Updated on February 26th, 2023 by Samuel Smith

Income investors often find high-yielding stocks to be attractive, due to the income that these investments can produce. But sometimes the need for income can blind investors to the issues with the company itself. If this is the case, then investors can be blindsided when the company cuts its dividend.

The same can be said for monthly dividend paying companies. Investors might overlook weak fundamentals with a company in order to obtain monthly dividend payments. Monthly dividend stocks can be appealing as they create more regular cash flow for investors.

There are 50 monthly dividend stocks that we cover. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

But investors shouldn’t buy a high yield monthly dividend paying stock simply because of its monthly payments. This is particularly true when it comes to oil and gas royalty trusts.

Permian Basin Royalty Trust (PBT) fits the description of a dividend stock with a questionable outlook. Distributions vary on a month-to-month basis based on profitability. Shares currently yield 4.8% based on its dividends over the past twelve months.

This article will look at Permian Basin’s business, growth prospects and dividend to show why investors should avoid this stock.

Business Overview

Permian Basin holds overriding royalty interest in several oil and gas properties in the United States. The trust is a small-cap stock which trades with a market capitalization of $559 million. The trust has oil and gas producing properties in Texas.

The trust was established in 1980 and has a 75% net profit royalty interest in the Waddell Ranch properties. These properties consist of over 300 net productive oil wells, over 100 net producing gas wells and 120 net injection wells.

Permian Basin also holds a 95% net profit royalty interest in the Texas Royalty Properties, which consist of approximately 125 separate royalty interests across 33 counties in Texas covering 51,000 net producing acres.

The assets of the trust are static, i.e., the trust cannot add new properties in its asset portfolio. PBT had royalty income of $12.0 million in 2020 and $11.8 million in 2021.

Growth Prospects

As an oil and gas trust, it goes without saying that Permian Basin will perform in direct relation to oil and natural gas prices. Investments like Permian Basin are designed as income vehicles. Higher energy prices will likely lead to higher royalty payments, driving up demand for units. In the same way, lower energy prices will lead to lower dividend payments.

Distributions are based on the prices of natural gas and crude oil. Permian Basin is impacted in two ways when the price of either declines. First, distributable income from royalties is reduced, lowering dividend payments. In addition, plans for exploration and development may be delayed or canceled, which could lead to future dividend cuts.

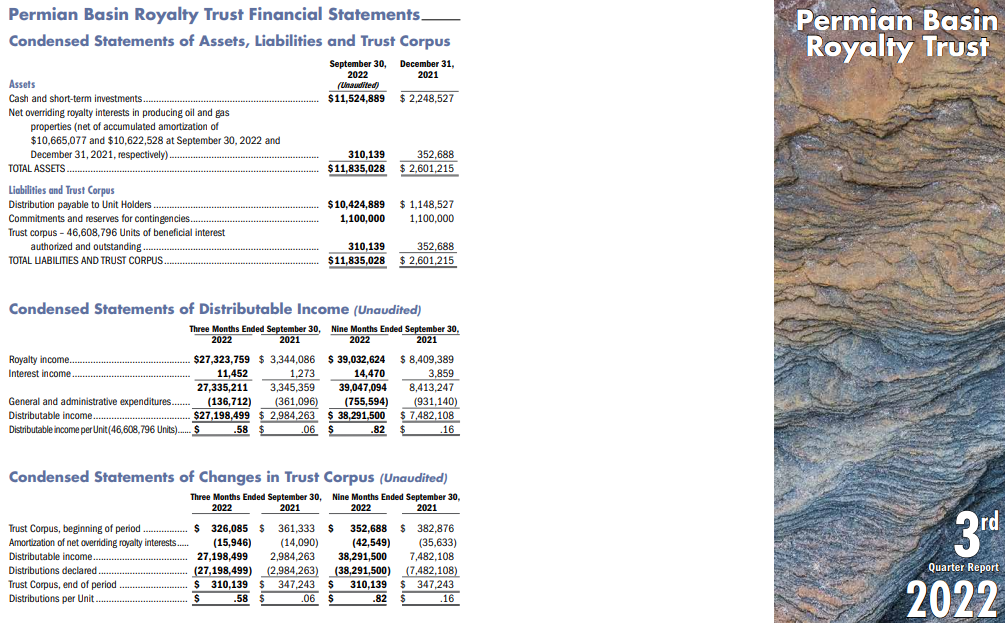

PBT released on 11/14/22 its financial results for the third quarter of fiscal year 2022. The company experienced a significant increase in its average realized prices of oil and gas, up 59% and 96% respectively, from the same quarter in the previous year. This increase was attributed to the multi-year high benchmark prices resulting from the sanctions imposed by Europe and the U.S. on Russia for its invasion in Ukraine. The company’s oil volumes nearly doubled, while its gas volumes more than doubled, resulting in a jump in distributable income per unit from $0.06 to $0.58.

