Up to date on October seventeenth, 2024 by Aristofanis Papadatos

Buyers who search secure and reliable money move might discover it advantageous to put money into corporations that supply month-to-month dividend funds. These corporations present a extra frequent and constant supply of earnings as opposed to people who distribute dividends quarterly or yearly.

Choosing such corporations permits traders to keep up a gradual stream of earnings that caters to their monetary necessities frequently.

We’ve recognized a complete of 76 corporations that presently supply a month-to-month dividend fee. Whereas the quantity could also be modest, it’s important sufficient to mean you can peruse and choose those that align along with your funding preferences.

You may see all 76 month-to-month dividend-paying names right here.

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

Richards Packaging Earnings Fund (RPKIF) is a Canadian belief that focuses on packaging containers and related parts.

The inventory is presently providing a dividend yield of 4.4%, which, whereas not great, remains to be greater than triple the 1.2% yield of the S&P 500 Index.

Provided that Richards Packaging’s distributions are paid on a month-to-month foundation and the belief has maintained or raised its distributions for the previous 14 years, the inventory seems reasonably interesting for distribution development traders who search a daily stream of reliable funds.

Enterprise Overview

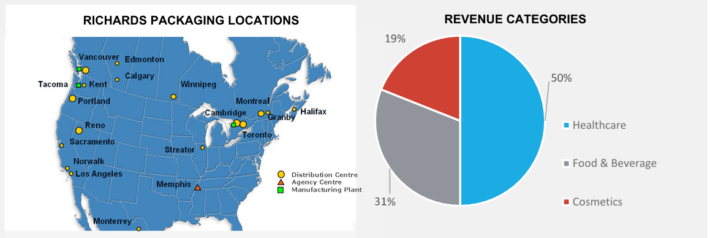

Richards Packaging Earnings Fund, established on February 26, 2004, as a limited-purpose, open-ended belief, is dedicated to investing in distribution enterprises throughout North America.

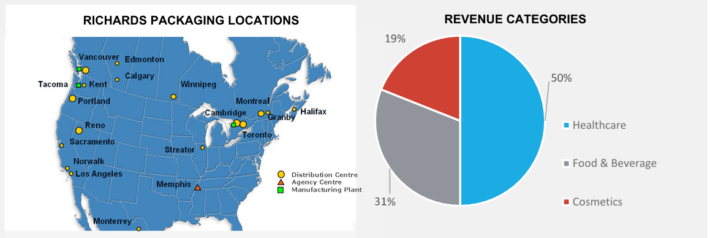

By its subsidiaries, every of which focuses on a special space, the belief caters to an enormous clientele of over 17,000 regional companies, together with these within the meals, beverage, cosmetics, and healthcare industries.

Its major income stream comes from the distribution of over 8,000 various kinds of packaging containers and healthcare provides and merchandise sourced from a community of greater than 900 suppliers, in addition to their three specialised manufacturing amenities.

Supply: Annual Report

Amidst the COVID-19 pandemic, the belief skilled a big increase, because the surge in e-commerce orders on account of lockdowns and different restrictions resulted in a spike in demand for containers and healthcare provides. Thus, revenues in fiscal 2020 soared by 46% to C$489.2 million, in comparison with C$334.2 million in fiscal 2019.

Since then, the belief’s subsidiaries have managed to bolster their market place, retaining an elevated income base. However, there are indications of a reversal within the influence of the pandemic, as evidenced within the belief’s outcomes.

In fiscal 2023, the belief’s income was down 4.7% due primarily to a 21.4% drop in meals and beverage reflecting a shifting demand and overstocked market, and 4.7% decrease gross sales of pumps and sprayers on account of an oversupplied market. These results have been partly offset by 6.6% development in healthcare.

Working earnings decreased 3%, from US$42.5 to US$42.1 million, and earnings per share dipped 3%, from $2.43 to $2.35.

