I spoke to Robert Levy a couple years ago. He’s the chairman of the Cato Institute (a libertarian think tank) and a prominent constitutional law expert.

I had then tracked Bob down to chat with him specifically about his controversial 1967 The Journal of Finance article.

“Relative Strength as a Criterion for Investment Selection” was the first academic paper to show a strategy that consistently beat the market. It described what we now call the momentum factor.

But the time it was first introduced, it was revolutionary and intensely debated.

You see, the efficient market hypothesis (EMH) was also new and increasingly popular at that time.

EMH stated that there was no way to consistently beat the market. But Levy had shared a simple formula to beat the market.

Letters to the editor blasted Levy even though no one could find flaws in his work. Some scholars insisted he’d made a programming error.

Others argued he’d merely found a false positive. They reasoned that because it was impossible to beat the market, his results were a false positive that wouldn’t hold up in the long run.

Levy remembered the controversy at the time. He spent the next 25 years in the investment industry providing data he collected from SEC filings. He sold that business to a large publisher and decided to go to law school when he was 50 years old.

When we talked, Bob was surprised to learn that his paper is now widely cited. He didn’t keep up with the industry. I explained that a 1993 paper rediscovered his results. And now many academics have built on his work.

Then he surprised me when he said he always assumed that the results were a false positive. He did that work as part of his Ph.D. program. He’d found a more lucrative niche in finance, gathering that SEC data and selling it at high prices to Wall Street firms.

He’d always wanted to be a lawyer and used the profits from selling his firm to fund his second career. In a way, Bob was like Rip Van Winkle — waking up in a factor zoo that he laid the foundation for.

Most Factors Won’t Help You Beat the Market

Levy’s relative strength criterion is momentum. He showed that stocks that are going up tend to beat the market. And stocks that are going down tend to underperform.

In 1993, the same year researchers confirmed Levy’s work, other researchers identified factors that beat the market.

A factor is a characteristic that explains a stock’s performance and can potentially help investors beat the market. Nobel Prize winner Eugene Fama and Kenneth French showed that stock market returns are explained by three factors: risk, size and value. Mark Carhart added momentum to the model in 1997.

Since then, researchers have found hundreds of factors. By 2017, one team identified 447 of them. They replicated the original studies and reported that 89.7% didn’t hold up at a statistically significant level.

Many investors find factors confusing. They don’t know which ones stand up to rigorous testing. They also don’t know how to apply them. Finding the right ones can be overwhelming for most.

The Money & Markets Green Zone Power Ratings system addresses all those problems…

Cutting Through Factor Chaos

Ratings in this system are drawn from six important broad factors (using both technicals and fundamentals). Each factor is broken down into smaller components to ensure the data is accurate.

Factors that haven’t been statistically validated are eliminated. So you don’t have to stress about trying to find the right ones or figuring out how to apply them.

A lot went into designing this ratings tool, but you’ll find that it’s quite easy to use.

Basically, the rating is a single number (0 to 100) that tells you whether the stock is bullish, neutral or bearish. There’s never a grey zone.

If you’re looking for stocks that have the potential to beat the market, stick to highly rated bullish stocks. If you want bear market candidates, consider stocks ranked low and in bearish territory.

And if you have limited capital and want only the best opportunities, avoid neutral rated stocks.

To view any stock’s score, click here to go to the Money & Markets homepage and start looking up stocks to see how they rate in today’s market. The Green Zone Power Ratings system cuts through all the factor noise to help you determine which assets are worth buying and which ones to sell.

The man behind the Green Zones Power Ratings system — my colleague Adam O’Dell — doesn’t just use this six-factor model to identify stocks that are slated to crush the market 3-to-1.

More importantly, his system has also just identified nearly 2,000 stocks at high risk of underperforming the market.

With 40% of so-called safe stocks now rated as high-risk, Adam’s sounding the alarm.

He’s sharing this Blacklist of stocks that could wreck your portfolio if left unchecked. Click here to learn how you can access it now.

Regards,Michael CarrEditor, Precision Profits

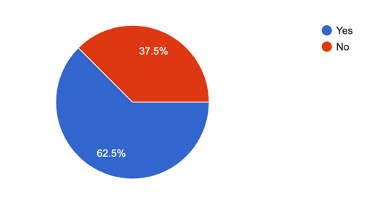

On Tuesday, I asked our readers if inflation was having a significant impact on their spending.

Virtually every major American retailer has commented on shifting spending patterns: On average, people are prioritizing their necessities. And there’s even a trend of higher-income shoppers trading down to more modest stores, like Walmart and Dollar General.

It seems that our Banyan Nation is in the same boat!

About 62.5% of our readers reported that inflation was, in fact, impacting their spending.

You can count me among them.

I’ve been trimming the fat in my budget as well. And interestingly enough, I don’t feel like I miss anything that I cut back on.

We’re not in a recession yet, or at least one hasn’t been officially declared. But with such a large swath of Americans adjusting their spending lower to counteract inflation, it would seem that it’s a matter of when rather than if.

That’s OK. We’re ready for it, and we’re already looking past the coming recession and into the boom that will follow it in artificial intelligence and automation technology.

Just as the pandemic forced us to get more productive, this rough inflationary patch will be the anvil that the labor-saving technology of the future will be hammered out on.

And in the meantime, like Mike Carr recommends, you can try more nimble, short-term trades — as he’s been working on in his Trade Room.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge