Published on March 31st, 2023 by Nikolaos Sismanis

Investors seeking steady and reliable cash flows can benefit from companies that offer monthly dividend payments, as these companies provide a more frequent source of income compared to those that distribute dividends quarterly or annually. By choosing such companies, investors can ensure a consistent stream of income that meets their financial needs on a regular basis.

That said, there are just 86 companies that currently offer a monthly dividend payment, which can severely limit the investor’s options. You can see all 86 monthly dividend-paying names here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

One stock that we have yet to review is Sienna Senior Living (LWSCF), a Canada-based company focusing on senior living and long-term care (LTC) services. Shares are currently offering a substantial yield of 8.7%, which is nearly 5.5 times the average yield of the S&P 500 Index.

With such a notable yield and the fact that Sienna’s dividends are paid on a monthly basis, the stock appears rather appealing for income-oriented investors who seek a regular stream of substantial payments – especially given that Sienna has never cut its dividend.

This article will evaluate the company, its business model, and its dividend to see if Sienna Senior Living could be a good candidate for purchase. While Sienna reports in CAD, all figures in this article have been converted to USD unless stated otherwise.

Business Overview

Sienna Senior Living provides senior housing and long-term care (LTC) services in Canada. The company offers a range of seniors’ living options, including independent and assisted living, memory care, long-term care, and specialized programs and services, as well as management services.

As of its latest filings, Sienna owned and operated a total of 80 properties, including 38 retirement residences, 34 LTC communities, and eight senior living residences. The company also manages only an additional 13 senior living residences. Sienna generates around $530 million in annual revenues.

Source: Investor Presentation

Although Sienna Senior Living primarily deals in real estate, its performance is not as closely linked to the real estate market as one might assume. Unlike other types of real estate properties, such as retail, commercial, or industrial, Sienna’s tenants are mainly seniors who allocate a portion of their pensions for assisted living services. This results in a more stable and durable stream of income for the company, as seniors require long-term care and are less likely to move out of their homes quickly. There is a sense of community as well, which also contributes to this concept.

Furthermore, assisted living properties like those provided by Sienna Senior Living are more critical from a socio-economic standpoint. These properties provide essential care and support to seniors who may not be able to live independently due to their health or other factors. As a result, the government is more likely to provide support to these types of properties during times of crisis.

For example, during the pandemic, the Canadian government fully funded vacancies for Sienna’s Ontario and British Columbia residents, who make up the majority of the company’s rental revenue. This government assistance helped the company weather the pandemic and continue to provide essential care to its residents while retaining robust financials.

Growth Prospects

Sienna Senior Living has identified three key growth drivers: expanding its property portfolio, increasing rental rates, and optimizing occupancy rates. In line with this strategy, Sienna is currently developing a 147-suite retirement residence as part of a campus of care project in Brantford, Ontario. Additionally, a 150-suite retirement residence in Niagara Falls is scheduled to be completed by the end of 2023. As Canada’s senior population continues to grow, Sienna is well-positioned to meet the rising demand for assisted-living properties.

