Up to date on April thirteenth, 2022 by Quinn Mohammed

Actual property funding trusts generally have excessive dividends yields in extra of 10%. Ellington Residential Actual Mortgage REIT is one such instance. The REIT has an enormous dividend yield of 12.9% at this time.

Actual property shares are a preferred alternative for creating passive retirement revenue, however high-yielding shares can generally be a warning signal that important challenges are impeding the enterprise. For Ellington Residential, because the share value drops attributable to its circumstances, the dividend yield will increase.

Ellington Residential Mortgage (EARN) might not be a well known REIT. In October 2021, the company selected to switch its dividend cost schedule from quarterly to month-to-month.

Which means EARN joins the listing of month-to-month dividend shares. We’ve compiled a listing of 52 month-to-month dividend shares, together with necessary monetary metrics like dividend yields and payout ratios, which you’ll be able to view by clicking on the hyperlink beneath:

This text will analyze the funding prospects of Ellington Residential Mortgage REIT intimately.

Enterprise Overview

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and actual estate-related belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. government-sponsored enterprise.

Ellington Residential is headquartered in Outdated Greenwich, Connecticut. It’s a small-cap firm with a market capitalization of solely $122 million. Ellington Residential Mortgage REIT is externally managed by Ellington Residential Mortgage Administration LLC.

The mortgage REIT has an company residential mortgage-backed securities (RMBS) portfolio of $1.3 billion and a non-agency RMBS portfolio of $9.1 million. Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS will not be assured by the federal government.

Supply: Investor Presentation

On March seventh, 2022, Ellington Residential reported its This fall outcomes for the interval ending December thirty first, 2021. The corporate booked a $(0.21) internet loss per share for This fall. Core earnings of $3.7 million this quarter led to core EPS of $0.28 per share, which doesn’t cowl the $0.30 quarterly dividend cost.

For the total yr, Ellington Residential generated core earnings per share of $1.27 and paid out $1.18 in dividends. For 2021, EARN coated its dividend with a 93% payout ratio.

EARN achieved a internet curiosity margin of 1.81% in This fall. At quarter finish, Ellington had $69 million of money and money equivalents, and $16.7 million of different unencumbered belongings. The debt-to-equity ratio was 6.9x. The corporate additionally had a ebook worth of $11.76 per share.

Progress Prospects

Ellington has seen its core earnings per share shrink quite than develop for many of its historical past. Since 2016, the compound annual progress fee has been -5.8%.

In its first few years, the corporate held their share depend constant, however following 2016, the variety of shares excellent has grown, which may be one other barrier to rising earnings on a per share foundation.

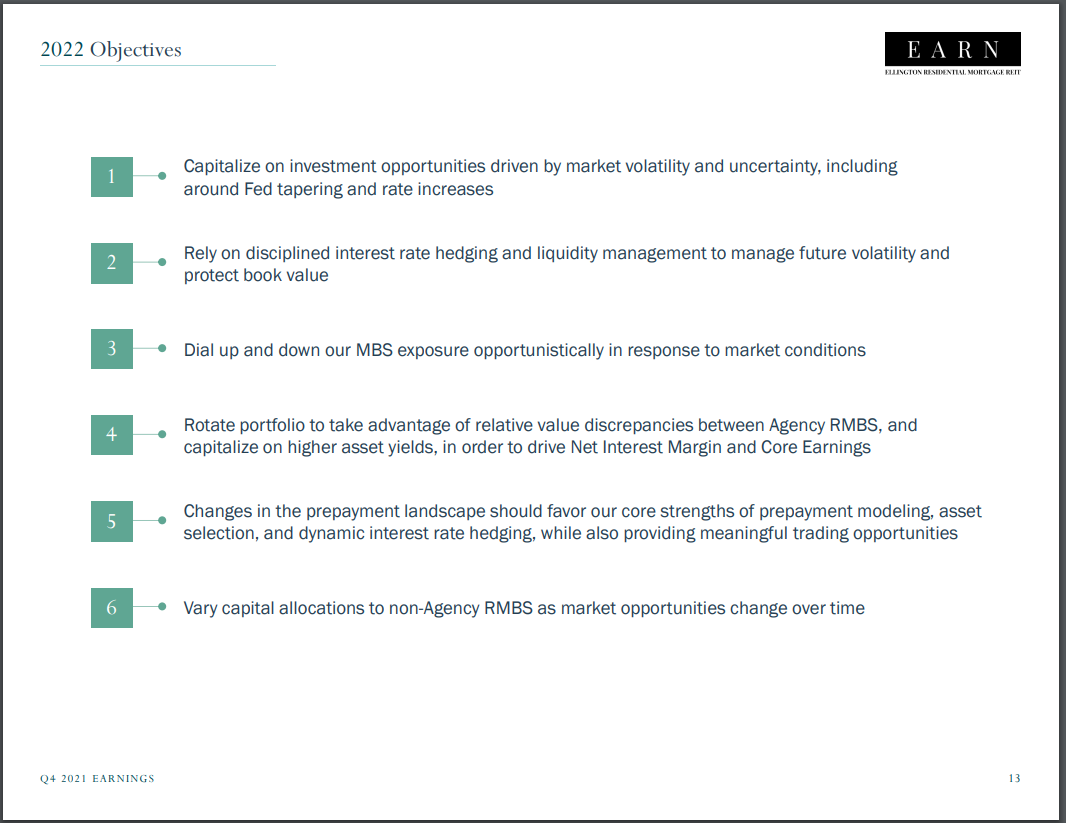

The company has a number of avenues of progress, which all revolve round optimizing their MBS portfolio. Capitalizing on alternatives pushed by market volatility, significantly round Fed tapering, might yield outcomes. The growing rates of interest may even profit the corporate within the long-term.

