Updated on February 27th, 2023 by Samuel Smith

Investors looking for high yields might consider buying shares of Business Development Companies, or BDCs for short. These stocks frequently have a higher dividend yield than the broader stock market average.

Some BDCs even pay monthly dividends.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Oxford Square Capital Corporation (OXSQ) is a BDC that pays a monthly dividend. Oxford Square is also a very high-yielding stock, with a yield of 11.8% based on expected dividends for fiscal 2022. This is more than 7 times the average yield of the S&P 500.

However, investors should always keep in mind that the sustainability of a dividend is just as important (or more important) than the yield itself.

BDCs often provide high levels of income, but many (including Oxford Square) have trouble maintaining their dividends, particularly during recessions. This article will examine the company’s business, growth prospects and evaluate the safety of the dividend.

Business Overview

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early and middle–stage businesses through loans and CLOs. You can see our full BDC list here.

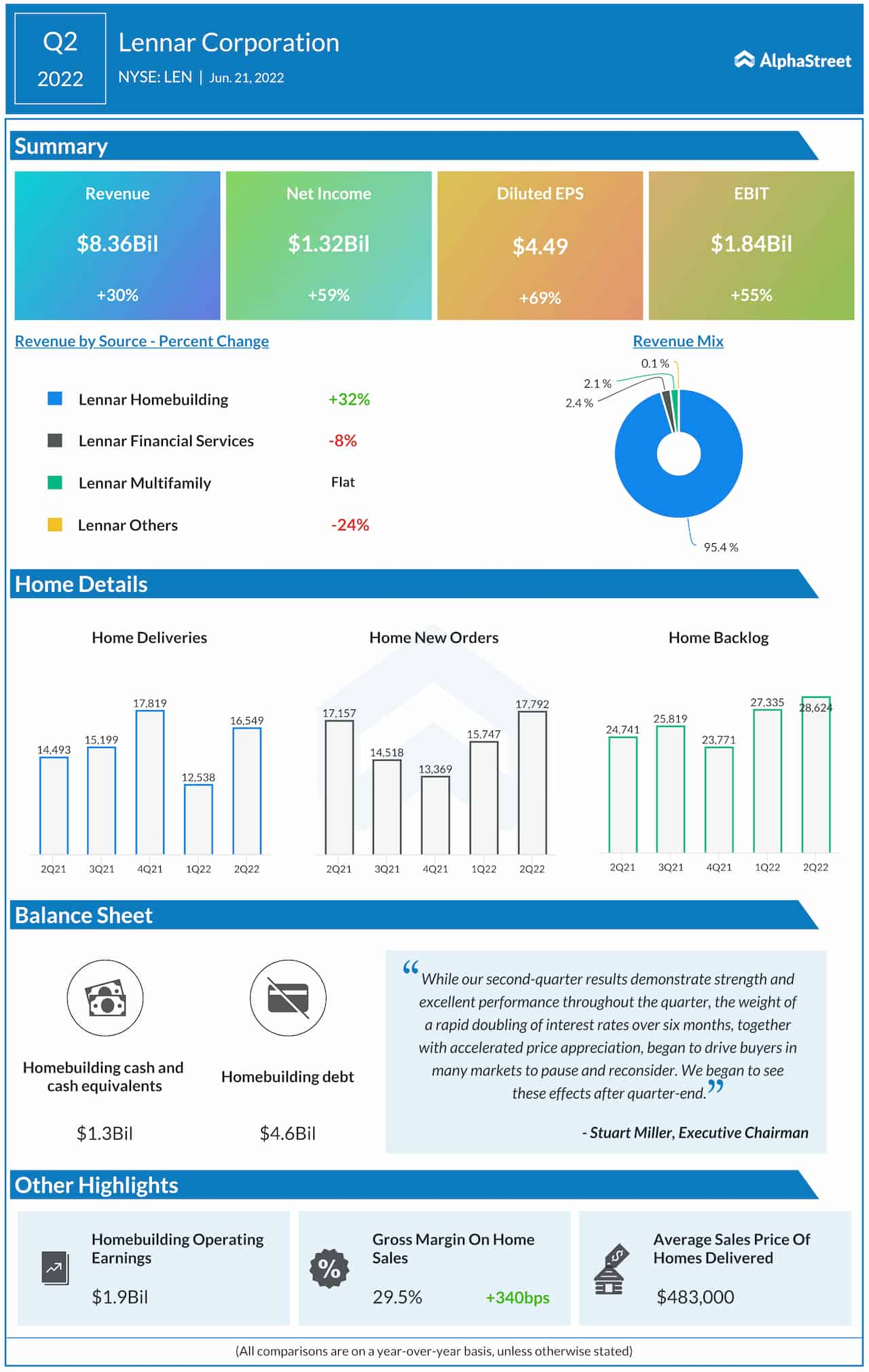

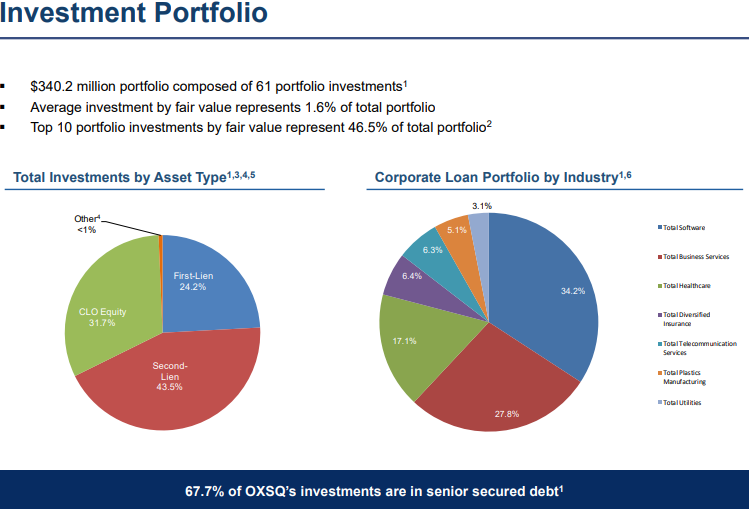

The company holds a well-diversified portfolio of First–Lien, Second–Lien, and CLO equity assets spread across seven industries, with the highest exposure in software and business services, at 34.2% and 27.8%, respectively.

Source: Investor presentation

The company’s assets have a gross investment value of around $340.2 million in 61 positions, with the average investment by fair value representing just 1.6% of the total portfolio.

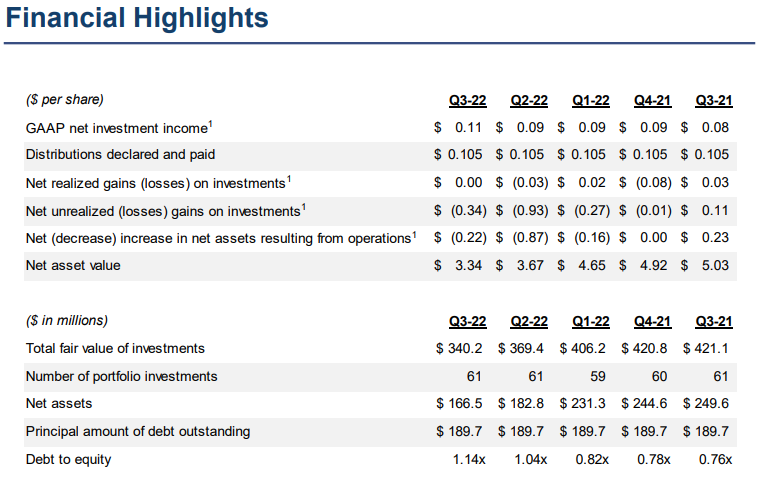

Oxford Square announced its Q3 results for the period ending September 30th, 2022, on November 7th. The company reported generating around $11.4 million of total investment income, indicating a 15.2% increase from the previous quarter. The increase in total investment income was primarily due to rising interest rates. In particular, the weighted average yield of debt investments was 10.4% at the current cost, compared to 9.0% in Q2-2022. However, the increase was partially offset by a lower cash distribution yield from OXSQ’s CLO equity investments, which fell sequentially from 20.7% to 16.6%.

