Updated on February 24th, 2023 by Samuel Smith

Investors are often attracted to dividend paying stocks because of the income they produce. Dividend paying stocks provide income, even while the price of the stock can fluctuate.

There are some companies that even pay monthly dividends, which allow for consistent cash flows for investors. But there are 50 stocks that pay a monthly dividend.

You can download our full list of monthly dividend paying stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

Ellington Financial Inc (EFC) is a Real Estate Investment Trust, or REIT, that pays a monthly dividend. Even better, the stock has a very high dividend yield of 13.5%.

Of course, high-yielding stocks can often be a warning sign that the underlying business has significant challenges. Stocks with extremely high yields above 10% can trap investors with dividend cuts later on. Those “yield trap” stocks should be avoided.

This article will examine Ellington Financial’s business model, prospects for growth, and the safety of its dividend to determine if investors should consider buying the stock.

Business Overview

Ellington Financial only transitioned into a REIT at the beginning of 2019. Prior to this, the trust was taxed as a partnership. It is now classified as a mortgage REIT.

Ellington Financial is a hybrid REIT, meaning that the trust is a combination of an equity REIT, which owns properties, and mortgage REITs, which invest in mortgage loans and mortgage-backed securities. The mortgage-backed securities the company manages are backed by prime jumbo loans, Alt-A loans, manufactured housing loans, and subprime residential mortgage loans.

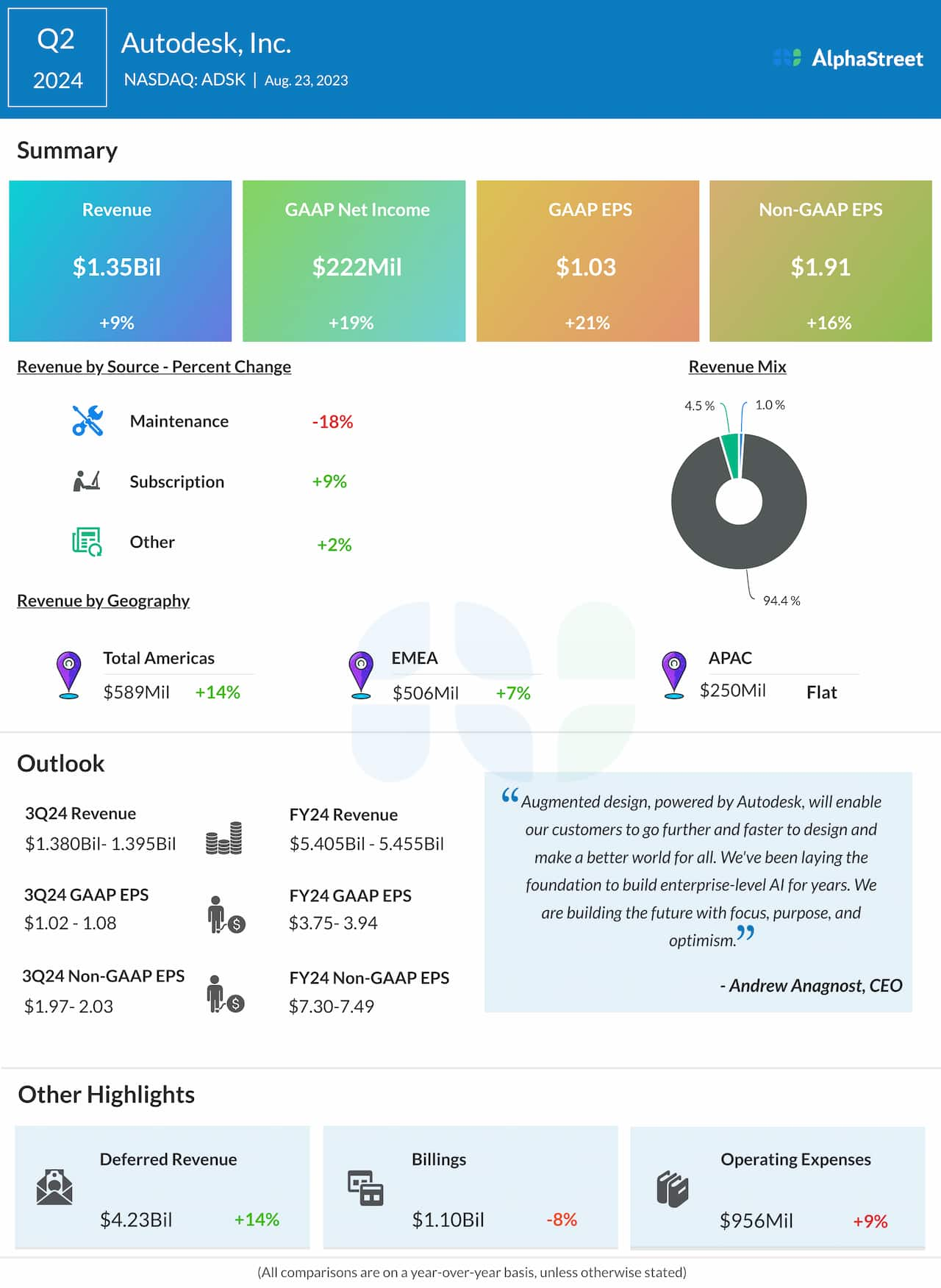

Ellington Financial has a market capitalization of about $900 million. You can see a snapshot of Ellington’s investment portfolio in the image below:

Source: Investor Presentation

Ellington Financial reported its Q4 results on February 23rd, 2023. Net income attributable to common stockholders was $22.7 million, equivalent to $0.37 per common share. The investment portfolio contributed $19.0 million, or $0.31 per common share, while the credit strategy contributed $7.2 million, or $0.12 per common share, the Agency strategy contributed $11.8 million, or $0.19 per common share, and Longbridge contributed $14.5 million, or $0.24 per common share. Adjusted Distributable Earnings totaled $26.0 million, or $0.42 per common share.