Source: Investor presentation

Despite disappointing distributions in recent years, which were impacted by high operating expenses on the Waddell Ranch properties, PBT has finally increased its distributions recently. The rally of the oil price has resulted from the recovery of global demand from the pandemic, tight global supply and the invasion of Russia in Ukraine. As Russia produces ~10 million barrels of oil per day and exports ~5 million barrels of oil per day (~5% of global supply), the sanctions of western countries on Russia have greatly tightened the oil market.

The rally of the price of natural gas has resulted from the sanctions of western countries on Russia. Europe, which generates 31% of its electricity from natural gas provided by Russia, is currently doing its best to diversify away from Russia. As a result, there has been a huge increase in the number of LNG cargos directed from the United States to Europe. As a result, the U.S. natural gas market has become exceptionally tight and hence the price of U.S. natural gas has rallied to a 13-year high lately. Overall, PBT cannot hope for a more favorable business environment than the current one.

Thanks to the recovery in commodity prices and ongoing geopolitical uncertainty, we expect PBT to continue generating solid results for the foreseeable future.

On the other hand, given the significant cyclicality of these prices, investors should keep conservative growth expectations from PBT. Moreover, PBT suffers from the natural decline of its fields in the long run. During the last six years, its production of oil and gas has decreased at an average annual rate of 6% and 2%, respectively. The natural decline of output is a strong headwind for future results.

Dividend Analysis

Royalty trusts are usually owned for their dividends. These investments are not likely to have multiple decades of dividend growth like the more well-known dividend paying companies such as Johnson & Johnson (JNJ) or Procter & Gamble (PG). That is because trusts like Permian Basin depend entirely on the prices of oil and gas to determine dividend payments.

Listed below are the trust’s dividends per share over the last seven years:

- 2014 dividends per share: $1.02

- 2015 dividends per share: $0.34 (67% decline)

- 2016 dividends per share: $0.42 (24% increase)

- 2017 dividends per share: $0.63 (50% increase)

- 2018 dividends per share: $0.66 (5% increase)

- 2019 dividends per share: $0.42 (36% decline)

- 2020 dividends per share: $0.235 (44% decline)

- 2021 dividends per share: $0.23 (2% decline)

- 2022 dividends per share: $1.1487 (399% increase)

Dividends come directly from royalties, so higher oil and gas prices will likely lead to distribution growth. Given this, it shouldn’t come as a surprise that shareholders of Permian Basin saw a significant decline in dividends during the 2014 to 2016 oil market downturn.

As oil prices stabilized following this downturn, the dividends returned to growth again. And, as you can see, the dividend growth was extremely high as energy prices improved.

The trust has distributed $0.0782 per share in the first two months of 2023. Annualized, this would come out to a distribution of $0.4692 per share for the full year. This would mark a significant decrease from the prior year, but it would still be significantly higher than the distribution in 2021.

This expected dividend per share equates to a yield of 1.9% based on the recent share price. While the yield compares favorably to the 1.3% average yield of the S&P 500 Index, it is a markedly low yield for an oil and gas royalty trust, which carries much greater risk than the S&P 500.

Final Thoughts

Monthly dividend paying stocks can help investors even out cash flows compared with stocks that follow the traditional quarterly payments. Monthly payments can also help investors compound income at a faster rate.

High yield stocks can provide investors more income, something that is important to those investors living off dividends in retirement. Permian Basin does offer a yield that is higher than that of the market index.

Investors with a higher appetite for risk might feel that the large dividend raises expected amid favorable commodity prices and the 1.9% yield are a solid tradeoff for the steep declines that occur when energy prices fall.

With that said, Sure Dividend believes that the risk is not worth the reward when it comes to royalty trusts. Permian Basin does offer a monthly dividend but doesn’t provide certainty of what the payment may look like. The dividend payments rely totally on the price of oil and gas. When one or both are down, so are dividend payments. Investors who need steady, reliable income are strongly encouraged to invest elsewhere.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].