Printed on October sixteenth, 2024 by Aristofanis Papadatos

Freehold Royalties (FRHLF) has two interesting funding traits:

#1: It’s a high-yield inventory based mostly on its 7.7% dividend yield.

Associated: Record of 5%+ yielding shares.

#2: It pays dividends month-to-month as a substitute of quarterly.

Associated: Record of month-to-month dividend shares

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

The mix of a excessive dividend yield and a month-to-month dividend render Freehold Royalties interesting to income-oriented traders. As well as, the corporate is ideally positioned to profit from excessive manufacturing development in exceptionally wealthy useful resource areas in North America. On this article, we are going to talk about the prospects of Freehold Royalties.

Enterprise Overview

Freehold Royalties is targeted on buying and managing royalty curiosity in crude oil, pure gasoline, pure gasoline liquids, and potash properties in Western Canada and the USA. The corporate was based in 1996 and is headquartered in Calgary, Canada.

Freehold Royalties goals to ship development and enticing risk-adjusted returns to its shareholders by buying high-quality belongings with acceptable threat profiles and lengthy financial life. It then tries to generate extremely worthwhile lease out applications for the event of its properties.

Freehold Royalties generates roughly 93% of its revenues from oil and pure gasoline liquids and the remaining 7% from pure gasoline.

Supply: Investor Presentation

Furthermore, the corporate generates 55% of its income from its properties in Canada and the remaining 45% of its revenues from its properties within the U.S.

As an oil and gasoline royalty firm, it’s only pure that Freehold Royalties has exhibited a extremely risky efficiency file. The royalties that its new clients are keen to pay are significantly affected by the prevailing circumstances within the oil and gasoline market and the underlying costs of oil and gasoline.

As well as, the oil and gasoline manufacturing of its current clients considerably varies from yr to yr, as it’s depending on the prevailing costs of oil and gasoline. It’s thus not stunning that Freehold Royalties has posted losses in 3 of the final 10 years.

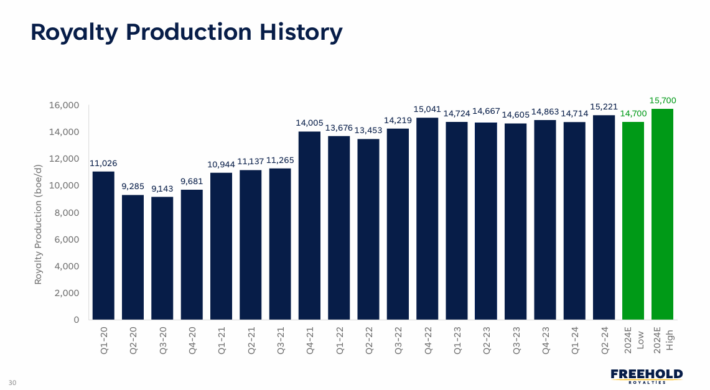

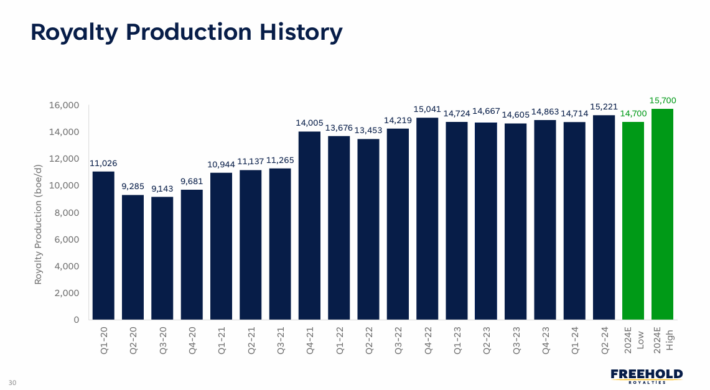

Alternatively, Freehold Royalties significantly advantages from the ample reserves of oil and gasoline within the areas wherein the corporate is current. The corporate has grown its manufacturing by a formidable 38% because the starting of 2020, from 11,026 barrels per day to a brand new all-time excessive of about 15,200 barrels per day this yr.

Supply: Investor Presentation

This admirable efficiency is in sharp distinction to that of most oil majors, that are struggling to develop their manufacturing organically.

Similar to most oil and gasoline producers, Freehold Royalties incurred losses (-$0.09 per share) in 2020 because of the plunge of the costs of oil and pure gasoline brought on by the pandemic. Nonetheless, due to the large distribution of vaccines worldwide, the worldwide consumption of oil and gasoline recovered in 2021 and thus the corporate returned to excessive profitability in that yr.

In early 2022, the onset of the warfare in Ukraine rendered the worldwide oil and gasoline markets extraordinarily tight. Because of this, the costs of oil and pure gasoline rallied to 13-year highs in 2022. That rally created an exceptionally favorable enterprise setting for Freehold Royalties, which thus posted 10-year excessive earnings per share of $1.03 in that yr.