A 3% lower within the backside line will not be dramatic however traders ought to observe that the earnings per share of Richards Packaging in 2023 have been 33% decrease than the 10-year excessive earnings per share of $3.51, which the corporate posted in 2020. The efficiency of the belief within the first half of this 12 months has stabilized and therefore we count on primarily flat earnings per share this 12 months.

Progress Prospects

Richards Packaging Earnings Fund’s development is being powered by the belief’s underlying companies, in addition to accretive acquisitions or tendencies of its belongings.

In 2020, as an illustration, the belief acquired Clarion Medical Applied sciences, a number one Canadian supplier of medical, aesthetic, imaginative and prescient care, and surgical tools and consumables. In late 2022, Richards Canada bought the Rexplas manufacturing facility to a strategic provider who will proceed to provide bottles for the trusts’ wants.

Over time, the belief has managed to develop steadily following this technique. Extra exactly, over the past 9 years, the belief’s revenues have grown at a compound annual development price (CAGR) of 6.4%.

Dividend per unit (DPU) has grown at a slower tempo, partly on account of a depreciation of the change price between CAD and USD. DPU has grown at a CAGR of three.2% over the past 9 years.

Administration outlined its focus for 2024, stating that the first purpose is to maintain the expansion of core revenues throughout the vary of two% to five%, offered that the economic system doesn’t face a recession.

Administration additionally affirmed that acquisitions would proceed to play a big function within the belief’s strategic path. Nevertheless, natural development is predicted to decelerate in comparison with previous ranges as a result of probability of decreased demand for the belief’s packaged merchandise throughout an financial downturn.

Dividend Evaluation

Richards Packaging Earnings Fund has paid month-to-month distributions since its inception. Payouts have been briefly suspended throughout the Nice Monetary Disaster and have been then resumed at a decrease price.

On the intense aspect, since then, the belief has both stored the month-to-month distribution secure or has grown it.

With the belief paying a continuing distribution for six consecutive years, DCFU’s development has outperformed that of DPU over the previous decade. Particularly, the belief’s DPU has grown at a 10-year CAGR of three% in comparison with DCFU’s equal price of 9%.

Because of this, the belief’s payout ratio has improved notably throughout this era. It was 62% in 2012 and 40% in 2023. Due to this fact, we imagine the belief is to show extra favorable towards resuming distribution development transferring ahead. That is additionally signaled by the truth that the belief has began paying particular distributions to pay out its earnings surplus.

In March 2022, March 2023 and March 2024, particular distributions of US$0.539, US$0.275 and US$0.266 have been paid, respectively.

At its present annualized price of C$1.32 ($0.98), the belief yields roughly 4.4%. It used to yield as much as 11% in earlier years, however the yield has slowly declined following the inventory’s gradual positive aspects towards a reasonably stagnated distribution.

Closing Ideas

Richards Packaging Earnings Fund has displayed first rate development over time, with accretive acquisitions, good tendencies, and the natural growth of its underlying companies, contributing to passable DCFU development.

The belief’s present yield will not be adequate to fulfill the wants of some traders searching for substantial earnings. That stated, its prospects for important distribution hikes and particular distributions are promising, given the constant enchancment within the payout ratio of the inventory.

Assuming secure DCFU in fiscal 2024 following administration’s conservative outlook, the inventory is presently buying and selling at a P/DCFU of about 9.3. The a number of displays traders’ expectations for below-average development within the close to time period, however it may possibly additionally sign a shopping for alternative, if development picks up steam within the medium time period.

In any case, we imagine that the belief’s base month-to-month distribution may be very protected, and the inventory is prone to cater to traders who search common distributions with the potential for development.

In any case, we imagine that the belief’s base month-to-month distribution may be very protected, and the inventory is prone to cater to traders who search common distributions with the potential for development.

Don’t miss the assets under for extra month-to-month dividend inventory investing analysis.

And see the assets under for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].