Economists forecast mortgage rates will continue to fall as Federal Reserve minutes suggest policymakers are preparing to wind down an aggressive campaign to fight inflation.

New markets require new approaches and tactics. Experts and industry leaders take the stage at Inman Connect New York in January to help navigate the market shift — and prepare for the next one. Meet the moment and join us. Register here.

Demand for mortgages picked up for the third week in a row last week as mortgage rates continued to retreat from 2022 highs, according to a weekly survey by the Mortgage Bankers Association.

The MBA’s Weekly Mortgage Applications Survey showed demand for purchase loans was up by a seasonally adjusted 3 percent last week compared to the week before but was down 41 percent from a year ago. Requests to refinance were up 2 percent week over week, but down 86 percent from a year ago.

Joel Kan

“The decrease in mortgage rates should improve the purchasing power of prospective homebuyers, who have been largely sidelined as mortgage rates have more than doubled in the past year,” MBA Deputy Chief Economist Joel Kan said, in a statement. “As a result of the drop in mortgage rates, both purchase and refinance applications picked up slightly last week.”

Mortgage rates retreat from 2022 highs

The Optimal Blue Mortgage Market Indices, which are updated daily, show rates for 30-year fixed-rate loans averaged 6.58 percent on Tuesday, down 58 basis points from a 2022 high of 7.16 percent on Oct. 24.

At 6.63 percent, rates for jumbo mortgages not eligible for purchase by Fannie Mae and Freddie Mac were also down from a Nov. 4 peak of 7.20 percent.

For the week ending Nov. 18, the MBA reported average rates for the following types of loans:

- For 30-year fixed-rate conforming mortgages (loan balances of $647,200 or less), rates averaged 6.67 percent, down from 6.90 percent the week before. Although points increased to 0.68 from 0.56 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans, the effective rate decreased to 6.87 percent.

- Rates for 30-year fixed-rate jumbo mortgages (loan balances greater than $647,200) averaged 6.30 percent, down from 6.51 percent the week before. Although points increased to 0.74 from 0.64 (including the origination fee) for 80 percent LTV loans, the effective rate decreased to 6.52 percent.

- For 30-year fixed-rate FHA mortgages, rates averaged 6.66 percent, down from 6.93 percent the week before. Although points increased to 1.01 from 0.99 (including the origination fee) for 80 percent LTV loans, the effective rate decreased to 6.96 percent.

- Rates for 15-year fixed-rate mortgages averaged 6.08 percent, down from 6.27 percent the week before. With points decreasing to 0.70 from 0.73 (including the origination fee) for 80 percent LTV loans, the effective rate decreased to 6.25 percent.

- For 5/1 adjustable-rate mortgages (ARMs), rates averaged 5.78 percent, up from 5.73 percent the week before. With points increasing to 0.73 from 0.65 (including the origination fee) for 80 percent LTV loans, the effective rate increased to 6.05 percent.

With the decline in rates for fixed-rate mortgages, requests for ARM loans accounted for 8.8 percent of all loan applications, down from a range of 10 to 12 percent during the past two months, Kan said.

Requests to refinance accounted for 28.4 percent of last week’s mortgage applications, up from 27.6 percent the week before.

Forecasters expect mortgage rates will continue to fall

Forecasters expect mortgage rates will continue to fall as the Federal Reserve winds down an aggressive campaign to fight inflation by raising short-term interest rates. The Fed has raised the short-term federal funds rate six times this year, bringing the target for the benchmark rate to between 3.75 and 4 percent.

At each of its last four meetings, the Fed implemented drastic, 75-basis point increases in the federal funds rate. With signs emerging that inflation is beginning to ease, Fed policymakers have signaled that they will slow, but not halt, the pace of rate hikes.

The CME FedWatch Tool, which monitors futures contracts to calculate the probability of Fed rate hikes, shows traders now see a 76 percent chance of a smaller, 50-basis point increase in the federal funds rate at the Fed’s final meeting of the year on Dec. 14.

Minutes of the Fed’s November meeting released Wednesday reveal that “a substantial majority” of Fed policymakers “judged that a slowing in the pace of increase would likely soon be appropriate.”

In a Nov. 21 forecast, economists at Fannie Mae said they expect Fed policymakers to slow the pace of rate hikes at upcoming meetings, but that the Fed won’t conclude its rate hike campaign until the federal funds rate is near 5 percent.

Mortgage rates expected to continue falling

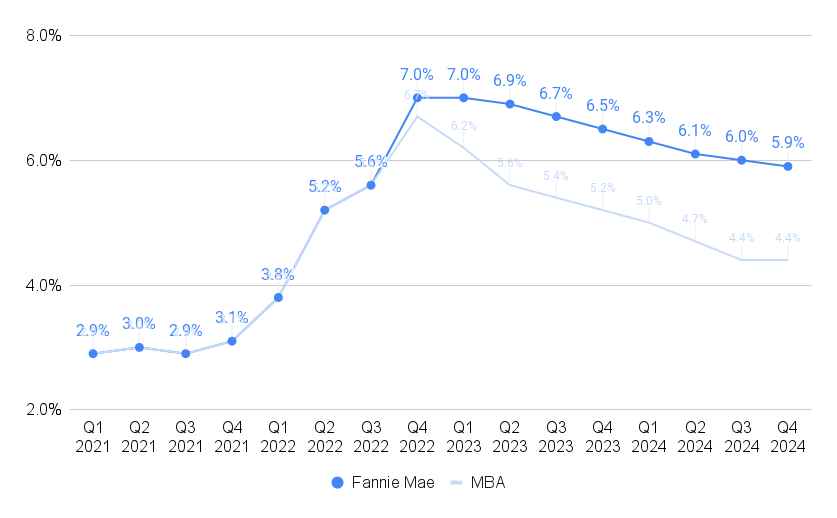

Source: Fannie Mae and MBA forecasts, November 2022

Fannie Mae forecasters are expecting a modest recession next year and a slow, steady decline in mortgage rates over the next two years, with rates for 30-year fixed-rate loans dropping below 6 percent in late 2024.

Economists at the Mortgage Bankers Association are forecasting a more severe pullback, with 30-year fixed-rate loans retreating below 6 percent next spring and averaging 4.4 percent in the second half of 2024.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter