Updated on March 7th, 2023 by Nathan Parsh

Shaw Communications (SJR) is a rare stock. It is based in Canada and is the only telecom stock with a monthly dividend. The stock is listed in both New York and Toronto, and we’ll be using the latter throughout this article, unless otherwise noted.

While the U.S. telecoms like Verizon (VZ) and AT&T Inc. (T) pay quarterly dividends, Shaw’s monthly payouts allow investors to compound their dividend growth more quickly.

Indeed, Shaw is one of just 69 stocks that pay monthly dividends. You can download a full list of all monthly dividend stocks, plus important financial metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

The other advantage for Shaw is it is outside the highly-competitive U.S. wireless market.

Shaw is growing subscribers and revenue, which fuels its 3.1% dividend yield. On March 15th, 2021, a significant announcement was made, that Shaw agreed to be fully acquired by Rogers Communications (RCI) in a deal valued at roughly $26 billion CAD. The offer to shareholders is $40.50 CAD per share in cash (~$31.63 USD), which was a significant premium to the price it was trading on the public market.

The transaction has been approved by the shareholders and the CRTC, however, there remains pending approvals from the Competition Bureau and ISED. It is possible the deal could be flagged as highly anti-competitive due to the small amount of telecommunications company operating in Canada. The deadline to extend the outside date has now been moved once again to March 31st, 2023.

Business Overview

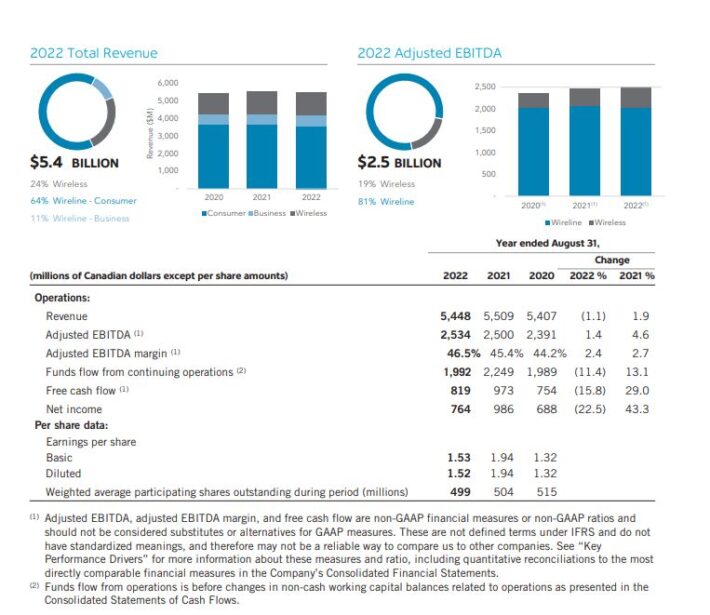

Shaw Communications was founded in 1966 as the Capital Cable Television Company. It has since grown to become Western Canada’s leading content and network provider, catering to both consumers and businesses. The company produces over $4 billion USD in revenue each year.

Shaw Communications is a large-cap stock with a market capitalization of more than $14 billion.

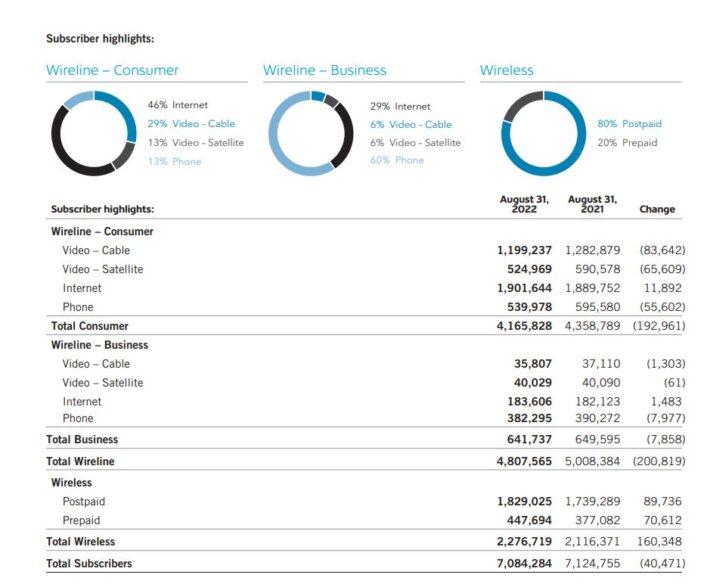

The stock is listed in both Canada and the U.S., and it is a diversified telecommunications company. The company recently consolidated its four prior reporting segments into just two major segments, Wireless and Wireline. The Wireless segment includes service and related equipment, while the core Wireline segment includes consumer and business services.

