The average rate on the 30-year fixed mortgage jumped back over 7% on Thursday, rising to 7.1%, according to Mortgage News Daily.

Growing fears that inflation is not cooling off are pushing bond yields higher. Mortgage rates loosely follow the yield on the U.S. 10-year Treasury.

“Rates continue to move at the suggestion of economic data, and the data hasn’t been friendly. This is scary considering this week’s data is insignificant compared to several upcoming reports,” said Matthew Graham, chief operating officer at Mortgage News Daily.

Rates went over 7% last October. That was the highest level in more than 20 years. But they pulled back in the following months, as inflation appeared to be easing. By mid-January rates were touching 6%, spurring a big jump in buyers signing contracts on existing homes.

So-called pending home sales rose an unexpectedly strong 8% from December, according to the National Association of Realtors. But the past four weeks have been rough. Rates have moved 100 basis points higher since the start of February.

For a buyer purchasing a $400,000 home with 20% down on a 30-year fixed loan, the monthly payment, including principal and interest, is now roughly $230 a month more than it would have been a month ago. Compared with a year ago, when rates were in the 4% range, today’s monthly payment is about 50% higher.

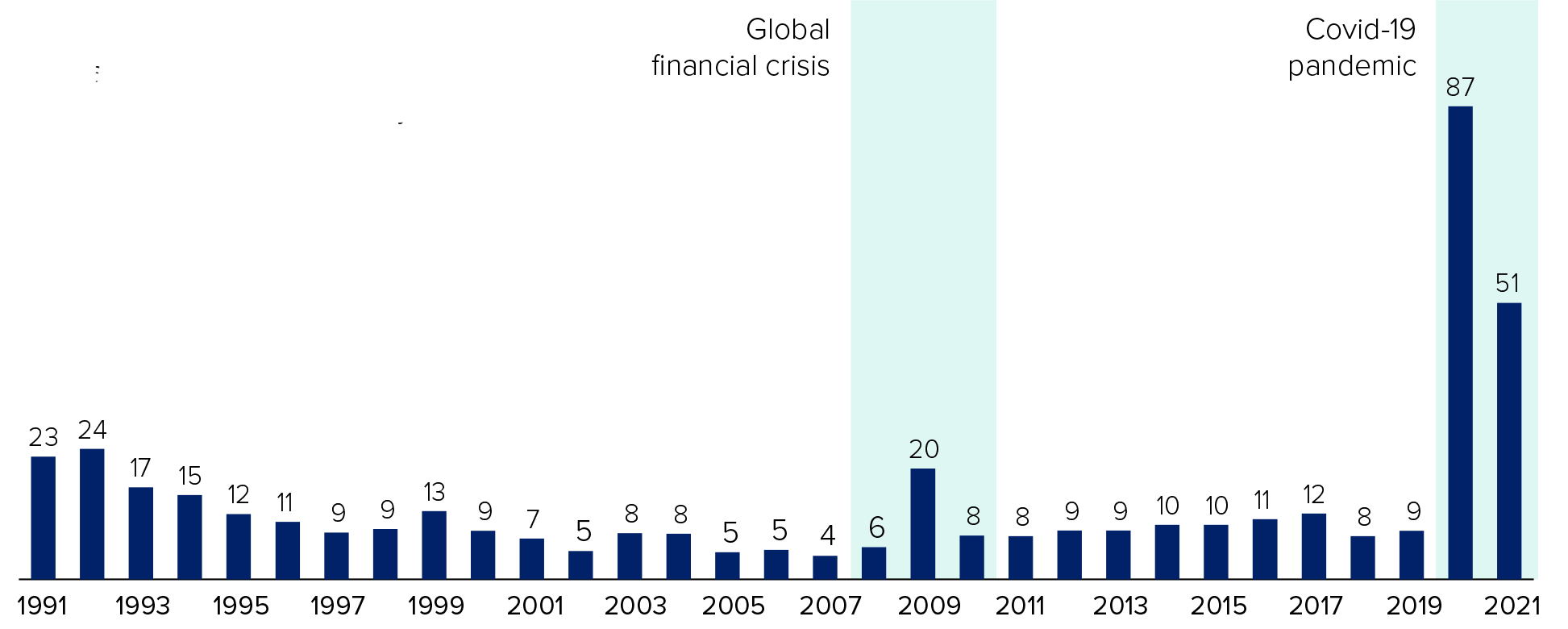

As a result, mortgage applications from homebuyers have been falling for the past month and last week hit a 28-year low, according to the Mortgage Bankers Association.

“The recent jump in mortgage rates has led to a retreat in purchase applications, with activity down for three straight weeks,” said Bob Broeksmit, president and CEO of the Mortgage Bankers Association. “After solid gains in purchase activity to begin 2023, higher rates, ongoing inflationary pressures, and economic volatility are giving some prospective homebuyers pause about entering the housing market.”

At the start of this year, with rates slightly lower, it appeared the housing market was starting to recover just in time for the traditionally busy spring season. But that recovery has now stalled, and rising rates are only part of the picture.

“Consumers have taken on a record amount of debt, including mortgage, personal, auto, and student loans,” noted George Ratiu, senior economist at Realtor.com. “With rising interest rates, financial burdens are expected to increase, making consumer choices more difficult in the months ahead.”

While the trajectory for rates now appears to be higher again, it is not necessarily guaranteed for the long term.

“If the bigger-ticket data has a friendlier inflation implication, we could see a bit of a correction. Unfortunately, traders will be hesitant to push rates aggressively lower until they have several successive months pointing to meaningfully lower inflation,” added Graham.