Total expenses, which consist mainly of managers’ fees and interest paid on its own financing, amounted to $5.8 million, remaining stable compared to Q2-2022. Due to the higher total investment income and stable expenses, the net investment income (NII) amounted to $5.6 million, or $0.11 per share, compared to $4.3 million or $0.09 sequentially.

The net asset value (NAV) per share was $3.34, which was lower than the previous quarter’s $3.67 due to a decrease in the value of the company’s assets. Given the current portfolio composition, we now project a FY2022 IIS of $0.40 for the company.

Source: Investor presentation

Growth Prospects

The company’s investment income per share has been declining at an alarming rate, as financing has become cheaper, preventing Oxford Square from refinancing at its previously higher rates. Additionally, the company has been historically over–distributing dividends to shareholders, decaying its NAV, and therefore future income generation, due to fewer assets.

Considering that the Fed has made it clear that they intend to increase rates at least once more this year, we expect that Oxford Square will be able to generate stable investment income per share in the near term.

The 2020 dividend cut should result in Oxford Square retaining some cash, hopefully starting to regrow its NAV. With rates unlikely to continue moving any lower, income generation should stabilize over the next few years

With investment across a wide breadth of different industries, Oxford Square has a fairly balanced portfolio. The company’s top three industries do make up most of the portfolio, but they are in different areas of the economy. This adds some protection in case of a downturn in one industry.

However, with rates declining over time, the company’s receivables have been further pressurized, worsening its financials annually. Overall, we believe that the company’s future investment income generation carries substantial risks, while a potential recession and an adverse economic environment could severely damage its interest income.

Dividend Analysis

Oxford Square only recently began paying a monthly dividend, with the first being distributed in April 2019. Total dividends paid over the past few years are listed below:

- 2015 dividends: $1.14

- 2016 dividends: $1.16 (1.8% increase)

- 2017 dividends: $0.80 (31% decline)

- 2018 dividends: $0.80 (no increase)

- 2019 dividends: $0.80 (no increase)

- 2020 dividends: $0.6120 (23.5% decline)

- 2021 dividends: $0.42 (31.4% decline)

Shareholders received a small increase in 2016, followed by three large dividend reductions since 2017. This inconsistency in dividend payout is due to the company’s volatile financial performance.

Oxford Square currently pays a monthly dividend of $0.035 per share, equaling an annualized payout of $0.42 per share. This would represent flat year-over-year performance for dividends in 2022.

Based on a full-year payout of $0.42 per share, Oxford Square stock yields 11.8%. While the dividend cuts in recent years have been large, the dividend yield remains very high. That said, investors should not focus solely on yield; dividend safety is an important consideration for income investors, and in that regard, Oxford Square leaves a lot to be desired.

Using our expectation for full-year investment income per share of $0.40 for 2022, the company is projected to maintain a dividend payout ratio of 105% for 2022. This could result in another dividend cut if its investment income declines from current levels.

Final Thoughts

Oxford Square has a solid business model, with diversification across investment assets and industries. The company has also taken steps to build up its less risky asset position while decreasing its reliance on riskier CLOs.

That said, Sure Dividend recommends that risk-averse investors avoid Oxford Square. We believe that the dividend does not offer enough safety. The company distributes essentially all of its investment income, leaving little wiggle room. Any drops in investment income can result in dividend cuts.

We echo these concerns and rate Oxford Square a Sell.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].