Published on April 10th, 2023 by Nikolaos Sismanis

Investors seeking a dependable and consistent source of income may find it advantageous to invest in companies that distribute monthly dividends. This can greatly enhance predictability and reduce the uncertainty associated with investing in equities. Thus, monthly dividend stocks can be particularly during the current, highly volatile market environment.

That said, there are just 86 companies that currently offer a monthly dividend payment, which can severely limit the investor’s options. You can see all 86 monthly dividend paying names here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

One name that we have not yet reviewed is First National Financial Corporation (FNLIF), a Canadian-based company that operates in the financial services industry. Currently, the stock comes attached to a yield of 6.4%, which is more than four times higher than the yield of the S&P 500 Index. Coupled with the fact that the company pays out dividends on a monthly basis, it may be a fitting pick for income-oriented investors.

This article will evaluate the company, its business model, and its distribution to see if First National Financial Corporation could be a good candidate for purchase.

Business Overview

Over the last three decades, First National has grown to become a recognized and respected leader in real estate financing. Being Canada’s biggest non-bank issuer of single-family residential mortgages, the company provides a comprehensive array of mortgage solutions tailored to suit the unique requirements, lifestyle, and financial objectives of each client.

Additionally, First National offers commercial mortgages, attributing its triumph to its team of experts who are among the most respected and renowned in the industry.

As an originator and underwriter of mortgages, 2022 was a transitional year for First National. The industry underwent a rapid transformation due to the significant rise in interest rates, leading to a sharp deceleration in housing activity. This stands in stark contrast to 2021 when the housing market experienced heightened activity due to historically low-interest rates resulting from the government’s monetary policy aimed at mitigating the economic fallout of the Covid-19 pandemic. Consequently, First National’s single-family and commercial originations were 17% and 1% lower, respectively, year-over-year.

While higher interest rates negatively impacted the number of new originations last year, they did have a fairly positive income on the company’s results.

In fact, the favorable outcome of the higher rates more than compensated for the headwinds it created. This was due to the company being able to earn higher interest revenue on mortgages held for securitization and investments, resulting in a remarkable 13% growth in revenues to C$1.57 billion. Following higher revenues, First National’s income before taxes landed at C$269.1 million in 2022 compared to C$263.8 million in 2021.

Source: Annual Report

Growth Prospects

To grow its revenues and earnings, First National can primarily rely on two factors – expanding its mortgage portfolio and increasing the interest income generated from it.

The problem is that assessing First National’s growth prospects is somewhat challenging these days due to the highly uncertain nature of the evolving interest rates. At first glance, the company’s revenues and income last year rose last year as the company was able to earn more on its existing mortgage portfolio.

That said, rising interest rates are generally not beneficial for mortgage issuers for a few reasons:

- First, when interest rates rise, it becomes more expensive for potential buyers to take out mortgages, which can result in lower demand for mortgages. We saw this happening in the company’s 2022 results.

- Second, First National could experience a decrease in profitability, as higher interest rates can lead to higher borrowing costs for the company as well. This wasn’t the case last year, but it could be once the company has to refinance its own debt.

- Third, as interest rates rise, some borrowers may find it difficult to make their mortgage payments, which can result in an increase in the number of defaults. This, in turn, can cause mortgage issuers to suffer losses as they may have to repossess and sell properties at a loss.

Therefore, despite last year’s improving results, it’s important to note that if interest rates remain high, the company’s profitability may not be as strong in the upcoming years.

Overall, the company’s earnings track record is quite volatile, which can be attributed to various factors that have the potential to impact its profitability depending on the prevailing macroeconomic conditions significantly.

Still, First National’s earnings tend to trend upward over the long term. The company’s earnings-per-share over the past five, seven, and ten years have grown on average by -1%, 9.6%, and 6.3%, respectively.

Dividend Analysis

First National is currently yielding 6.4%, with the company boasting a remarkable track record of paying dividends. In fact, First National is a member of the S&P/TSX Canadian Dividend Aristocrats Index.

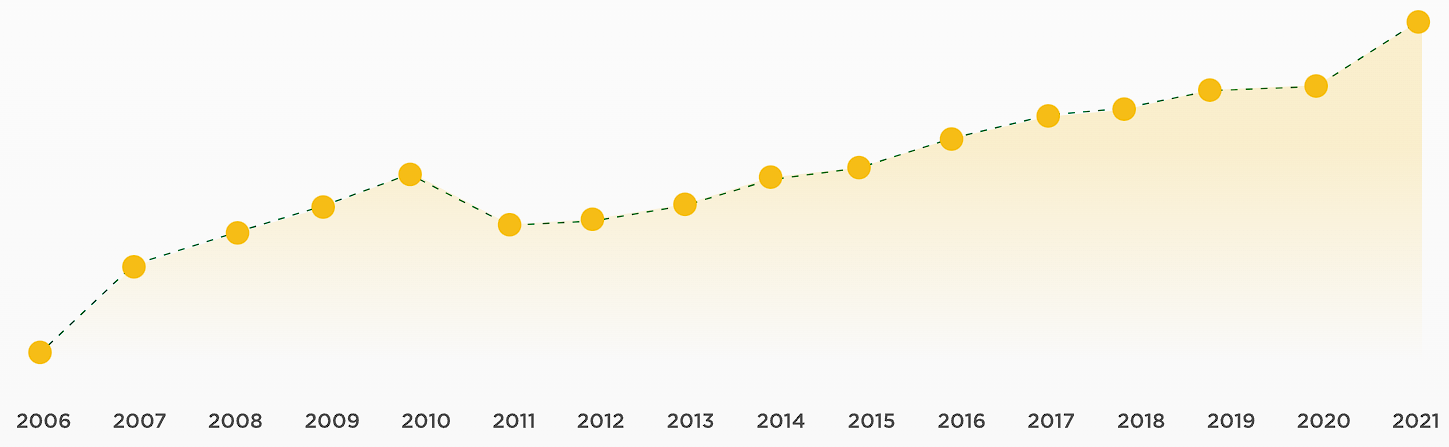

Although the dividend experienced a decrease of approximately 20% in 2010 due to the adverse impact of the Great Financial Crises on the real estate mortgage market, the dividend has grown steadily every year from 2011 onward.

Specifically, over the past decade, the company’s dividend has grown at a compound annual growth rate of 6.4%, mirroring its earnings-per-share growth over the same period.

Source: Investor Relations

Moving forward, we believe that First National may slow down the pace at which it grows its dividend. This is because the current payout ratio already appears relatively high at 72%, and profitability could decline in the coming years due to higher interest rates.

Therefore, the company is unlikely to take the risk of pushing the payout ratio to a level that could jeopardize its financial stability. The most recent dividend increase of just 2.1% supports this rationale.

Final Thoughts

First National is likely to experience profitability headwinds in the coming years, especially if interest rates remain elevated. While higher interest income on its existing mortgage portfolio could somewhat offset the lack of new originations, the company’s own financial expenses are likely to pressure its bottom line.

That said, for investors seeking a steady stream of monthly income and an above-average yield, First National may be an attractive option. Despite operating in a challenging environment, the company has maintained a reasonable payout ratio and even slightly increased its dividend last year, indicating its commitment to rewarding its shareholders.

As such, income-oriented investors are likely to find value in the stock albeit any short-term setbacks in its financials due to higher interest rates.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].