Updated on March 3, 2023 by Jonathan Weber

Investors that are interested in owning stocks for income can find it easy to be drawn to Real Estate Investment Trusts, or REITs. These stocks offer investors the chance to own a piece of a trust that leases out properties and passes essentially all of its earnings back to shareholders in the form of dividends.

Realty Income (O) has a 4.8% dividend yield and an extraordinary dividend history. And, Realty Income pays its shareholders monthly instead of quarterly, which affords investors faster compounding of wealth.

There are only 50 companies that pay monthly dividends. You can download our full Excel spreadsheet of all monthly dividend stocks along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

This article will discuss Realty’s business model, its growth prospects, and its dividend in detail.

Business Overview

Realty Income is a retail-focused Real Estate Investment Trust that has earned a sterling reputation for its dividend growth history. Part of its appeal certainly is not only in its actual payout history, but the fact that these payouts are made monthly instead of quarterly.

Indeed, Realty Income has declared more than 630 consecutive monthly dividends, a track record that is unprecedented among monthly dividend stocks.

The trust owns more than 11,000 properties and has a market capitalization in excess of $42 billion. Realty Income focuses on standalone properties, rather than ones connected to a mall, for instance. That increases the flexibility of the tenant base and helps the trust diversify its customer base.

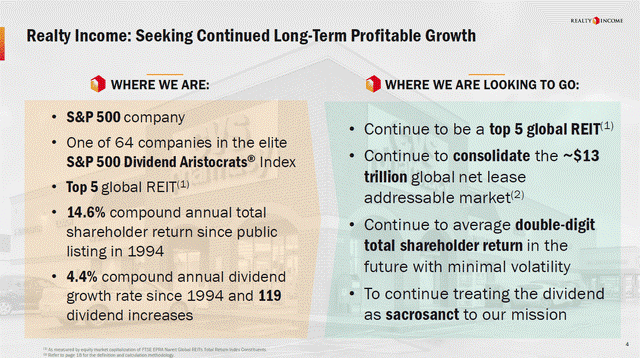

The company has increased its dividend more than 110 times since its initial public offering in 1994. Realty Income is a member of the Dividend Aristocrats.

The company’s long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Source: Investor Presentation

In the most recent quarter, Realty Income beat analyst estimates on both revenue and FFO-per-share. Revenue increased 30% from the same quarter last year, due to acquisitions and rent increases. Normalized FFO-per-share increased 15% year over year, to $1.05.

Growth Prospects

Realty Income’s growth has been quite consistent; the trust has a very long history of growing its asset base and its average rent, which have collectively driven its FFO-per-share growth. We don’t believe this has changed, thus we see its growth capacity in the mid-single-digits annually, as it has been for many years.

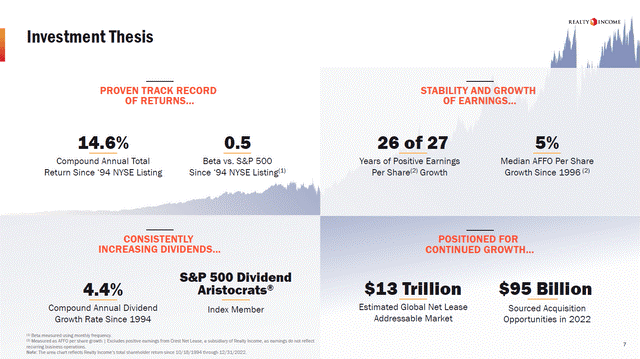

Realty Income will achieve these results by simply continuing to do what it has always done. In the following slide, we see that Realty Income has generated positive per-share growth in 26 out of the last 27 years, which is outstanding:

Source: Investor Presentation

Realty Income has reduced its exposure to lower-quality tenants over the years. Today, more than 50% of its revenue comes from investment-grade tenants, and the trust has reduced its reliance on restaurants, favoring convenience stores and grocery stores instead.

