Updated on September 13th, 2022 by Quinn Mohammed

Midstream energy companies are widely-known to be a source of high dividend yields. Midstream operators benefit from favorable economics because of the continued need for oil. In addition, midstream companies are less exposed to commodity price risk than their upstream peers in the exploration and production industry.

Pembina Pipeline Corporation (PBA) is a midstream energy stock that rewards its shareholders with high dividend income. This Canadian monthly dividend paying company currently has a 5.5% dividend yield, more than three times the average yield of the S&P 500 Index.

Pembina Pipeline is unique among midstream oil companies because it pays its dividend monthly.

Despite their appeal, monthly dividend stocks are quite rare. You can see our full list of all 49 monthly dividend stocks (with important metrics like dividend yields and payout ratios) by clicking on the link below:

Pembina Pipeline’s high dividend yield and monthly dividend payments make it an intriguing investment from an income perspective.

However, there is more to investing than picking a high yield, and this article will analyze the investment prospects of Pembina Pipeline in detail.

Business Overview

Pembina Pipeline Corporation is a Canadian pure-play energy infrastructure company based in Calgary, Alberta, Canada.

With a market capitalization in excess of $20 billion, Pembina is a large cap stock.

Pembina owns an integrated system of pipelines that transport various hydrocarbon liquids and natural gas products, primarily in western Canada.

Source: Investor Presentation

The company also has gathering and processing facilities. Pembina operates in three segments: Pipelines, Facilities, and Marketing & New Ventures.

On August 4th, 2022, Pembina reported second quarter 2022 results. As has been the theme in recent previous quarters, Pembina benefited from the increased prices of crude oil and natural gas liquids.

The company grew earnings-per-share by 77% year-over-year to $0.69, due to improved margins on crude oil and NGL sales, higher volumes, higher tolls due to inflation, and contribution from recently completed projects.

Pembina achieved a second quarter adjusted EBITDA record of $849 million, up from $778 million in the year-ago quarter.

Management raised its guidance for adjusted EBITDA in 2022 to $3.575 billion to $3.675 billion, from $3.45 billion to $3.60 billion. This increased guidance was the result of strong year-to-date earnings and stronger marketing results, higher contributions from the Alliance and Cochin pipelines, and the closing of the transaction with KKR.

On September 7th, 2022, Pembina announced a C$0.0075 monthly dividend increase, which amounts to a C$0.09 annual increase, and represents 3.6% growth.

While Pembina is still beholden to crude demand, it is better insulated than companies that sell oil directly. This insulation helped it weather many storms, including the COVID-19 crisis. Thanks to its resilient business model, Pembina is on track to reach or exceed its pre-pandemic earnings per share this year.

According to the company, Pembina has steadily increased the fee-based portion of its EBITDA, from 77% in 2015 to 88% in 2021 and 80% to 85% this year. This means that the vast majority of the company’s cash flow comes from services that are paid based on the volumes of products transported and stored.

The company also operates under the “take-or-pay” model which further secures a certain level of cash flow, even during fluctuations in the underlying commodity price. This has helped Pembina generate positive cash flow and maintain its dividend over multiple difficult periods for the oil and gas industry in the past several years.

Growth Prospects

We expect Pembina to grow its earnings per share by 3% per year on average over the next five years. This growth will be fueled by new projects and acquisitions.

On June 1st, 2021, Pembina agreed to acquire Inter Pipeline for C$8.3 billion, in an all-stock deal. Pembina viewed the complementary nature of Inter Pipeline’s assets as highly appealing. However, Inter Pipeline was eventually acquired by Brookfield Infrastructure Partners (BIP).

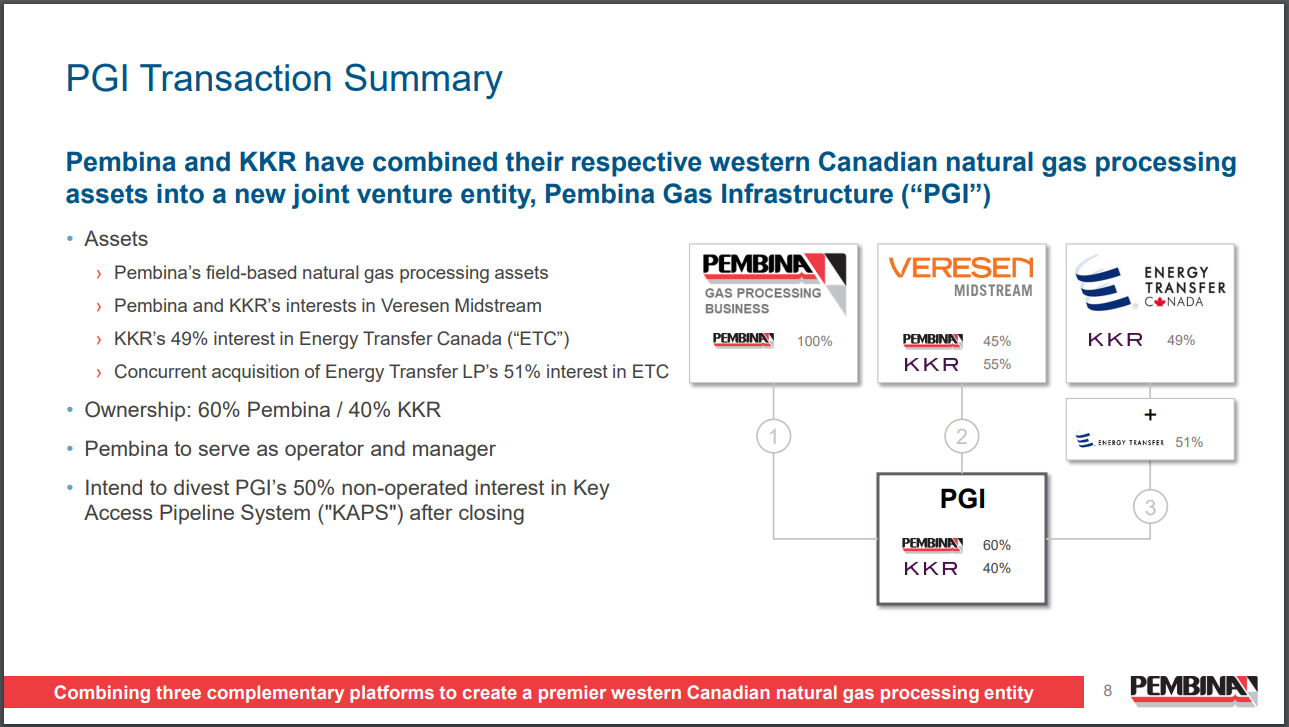

On March 1st, 2022, Pembina and KKR agreed to combine their western Canadian natural gas processing assets into a single, new joint venture entity, which will be owned 60% by Pembina and 40% by KKR. The value of the joint venture is estimated around C$11.4 billion (~$8.8 billion) and Pembina will have the role of the operator and manager.

Source: Investor Presentation

The two companies formed this joint venture to create synergies and offer improved customer service. As the value of the joint venture is about 40% of the market capitalization of Pembina, it will obviously be a significant contributor to the growth trajectory of Pembina.

