Published on March 9th, 2023 by Nathan Parsh

Real Estate Investment Trusts – or REITs, for short – can be a fantastic source of yield, safety, and growth for dividend investors. For example, Choice Properties Real Estate Investment Trust (PPRQF) has a 5.2% dividend yield.

Choice Properties also pays its dividends on a monthly basis, which is rare in a world where the vast majority of dividend stocks make quarterly payouts.

There are only 69 monthly dividend stocks that we currently cover. You can see our full list of monthly dividend stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

Choice Properties’ high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though its dividend payment has been largely stagnant in recent years.

This article will analyze the investment prospects of Choice Properties.

Business Overview

Choice Properties is a Canadian REIT with concentrated operations in many of Canada’s largest markets. It is one of Canada’s premier REITs given its size and scale, and the fact that its operations are solely focused in Canada. The trust has bet big on Canada’s real estate market, and thus far, the strategy has worked.

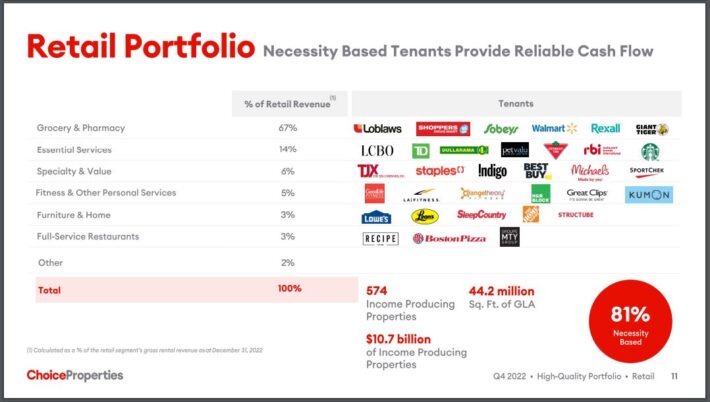

The company has a high-quality real estate portfolio of over 700 properties which make up nearly 64 million square feet of gross leasable area (GLA).

Source: Investor Presentation

Properties include retail, industrial, office, multi-family, and development assets. Over 500 of Choice Properties’ investments are to their largest tenant, Canada’s largest retailer, Loblaw.

From an investment perspective, Choice Properties has some interesting characteristics, not the least of which is its yield. However, it also has an unusual dependency on one tenant, a lack of diversification that we find somewhat troubling.

While grocery stores are generally quite stable, this level of concentration on what amounts to one tenant is very rare. This lack of diversification is a significant consideration for investors that are looking at Choice Properties.

While it would be preferable for the company to diversify to fix its concentration, that is a slow process. In addition, since the tenant it is so dependent upon is generally stable, we don’t necessarily see a huge risk due to the industry struggling. However, this sort of concentration on one tenant is extremely unusual for a REIT, and it is worth noting.

Growth Prospects

Choice Properties has struggled with growth since it came public in 2013. Since the end of 2014, the trust’s first full year of operations as a public company, it has compounded adjusted funds-from-operations per share at a rate of just ~0% per year.

The trust has grown steadily in terms of portfolio size and revenue, but relatively high operating costs and dilution from share issuances have kept a lid on returns for shareholders. History has shown Choice Properties can exhibit strong growth characteristics on a dollar basis, but once translated to a per-share basis, investors have been left wanting.

The company has made improvements in 2021 where FFO grew 27% compared to 2020. However, results were once again poor last year.

For example, Choice Properties reported fourth-quarter and full year results on February 16th, 2023. Net loss for the quarter was $579 million, which compared to a net loss of $163.1 million in the fourth-quarter of 2021. Revenue fell 3.5% to $314.4 million. The increase in the net loss was largely due to the unfavorable adjustment of $486.8 million to the fair value of the trust’s exchangeable units.

The trust collected nearly all of its rent during the quarter. The occupancy rate expanded 70 basis points to 97.8% at the end of the most recent quarter. Meanwhile, the company completed over $74.6 million of acquisitions in Q4, including acquiring two strategic retail properties in the greater Toronto Area.

We see Choice Properties as continuing to grow at a rate of 6.7% per year over the next five years. The concentration of the trust’s portfolio and constant dilution make Choice Properties unattractive from a growth perspective. When constant share issuances are factored in, the outlook becomes even less attractive.

Source: Investor Presentation

Dividend Analysis

In addition to its growth woes, Choice Properties’ dividend appears to be shaky for the time being. The expected dividend payout ratio for 2023 is 119%. Long-term, this is unsustainable, but we project that the payout ratio will eventually drop down to 88% by 2028, which is close to where the trust’s long-term average has been since 2013.

While even that payout ratio is high, it is also true that REITs generally distribute close to all of their income, so it is hardly unusual that Choice’s payout ratio over 80%. Choice Properties’ current distribution gives the stock a 5.2% yield, which is an attractive dividend yield.

Note: As a Canadian stock, a 15% dividend tax will be imposed on US investors investing in the company outside of a retirement account. See our guide on Canadian taxes for US investors here.

Investors should not expect Choice Properties to be a dividend growth stock, as the distribution has remained relatively flat since May 2017. The trust did increase its dividend by 1.4% to a total annual distribution of $0.75 during the most recent quarter. That said, with the payout ratio as high as it is, and FFO-per-share growth muted, investors should not expect the payout to see a massive raise anytime soon.

Choice Properties has also not cut the distribution, and we don’t see an imminent threat of that right now. But it is worth mentioning that if FFO-per-share deteriorates significantly going forward, the trust will likely have to cut the distribution due to its high payout ratio.

This is particularly true because we see Choice Properties’ borrowing capacity as limited, given its already-high leverage. Choice Properties has a debt to equity ratio of almost 2, which according to the company is below the industry peers, but is still alarmingly high.

In addition, it has large amounts of debt coming due in stages in the coming years, so we see the trust’s debt financing as near capacity today. Choice has steady debt maturities in the coming years, and while they are spread out, the amounts are significant. Choice has no ability to pay these off as they mature, so refinancing appears to be the only viable option.

Should it experience a downturn in earnings, Choice Properties would have to turn to more dilution for additional capital. While we don’t see a dividend cut in the near future, the combination of a lack of adjusted FFO-per-share growth, the high payout ratio, and a high level of debt appears risky.

Final Thoughts

Choice Properties is a high dividend stock and its monthly dividend payments make it stand out to income investors. However, a number of factors make us cautious about Choice Properties today, such as its lack of diversification within its property portfolio, and its alarmingly high level of debt.

With a somewhat risky dividend, we view the stock as unattractive for risk-averse income investors. Investors looking for a REIT that pays monthly dividends have better choices with more favorable growth prospects, higher yields, and safer dividends.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].