optimistic, and bullish.

International stocks continue to trade at a sizable discount to U.S. equities. Performance has been mixed too, but I’m less optimistic, as I’ve found fewer outstanding international stock funds.

The cheapest industry is energy, due to a combination of bearish investor sentiment and unclear long-term growth prospects. Industry performance has been exceedingly strong post-pandemic, but very volatile.

Senior loans are the most undervalued / highest-yielding bond or loan sub-asset class. They look somewhat undervalued even after accounting for potential Fed rate cuts took, although much less. I’m very bullish, although significant outperformance seems unlikely.

As a final point, I wrote a similar article to this in early 2023, another one in late 2023. Results since have been somewhere between mixed and slightly positive, with most cheap asset classes performing about average, but a few outperforming, including some of my top picks.

Most Undervalued U.S. Equity Market Segments – Small and Cheap

Valuation Analysis

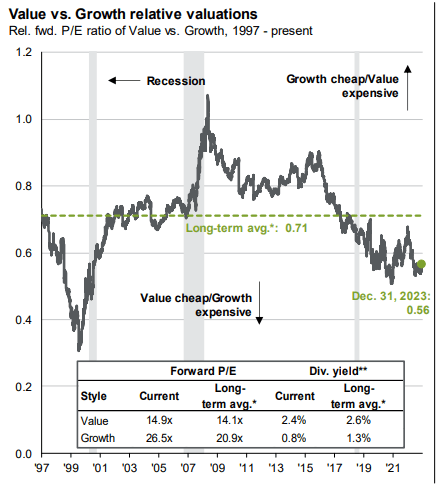

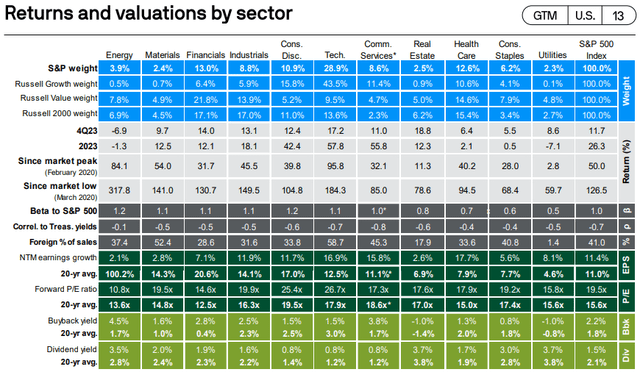

U.S. growth stocks always trade with comparatively high valuations, as investors are generally willing to pay premium prices for premium growth. Growth stocks are generally 47% more expensive than value stocks. Right now, growth stocks are 78% more expensive, quite a bit more than average.

JPMorgan Guide to the Markets

Right now, small-cap value is cheapest on an absolute and historical basis. Mid-cap and large-cap value is cheaper than broader equity indexes, but slightly more expensive than average on a historical basis.