Book value per common share as of December 31, 2022 was $15.05, which includes dividends of $0.45 per common share for the quarter. The dividend yield was 13.4% based on the closing stock price of $13.40 per share on February 22, 2023, and a monthly dividend of $0.15 per common share declared on February 7, 2023.

As of December 31, 2022, the recourse debt-to-equity ratio was 2.5:1, while the debt-to-equity ratio, including all non-recourse borrowings primarily consisting of securitization-related liabilities, was 10.2:1. As of the same date, the company had cash and cash equivalents of $217.1 million and other unencumbered assets of $277.9 million.

Growth Prospects

Ellington’s EPS generation has been quite inconsistent over the past decade, as rates have mostly been decreasing. As a result, its per-share dividend has also mostly been falling since 2015.

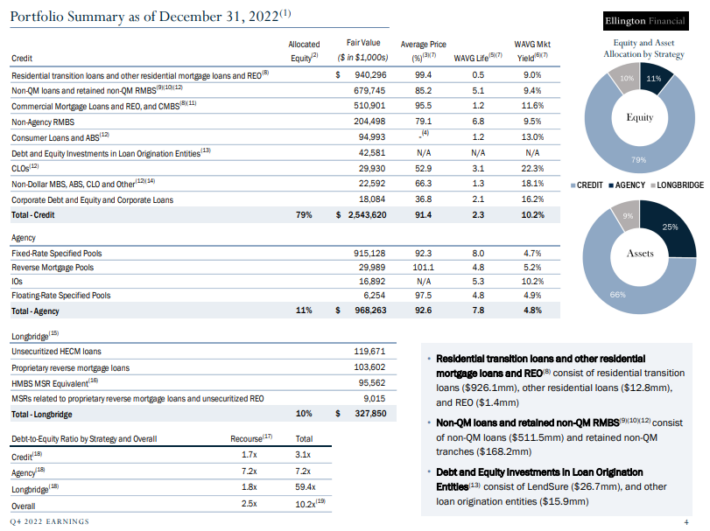

However, the company has done its best to diversify its portfolio and reduce its performance variance.

Additionally, its residential mortgage investments are diversified among many different security types (Non-QM, Reverse mortgages, REOs, etc.). Ellington has taken great care as of late not to concentrate its risk in too few areas, which improves economic return volatility.

Source: Investor Presentation

Ellington has designed its portfolio in such a way that movements in rates over time won’t have a major impact on its overall portfolio.

However, the stock’s expensive financing due to its high dividend and the increasing cost of funds should continue pressuring EPS generation.

Competitive Advantage & Recession Performance

Ellington does not possess any major competitive advantage, but one positive is that the balance sheet remains of high quality, and Ellington’s debt-to-equity ratio is relatively low for a mortgage REIT, which should improve safety and reduce volatility during both good and bad times.

Ellington Financial was not a public company in the throes of the Great Recession, but the company’s share price was decimated at the onset of the COVID-19 pandemic. During this time the company cut its dividend further, but has since increased it. Earnings have also recovered, but is still below levels seen in 2012, 2013, and 2014.

Dividend Analysis

Ellington Financial has a volatile dividend history, with multiple reductions followed by increases. The company cut its monthly dividend from $0.15 to $0.08 in Q1 2020 due to the pandemic, but management has increased it several times since then.

In the 2021 first quarter, the company announced another increase back to $0.15 paid monthly, which is now on par with the pre-pandemic dividend level. At a level of $0.15 per share each month, Ellington Financial’s annualized dividend payout is $1.80 per share. So, it is still lower than the dividends paid before 2016. We forecast FY 2023 EPS at $1.68, which will not sufficiently cover the current dividend payout rate.

This is a problematic sign for the dividend’s safety and therefore the company’s DPS should not be seen as safe for the time being. Furthermore, based on the DPS’ downward historical trajectory, slight decreases going forward are possible due to the risks of mortgages defaulting amid the ongoing pandemic and the upcoming increasing rates.

With a yield above 10%, the stock is certainly attractive for income investors, although a high level of volatility is to be expected. Since its IPO, the company has paid cumulative dividends in excess of $29/share, which works out to more than 2x its current share price. Therefore, it has delivered a solid income stream to its shareholders over the years.

Final Thoughts

High-yield dividend stocks always need to be considered carefully as the elevated yield is often a warning sign of fundamental deterioration. In the case of Ellington Financial, this seems to be the case, as the company has exhibited a great deal of volatility in its dividend payments.

The trust has a diversified loan portfolio and has proven successful at increasing its profitability over time. Ellington Financial’s dividend yield also looks safe for now, though another cut could be in the offering if the trust were to see a slowdown in its business.

Investors not looking to take elevated risks should probably avoid Ellington Financial stock. That said, Ellington Financial stock pays monthly dividends and has a high yield, assuming the dividend remains intact. Investors with a higher tolerance for risk may find Ellington Financial an attractive investment option.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].