Published on March 13th, 2023 by Aristofanis Papadatos

Diversified Royalty Corporation (BEVFF) has two appealing investment characteristics:

#1: It is a high yield stock based on its 7.7% dividend yield.

Related: List of 5%+ yielding stocks.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

The above characteristics of Diversified Royalty Corporation, namely its high yield and its monthly dividend payments, make it an attractive candidate for income-oriented investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Diversified Royalty Corporation.

Business Overview

Diversified Royalty Corporation, which is based in Canada, is a multi-royalty corporation that engages in the acquisition of royalties from multi-location businesses and franchisors in North America. The company owns the Mr. Lube, AIR MILES, Sutton, Mr. Mikes, Nurse Next Door, and Oxford Learning Centers trademarks.

The company was formerly known as BENEV Capital and changed its name to Diversified Royalty Corporation in September 2014. Its objective is to acquire predictable, growing royalty streams from a diverse group of multi-location businesses and franchisors.

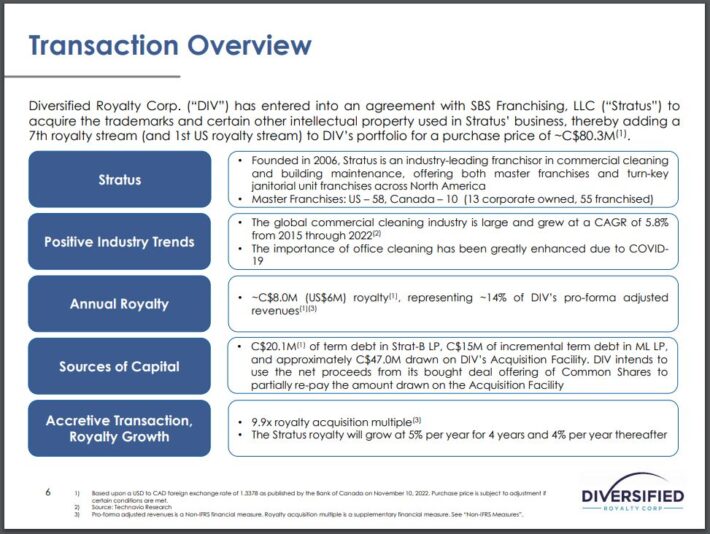

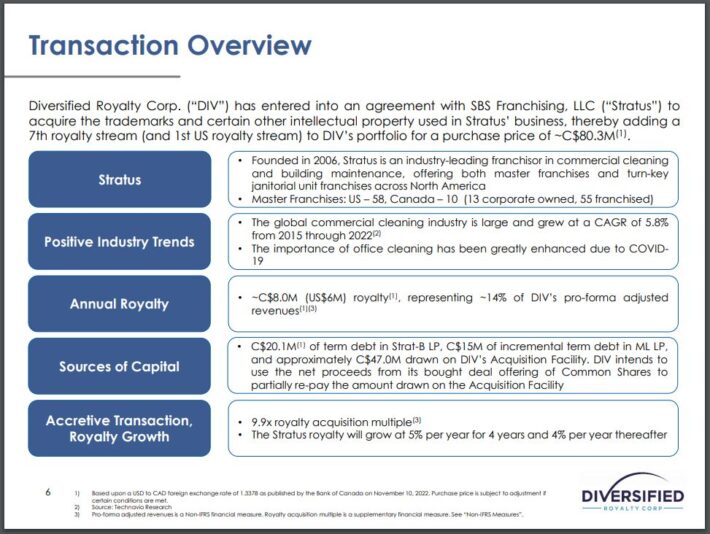

Diversified Royalty Corporation has been building a diversified portfolio of royalties from multi-location and franchisors in Canada. It also intends to expand its business model in the U.S. To this end, the company has been promoting its business model at various International Franchise Association events in the U.S. Its expansion efforts bore fruit with Stratus, the first royalty transaction of the company in the U.S.

Stratus is an industry-leading franchisor in commercial cleaning and building maintenance, offering both master franchises and turn-key janitorial unit franchisees across North America. The global commercial cleaning industry is immense and grew by 5.8% per year on average between 2015 and 2022.

Source: Investor Presentation

Diversified Royalty Corporation has agreed to acquire the trademarks and certain other intellectual property used in the business of Stratus for about C$80.3 million. As this amount is approximately 20% of the current market capitalization of Diversified Royalty Corporation, the deal is undoubtedly important for the future growth prospects of the company. This transaction marks the seventh royalty stream in total and the first royalty stream in the U.S. for the company.

The transaction seems quite attractive. Diversified Royalty Corporation paid 9.9 times the initial annual royalties for the deal while the royalties will grow by 5% per year for four years and by 4% per year thereafter.

Growth Prospects

Diversified Royalty Corporation has exhibited a somewhat volatile and inconsistent performance record, partly due to the effect of the gyrations of the exchange rate between the Canadian dollar and the U.S. dollar. Nevertheless, the company has grown its earnings per share by 4.7% per year on average, from $0.08 in 2015 to $0.11 in 2022.

Moreover, the aforementioned royalty acquisition of Stratus is likely to prove a major growth driver for the company. Stratus expects to grow from 68 Master Franchisees up to 150 across the U.S. and Canada over the next 5-10 years.

Source: Investor Presentation

Stratus has grown its system sales by 21% per year on average over the last five years. As its business has ample room for future growth, one can reasonably expect the company to meet or exceed its above growth target over the next decade.

Given the historical growth record of Diversified Royalty Corporation and expected business acceleration thanks to its major recent acquisition, we expect 6.0% average annual growth of earnings per share over the next five years.

Dividend & Valuation Analysis

In contrast to many companies that cut their dividends in 2020-2021 due to the coronavirus crisis, Diversified Royalty Corporation defended its dividend during that downturn. In addition, the company recently raised its dividend by 2% and thus it is now offering an exceptionally high dividend yield of 7.7%.

However, it is important to note that the company has kept its dividend essentially flat over the last six years. During this period, it has marginally raised its dividend in CAD a few times, but the strengthening of the USD versus CAD has offset these raises.

Moreover, Diversified Royalty Corporation currently has a proforma payout ratio of 94%, which is very high. The company also has an interest coverage ratio of 34% and net debt of $154 million, which is about 14 times the annual earnings of the company. Overall, due to the remarkably high payout ratio and the material debt load of Diversified Royalty Corporation, the dividend has a thin margin of safety and may be cut whenever the next recession shows up.

In reference to the valuation, Diversified Royalty Corporation is currently trading for 20.5 times its earnings per share in the last 12 months. Given the promising growth prospects of the company, we assume a fair price-to-earnings ratio of 18.0 for the stock. Therefore, the current price-to-earnings ratio is higher than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will incur a -2.5% annualized drag in its returns.

Taking into account the 6% annual growth of earnings per share, the 7.7% dividend and a 2.5% annualized contraction from valuation reversion, Diversified Royalty Corporation could offer a 9.5% average annual total return over the next five years. This is a fairly attractive expected return for income-oriented investors, who may consider purchasing the stock around its current price.

Final Thoughts

Diversified Royalty Corporation has an attractive business model, as it does its best to add reliable and growing royalty revenues in its income stream. In this way, the company aims to offer a rising income stream to its shareholders.

Moreover, the company has promising growth prospects ahead. Its recent royalty acquisition of Stratus is the first transaction of the company in the U.S., which is likely to be a major growth driver in the upcoming years thanks to the promising growth potential of Stratus and the mid-single digit annual growth of royalties from this deal. Moreover, investors should expect more similar transactions in the U.S. in the upcoming years.

The only caveats are the sensitivity of Diversified Royalty Corporation to recessions and the exceptionally low trading volume of the stock. This makes it hard to purchase or sell a large position in this stock.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].