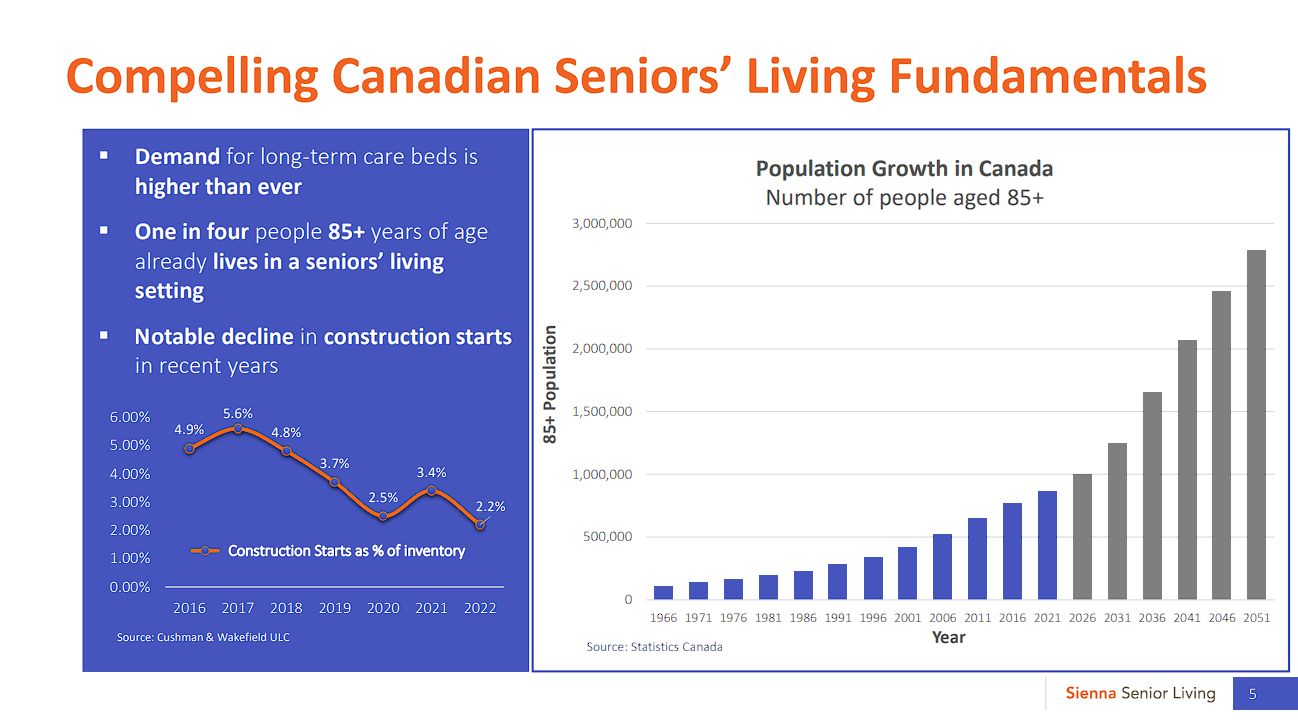

With over 861,000 people aged 85 and older recorded in the 2021 census and this age group growing at a rate of 12% since 2016, Sienna enjoys a long runway of highly predictable growth in demand. In fact, by 2050, it is expected that the 85-and-older population will surpass 2.7 million people, providing Sienna with an excellent opportunity to capitalize on this growing market.

Source: Investor Presentation

Sienna’s management has highlighted a significant opportunity in the current market. They have observed that the demand for long-term care beds has reached an all-time high, while the number of new assisted-living properties being constructed has significantly decreased in recent years. This market dynamic presents an exceptional opportunity for Sienna to capitalize on this gap in supply and demand and expand the business, and continue to optimize their occupancy rate, which currently stands at a notable 88.6%, nonetheless.

While Sienna has managed to grow its revenues consistently, executing this strategy, the same cannot be said for its profitability. Operating assisted-living properties, Sienna undertakes a number of expenses, including caretakers and other medical personnel whose costs tend to increase notably over time.

Further, as a real estate company, Sienna regularly issues shares to expand its assets, which, when combined with the depreciation of CAD against USD over the last decade, has led to a notable decline in the company’s AFFO per share. In fact, Sienna’s AFFO/share has decreased from $1.13 in 2013 to $0.70 in 2022. Looking ahead, we anticipate that Sienna’s AFFO/share will remain stable. Despite expected revenue growth, higher operating expenses and interest rates following the ongoing increase in interest rates are likely to offset the top-line drivers.

Dividend Analysis

Sienna Senior Living, since its initial public offering on the Toronto Stock Exchange in 2010, has been paying a monthly dividend that has gradually increased from C$0.071 to C$0.078. However, due to fluctuations in foreign exchange rates, USD-denominated shares traded over the counter (OTC) have paid declining dividends over time.

In fact, even though the dividend has only grown in CAD, the company’s annual dividend has decreased from $0.85 in 2013 to $0.69 last year. At the current CAD/USD exchange rate, Sienna’s C$0.94 annual dividend translates to approximately $0.68.

We expect that Sienna’s dividend will not grow further in the coming years, following the same rationale regarding why the company’s profitability is likely to lag moving forward. Still, we expect the current dividend to remain covered.

Final Thoughts

Sienna Senior Living has been prudently managed over time, resulting in robust results and a gradual increase in its monthly dividend (in CAD terms). Looking ahead, we anticipate the company’s profitability and dividends to remain relatively stable, as rising expenses and interest rates may counterbalance any growth from new properties and increasing demand for assisted living properties.

Nonetheless, we believe the stock is fairly priced. When paired with its noteworthy 8.7% dividend yield and the appealing frequency of its payouts, Sienna Senior Living possesses the necessary attributes to be a suitable choice for conservative, income-oriented investors.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].