Supply: Investor Presentation

Moreover, Ellington will defend their ebook worth by rate of interest hedges and liquidity administration. Regardless of this, the corporate has a poor observe file of earnings, main us to anticipate little or no progress of 1.0%. This anemic progress is unlikely to result in any additional dividend will increase within the medium time period.

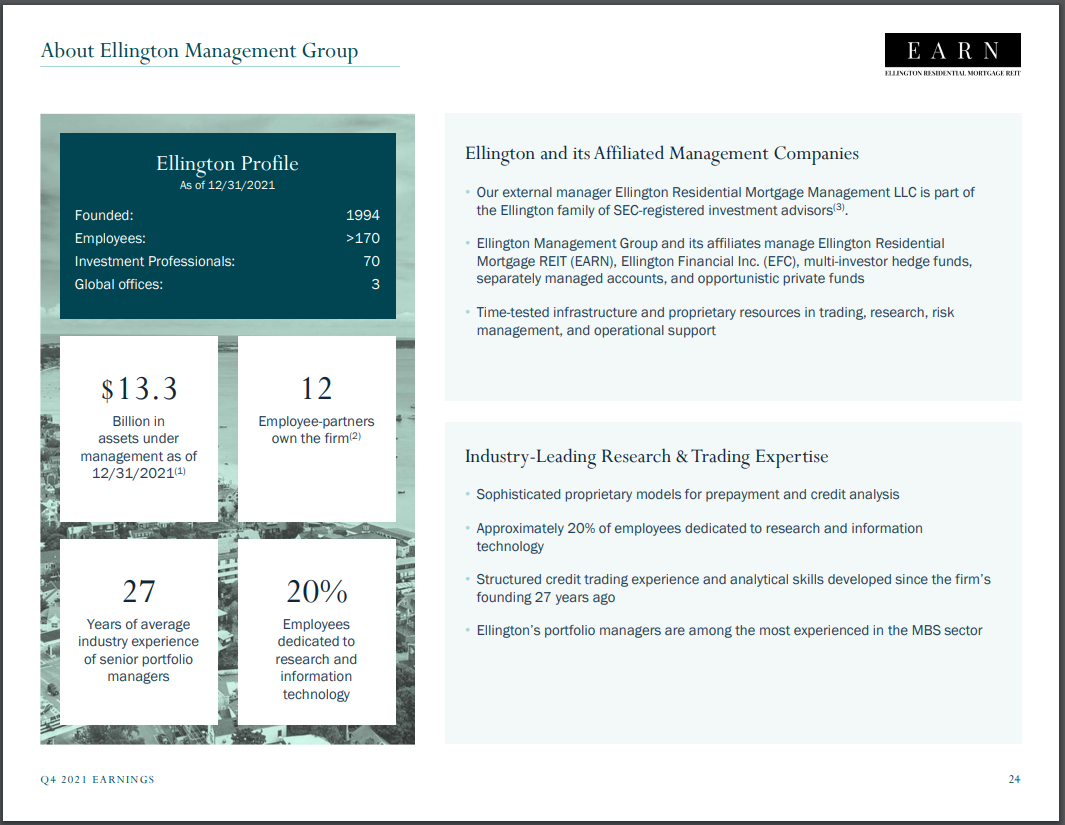

Aggressive Benefit & Recession Efficiency

Ellington claims that their portfolio managers are among the many most skilled within the MBS sector and their analytics have been developed over the corporate’s 27-year historical past. Elligton Administration Group is massive, with $13.3 billion in belongings underneath administration. The group has been round since 1994 and has over 170 staff and 70 funding professionals.

Supply: Investor Presentation

The corporate possesses superior proprietary fashions for prepayments and credit score evaluation. Additionally, roughly 25% of the corporate’s staff deal with analysis and data expertise.

Whereas the corporate’s particulars weren’t public within the 2008 actual property crash, a recession of that magnitude would virtually positively have an effect on EARN. It’s deal with government-sponsored MBS present some security, however a chronic recession sooner or later would seemingly have an effect on EARN’s backside line, and end in additional dividend reductions.

Dividend Evaluation

The dividend has been reduce each single yr (outcomes from 2013 solely account for half the yr) in its historical past with a rise in 2021. Adopted by the dividend schedule being modified to month-to-month over quarterly, which sure shareholders might favor.

Ellington’s newest dividend enhance was a 7.1% increase and is now $0.10 monthly. This equals an annual dividend of $1.20.

On an annualized foundation, the $1.20 per share dividend continues to be beneath the 2018 payout of $1.45 per share. The annual dividend was additionally increased from 2014 to 2018 than it’s at this time.

Nonetheless, at a stage of $1.20 per share, EARN inventory yields 12.9%. Due to this fact, EARN inventory continues to be enticing for revenue traders as a excessive dividend inventory.

EARN’s dividend is much from reliable given the company has a path of cuts prior to now. In not less than three years of the final eight full calendar years in operation, the corporate’s payout ratio was close to or above 100%. At present, the dividend seems to be stretched, and it might not be coated for the yr.

Remaining Ideas

Ellington Residential Mortgage REIT has an enormous dividend yield of 12.9%, and the corporate solely lately began paying out month-to-month dividends.

Nonetheless, Ellington Residential has a protracted historical past of chopping their dividend. That, and the truth that the corporate is anticipating paying out 100% of core earnings for 2022, places the dividend in danger for an additional reduce.

Ellington Residential could also be a becoming alternative for high-yield traders with an urge for food for danger, nevertheless it’s dividend historical past is much lower than stellar. And the dividend at this time is on shaky grounds.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].