JPMorgan Guide to the Markets

Performance Analysis

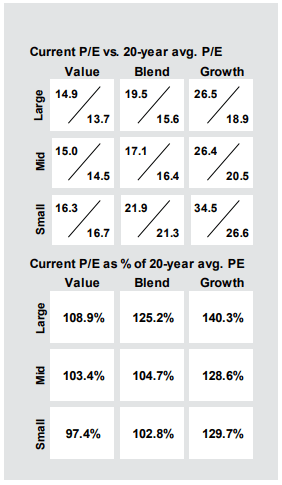

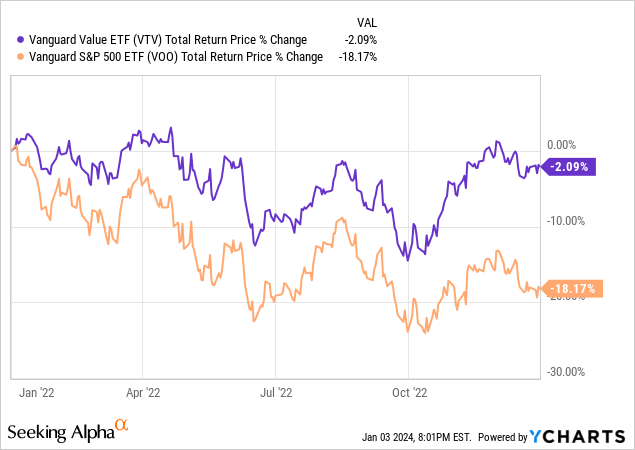

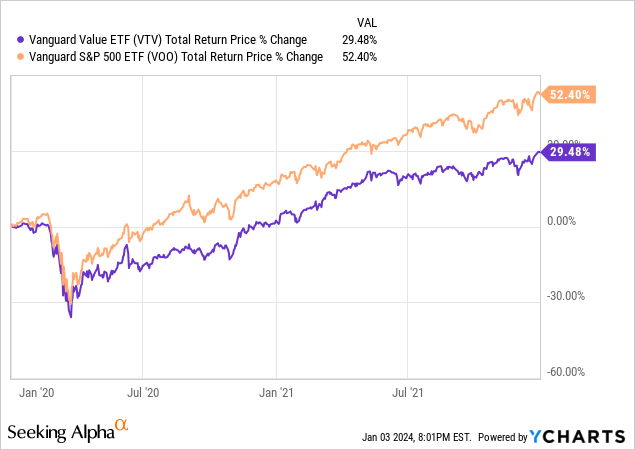

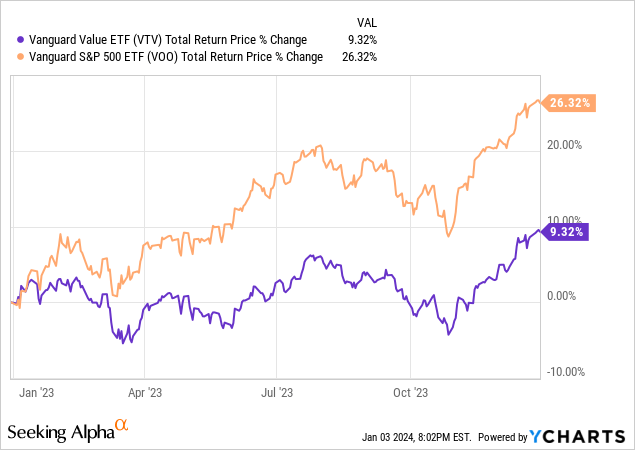

Growth has been expensive for quite a few years already. Results since then have been mixed, with value significantly outperforming in 2022:

Data by YCharts

but significantly underperforming during the pandemic:

Data by YCharts

and during 2023:

Data by YCharts

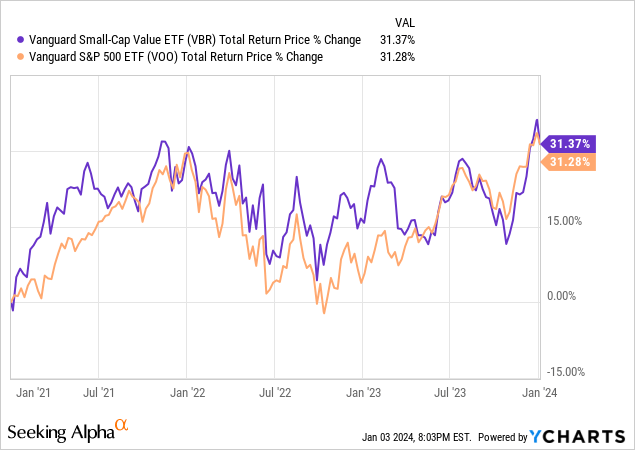

Small-cap value stocks had been performing reasonably well until the regional banking crisis of early 2022. Said crisis led to double-digit losses in the sector, wiping out about a year’s worth of gains, and several years of outperformance.

Data by YCharts

Overall, performance for value stocks has been fair these past few years.

Value Funds

Investors looking for strong funds offering diversified exposure to U.S. value stocks have a wide variety of options.

The Vanguard Value Index Fund ETF (VTV) offers exposure to U.S. large-cap value stocks. It is a simple, straightforward play on U.S. value stocks, and should outperform as valuations normalize. I last covered VTV here.

The Vanguard Small-Cap Value Index Fund ETF (VBR) offers exposure to U.S. small-cap value stocks. These are particularly cheap stocks, but riskier than average, and their recent returns have been much weaker. I last covered VBR here.

Looking at actively-managed funds, I think Avantis Investors ETFs are the best of the bunch. For large-caps we have the Avantis U.S. Large Cap Value ETF (AVLV), for small-caps the Avantis U.S. Small Cap Value ETF (AVUV). Both have outperformed their respective index benchmarks and the S&P 500 since inception. I last covered AVLV here, AVUV here.

As a final point, I’ve been bullish on value stocks for several years by now. In that time, value index ETFs have mostly matched the performance of the S&P 500 or relevant benchmark, most of the Avantis value ETFs have exceeded these.