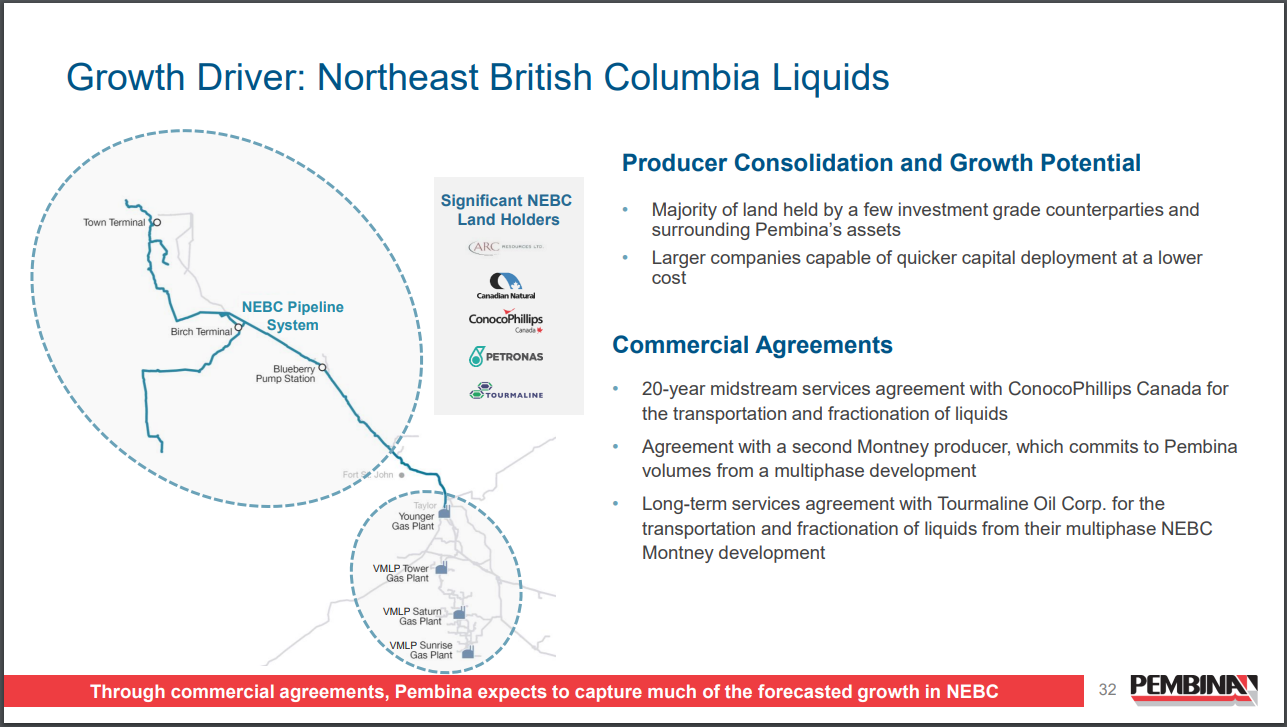

Moreover, due to the impact of the pandemic on the energy market, there has been increased merger activity among oil producers. As a result, there are a few large oil producers, which can deploy their capital plans more readily than small producers, at a lower cost.

Source: Investor Presentation

As these large producers have operations around the assets of Pembina, the recent consolidation activity among producers will provide a tailwind to the business of Pembina, which will enjoy increased volumes through its network.

Pembina’s current business is well-run and highly profitable, but the company does not rest on its laurels; it is also investing in its future. Overall, we see Pembina’s growth outlook as promising.

Dividend Analysis

Pembina currently pays a monthly dividend of C$0.2175 per share, or C$2.61 per share annualized. In U.S. dollars, this works out to an annualized payout of approximately $2.01 per share at current exchange rates. This means Pembina stock currently yields 5.5%.

Note: As a Canadian stock, a 15% dividend tax will be imposed on US investors investing in the company outside of a retirement account. See our guide on Canadian taxes for US investors here.

The company has a solid track record when it comes to dividends, having maintained and grown the payout steadily since 1998. Moreover, Pembina has a strict policy of financial guardrails, which include a strong credit rating and manageable debt.

Source: Investor Presentation

It has a stronger balance sheet than most midstream companies, with a BBB credit rating. It also expects to have a payout ratio of 70% to 75% this year, which bodes well for the safety of the dividend.

We see a long runway for dividend growth ahead, given that the company should continue to grow its earnings and distributable cash flow. This is a hugely attractive proposition for dividend investors and when one considers the payout is also monthly instead of quarterly, Pembina is in a class of its own.

Final Thoughts

Pembina is a high dividend stock with a long track record of steady dividends. It also has monthly dividend payments which are among the biggest reasons why investors might take an initial interest in the stock.

Looking more closely, Pembina appears to be well-positioned to grow over the mid-to-long term given its robust pipeline of projects on the horizon.

Pembina’s 5.5% dividend yield is highly appealing for income investors, particularly given the promising growth prospects of the company. We see the safe and growing dividend as the principal reason to own Pembina, though we note that the stock has rallied 19% year-to-date, thanks to the multi-year high prices of oil and natural gas prevailing right now.

Given the cyclicality of the energy sector, we would advise long-term investors to wait for a meaningful correction of Pembina before purchasing the stock.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].