Published on March 24th, 2023 by Jonathan Weber

Real estate investment trusts, or REITs, can offer highly attractive income yields, as they are required to pay out the majority of their profits via dividends to their shareholders.

This is why many retirees and other income investors like to invest in REITs, although not all REITs are equally well-liked. It can make sense to look for REITs outside of the US, as there are attractive and reliable dividend payers in other countries as well. This includes RioCan Real Estate Investment Trust (RIOCF), for example, which is a Canadian REIT.

RioCan REIT is a somewhat special REIT as it makes monthly dividend payments. While there are some other REITs that make monthly dividend payments as well, most REITs offer quarterly dividend payments to their owners.

There are currently just 86 monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

RioCan REIT offers a dividend yield of more than 5% at current prices, which is around thrice as high as the broad market’s dividend yield, as that stands at less than 2% right now.

The above-average dividend yield and the fact that RioCan offers monthly dividend payments make the REIT worthy of research for income investors. This article will discuss the investment prospects of RioCan REIT in detail.

Business Overview

RioCan is a real estate investment trust that was founded in 1993 by Ed Sonshine, making it one of the first REITs in Canada overall. RioCan is headquartered in Toronto, Canada and one of the largest REITs in the country. At the end of 2022, its enterprise value totaled around CAD$13 billion, while its market capitalization is US$4.3 billion today.

The REIT invests in commercial properties with a retail real estate focus, but the company has been diversifying its asset base in recent years, which is why RioCan describes its portfolio as retail-focused, increasingly mixed-use.

Some of the REIT’s headline numbers can be seen here:

Source: Investor Relations

RioCan operates with a focus in large urban markets, where demand for properties generally is higher and where average rents are higher as well. Thanks to urbanization, people are moving into these markets, which is why the longer-term outlook for these properties is positive. A little more than half of its properties (by square footage) are located in the Greater Toronto Area.

Overall, RioCan owns close to 200 properties, with well above 30 million square feet of net leasable area. On top of that, there’s a huge pipeline of high-quality assets that RioCan plans to develop over time, although this will take years.

While retail REITs can be vulnerable to recessions and other macro shocks when they have a focus on (lower-quality) malls where tenants aren’t resilient, RioCan’s focus is different. Many of its tenants are necessity-based, i.e. drug stores, grocers, and so on. These tend to remain resilient during recessions, which is why there is little risk that RioCan’s tenants will default or run into trouble in a big way.

Under its RioCan Living brand, RioCan also offers residential real estate. The focus here is, like in the commercial portfolio, on high-class assets in the largest and fastest-growing markets. While average lease yields in the residential space are lower relative to commercial assets, residential real estate is very resilient, thus the buildout of this business derisks RioCan’s business.

On top of that, rent growth in the residential space is higher than in many other real estate markets, thus the residential business could allow for an improved organic growth rate in the future.

Growth Prospects

RioCan has grown its funds from operations-per-share at a solid pace in the past and targets 5% to 7% annual FFO-per-share growth in the coming years.

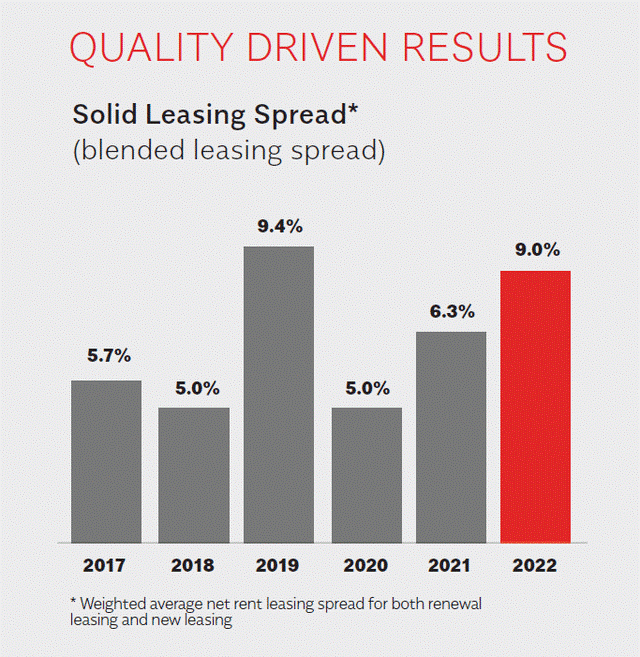

This funds from operations growth was made possible by several contributing factors. First, the company can increase its same-property rents over time:

Source: Investor Presentation

We see that leasing spreads have been in the 5% to 10% range, per year, in the recent past. While leasing spreads will likely not be as high as the level seen in 2022 going forward, it can be expected that RioCan’s high-quality assets and underlying market growth will allow for ongoing solid lease rate growth at existing properties. Growing rents at existing properties allow for positive same-property net operating income growth, which is an important driver for the company’s FFO.

Second, RioCan’s development pipeline and asset purchases should result in additional growth in the cash flows the company generates going forward. RioCan pays out around 60% of its funds from operations via dividends right now, which means that there is considerable additional cash that is retained. That can be used for financing the development of new projects, while using it for acquisitions is another possibility.

RioCan’s healthy balance sheet also allows the REIT to finance some of its future investments via debt. The company’s capital recycling activity of selling non-core assets also generates cash that can be used to pay for the development of new and attractive properties in RioCan’s pipeline.

Dividend Analysis

Like many other REITs, RioCan REIT is seen as an income investment primarily. And rightfully so, as the company offers an attractive dividend yield of 5.5%, based on a monthly dividend payout of CAD$0.09. At the current exchange rate of CAD$1.37 per USD, shares of RioCan REIT are trading at US$14.40 right now.

Based on the funds from operations-per-share of CAD$1.78 that RioCan forecasts for 2023, the payout ratio is 61%. This indicates that the dividend is relatively safe, as that is not a high payout ratio for a REIT, as many peers operate with payout ratios of 70% or even 80%.

RioCan REIT has grown its FFO-per-share by 7% in 2022 and targets 5% FFO-per-share growth this year. When FFO keeps growing on a per-share basis, even in a tough economic environment, there is little reason to worry about the dividend, as coverage improves over time, all else equal.

The strong balance sheet further indicates that there is little reason to worry about a dividend cut. RioCan’s debt to assets stand at only 45%, which is rather conservative for a REIT.

Final Thoughts

RioCan REIT is one of Canada’s largest and oldest REITs that operates with a retail-focused portfolio but that has been expanding in the mixed-use and residential space in recent years. The REIT offers an attractive dividend yield of 5.5%.

The focus on high-quality assets in large and growing markets means that RioCan’s portfolio is likely positioned well for the long run, as rents should continue to climb over time, as they have done in the past.

Based on the forecasted funds from operations-per-share of CAD$1.78 for this year, which is equal to US$1.30, RioCan REIT trades for 11x this year’s FFO today, which pencils out to a 9% FFO yield. That is not an ultra-cheap valuation, but seems rather inexpensive for a high-quality REIT like RioCan.

With its strong high-quality asset base, a well-covered dividend that yields more than 5%, and an undemanding valuation, monthly-paying RioCan REIT has merit as an income investment at current prices.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].