Most Undervalued U.S. Equity Industries

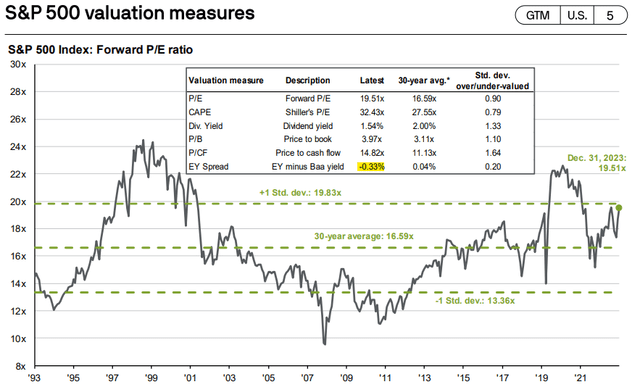

Right now, the S&P 500 is significantly overvalued on an earnings basis.

JPMorgan Guide to the Markets

Notwithstanding the above, two industries are undervalued on an earnings basis: energy and communications.

Energy

The energy industry is currently undervalued due to a combination of bearish investor sentiment and expectations of long-term decline. Investors expect demand for oil and other assorted energy products to decline long-term, as countries pivot towards renewable energies, EVs, and assorted technologies and products. Earnings should decline too, but are expected to grow 2.1% in the next twelve months. Expected growth is mediocre, but still positive.

On a more positive note, the energy industry has decided to return excess cash to shareholders through buybacks and dividends. Doing so boosts EPS growth, especially considering industry valuations. It also serves to somewhat reduce industry risk, insofar as buybacks and dividends are safer than exploration or capital investments. Industries in long-term decline can generate strong returns through delivering cash to shareholders, as could happen to the energy industry.

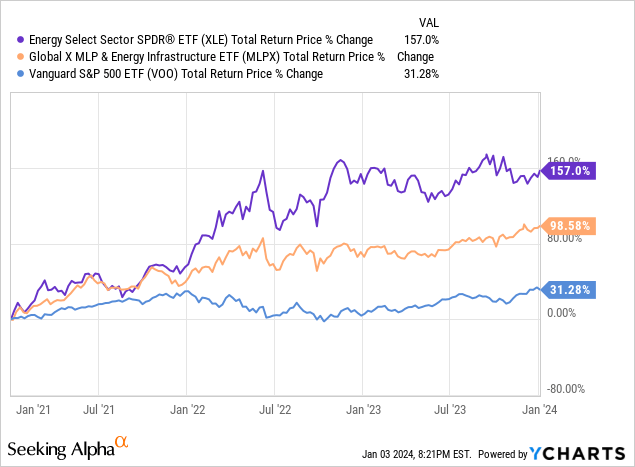

The Energy Select Sector SPDR Fund ETF (XLE) offers investors diversified exposure to U.S. energy companies. Investors looking for income might not find XLEs’ 3.5% yield to be compelling. Income investors might prefer the Global X MLP & Energy Infrastructure ETF (MLPX), which focuses on midstream energy companies, and sports a growing 5.2% yield. I last covered XLE here, MLPX here.

As a final point, energy has been overvalued for several years. Energy has significantly outperformed for several years too, but inconsistently so, and with a ton of volatility.

Data by YCharts

Communication Services

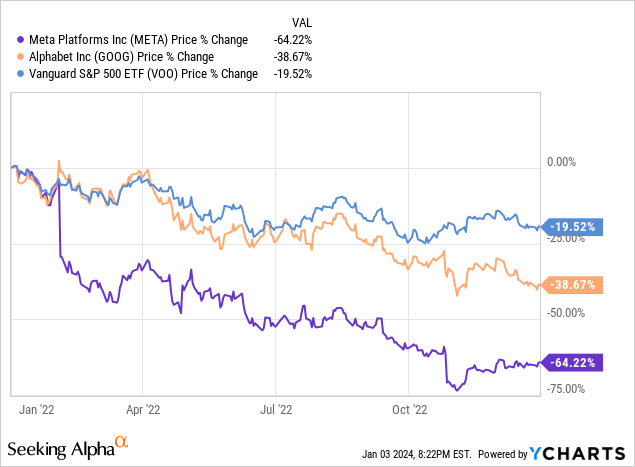

The communications services industry is currently slightly undervalued on an earnings basis. This is mostly due to prior losses in some of the larger companies in this space, including Facebook (META) and Google (GOOG). Graph below is for 2022.

Data by YCharts

The stocks above have seen very strong gains in the recent past, narrowing valuations in the sector. It remains slightly undervalued, however.