Nonetheless, the worldwide oil and gasoline markets have absorbed the influence of the Ukrainian disaster since early final yr. The worth of pure gasoline has remained depressed since final yr as a result of abnormally heat winter climate for 2 consecutive years. The worth of oil has corrected virtually 50% off its peak in 2022, as Russia has discovered other ways to direct its barrels amid the sanctions of western nations. Because of this, Freehold Royalties noticed its earnings per share decline 36% final yr, from $1.03 to $0.66.

The corporate has posted considerably larger earnings this yr, because it has reported earnings per share of $0.36 within the first half of this yr. However, the consumption of oil of China has considerably weakened whereas some OPEC members have begun to disapprove of the strict manufacturing quotas of the cartel. Because of this, the outlook is unsure for Freehold Royalties.

Progress Prospects

Freehold Royalties at present enjoys respectable enterprise momentum. The corporate has grown its manufacturing by 38% over the past 4 years, to a brand new file stage.

Such a excessive manufacturing development charge is extraordinarily uncommon within the oil and gasoline business. To supply a perspective, most oil majors, resembling Shell (SHEL) and BP (BP), have did not develop their output over the past a number of years. It is a key distinction between Freehold Royalties and most oil and gasoline producers.

Alternatively, Freehold Royalties is inevitably delicate to the cycles of the oil and gasoline business. That is clearly mirrored within the risky efficiency file of the corporate. Over the past decade, Freehold Royalties has did not develop its earnings per share. As well as, the corporate has posted losses in 3 of the final 10 years and has posted negligible income in 3 of the final 10 years.

Freehold Royalties at present enjoys respectable enterprise momentum, not solely due to its excessive manufacturing development, but in addition due to the deep manufacturing cuts carried out by OPEC in an effort of the cartel to help the worth of oil. The worth of pure gasoline has remained depressed this yr, primarily as a result of an abnormally heat winter, however the value of oil has remained above common. Because of this, Freehold Royalties is more likely to publish above common income this yr.

Given the respectable enterprise momentum but in addition the cyclical nature of the enterprise of Freehold Royalties, we count on roughly flat earnings per share in 5 years from now.

Dividend & Valuation Evaluation

Freehold Royalties is at present providing an exceptionally excessive dividend yield of seven.7%, which is greater than six occasions as a lot because the 1.2% yield of the S&P 500. The inventory is thus an fascinating candidate for income-oriented traders however the latter needs to be conscious that the dividend is just not protected because of the cyclical nature of the oil and gasoline business.

Freehold Royalties is paying a beneficiant dividend however its earnings have decreased considerably vs. the 10-year excessive earnings per share of $1.03 in 2022. Because of this, the payout ratio has risen from 68% in 2022 to 109% now. Such a payout ratio is unsustainable over the long term.

Fortuitously, the corporate has a rock-solid stability sheet. It pays negligible curiosity expense and its web debt is simply $174 million, which is simply 9% of the market capitalization of the inventory. General, Freehold Royalties has one of many strongest stability sheets within the power sector.

Administration needs to be praised for the pristine stability sheet, which is paramount within the power sector given the dramatic cycles of the sector. Alternatively, because of the inevitable swings of the costs of oil and gasoline, the dividend of Freehold Royalties is way from protected. Notably, the corporate has lower its dividend in 3 of the final 10 years.

As well as, U.S. traders needs to be conscious that the dividend acquired from this inventory will depend on the change charge between the Canadian greenback and the USD.

In reference to the valuation, Freehold Royalties is at present buying and selling for 14.3 occasions its earnings per share within the final 12 months. We assume a good price-to-earnings ratio of 10.0 for the inventory. Subsequently, the present earnings a number of is far larger than our assumed honest price-to-earnings ratio. If the inventory trades at its honest valuation stage in 5 years, it’s going to incur a -6.9% annualized drag in its returns.

Bearing in mind the flat earnings per share, the 7.7% dividend yield and a -6.9% annualized contraction of valuation stage, Freehold Royalties may provide only a 1.6% common annual whole return over the following 5 years. It is a low anticipated whole return and therefore we advocate ready for a considerably decrease entry level with a purpose to improve the margin of security and enhance the anticipated return from this extremely cyclical inventory.

Remaining Ideas

Freehold Royalties has significantly better prospects in rising its manufacturing and its reserves than most of its friends and is providing an above common dividend yield of seven.7%. The corporate additionally has a rock-solid stability sheet. Because of this, it’s more likely to entice some income-oriented traders.

Nonetheless, the corporate has exhibited a extremely risky efficiency file because of the cycles of its enterprise and appears virtually totally valued proper now. Subsequently, traders ought to look ahead to a way more enticing entry level.

Furthermore, Freehold Royalties is characterised by low buying and selling quantity. Because of this it might be exhausting to determine or promote a big place on this inventory.

And see the assets beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].