Published on March 17th, 2023 by Aristofanis Papadatos

SmartCentres Real Estate Investment Trust (CWYUF) has three appealing investment characteristics:

#1: It is a REIT so it has a favorable tax structure and pays out the majority of its earnings as dividends.

Related: List of publicly traded REITs

#2: It is a high-yield stock based on its 7.3% dividend yield.

Related: List of 5%+ yielding stocks

#3: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

There are currently just 86 monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

SmartCentres Real Estate Investment Trust’s trifecta of favorable tax status as a REIT, a high dividend yield, and a monthly dividend make it appealing to individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about SmartCentres Real Estate Investment Trust.

Business Overview

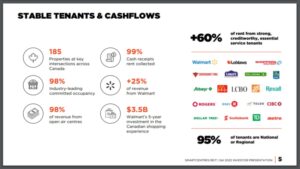

SmartCentres Real Estate Investment Trust is one of the largest fully integrated REITs in Canada, with a best-in-class portfolio that consists of 185 strategically located properties in every province across the country. SmartCentres REIT has $7.5 billion in assets and owns 34 million square feet of income producing value-oriented retail space with 98% occupancy, on 3500 acres of owned land across Canada.

Source: Investor Presentation

SmartCentres REIT faces a secular headwind, namely the shift of consumers from traditional shopping to online purchases. This trend has remarkably accelerated since the onset of the coronavirus crisis. Many retail REITs have been hurt by this secular shift.

However, SmartCentres REIT enjoys a key competitive advantage, namely the strong financial position of its tenants. The REIT generates more than 25% of its revenues from Walmart and more than 60% of its revenues from financially strong tenants, which offer essential services. This is a major competitive advantage, as it renders the cash flows of the REIT reliable and renders the REIT resilient to economic downturns.

Thanks to its strong business model, SmartCentres REIT has proved markedly resilient throughout the coronavirus crisis, in sharp contrast to many other REITs. The trust posted essentially flat adjusted funds from operations (FFO) per unit in 2020 and grew its bottom line by 4% in 2021 while it also kept raising its dividend, albeit at a slow pace.

Moreover, SmartCentres REIT currently enjoys positive business momentum. In the fourth quarter of 2022, the trust grew its net rental income by 2% and its FFO per unit by 7% over the prior year’s quarter. Increased rental income was more than offset by increased interest expense but the REIT grew its bottom line thanks to a decrease in its operating expenses.

Growth Prospects

SmartCentres REIT can boast of having a defensive business model thanks to the high credit profile of its tenants. On the other hand, the REIT has failed to grow its FFO per unit over the last decade, as its bottom line has remained essentially flat over this period.

It is important to note that the lackluster performance record has resulted primarily from the strengthening of the USD vs. CAD. As the Canadian dollar has depreciated by about 30% over the last decade, it is obvious that SmartCentres REIT has grown its FFO per unit by about 2.7% per year on average in its local currency over the last decade.

Moreover, SmartCentres REIT currently has 274 individual growth projects in place.

Source: Investor Presentation

More precisely, SmartCentres REIT has 179 initiatives that are related to recurring income and 95 initiatives that are related to intensification of existing properties. Therefore, the future looks brighter than the past decade for the REIT.

On the other hand, central banks are raising interest rates aggressively in order to cool the economy and thus restore inflation to its normal range. Higher interest rates are likely to significantly increase the interest expense of SmartCentres REIT. This is an important headwind to consider going forward.

Given the promising growth prospects of SmartCentres REIT but also its lackluster performance record, its currency risk and the headwind from rising interest rates, we expect the REIT to grow its FFO per unit by about 2.0% per year on average over the next five years.

Dividend & Valuation Analysis

SmartCentres REIT is currently offering an above-average dividend yield of 7.3%. It is thus an interesting candidate for income-oriented investors but the latter should be aware that the dividend may fluctuate significantly over time due to the gyrations of the exchange rates between the Canadian dollar and the USD.

Moreover, the REIT has an elevated payout ratio of 90%, which greatly reduces the margin of safety of the dividend. On the bright side, thanks to its defensive business model and its strong interest coverage ratio of 4.7, the trust is not likely to cut its dividend in the absence of a severe recession. Nevertheless, investors should not expect meaningful dividend growth going forward and should be aware that the dividend may be cut in the event of an unforeseen downturn, such as a deep recession.

We also note that SmartCentres REIT has a material debt load on its balance sheet. Its net debt is currently standing at $4.0 billion, which is 121% of the stock’s market capitalization. The high payout ratio and the material debt load of the REIT significantly reduce its resilience to a potential future recession.

In reference to the valuation, SmartCentres REIT is currently trading for 12.4 times its FFO per unit in the last 12 months. Given the material debt load of the REIT, we assume a fair price-to-FFO ratio of 12.0 for the stock. Therefore, the current FFO multiple is slightly higher than our assumed fair price-to-FFO ratio. If the stock trades at its fair valuation level in five years, it will incur a -0.7% annualized drag in its returns.

Taking into account the 2% annual FFO-per-unit growth, the 7.3% dividend, and a -0.7% annualized contraction of valuation level, SmartCentres REIT could offer a 7.8% average annual total return over the next five years. This is a decent expected return, though we recommend waiting for a better entry point in order to enhance the margin of safety as well as the expected return. Moreover, the stock is suitable only for investors who are comfortable with the risk that comes from the high payout ratio and the material debt load of the trust.

Final Thoughts

SmartCentres REIT can generate most of its revenues from companies with rock-solid balance sheets. It thus enjoys much more reliable revenues than most REITs. This is an important competitive advantage, especially during economic downturns.

Despite its high payout ratio of 90%, the stock offers an exceptionally high dividend yield of 7.3% and hence it is an attractive candidate for the portfolios of income-oriented investors.

On the other hand, investors should be aware of the risk that results from the somewhat weak balance sheet of the REIT. If high inflation persists for much longer than currently anticipated, high-interest rates will greatly burden the REIT. Therefore, only the investors who are confident that inflation will soon revert to normal levels should consider purchasing this stock.

Moreover, SmartCentres REIT is characterized by extremely low trading volume. This means that it is hard to establish or sell a large position in this stock.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].