The Communication Services Select Sector SPDR Fund ETF (XLC) offers diversified exposure to U.S. communication services companies, and is a solid investment choice.

Most Undervalued Equity Region – International

Valuation Analysis

U.S. equities consistently trade at higher valuations than comparable international equities, as investors are willing to pay a premium for the strength, resilience, and stability of the country’s economy and corporate sector.

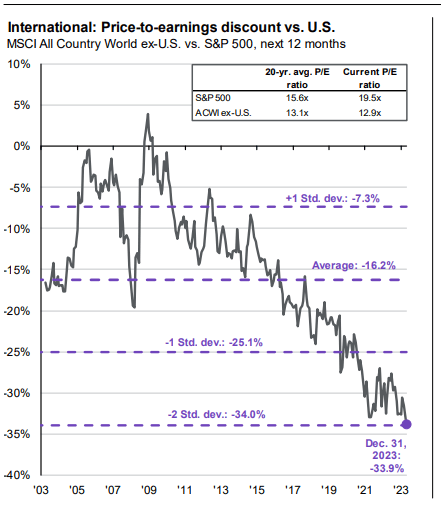

International stocks have traded with a 16.2% discount to U.S. equities for the past 20 years, on average. Right now, the gap has widened to 33.9%, more than twice the historical average.

JPMorgan Guide to the Markets

International stocks are very cheap, which should lead to significant capital gains and outperformance moving forward, contingent on earnings growth and investor sentiment.

Performance Analysis

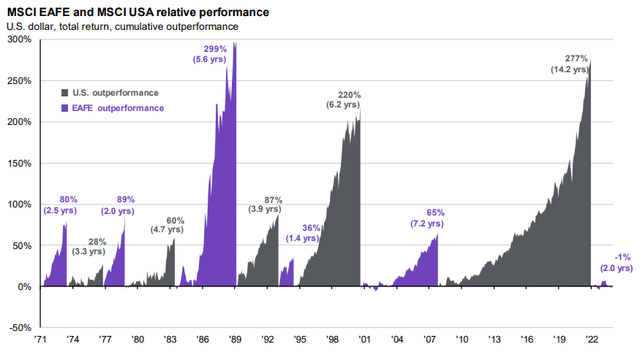

International stocks have been cheap for several years, during which their performance has generally been fair. J.P. Morgan says we are currently on a cycle of international outperformance, although it has been incredibly shallow, inconsistent, and somewhat short-lived.

JPMorgan Guide to the Markets

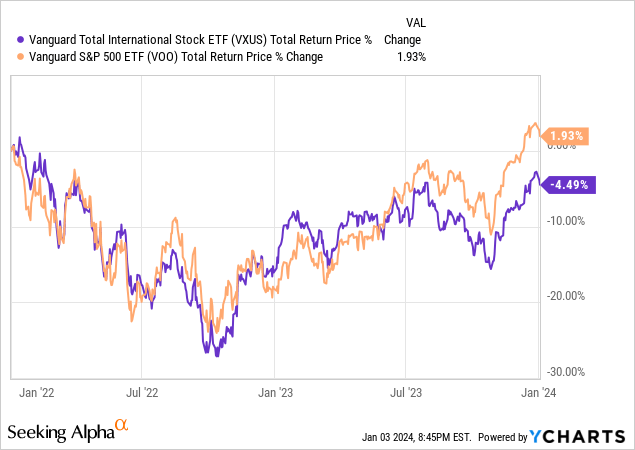

Looking through the data myself, it seems that international stocks have underperformed, although much depends on the specific time period in question.

Data by YCharts

In my opinion, international equity valuations should lead to outperformance moving forward, even though that has mostly not been the case in the past. Fundamentals do matter long-term, and markets rarely remain irrational for long. On the other hand, I have thought so for years, and have mostly been wrong.

International Funds

Investors looking for strong funds offering diversified exposure to international equities have a wide variety of options.

The Vanguard Total International Stock Index Fund ETF (VXUS) offers exposure to international stocks. It is a simple, straightforward play on international equities, and should outperform as valuations normalize. I last covered VXUS here.

The Avantis International Equity ETF (AVDV) is an actively-managed ETF focusing on cheaply valued international stocks. AVDV is a bit riskier than VXUS, but has performed much better.

Income investors might prefer the Vanguard International High Dividend Yield ETF (VYMI), an index fund investing in international equities with above-average dividends yielding 4.6%. I last covered VYMI here.

Most Undervalued Income Security – Senior Loans

Valuation Analysis

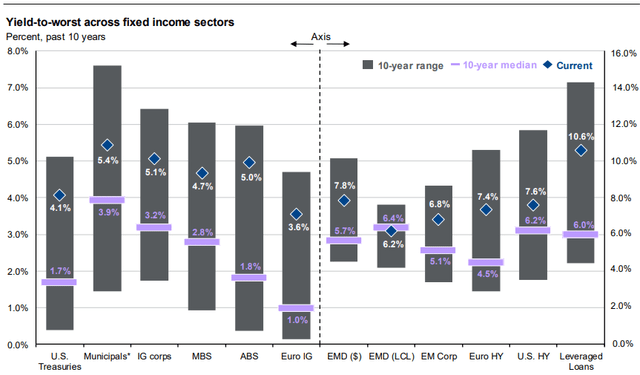

Right now, almost all fixed-income securities offer investors strong, above-average yields, as interest rates have risen. Senior loans / leveraged loans offer the highest yields, at 10.6%. Senior loan spreads relative to historical average are also the highest, at 4.6%.

JPMorgan Guide to the Markets

Leveraged loans are almost always variable rate loans, and so their coupon rates change when benchmark rates change too. Leveraged loan rates increased as the Federal Reserve hiked rates, and will almost certainly decrease if the Fed were to cut rates, which seems exceedingly likely.

Importantly, senior loan yields would remain quite strong under current Fed guidance. The Fed is guiding for three rate cuts this year, which would leave senior loans yielding 9.8%, still quite high on an absolute basis, and higher than fixed-rate, high-yield bonds. The Fed is guiding for another five cuts in 2025, which would leave senior loans yielding 8.6%, still higher than fixed-rate bonds. Terminal rate of 2.5% would leave senior loans yielding 7.8%, marginally higher than fixed-rate bonds.

Considering the above, it seems to me that senior loans continue to offer compelling yields. More dovish investors might disagree.

Performance Analysis

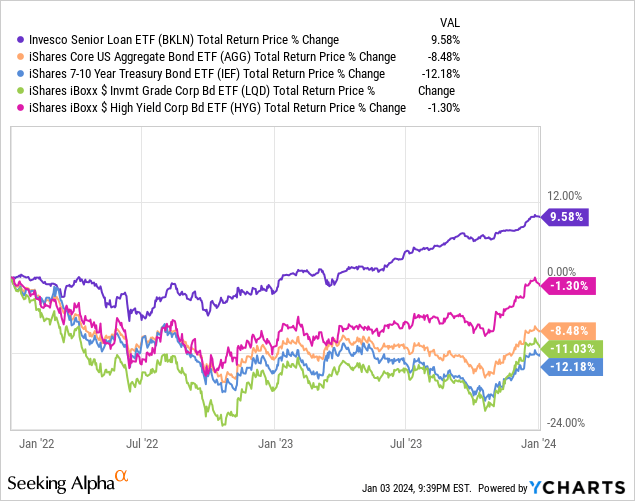

Senior loans have significantly outperformed since early 2022, due to Fed hikes. Senior loans started to look cheap sometime around mid-2022 and early 2023, during which they outperformed, but less.

Data by YCharts

Overall, senior loans have performed exceedingly well in the recent past. Economic conditions were very favorable to these investments in the past, and will very likely worsen moving forward, however.

Senior Loan Funds

Investors looking for leveraged loan index ETFs could consider an investment in Invesco Senior Loan ETF (BKLN). BKLN is the largest ETF in this space, and sports a 8.6% dividend yield. I last covered BKLN here.

There are lots of strong senior loan CEFs out there too, although many of these have seen their discounts narrow these past few months. The Apollo Senior Floating Rate Fund (AFT) is a fantastic CEF in this space, and sports a particularly high 11.9% discount. I last covered AFT here.

Quick Stock Versus Equity Comparison

As a final point, high-yield bonds have tended to offer incredibly compelling yields relative to stocks these past few months. They still do, with stock earnings yield a bit lower than Baa / BBB bond yields.

JPMorgan Guide to the Markets

In my opinion, although bonds look a bit more attractive than equities right now, the differences are small / valuation gaps are narrow. On the other hand, I’ve been keeping tabs on this data for a few years, and gaps were much wider in the past. A couple extra percentages on the 10Y treasury and bonds would look much stronger than equities, at least on a risk-adjusted basis.

Conclusion

Undervalued equity market segments and asset classes offer investors the potential for strong, market-beating returns. The asset classes and funds presented here are all undervalued and could outperform in the coming months and years. Hopefully this article was an interesting, useful, informative starting point for investors interested in undervalued asset classes and funds.