Shaw provides customers with a wide variety of services, including satellite video, fiber-coax network connectivity, and mobile phone services, among others. The company serves consumers and small to medium businesses in its service area, which mostly includes Canada. The bulk of the company’s revenue is from consumer services.

Shaw has struggled a bit in recent years to grow earnings as it has undergone a strategic transformation. Over the past several years, it has acquired Freedom Mobile, divested the Shaw Media and ViaWest businesses, and acquired wireless spectrum. These changes have left the company more focused on its long-term goals of sustainable growth.

Still, Shaw has a massive customer base of more than 7 million subscribers from which the company can grow its business.

Source: Investor Presentation

Growth Prospects

Shaw reported third quarter results on January 12th, 2023.

Source: Investor Presentation

Consolidated revenues for the first quarter of fiscal year 2023 decreased 1.2% to $1.37 billion CAD. Adjusted EBITDA decreased 2.5% to $617 million CAD. Net income decreased more than 14% to $168 million CAD. Diluted earnings per share of $0.34 CAD decreased 12.8% over last year.

Wireless led the way in the most recent quarter, with the category growing 3.1% to $345 million CAD. For the quarter, service revenue improved 5.4% to $252 million CAD while equipment sales of $93 million were flat compared to the prior year. Adjusted EBITDA improved 11% to $121 million CAD. Average revenue per user decreased 1% to $36.58. Wireless postpaid churn rate of 1.89% was a 19-basis point increase over the prior year.

Further revenue gains will come from a growing user base. It will also depend on if Shaw can gain new customers or push existing customers into the higher-tiered, more expensive plans. This, in turn, will lead to an increase in ARPU growth.

Dividend Analysis

Shaw is a Canadian monthly dividend stock, so the company’s current monthly dividend rate is approximately $0.09875 per share in Canadian dollars, and it has paid the same monthly dividend rate since March 2015. On an annualized basis, this comes out to roughly $1.185 per share. Investors should consider that since Shaw is based outside the U.S., the dividend is exposed to currency risk as the dividend is declared in Canadian dollars.

As currencies fluctuate, the dividend rate is subject to change once it is translated back into U.S. dollars. Based on prevailing exchange rates, Shaw’s dividend comes out to approximately $0.88 per share in U.S. dollars. Therefore, the currency-adjusted dividend yield is 3.1%. Shaw’s yield is lower than AT&T’s 5.9% yield and Verizon’s 6.9% yield. However, Shaw has the added advantage of monthly dividend payouts, which could be appealing for income investors desiring even more frequent payments.

Another important consideration for investing in foreign companies is withholding taxes. Dividends received in Canadian dollars are typically subject to a 25% withholding tax (15% for most U.S. investors). However, there is an exception for Canadian stocks – the withholding tax is waived for U.S. investors who hold the stock in a qualified retirement account, such as a 401(k) or IRA.

Shaw’s history of returning capital to shareholders is significant, even if it hasn’t raised the payout since 2016. The dividend was raised briskly up until 2016, but Shaw’s major business transformation caused it to pause on payout increases.

Overall, we view the dividend as sustainable, barring a major recession or business downturn. Shaw’s free cash flow guidance and earnings outlook have both improved significantly and we see the company growing its way out of the precariously financed dividend situation.

Certainly, investors would have liked dividend increases in the past few years, but Shaw simply couldn’t afford it. Now, we believe those days to be over and growth in the payout can resume at some point in the relatively near future.

Importantly, Shaw’s balance sheet is healthy. It has an investment grade credit rating from Standard & Poor’s and a net-debt-to-adjusted EBITDA ratio of 2.2x at the end of last quarter. Its leverage ratio is slightly below its target range of 2.5x to 3.0x.

Final Thoughts

When investors think of telecoms, they likely think of AT&T and Verizon. These are both very strong dividend stocks, but there may also be strong telecom stocks outside the U.S. that are worth considering.

Shaw has a strong business model, growth potential thanks to revenue increases and margin expansion, and its 3%+ yield is now safer than it has been in recent years. Plus, Shaw gives investors the added bonus of dividend payments each month.

One notable caveat is that Shaw has an agreement in place to be acquired by Rogers Communication. The deal has not received all of the necessary approvals, and there is still some chance that Shaw will remain an independent company. However, the acquisition premium is largely priced in today and shares are trading only 5% below the acquisition price.

Overall, Shaw is not a particularly attractive investment today due to the majority of the acquisition premium already being priced in. And, if the acquisition were to fail to garner the necessary approvals, it’s likely the share price will drop from here. However, Shaw has a fair yield of more than 3.0% that is also paid monthly.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].