The trust’s list of tenants is a high-quality, diversified group where companies such as Walgreens Boots Alliance (WBA), one of the largest drug store companies in the world, belonging to its top tenants.

Realty Income also is geographically diversified, especially since the company has been expanding its presence in Europe in the recent past. This diversification, like the industry composition, helps Realty Income reduce its risk from sector downturns, and allows it to capture growth over the long term.

All of this has resulted in Realty Income’s results over time being outstanding. Realty Income has never had a year-end occupancy level below 96.6%, which is a great track record of consistency as its history contains the dot-com bubble, the financial crisis, and the recessions that followed those events, as well as the pandemic. Occupancy was 99% at the end of 2022, which is the highest reading over the last 20 years, showcasing that the environment is pretty strong for Realty Income today.

Same-store rent growth has nearly always been positive as well, meaning Realty Income is capturing more revenue on its existing portfolio over time. Its long-term leases also afford it relatively low annual volatility in its rent terms. This helps with capturing higher base rents, which drives organic top-line growth.

Putting all of this together, we see Realty Income producing 4% annual FFO-per-share growth over time, consistent with its recent history.

Dividend Analysis

Realty Income’s dividend history is second to none in the world of REITs. Its dividend has been increased over 110 times since the company came public in 1994, and the payout has increased by 4.4% per year on average.

The dividend is also safe considering not only this extraordinary history of boosting the payout throughout all types of economic conditions but also because the trust pays out a very reasonable 74% of adjusted FFO.

REITs are required to pay out most of their income in the form of dividends, so Realty Income’s dividend payout ratio will never be low. We see ~80% of FFO as strong for a REIT, particularly for one that is growing FFO-per-share very consistently.

That means that even if FFO-per-share were to go flat for some period of time, the dividend is still sustainable. We expect the payout to continue to rise in the mid-single digits annually, as it has for so many years.

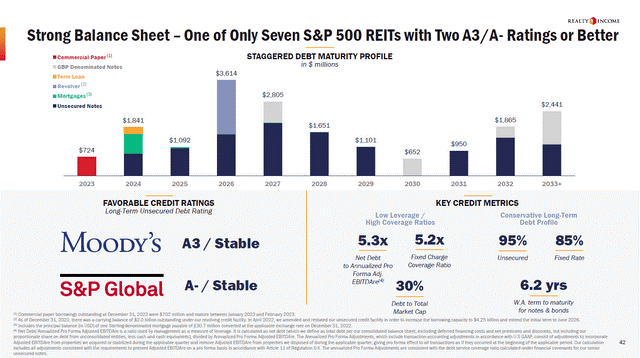

Realty Income is able to maintain this record not only because its business is fundamentally superior, but also because its capital structure is conservative.

Source: Investor Presentation

The trust has strong, investment-grade ratings on its credit. This means that the trust does not have to spend heavily on interest expenses, which is a competitive advantage versus more indebted peers.

It also has a net-debt-to-EBITDAre ratio of 5.3x, and a weighted average term to maturity of more than 6 years. In other words, liquidity and leverage aren’t concerns for Realty Income, adding to the allure of the stock for income investors.

Final Thoughts

REITs are favorites among dividend investors because they pay out the vast majority of their earnings to shareholders via dividends, which generally leads to high yields.

Realty Income’s 4.8% current yield is not the highest in the REIT universe, but still pretty attractive, especially when we consider the extremely consistent dividend growth.

For income investors looking for a yield that is more than twice as high as the yield of the broader market and for dividend safety that is not a concern at all, Realty Income fits the bill. Realty Income is not growing overly fast, but growth has been very consistent. The combination of a solid dividend yield and expected future dividend increases is attractive.

The valuation is very reasonable at ~15.6 times this year’s expected FFO-per-share, as we believe that the multiple could expand to the high-teens area over time. Total returns could thus see a tailwind from multiple expansion over the coming years, which adds to the attractive dividend yield and the unspectacular, but solid expected FFO-per-share growth.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].